SLC | S21W2 | Costs for entrepreneurs - Cost elements

How are the costs related to financial accounting? |

|---|

Cost form the foundation for recording and reporting an organization's financial transactions and are crucial for businesses. Financial accounting takes data from cost analysis to track and distribute expenses among various departments, activities, or products. For example, the cost of goods sold is determined in financial accounting to align production costs with revenue for assessing profitability.

In financial accounting, costs are recorded as expenses in the period they help generate revenue for a business. It allows accountants to accurately report the net income for that period.

In all, financial accounting focuses on showing how well a business has performed over a specific time, usually a year, and its financial status at the end of that time. In contrast, cost accounting is mainly about figuring out the costs of various items. It won't be a bad idea if I share some comparison between cost accounting and financial accounting...

| Cost accounting | Financial accounting |

|---|---|

| This is an accounting method that helps a company track the various expenses related to its manufacturing processes. | Financial accounting is the process of collecting and recording a company's financial information to show its true financial status at a specific moment. |

| Cost accounting records the labor, materials, and overhead costs used in production. | Financial accounting keeps track of information in terms of money. |

| When it comes to cost accounting data, it is used solely by the company's internal management, such as directors, employees, supervisors, and managers. | Financial accounting data is used by customers, lenders, shareholders, and other outside parties to prepare financial statements. |

| Net profit is typically calculated in cost accounting for a specific task, batch, product, or procedure. | Financial accounting looks at expenses, profits, and income for a specific period of the entire organization at once. |

Establish the difference between fixed costs and variable costs, providing examples of each. |

|---|

Fixed cost

Fixed cost is the expense that stays the same regardless of how much a company produces. These costs must be paid no matter how many goods are made.

Fixed costs are harder to manage compared to variable costs because they do not change with production levels.

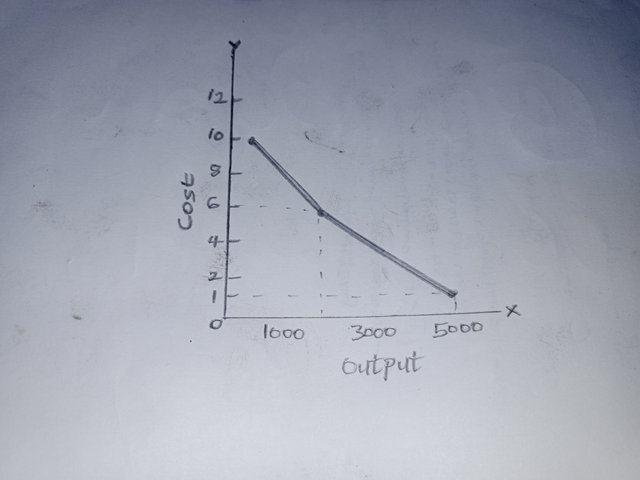

Average fixed cost is calculated;

AFC= Total fixed cost / Output

If the fixed cost of a bakery factory is 5,000 and it produces 500 bread, then the average fixed price will be total fixed cost/ output which is = 10 per unit. Similarly, if this bakery produces 1,000 bread, then the cost of a unit will be 5 and if the total production is 5,000 bread, then the price will come down to 1 per unit.

Demonstrating it in a diagram

Variable cost

As production volume goes up or down, variable costs will also increase or decrease.

Examples of variable costs include the cost of raw materials, sales commissions, and labor costs, among others.

Variable cost is calculated;

Cost of one unit of product × the total number of products

For example, if it costs #60 to make one unit of bread and I have 20 units already produced, then my total variable cost will be #60 x 20 units= #1200.

In a real or fictional case, identify the cost elements in manufacturing a product or providing a service |

|---|

There are mainly three cost elements that are considered in manufacturing a product and they are; direct materials, direct labor, and manufacturing overhead. Knowing manufacturing costs is crucial for a business because it allows them to set the selling price of a product, find ways to cut costs, and assess how profitable a product is.

Direct materials

For instance, let’s say a company has an inventory worth #1,500. The company purchases #1,000 worth of new materials to make product Z. Now, the total inventory value is: #1,500 + #1,000 = #2,500

When product X has manufactured, let’s say the company’s left over inventory is #500. This means the cost of direct materials is: #2,500 – #500 = #2,000

Direct labor: The costs associated with making the product

For instance, let's say the company pays #30 hourly to it's employees, now each worker worked for different hours;

Worker A- 6 hours

Worker B- 8 hours

Worker C- 9 hours

The direct labour cost will be #30 (the labor rate hourly) / 6+8+9 ( total number of hours worked)= 23

#30/23= #1.30

Overhead cost: These are neither direct materials or direct labor, but are indirect materials and indirect labor.

