A. Motive Waves (5-Wave-Structure) – A.1 Impulse - Extension

The last blog post concerns some general knowledge of a motive wave (five-wave-structure) and some information for one of the motive waves type called IMPULSE. This impulse is the most common motive wave. The impulse itself is subdivided in two interesting groups which are:

1.) extension

2.) truncation

Well in todays journey I am going to learn and show you what a so called EXTENSION within an impulse is.

The second one, the truncation part, is going to be considered in the next post.

For recall: Keep this both figures good in mind, so there would be no irritations in case of labeling and dechiffring.

Most impulses contain an extension.

An extension is an elongated impulse with some special subdivisions.

An impulse can be found in ONE of the three ACTIONARY waves of the impulse subwaves.

It could be wave 1, wave 3 or wave 5 the so called actionary subwaves.

In the rest of the (special-)cases either in both wave 3 and wave 5 an extension visiblity or in no one of them.

For the case IF the first and the third waves are of about equal length, the fifth wave will likely be a protracted surge.

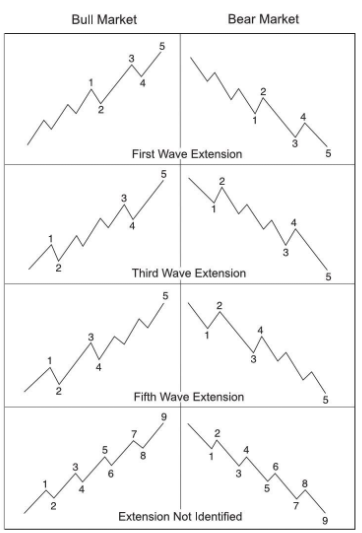

The figure below shows the extension cases in a bull and bear market.

Remember that there are impulse in each of them which are called downward and upward trending impulses.

It is important to DON'T get the habit of hesitation in labeling in the early stage of a third wave extension.

The best way is to wait for confirmation of completion.

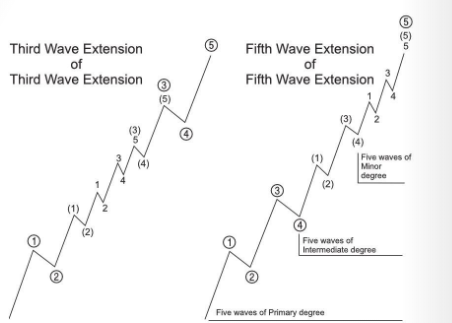

Extensions may also occur within extensions. In the picture below you can see the so called sub-extensions.

And again for revision:

Rules for interpreting impulses properly :

1.) An impulse always subdivides into five waves

2.) Wave 1 always subdivides into an impulse or rarely a diagonal

3.) Wave 3 always subdivides into an impulse

4.) Wave 5 always subdivides into an impulse or a diagonal

5.) Wave 2 always subdivides into a zigzag, flat or combination

6.) Wave 4 always subdivides into a zigzag, flat, triangle or combination

7.) Wave 2 never moves beyond the start of wave 1

8.) Wave 3 always moves beyond the end of wave 1

9.) Wave 3 is never shortest wave

10.)Wave 4 never moves beyond the end of wave 1

11.)Never are waves 1, 3 and 5 all extended

In my next blog I am going to learn and write about the truncation within an impulse.

Thanks for your attention.

I am going to try to post time by time some interesting posts about technical analysis.

This posts are reflecting my learning process.

Be blessed, happy and keep it always going on.

sources:

www.elliottwave.com

https://www.amazon.de/Elliott-Wave-Principle-Market-Behavior/dp/0932750753

Elliott Wave Principle: Key to Market Behavior by Frost and Prechter

Congratulations @rabenstein! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!