Crypto Academy Season 6 Week 1 : Leverage With Derivatives Trading Using 5 Min Chart

Cover Image Created by Adobe PS

Hello Steemians!

After a short vacation, I'm here again as a Crypto Trading Professor. This time the crypto academy has made a very successful start again in a slightly different form than before. Because here we have focused more on trading-related lessons. However, as usual, I always try to present various and interesting lessons about the field of crypto trading. So, today we will talk about one of the most useful and beneficial trading methods used in Cryptocurrency Trading

Today our topic is "Leverage With Derivatives Trading Using 5 Min Chart" I think a lot of people are already aware of this Derivatives Trading method. In today's lesson, we will learn how to do that Trading method safely and beneficially using special Trading Tactics. So let's go straight to the lesson.

Image Source

Leverage trading can be defined as one of the most lucrative and as well as very risky methods that we can use in Crypto trading. The main feature here is the ability to trade with multiple times the monetary value of the capital we have. As an example, if someone has $ 10 in their exchange wallet, he can trade ten times or more of that amount using the Leverage Trading facility.

Here it is possible to make a profit, especially in a Market Uptrend and as well as a Market Downtrend. That is, you can trade as "long" if the market appears to be up and actually make a profit when the market goes up, and trade as "short" if the market appears to be down and actually make a profit when the market goes down.

The important thing to keep in mind is that Leverage Trading can make a huge profit and if we fail to accurately identify market behaviour, we may lose even the full amount we have invested and this is what we call Liquidation. That is why we need to use specialized security strategies when following these types of Trading Methods. We will further discuss these special strategies through the next subtopics.

As I described earlier, Leverage Trading is a very beneficial Trading method as compared to other traditional Cryptocurrency Trading methods such as Spot Trading and Staked Trading. So let's discuss the special benefits of Leverage Trading.

We have the ability to borrow more money at very low-interest rates based on our initial capital. Especially, in this case, there is no need to repay the loan separately as the borrowing is a spontaneous process.

Even if the market does not move as we expected, it can be saved by using a mode like cross margin and adding extra funds to it without having to liquidate all the money.

As we have the ability to see the profit easily without calculating, we can leave the market when the relevant profit is shown.

It is possible to obtain a portion of the profits of an existing leverage order without closing the entire order.

Leveraged trading techniques such as scalp trading can be used to make a profit and exit from the market as quickly as possible.

Although leverage trading is a very profitable trading method, there are some disadvantages as well. Here I will discuss the special disadvantages and weaknesses of Leverage Trading.

leverage trading is very risky as compared to other Crypto Trading Methods. Therefore, even a small mistake can ruin our entire investment.

In spot trading, there is no fee for holding coins and waiting for them to increase, but here we are charged a specified amount of money from our investment as periodic funding fees.

When the market behaves in an unexpected way, all the money will be lost (Liquidation) when the loss equals the initial capital.

Even when the level of liquidation is kept to a minimum and the trade is kept at a loss for a long time, the initial capital is depleted day by day and the level of liquidation rises.

In Leverage Trading, we should have a clear vision of the relevant Market Trend before placing an order. It is an important fact in leverage Trading. Therefore, we can filter the trend using different trend-based indicators such as MAs, EMAs, Parabolic SAR, Supertrend, MACD and many other indicators.

Here I will not deeply explain the above-mentioned indicators as we have already learned and practised them a few times in previous lessons. However, I will use several indicators for this trading strategy.

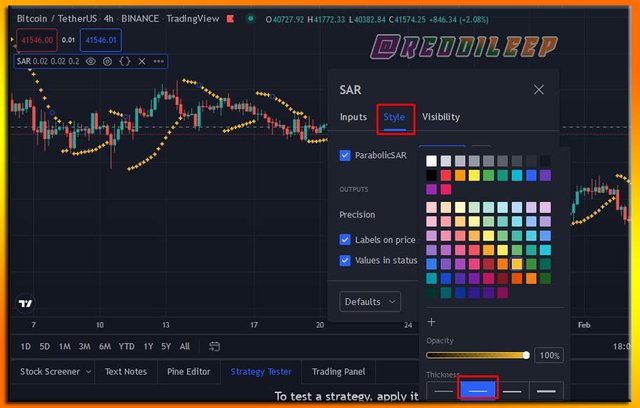

1.) Parabolic SAR

- Here we don't need to change any settings related to the Parabolic SAR indicator. However, we can modify its colour or thickness according to our choice.

