WandX: Decentralized Crypto-ETF Creation and Trading

In 1990, the world’s first Exchange Traded Fund (ETF) was released.

Since then, over $2 trillion is managed in ETFs, which are an incredibly popular market. An ETF allows investors the ability to buy a related group of stocks or bonds in a convenient and low cost manner.

The ICO craze of 2017 has now surpassed $3 billion! The ERC20 token standard was created less than two years ago, and there are dozens (hundreds?) of startups that have created ERC20 tokens to fuel their project. My ethereum wallet has nearly two dozen! I have enjoyed the opportunity to be a part of this growth sector, participating in the ups and downs and (sometimes insane) twists of this exciting market.

Those ups and downs, however, discourage many from buying ERC20 tokens. But what if there was a way to easily hedge an ERC20 token purchase by using a ready made basket that included more well known cryptocurrency such as BTC and ETH? What if there was a way to buy a group of ERC20 tokens that are competing in the same space, to ensure you could get a piece of the winner and less downside risk?

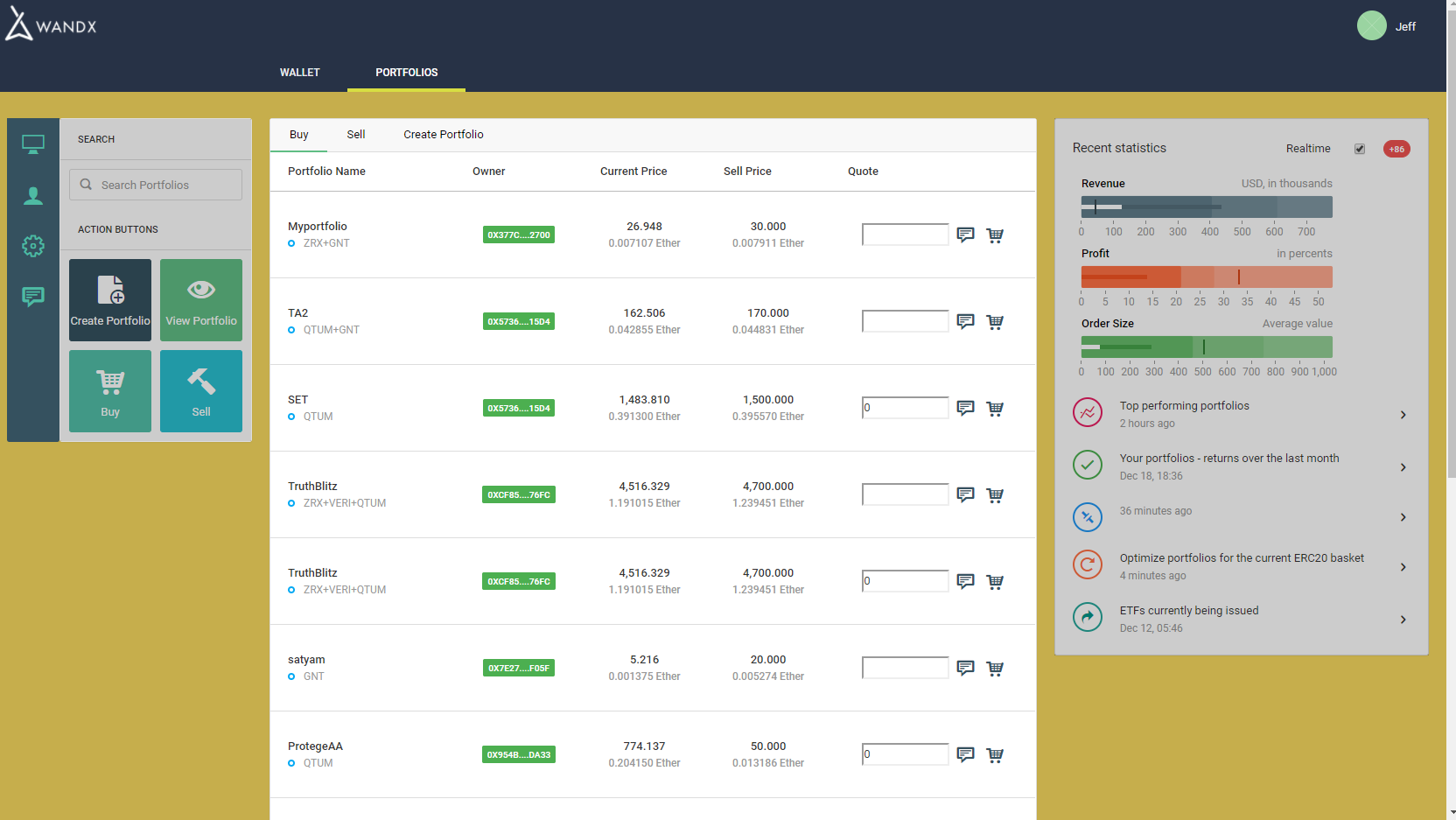

WandX has created that product. WandX is a decentralized platform enabling the creation and trading of baskets of cryptocurrencies. You can even play with their working beta if you have Meta Mask installed.

A look at the prototype you can play with on the Ropsten testnet

With WandX, anyone can create their own mix of cryptocurrencies. This is incredibly powerful, as it allows for a bottom up creation of products that mimic the ETFs found on the stock market. ETFs have made it incredibly easy to buy baskets of equities divided into sectors, size and many more factors. The success of the product is reflected in the aforementioned $2 trillion plus market

There are two major ways this will be used by early adopters of WandX: hedging volatile tokens with more trusted coins, and making bundles of tokens that track groups of tokens centered on a common market sector or theme.

