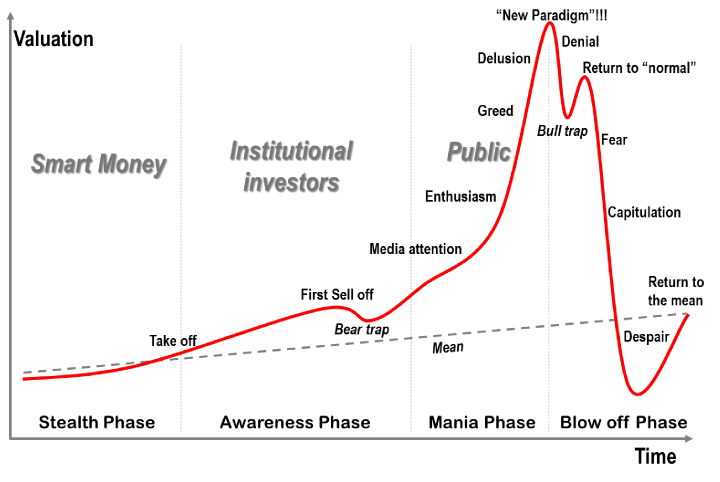

The Only Chart You Need To Understand

All markets are the same. . .I will repeat. . . All Markets are the same.

This may come as a surprise to some readers, but if you were to remove the symbol off a chart and were to look at multiple different charts over long time spans they would have the same characteristics. The key to investing is to recognize the characteristics and act accordingly. Notice that I use the word "investing" and not "trading". This information is for people that want to capitalize on markets over longer periods of time. . months or years. . not minutes,hours, or days. Most people that trade within minutes, hours, or days are doing nothing more than gambling. This is fact.

If you are interested in becoming wealthy from crypto, stocks, gold, silver, commodities, or any other asset class then you will learn to invest and be patient over long periods of time. You will recognize when the stages depicted in the life cycle of this chart are happening and act accordingly. . .

These stages are the same in all asset classes but the time for these stages to develop is different depending on how narrow based or broad based the asset class you are looking at is. .

What the fuck does that mean?

This means that if you are looking at something like the S&P 500, Dow Jones Index, Nasdaq, or any other index or basket of stocks/sector ETF etc then these cycles will take longer to occur. These would be considered broad-based/semi broad. More than one component determining prices.

Something like individual stocks, cryptocurrency, gold, silver, crude oil, etc etc. . One component to the chart and the quicker these stages happen. .

Currently, Bitcoin is in the capitulation stage and we haven't reached despair just yet. .

Despair sets in around $6,000 maybe as low as $5,000. . Once this is complete, we can then start the cycle all over again which will push Bitcoin to $45,000 by the end of 2018.

@rawdawg says you heard it here first. . .

2017 kind of destroyed realistic investor expectations. Many people expecting crypto to go to the moon without thinking about the big picture. These assets are completely untested in a true “crisis” environment, engineered or not.

I think there is still huge potential, but I wouldn’t be surprised in the least bit to see the big players make a big run on lowering cryptos when the indexes finally dump.

Would be nice to see some realistic price expectations get into people’s heads. 2017 was a moonshot, even at 8k per, bitcoin is about a 10x multiple from this time last year. You shouldnt risk in those type of gains without expecting possible huge volatility the other way.

Gonna get very interesting soon

Great post! :-) Smart money gets in early, rides the waves, and has the patience of a Saint. HODL if ya got em, and if ya don't... watch the cycles and buy in at the most opportune time.

So get set with some popcorn and your favorite frosty beverage, and watch the drama unfold. And do not let yourself fall prey to the FUD.

Resteemed by @resteembot! Good Luck!

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

dunno about commodities..

UPVOTE...good work..please see my post up today..let me know what you think??

This post has received gratitude of 4.27 % from @appreciator thanks to: @rawdawg.