1/23/2017 The Market View and Trading Outlook

Another somewhat uneventful day of corrective price action for Bitcoin and it’s basically doing what I pointed out yesterday as a result of the unenthusiastic buying activity on each new low. Today, does not appear to be any different as we had a low of $9900.00 at 0630 EST that was once again bought up on lower volume than the selling period that preceded it.

In fact (on the hourly) follow on buying was less today for $9900 @ 3.5k than it was yesterday at $10,100 @ 5.5 k. These low volume run ups are not generally a good sign of a healthy market full of enthusiastic buyers eager to get in or of a market where the consensus is that price has bottomed and it’s a great value buy.

Take it with a grain of salt though as selling volume was less for this dive to $9900 than it was for the dive to $10,100 yesterday and 30 minute buying volume exceeded selling volume. Accordingly I think we are reaching what will be a short lived buyer/seller stalemate prior to the greater trend enforcing its downward will. We should get some run ups and trading opportunities but the longer term downwards trend is still in effect.

To me (and this is just my opinion) these post low run ups are more than likely the byproduct of a thin market. There are many (like myself) sitting on the sidelines which creates the perfect opportunity for those with deep pockets to prop the price up, pull in the small investor hoping for price to subsequently take off, sell back into them and force the next low with the panic sells by these same retail investors as price fails to rise and begins turns south.

Markets like this really suck for new comers to the shark infested waters of trading as the past year of rapid gains, near instantaneous recoveries and success of the buy on the dip mentality incorrectly programmed them to act in a way that will ultimately get them killed and force them out. It also indoctrinated them to the mentality that any price less than $15,000 is a discount and instead of sensibly selling on decline to limit risk, they should just double up and buy more thereby increasing their exposure, risk and dramatically increasing the potential for loss as price is sure to go back up in a couple days.

As the decline of an asset be it a stock or cryptocurrency is not an instantaneous event, expect a death by 1000 cuts. There will be hopeful run ups, declines, further hopeful run ups declines etc. It’s a wash machine on tumble that can easily strip the inexperienced of their capital a couple percentage points at a time over a prolonged period of time until there is nothing left to take.

Lecture over.. a brief overview of the charts..

