Meitu starts, Asian institutions undertake "Grayscale effect"?

On March 10th, Bitcoin broke through $55,000 again in the morning.

The blessings of major institutions have contributed to this. In the United States, Bitcoin is being introduced into mainstream asset allocation, including institutions represented by Tesla.

In Asia, Meitu fired the first shot in the region.

On March 7, Meitu, a Hong Kong listed company, announced that it had purchased US$ 22.1 million in Ethereum and US$ 17.9 million in Bitcoin in the open market transaction on March 5, 2021, and spent about RMB 260 million. This made Meitu the first Chinese listed company to publicly announce the purchase of Bitcoin and Ethereum.

Cai Wensheng, the helm of Meitu, later said in weichat: "The purchase of cryptocurrency is the value reserve of the long-term development of blockchain strategy, and someone must be the first to eat crabs. 」

The industry generally believes that due to the influence of Meitu, there will be an increase in the number of Hong Kong stock companies purchasing cryptocurrencies in the future. This makes a case for subsequent domestic institutions to enter cryptocurrency, and also makes Ethereum be included in the vision of strategic reserve of large institutions.

From a regional perspective, behind the active entry of these institutions, there is a shift and change around BTC chips.

The purchase of cryptocurrency by listed companies has spread rapidly from Wall Street. From North America to Asia, a route of BTC assets transfer between institutions has become clear.

- There is more than one Meitu

Facing the latest trend of Meitu, CZ, founder of Binance Exchange said on Twitter: "Many Asian companies already own bitcoin, but they are not very open".

Indeed, Meitu has been labeled as "Tesla in Hong Kong". Some time ago, many listed companies in the United States, Britain, Germany and other countries and regions chose cryptocurrency in asset allocation.

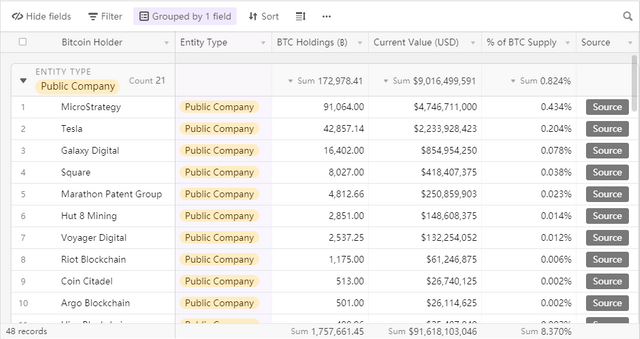

According to the data collected by KevinRooke, an authoritative BTC position ranking website, there are 21 listed companies and 6 non-listed companies, accounting for 0.824% and 1.008% of the total bitcoin supply respectively.

Among them, Meitu ranks 12th in BTC holdings, and the top listed companies mainly include the famous MicroStrategy, Tesla, Galaxy Digital Square, etc., as well as a large number of bitcoin mining institutions in North America.

In this website, the data update time is mostly concentrated in the second half of 2020, and the data sources are mostly the public information of the market and various companies.

(Source: BTC position ranking website KevinRooke)

The mainstream view is that since August last year, the market situation brought by institutions has gradually broken out. MicroStrategy, a business intelligence software listed on NASDAQ, announced its entry into the bitcoin market, which has become an important vane in the market. SEC (securities and exchange commission) and audit department approved MicroStrategy to include bitcoin in its balance sheet. This means that under the supervision of SEC, Microstrategy can learn from the way of buying bitcoin as its balance sheet and meeting the accounting and legal standards disclosed by listed companies.

Driven by Tesla, MicroStrategy and other listed companies, more and more listed companies in North America began to follow suit. Some traditional listed companies began to turn to Bitcoin at business level and asset reserve level. Soon, the payment company Square followed suit and invested 1% of its total assets in Bitcoin. In late October of the same year, PayPal also officially entered the bitcoin industry, allowing users to directly purchase bitcoin and other cryptocurrencies.

American listed companies interested in Bitcoin continued to increase in February this year. According to recent SEC documents, American listed companies immersed in technology (code: IMMR) indicated that they may choose to buy Bitcoin and other encrypted assets in the future. Urban Tea, the parent company of Mingyuntang, a Chinese tea brand listed on NASDAQ, also announced that it will start key strategic expansion in mining blockchain and encrypted assets.

On the other hand, mining enterprises in the United States and North America are also running into the market. North American mining enterprises, represented by Marathon Patent Group, ranked 4th above, are constantly buying mining machines. In addition, the founder of DCG, the parent company of Grayscale, recently announced that it would establish the largest bitcoin mining pool in the United States. It can be seen that the mining infrastructure in North America, represented by the United States, is becoming stronger, and overseas markets are gradually expanding their computing power share. Meng Xiaoni, CEO of Bitdeer, recently told the media that according to their calculations, it is estimated that by the end of 2021, the overseas computing power space may increase to 40%, and the computing power in China will drop to about 60%.

