Evaluating crypto token-based protocols

While there are hundreds of crypto token-based protocols, most have been simple forks of Bitcoin with minor changes to the rules and marketing. Litecoin and Dogecoin are the most well-known examples of copycat protocols with no major technological or economic innovations.

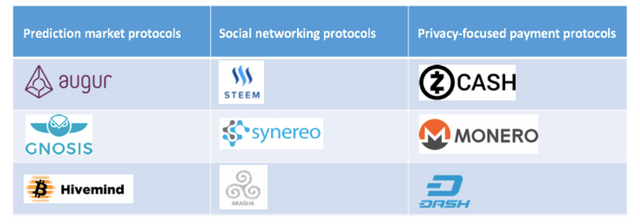

In the past year or so though, we’ve started to see more protocols that are innovating on tech and economics to enable new use cases. It's likely that some of these new protocols emerge as the foundational infrastructure for the decentralized web, which will give people control of their lives in ways never thought possible before. It's also likely that many of these protocols will fail spectacularly.

Given the binary nature of outcomes and potential for spectacular failure, it's important for newcomers to tread cautiously and ask the right questions about new projects. Here are 5 questions that should always be answered before getting involved in a crypto-token based protocol:

Is the founding team credible and transparent in their approach?

One might think that if you used this question when evaluating Bitcoin in the early days, you would have missed the opportunity to turn $100 into $72M in 5 years. After all, to this day Satoshi is pseudonymous and no one knows who he is.

This thinking is wrong though. The early investors in Bitcoin were part of the cypherpunks email chain and while Satoshi wasn’t known by identity, he was well known by his white paper and his communication on the email chain and in the forums. If you were part of those discussions, you were well equipped in evaluating Satoshi’s credibility. Satoshi was completely transparent in how he launched Bitcoin and he vigorously addressed all questions and concerns about Bitcoin to anyone that asked in the early days.

Reading the white paper, and observing how the team shares information is hugely important in the evaluation process. The vast majority of protocols have white papers and Slack groups or forums, so it’s easy for anyone that if you have the time and patience. And if a protocol doesn't have a white paper or a forum for open communication, you should stay away.

Is the protocol solving a real problem?

This is an important question for any crypto investor to consider. Some crypto protocols are attempting to solve clear cut problems (Monero, Steem). Others aren’t as clear in the problems they’re solving and instead have more general purpose use cases that could make the protocols ultimately bigger in scope (Ethereum, Synereo).

Is the protocol based on a user token, an equity token, or a debt token?

Demian Brener does a great job describing the difference between the three types of crypto tokens in this piece.

User tokens are tokens required to access the protocol the token is based on. Bitcoin and Ether are the most well-known examples of user tokens. User tokens are the most well-established category of crypto token.

Equity tokens are used to fund the development of the protocol, but aren’t necessarily needed to access the protocol. Equity token holders receive two benefits: a percentage of transaction fees from the protocol and voting rights for decisions. The DAO is the most well-known example of an equity token. Given that the most well-known attempt of an equity token was a disaster, this approach is more unproven than the user token approach.

Debt tokens are tokens that represent a loan to the network that earns the token holder interest. The Steem dollar is the most well-known example of a debt token and it’s still very early in the evolution of debt tokens.

Is the protocol based on fixed token distribution or continuous token distribution?

Every project has a slightly different approach to token distribution. Fairness of distribution and ease of access to all participants is important for all projects. Additionally, the monetary policy should be considered prior to investment.

Fixed token distribution: A fixed token distribution is a where the entrepreneurs do a fixed issuance of all of the tokens (e.g Augur). The benefit for investors is that it’s very clear what the outstanding token supply is and it’s easier to value the token. The investor can be sure that there will be no dilution of the token. The downside to this approach is that it makes the token more exclusive and not as accessible to newcomers. This approach looks a lot like a traditional fundraise, and my guess is that fixed token distributions will increasingly be dominated by institutions. As a result, a fixed token distribution may not drive the engagement that a continuous token distribution does.

Continuous token distribution: A continuous token distribution is when the tokens get distributed directly from the blockchain over-time. Bitcoin and Ethereum are the best examples of a continuous token distribution. Some continuously distributed tokens are the result of a fixed token distribution at the onset as well (see Ethereum). The main benefit of a continuous token distribution is that it drives engagement of the protocol. Steem is probably the best example of this to date, as the fact that new creators on Steemit can earn new Steem Power and dollars drives engagement of the protocol.

Do the economics make sense?

This is the toughest of the questions to evaluate. Bitcoin was an economic experiment that most traditional economists, like Robert Shiller, said would never work. It’s still working today though and is stronger than ever.

Crypto tokens protocols like Bitcoin are economic experiments have never been tried before and while it’s easy to opine on their success based on theory, often practice defies theory. That said, economic theory can be helpful and one should always be aware of the economics of the crypto token. Many Bitcoin holders believe that the monetary policy of bitcoin is one of its defining characteristics (myself included). My biggest concern about Steem, for example, continues to be the infinite inflation that's built into the monetary policy.

It's a great time to watch and learn

The creators of these protocols are paving completely new ground and attempting things that have never attempted before. Even projects that look good based on these questions will fail. The DAO is a good reminder of that, being the most recent example of a spectacular failure that measured up well on this analysis.

The DAO's fatal flaw was a flaw in the code, which only a few of the smartest technical minds in the world could identify. But there are valuable learnings from situations like the DAO disaster. The DAO will lead to more rigorously scrutinized smart contracts in the future and we will be better off for it and failures like the DAO in the future.

I hope that both investors and entrepreneurs alike will think long and hard about these five questions before getting involved in any crypto-token based protocol and take away as many learnings as possible as we go.

OK, I upvoted and followed you. But thanks to your link, I'm now addicted to Augur ... :)

Thanks @vegascomic.

Augur is pretty awesome and I'm looking forward to the coming launch. The team is great, the protocol is solving a real problem, its a user token with a fixed token supply and the economics make sense. One of the clear 5/5 crypto tokens for me right now!

I registered for the site with my email. It kept saying creating account. The Firefox crashed and I lost it. Will they contact me, do you know?

Thanks for this article. Well done!

very important post which every "investor" should read and take it as principles.

thanks @geronimo, appreciate that

Great read ! Was curious if you knew of any ways to evaluate the value of a particular crypto token. I have been looking all over but can't seem to find any methods to value them.

Thanks !

You are right about STEEM inflation. Even when Facebook raised capital, the inflation was always around 10% per capital raise:

https://steemit.com/steemit/@maarnio/did-steem-s-valuation-get-ahead-of-curve