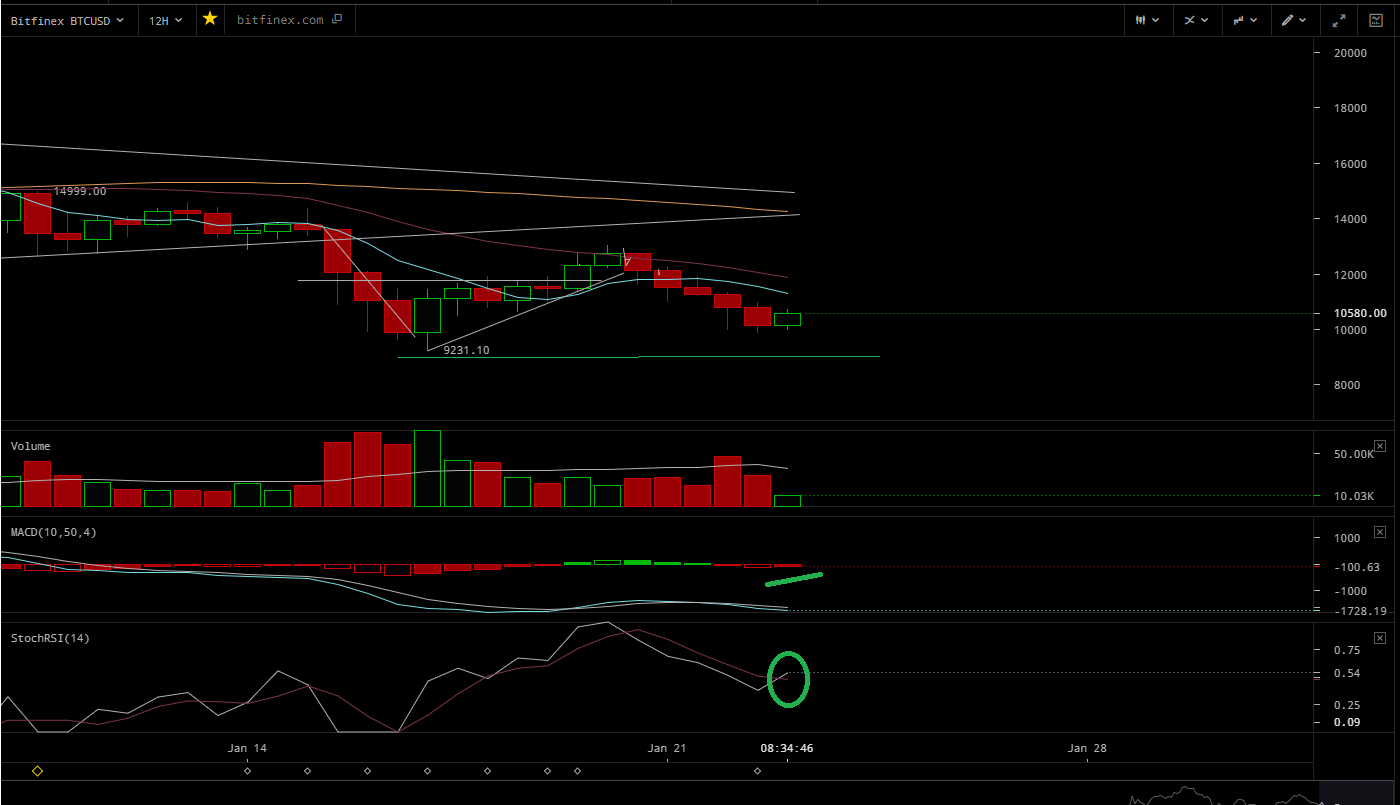

In the 12 there is not a lot to love as of yet, we do have an RSI cross but these can happen numerous times during an assets climb or descent; we are still around .50 so it’s basically neutral as the longer term RSI trend line is still heading south. The MACD histogram narrowed a bit towards the buying side, but retracements during a greater decline are also fairly normal and again nothing indicative of a strong buy signal. It’s a bit early in the current bar to make a volume determination but selling volume was less the prior period than the period preceding it. So the tail spin may be slowing for the moment.

Skipping the 6 hour for today as there is nothing of substance and going to the 4 hour we are seeing some bullish indicators and it appears as though there may be upcoming trades to be made. The Histogram indicates that this selling period may be coming to an end though volume has yet to confirm it. The RSI has been oversold for 20 periods which is generally the average before a small retracement or recovery is made. At this point, the moving averages are my best indicator as price is well below the 77 and tends to make attempts to meet up with it from time to time on the way down. Remember this is death by 1000 cuts, designed to get you to buy in on highs and sell on lows. As the two hour just went green, on the previous declining selling volume it may drag the four along with it and bring some lower highs we can sell into. I do not believe this is the end by any means and lower lows are the expected longer term trajectory. If we can make MA progress in the lower time frames, and that is a big if, the four will provide resistance at $11,450 or the 21 period MA, if that can be defeated it will most likely fold around 77 period MA or the $12,000-$12,100 mark in favor of another sub $10,000 low.

The two hour is at least giving us something to trade as it has entered a possible buying period though once again we DO NOT HAVE VOLUME CONFIRMATION OF TREND REVERSAL. I was in at $10,200 this A.M. or the third 77 bounce on a different time frame that gave life to the buying period in the 2 hour time frame. We have had 2 back to back selling periods on the histogram and are likely due for a muted buying period of some degree. We have an MACD/Signal cross to the upside; bullish and the RSI is in buying territory. The moving averages are “mehh” and likewise provide no confirmation of longer term trend reversal. The MACD is at -700, with -1800 being the lowest historic low thus far so there is plenty of room to go south and this is likely a mild retracement destined to once again go south at a later date.

The first level of resistance resistance will be $10,800 or the 2 hour 21 and also the 30 min 77. If we can break above the next battle will be fought at $11,300 which is close to the 4 hour 21, and both the 1 and 2 hour 77 period moving averages. This will be a tough fight and may be the temporary folding point in price to once again head south recharge, regroup and test it again. If we break above and hold the next fight would be $12,000 (4 hour 77) and that is critical and likely where (if we make it that far) the trend could reverse sharply down for the next lower low. If we breach and it holds, who knows..

Again remember this is a slow capital draining event designed to punish the inexperienced for making hopeful or fearful decisions. Trading in a down trending market is sort of like playing the game of heads or tails where you get heads and each time you win you get you 20 percent on your capital investment, but each time it lands on tails you lose it takes 10 percent of your capital investment. Not a bad deal and seemingly one you can’t lose, until you learn that in a down trending market the coin is going to land on tails 8 out of 10 times. Just enough to keep you playing, but in the long run it’s like the house odds in Las Vegas; the house wins 9 out of 10 times.. That’s what keeps the strip lit.. :)

My Previous Analysis:

https://steemit.com/bitcoin/@pawsdog/1-22-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-21-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-20-2017-the-market-view-and-trading-outlook-evening

https://steemit.com/bitcoin/@pawsdog/1-19-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-18-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-16-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-15-2017-the-market-view-and-trading-outlook

https://steemit.com/bitcoin/@pawsdog/1-14-2017-the-market-view-and-trading-outlook

$11,300 is proving tough.. next line of support is $10,800 and from there a sharp drop down if it fails.

I have to admit that I like the sound of it. Another thing is that this might create unbeliavable buy opportunites. Do you have long-term holdings ?

Long term FIAT... lol.. I do have some BTC... I have my first BTC still.. I bought at $80. It's sorta sentimental, like a good luck charm.. but I have no other BTC, I do have some NEO I bought at $7.00 and a few Alts but nothing much.. I trade and then pull the profits back to my account to keep my trading capital at about a set rate. I'm not greedy...but yes I'm all about some low low low prices.. I don't HODL..

