Unusual Options Activity In Avaya

Avaya Holdings Corp., through its subsidiaries, provides digital communications products, solutions, and services for businesses worldwide. Avaya competition includes Cisco Systems and Microsoft.

But in general Avaya because to a sector that isn’t exciting if you are a day trader, envied by investors who are seeking dividends.

So it was very odd when I noticed unusual trading activity in Avaya today. It was even odder to see that Avaya’s shares were up more than 30% yesterday. In a single day, the stock price has gain almost to cover the 35% loss it has suffered in the last six months.

And then I found what I was looking for…WHY are the shares up and what’s up with all the unusual option activity.

Telecommunications equipment and software vendor Avaya Holdings Corp is considering a leveraged buyout offer from a private equity firm that values it at more than $5 billion, including debt, people familiar with the matter said on Sunday.

The acquisition offer comes 15 months after Avaya emerged from bankruptcy protection, the legacy of a previous leveraged buyout, its $8.3 billion sale to private equity firms TPG Capital and Silver Lake in 2007.

Avaya's board of directors is evaluating an offer from a private equity firm that values it at more than $20 per share, the sources said. Avaya shares ended trading on Friday at $13.21, giving it a market capitalization of $1.5 billion.

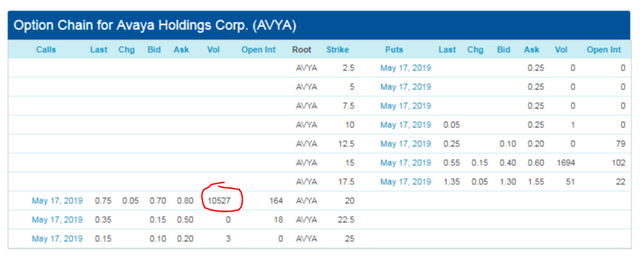

Today, the Smart Money bought over 10,000 May calls with a $20 strike price.

As the competition has gotten tougher, some believe a buyout makes since for Avaya. Again, Avaya filed for bankruptcy protection in January 2017. Thus, a buyout would give Avaya the flexibility to make the necessary moves to be successful long term without Wall Street breathing down their neck. So how high can Avaya’s stock price go between now and mid-May, lets go to the charts to find out?

The first test will be the daily supply at $19.50.

If the daily supply is breached, the next test will be the weekly supply at $22.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Congratulations @rollandthomas! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!