Let’s look one by one at each example.

ICO fund hedging

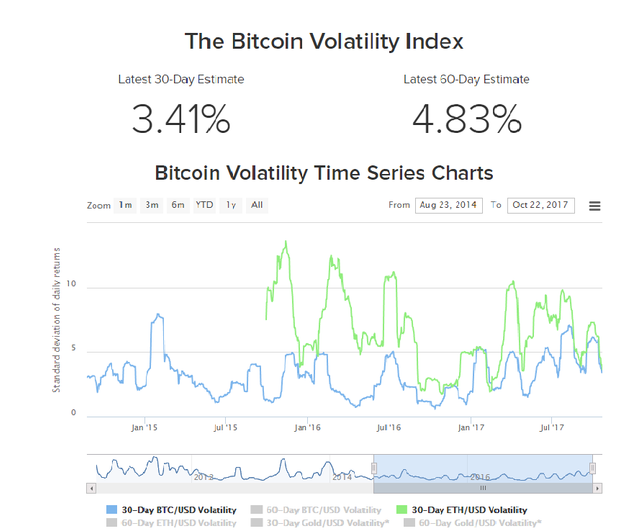

Many ICOs raised the majority (or all) of their funds in ETH or BTC. There has not been a sustained 80% drop in value of ETH or BTC since ICOs began heating up, but being 100% backed by these two tokens is extremely risky. Startups that raised a great deal of ETH may want to hedge their stash, and WandX will allow them to do exactly that. Instead of holding 10,000 ETH and watching the market swing wildly every day, a startup could put that into a portfolio using the WandX protocol that holds 25% DGX gold (less volatile than BTC or ETH), 25% Maker DAI (another stable coin), 25% of the native token, and 25% ETH.

Do you really want your startup’s funds to be this volatile?

Equal portions of this portfolio would be sold every month to keep the lights on and pay employees, with far lower price fluctuation and easier planning. Companies that routinely sell ETH once a month are vulnerable to an aggressive competitor shorting ETH before the expected sell date and therefore reducing the company’s stash unnecessarily.

Personalized ETFs

With WandX, anyone is able to choose the exact mix of assets that works for them.

Diversification is a very good way to lower risk. As new tokens and platforms are released, it can be incredibly hard to follow and determine which will be the winners and which will be the losers. There is no S&P 500 equivalent broad market fund available right now for cryptocurrencies. With WandX, users can create their own ETF tailored to their desires. They can even sell that fund on the WandX’s decentralized market to others who may want that same mix of cryptocurrencies!

Hedges

Here is a great example given on WandX’s page that demonstrates making a new token that is a combination of 50% BTC, 40% ETH, and 10% of an ICO token that is far riskier. This fairly simple example shows how WandX can simplify one’s portfolio. After creating this, one can either resell it on the WandX decentralized exchange, or break it up into its separate tokens again if desired. With one click of the mouse, one token becomes three again! This instant liquidity is an excellent feature that will help ensure rational pricing on the WandX decentralized exchange.

Market Plays

Let’s walk through another example. Say a user believes that payment tokens are going to be a major feature in the years to come, but isn’t sure which token to invest in. One option is to buy each token separately in equal amounts. This is a little cumbersome, and results in three separate coins to keep track of. Instead, using WandX, a user could create a basket holding Tenx, Plutus, and Tokencard, three companies competing in this space. This basket could be called “PayDApps” by the creator. The “bet” made is now on a specific sector in the blockchain, rather than specific tokens.

Furthermore, I can call a function on that basket at any time, and get those coins delivered into my wallet, allowing me to use their unique functions as necessary.

As more tokens are created, there will be more ways to bunch together groups that reflect shared attributes.

Beyond the Blockchain

Moving forward, WandX will go beyond Ethereum’s ERC20 tokens and allow for trading of tokens across blockchains. This will be incredibly useful! I’ve personally not had time to research into privacy coins, for instance, and don’t want to have to hold wallets in Monero, ZCash, and Dash, which is cumbersome and hard to keep track of. WandX will be incredibly useful down the road when it allows me to create a basket of privacy coins like this that will help me track the sector easily and with less risk than if I held one.

Of course, competition and decentralization are powerful tools. With WandX, somebody might focus on creating interesting cryptocurrency baskets to sell for WandX tokens, as a sort of blockchain John Bogle. Those of us who value our time would happily pay a small premium to get a basket of tokens that can be instantly liquidated into one address (currently, WandX only allows ERC20 tokens, but will grow beyond that in the future) if necessary, or held indefinitely as a group, to be resold on the market if desired.

WandX is easy to use, and doesn’t require programming knowledge. This walk through of the beta is helpful. The ease of use will encourage more people to adopt the platform and create their own tradable baskets.

Consider: right now, I have a few separate retirement accounts investing in the stock market, bitcoin, steem, ethereum and ERC20 tokens, and more. All of them have separate interfaces and require separate logins. WandX is going to bring these divided sectors together! You can check out their post on putting loyalty points on the blockchain[2]

WandX will then act as a decentralized platform to create, buy, and sell these tokens to users. Will you be the blockchain’s John Bogle?

Working Beta on Ropstein Testnet (Video)

Link to Beta DApp (Requires Chrome with Meta Mask Installed)

Telegram

Twitter

Medium

Github

This article is the first in a series of active collaborations between the team and me. My voice and opinions remain independent.

[1] I realize that many users of Mt Gox didn’t trust it for quite a while before it imploded, but were stuck using it as few alternatives were available at the time.

[2] Other future plans include physical items such as wine and whisky.

Very interesting article! Learning something new every day!