Many actions show that Bitcoin is no longer limited to small-scale capital participation. Institutional approach, asset hedging, hedging and arbitrage, and the macro environment of loose money. In Wall Street and North America, crypto and traditional financial markets were first linked.

It can be seen that in this round of big market, large institutional investors played a very important role, which was also an important factor for Bitcoin to complete its historical breakthrough. To some extent, institutional investors and high net worth individuals led the market, and they tend to hold bitcoin for a long time.

- Bitcoin is shifting

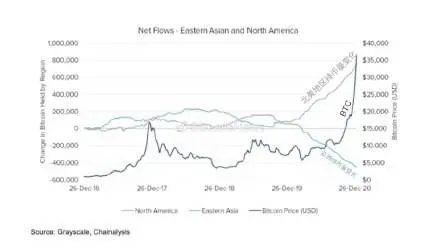

The chief economist of Chainalysis once thought that the market was driven by institutional investors in North America. According to statistics, exchanges in North America have received net inflow of bitcoin from other parts of the world, and the number of transfers sent by exchanges with a value of USD 1 million or more has increased by 19% this year. In the past year or so, the amount of bitcoin held in Asia has dropped by more than 400,000 pieces, and the amount of bitcoin held in North America (represented by the United States) has increased by more than 600,000 pieces.

(Source: BeatleNews)

Recently, overseas countries are still exploring to expand the digital asset compliance market. In mid-February this year, the first Bitcoin ETF in North America was approved for listing, and the first Bitcoin Exchange-traded Fund (BTCC) in North America launched by Purpose Investments was approved by Canadian financial regulators and started trading on Toronto Stock Exchange on February 18th. The fund is sold in Canadian dollars and US dollars. On the first day, the trading volume reached 200 million Canadian dollars (about 155 million US dollars), breaking the Canadian record.

According to Reuters's report on the crypto market trend in 2020, last year, the interest of institutions from North America suddenly increased, which promoted the transformation of bitcoin transactions and became the biggest participant in this round of increase last year. At the same time, the number of Asian investors, who are the main force to push up bitcoin prices in 2017, is decreasing. North American investors were the biggest participants in the increase last year. After a large number of institutions entered the market, American investors have gradually stopped worrying about compliance.

A large number of voices in the community believe that BTC is basically oriented well, and the pricing power of BTC is shifting to Wall Street.

- Asian institutional channels are opening up

Is it time for Asian institutions to enter the market?

With the continuous breakthrough of bitcoin prices, capital forces are still attracting more listed companies and institutions to join the bitcoin market. Faced with the rising enthusiasm of overseas institutions for bitcoin, Asian institutions have also begun to take action.

On March 4th, Huobi Technology Holdings Co., Ltd. announced that its wholly-owned asset management subsidiary, Huobi Asset Management, had been approved by the Hong Kong Securities Regulatory Commission to issue funds with 100% virtual assets. Huobi Asset Management will issue three virtual asset funds: Bitcoin Tracking Fund, Ethereum Tracking Fund and Multi-strategy Virtual Fund.

Dujun, co-founder of Huobi, publicly stated that institutions represented by Tesla in the United States are gradually introducing Bitcoin into mainstream asset allocation, Coinbase, a licensed digital cash exchange in the United States, formally submitted a prospectus, which is the last step before listing and trading, and Nasdaq is also attracting blockchain enterprises to join, which will affect the Asian region and the development trend of blockchain industry. This shows that blockchain and digital asset investment are gradually entering the mainstream field.

From the perspective of the industry, this is a typical Asian "interface" between traditional capital markets and digital assets. Some people think that the CSRC approved Huobi to launch a virtual currency fund, which may be inspired by the world's first Bitcoin ETF(BTCC). From Grayscale in the United States to Purpose and Evolve in Canada, and then to Huobi in Asia, Bitcoin is crossing the market and changing to the mainstream investment target, which also makes Asian institutional investors re-examine this kind of assets.

On March 9th, BCMG Genesis of Malaysia also announced the launch of Bitcoin Fund (BGBF-I). According to the official, this fund was launched in response to the increasing demand for institutional crypto products in Southeast Asia, and IBH Investment Bank served as the main consultant of the fund.

After the "Grayscale Effect" spread to Wall Street, the actions of Asian institutions also became an important observation direction of the market. The launch of fund products of Bitcoin and Ethereum will attract more traditional funds, and then boost the prices of mainstream projects.

Meitu also left a new expectation for the market in the public information: according to a cryptocurrency investment plan previously approved by the board of directors of the company, Meitu Company can purchase cryptocurrency with a net amount not exceeding 100 million US dollars, and the funds come from the existing cash reserves of the company.

From this point of view, Meitu Company's investment behavior in virtual currency is still likely to increase its position.

From investment giants to listed companies, and then from North America to Asia, there has been a new trend in the institutional buying boom of Bitcoin. We need to look forward to and observe how institutions in Asia will react.