Screenshot was taken from https://www.tradingview.com/symbols/BTCUSDT/

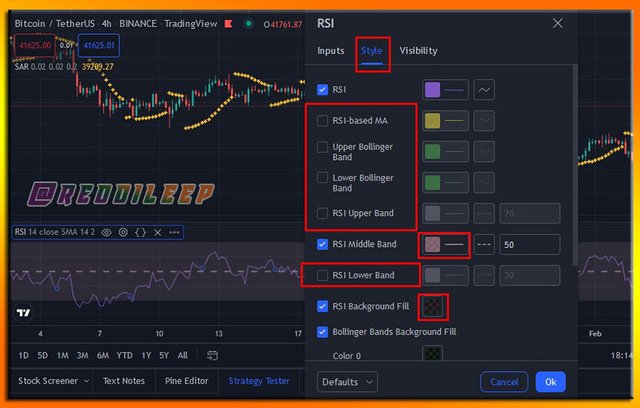

2.) Relative Strength Index

- For the RSI indicator, we can modify a few settings in the Styles menu. Here we can uncheck "RSI-based MA", "Upper Bollinger Band", "Lower Bollinger Band", "RSI Upper Band" and "RSI Lower Band". And also, we can change its "Background Color" to any white Based Color and the "Middle Band" Colour to any highlighted Color. Specially, we can increase thicknesses or RSI and Middle band.

Screenshot was taken from https://www.tradingview.com/symbols/BTCUSDT/

3.) Exponential Moving Average (Input 200 period)

- In the EMA indicator, I can select 200 as the length of the EMA input and change its colour and thickness according to our choice.

Screenshot was taken from https://www.tradingview.com/symbols/BTCUSDT/

As I mentioned earlier, filtering the relevant trend here is a very important factor. Therefore, I can use Heikin Ashi charts instead of Traditional candlestick charts. Then we can get a very smooth trend of the relevant Crypto Market. At the same time, we can use 5 min chart for this special Trading Strategy.

Screenshot was taken from https://www.tradingview.com/symbols/BTCUSDT/

As the first point, if the price level is below the EMA, we should take only "Sell Short" positions. Conversely, if the price level behaves above the EMA, we should take only "Buy Long" positions.

Secondly, we can focus on the Parabolic SAR indicator. if the Dots of Parabolic SAR indicator are above the Price level, we can take "Sell Short" positions and if the Dots of Parabolic SAR indicator are below the Price level, we can take "Buy Long" positions.

Finally, we can take the decision using the RSI indicator. Here we can Confirm our Buy position if the RSI is below 50 Level. (Below Middle Band). Because the RSI should not be extended much. However, if we can take our entry below 20 levels for the RSI after confirming the other 2 indicator signals, signal accuracy will be higher.

Below I have included a screenshot for a Good "Buy long" Opportunity. Here we can take the entry point when the Parabolic SAR begin to show dots below the Price level. Finally, we can close the order or take profit at the point when Parabolic SAR begin to show dots above the price level. Especially we should confirm EMA and RSI before taking to position. In the RSI, we can also observe hidden bullish divergences for a better trading opportunity instead of this simple RSI technique.

Screenshot was taken from https://www.tradingview.com/symbols/BTCUSDT/

Below I have included a screenshot for a Good "Sell Short" Opportunity. Here we can take the entry point when the Parabolic SAR begin to show dots above the Price level. Finally, we can close the order or take profit at the point when Parabolic SAR begin to show dots below the price level. Again, we should confirm EMA and RSI before taking to position. Same as previously, we can also observe hidden bearish divergences for a better trading opportunity instead of this simple RSI technique.

Screenshot was taken from https://www.tradingview.com/symbols/BTCUSDT/

In my lesson, I have described only a summary of these topics and you should do better research and answer all the following questions in your own words. You are totally free to use any language. But when you mention something in the screenshots, you must use only English.

1- Introduce Leverage Trading in your own words.

2- What are the benefits of Leverage Trading?

3- What are the disadvantages of Leverage Trading?

4- What are the Basic Indicators that we can use for Leverage Trading? (Need brief details for any essential Indicators and their purposes)

5- How to perform Leverage Trading using special trading strategies (Trading Practice using relevant indicators and strategies, Screenshots required)

6- Do a better Technical Analysis considering the above-explained trading strategy and make a real buy long or sell short position at a suitable entry point in any desired exchange platform. Then close that buy or sell position after appearing trend reversal signal from the Parabolic SAR indicator. Here you can also close your Buy or Sell position using any other desired Trading Method in addition to the signal coming from the Parabolic SAR indicator. However, here you must prove that trading method as a reason for closing your position. (Usually, You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines or any other trading pattern. Use at least 2X leverage and no more than 10X )

You must submit your Homework Posts in the Steemit Crypto Academy community.