For instance, we have indirect materials #2000, office rent #3000, tax #8000, insurance #10,000= #23,000

Overhead cost for manufacturing one unit of product is Total overhead cost / number of units manufactured. Let's say number of units manufactured is 15,000 units

Then the overhead cost = #23,000/ 15000= #1.53

To get the total manufacturing cost = Direct labor(#1.30) + direct materials(#2,000) + manufacturing overheads(#1.53)= #2,002.83

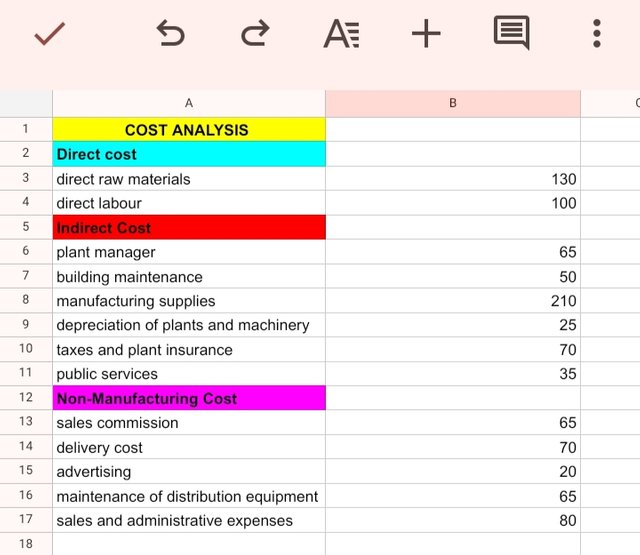

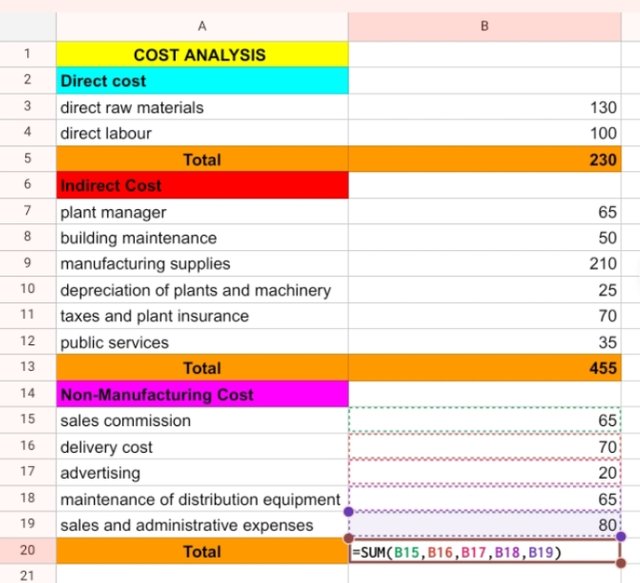

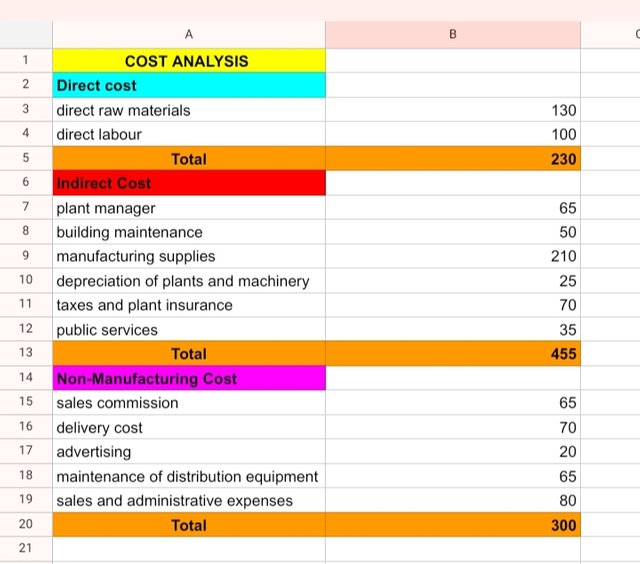

The company Steemians manufactures a single product. During a given period, the following costs were incurred |

|---|

| Concept | Cost |

|---|---|

| Direct raw material | 130 |

| Direct labor | 100 |

| Manufacturing supplies | 210 |

| Delivery costs | 70 |

| Sellers commissions | 65 |

| Depreciation of plant and machinery | 25 |

| Plant manager | 65 |

| Tax and plant insurance | 70 |

| Sales and administrative expenses | 80 |

| Building maintenance | fifty |

| Public services | 35 |

| Distribution equipment maintenance | 65 |

| Advertising | twenty |

|  |

|---|

I invite my friends @ruthjoe @mariami @pandora2010

Thank you!

Greetings friend @ninapenda

1.- You have developed the relationship between costs and financial accounting. Both seek to inform managers about the performance of the company, showing the impact of spending in different areas.

2.- You have presented the difference between fixed costs and variable costs, with their respective examples. It is important to detail the cost structure to know how much fixed and variable costs independently impact a production.

3.- You have developed a fictitious example to identify the cost elements. It is important to be clear where we must record each expense generated, this in order to provide confidence in the results.

4.- You have presented the solution to the proposed exercise, identifying the sum for each cost element. The income statement provides information that can be useful to generate production optimization strategies.

Gracias por unirte al concurso.

Thank you so much for the evaluation.