Beep! Beep! This humvee will be patrolling by and assisting new veterans, retirees, and military members here on Steem. @shadow3scalpel will help by upvoting posts from a list of members maintained by @chairborne and responding to any questions replied to this comment.

Have my 100% ! I think this is one of your best analysis. On the surface it doesn't look much different, but the context is really well-written. I like the lesson's you incorporate, while heading towards a point. Well done, my friend ! Absolutely agree with you on this one, as you well know. Great work

Thanks, I have had a couple others say the like the lessons. And truthfully I'm not really trying to give lessons as much as I am just typing what I am thinking and reinforcing my own discipline and decisions for the day. :)

Are you interested in reading trading books ? I might have some suggestions.

I ready all the time.. reading an elliot wave book at the moment and another charting book.. but I'm all about suggestions...

I really like reminiscences of a stock operator, the most practical one i've read. buy it here book That's my favourite one so far. Market wizards I like all of them in general.

check buying volume on SBD.... :) I'm still waiting for the 2 for 1 sale... but trending as I had hoped and thought thus far... everyone keeps telling me to convert, convert, convert.. I'm waiting a bit.. more.. I'm looking for .54-.48... May not get it but I'll wait a bit more..

How do you explain this ? I have an idea, but I am kinda confused.

Whats your idea? and I'll tell you mine..

Isn't it listed on a new korean exchange, I think this is the primary reason.

What do you think about the following theory / interpretation? Any increase till the 26th is nothing but a bulltrap?

https://www.tradingview.com/chart/BTCUSD/E25dvVua-BTCUSD-Potential-new-low-on-26th-of-January/

Good a theory as any I can come up with and coincides with my inner suspicion that we are not out of the wood yet...

Do you have an opinion on the medium to longer terms? Or do you just stick to trading short term?

Longer term this will pass and price will either go up as the 3 day and weekly charts go green or a flippening will occur and BCH will come out of nowhere; the latter being my conspiracy theory...

A lot of people are with you on that theory methinks. I personally don't care, financially invested != emotionally invested for me, I couldn't care less where the profits come from. The real future lies elsewhere imho but I don't think either blockchain is going away anytime soon, as we measure "soon" when talking about crypto at least.

BCH can sail along valued at some fraction of BTC for the forseeable future. If a flippening does happen though, I'm curious to see what happens to BTC, in that case a collapse of the BTC price to an ETH/ETC kind of relationship is not out of the question I think, could we see....BiTcoin Classic?

Awesome theory in regards to a legacy BTC or BTC Classic.. Looking at it purely objectively I can't find the benefit to BTC over BCH save the decentralization issue. BCH is faster, cheaper, larger block size etc.. So there is no reason from an objective point of view that it should not be the higher priced asset of the two. Additionally I don't think it would be that difficult for Bittrex etc to simply change and start using BCH as the medium instead of BTC.. In fact it would likely benefit them based on transaction fees.. but we will see. The first step in a potential flippening has already occurred with the addition of BCH to Coinbase..

Just noticing your reply, for some reason I missed it before.

BCH is certainly faster and cheaper, I haven't taken the time to look into the decentralisation issue. Most of what I've stumbled across seem to be opinions based on which side of the fence the author was on. One way or the other BTC has to move on or it will lose it's dominance sooner or later.

I'm curious, I'm sure I saw you mention somewhere that you traded stocks before getting into crypto, do you still do that or am I confusing you with someone else?

Nope that was me.. starting in the 90's passively, then actively in the 2000's.. I killed it on Google, Las Vegas Sands, and a few others.. but that was my primary gig for a long time before the birth of crypto..

Nice, you might consider posting about that if you have time on your hands? I for one have been considering diversifying and have been dabbling a little on etoro with marginally more success than failure, but once you have the balls for the swings, crypto seems simple compared to stocks and such.

A guide to traditional investing for the crypto crew?

Crypto is so fast is the main difference and its more pure TA the FA, which is also interesting.. that said there are bots out there now trapping traditional TA setups and swinging against.. It's interesting that is for sure..

Yup, I'm still dreading logging into my bittrex account. These red days just allow me to do a little more reading and a little more steeming. Gotta make the best of the situation

Red days are good and bad.. depends on what your holding FIAT or Crypto...

More Green than Red in the Top 100 right now.

I saw that, I came out of my NBT hiding spot this morning in Favor of BTC at $10,200 and some of my other recently punished ALTS... :) I keep a few bucks in each one during the beatings so they stay in my wallet and I don't forget about them..

It's funny how having even a small amount of money in something keeps you watching :)

True.. I like NBT for the moment as it's going nowhere... it's locked at $1.00 regardless of BTC.. someone is holding it there... so it works well to add to your btc in the down trends and ad to your $$$ in the uptrends..

i'm new in this community... really thankx to share an informative post ☺

Used the current dip to buy STEEM, I like the upside of it this year.

Think I will do the same today... was hoping for more from SBD.. but may not be over yet...I'm more concerned about the conversion rate between SBD and Steem.. than the price at this point

I still dont see a reason for SBD to climb, but as long as it's better than 1:1 STEEM and over $1, I'll make the most of it.

agreed