You have to include all the details in your own words without including someone's words in your content. The concept can be the same but your content should be unique.

You must include at least 600 words in your homework posts.

Plagiarism is strictly prohibited in the whole Steemit platform and you will not receive any privileges.

All the screenshots and images should be fully referenced and the referenced images should be copyright-free. And also, include your user name as a watermark in every screenshot.

You should use tags #reddileep-s6week1 #cryptoacademy and your country tag among the first five tags. Furthermore, you can include relevant tags such as #leverage-trading, #derivatives.

According to new rules changes, only people actively, and successfully, participating in #club5050 will be eligible to get rewards for the Steemit Crypto Academy homework tasks.

Your homework Title should be

[ Leverage With Derivatives Trading Using 5 Min Chart ]-Steemit Crypto Academy | S6W1 | Homework Post for @reddileepHomework task will run from Sunday 00:00 February 6th to Saturday 11:59 pm February 12th UTC Time.

If you have a reputation of 60 or above, and a minimum SP of 250, then you are eligible to partake in this Task. (You should not have any power-down history during the past 30 days and your effective SP should not be delegated-in SP). And also, if you have used any buying vote services to build your reputation, you will not be eligible to partake in this Task.

If you didn't receive the score for your homework post within 48 hours, you can put the link in the comment section. Otherwise, don't leave your post link here.

If you have any queries related to my lesson, you are totally free to ask anything in the comment section.

Cc:

Thanks you prof for this course...

😇

You are welcome @liasteem

Hope to see your participation as well.

Hello sir

Sir i submit my homework post for your lecture yesterday . i found all posts are checked. My post has not checked yet . plese check it sir.

https://steemit.com/hive-108451/@alexcarlos/leverage-with-derivatives-trading-using-5-min-chart-steemit-crypto-academy-s6w1-homework-post-for-reddileep

Ok, let me check it.

Wow, thats a very good topic to talk about and i really do enjoyed your teaching thank you very much

You are welcome @usmanismail882

Beautiful and interesting topic one would have tackle but reputation will not permit one 🤣

Try to post diary games and other interesting content in a good community. Then you will be eligible soon.

Yes prof indeed am working on that.

😂😂😂😂 i tell you o

Hello Prof @reddileep, please is the power up of 150 steems in the last 30day a necessity to participate?

No, it's not necessary. But you need to power up at least half of your earnings.

wonderful ..

Thank you @aneukpineung78

A wonderful topic, I was waiting for learn the leverage for a long time and finally its here.

Thank you for the appreciation. Hope to see your participation as well.

একটি চমৎকার টপিক দিয়ছেন ভাইয়া।

Hi. I took a break from steemit for a while and didn't earn any steem. Now I want to return in season 6, but I did not do 250 sp power ups. I can't buy steem from the stock market. I have never shot or power down. I meet club75 and club5050. I want to join your assignment. can i do this?

You don't need to power up 250sp. 250sp means your own Steem Power. So, you have 2,058.888 SP.

However, I couldn't find any single Steem Power up for the past month. Therefore, our club5050 checking indicator will not work for you. However, you can do some small amount of power up and use #club75 maintaining 75% power-ups for 60 days.

I couldn't do steem power up because I took a break from steemit. I can't buy steem from stock markets right now. However, I haven't taken any steem in the last 6 months. At least how many steem power ups I make, I will be in club5050. I would appreciate it if you could review my situation.

As you have not withdrawn any single steem for the past 3 months, you are eligible to use the #club100 tag. However, according to new rules, you have to power up at least 1 steem. Because, without a single steem power-up for the past 30 days, our indicator doesn't show your club5050 status. Tomorrow steemitblog will announce all the details. Kindly wait for the update.

Thank you Prof. @reddileep for this wonderful and interesting lecture. Pls, is someone who have 60 reputation and above 250SP but do not currently have anything in his wallet to participate in #club5050 be eligible to get reward?

I have gone through your account and I found you haven't powered up at least a single Steem for the past 30 days. But you are holding 61.552 liquid Steem in your account. So, try to power up at least half of that amount. Then you are eligible to take part in this course.

Contact me for any further clarification.

Thank you very much for the clarification prof. @reddileep. I am very grateful. Expect my home soon.

Hi professor @reddileep can you check if am eligible for club50/50 please before i start my task.

No, you are not eligible. Power-Ups should be equal to or greater than Transfers.