Crypto Academy Week 15 - Homework Post for @yousafharoonkhan

Hello Everyone,

I’m glad to be part of this class. I will read and attempt the assignment. Hope I am able to be the best student in this class.

Lets get started

Question 1.

Order book is a financial book that record and display the selling and buying of an asset. Order book displays the buying price and the selling price. This buying and selling order price placed is recorded and also records completed transactions. The order book identifies users behind the buying and selling bids but it also has an option to stay anonymous. Order book provides important information hence enhance transparency in the market.

Order book in crypto exchanges is so different from the local market order book. Crypto exchanges record and saves a successfully completed transaction either buy/sell in a trading pair and also it record and saves bids that are placed and yet to be completed. It reveals the pair volume traders are buying/selling at a given price. This transparency of the market helps traders in their analysis of the market so they can make a good entry and exit points to make profit.

In the local market order book the unit price of a commodity is what is only displayed. The past sale record wont be displayed and also the number of past and after sale wont be displayed. Hence in the local market order book there is no transparency compared to the crypto order book.

| Crypto Order Book | Local Market Order Book |

|---|---|

| Order book is transparent | Order Book is not transparent |

| Order book is accessible to everyone | Order book are accessible to only owners or sells person |

| Is possible to make price prediction using the order book in crypto order book | It is not possible to predict future price as price is not determine by unit price but its determined by supply and demand. |

| Consist of trading pair to be able to convert asset to crypto or fiat | Only single currency can be used for an exchange of commodity |

| Records of past and present transactions are displayed | Only unit price of commodity are displayed |

Question 2.

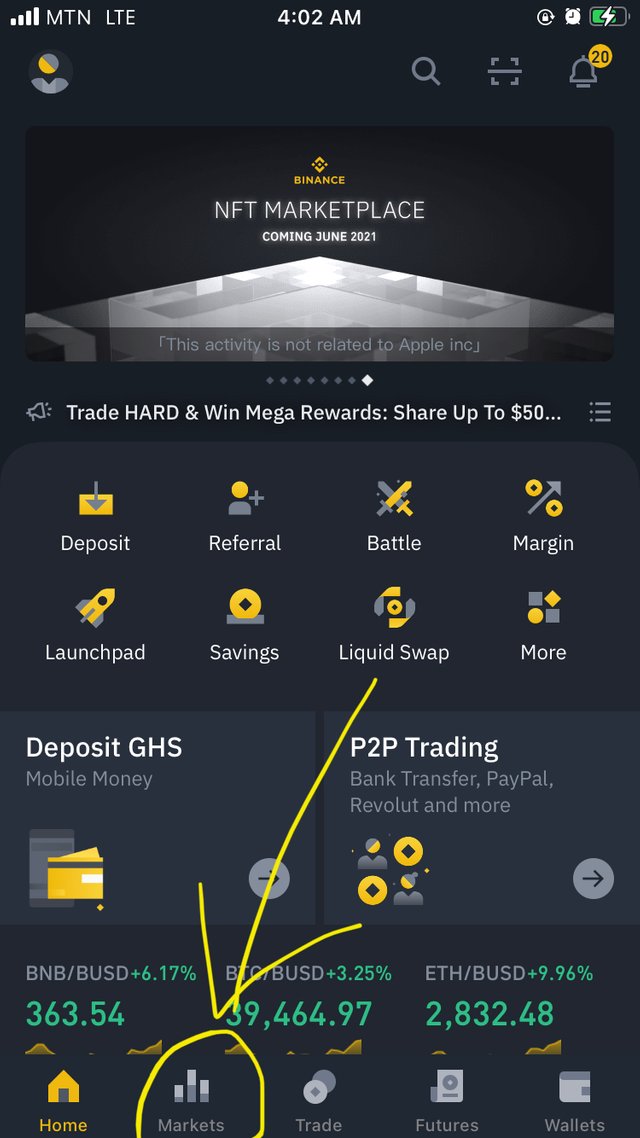

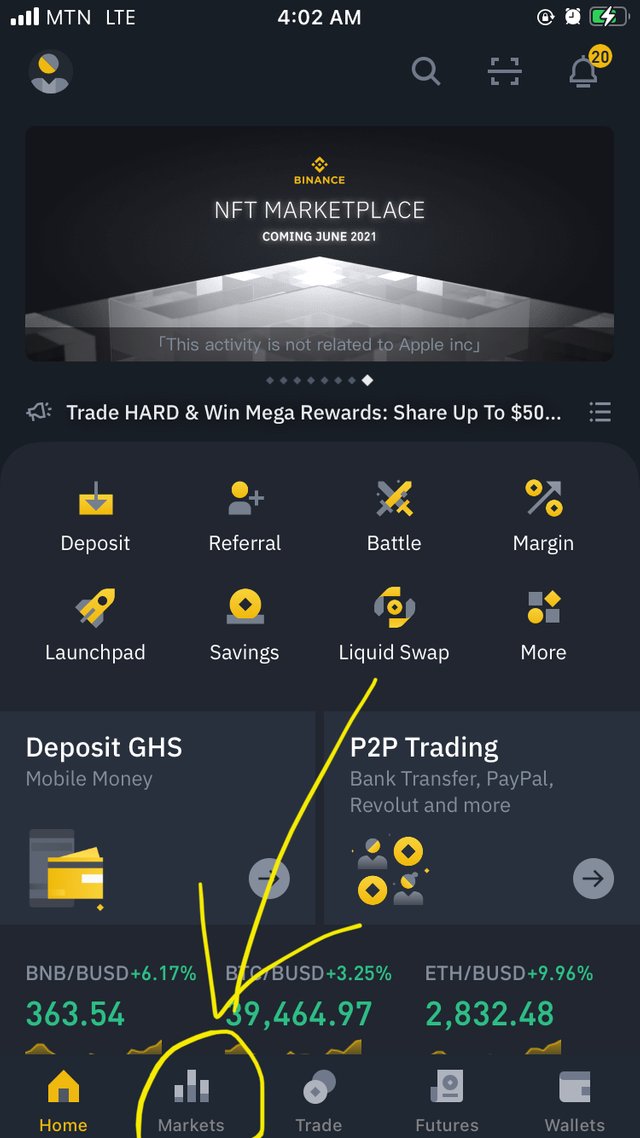

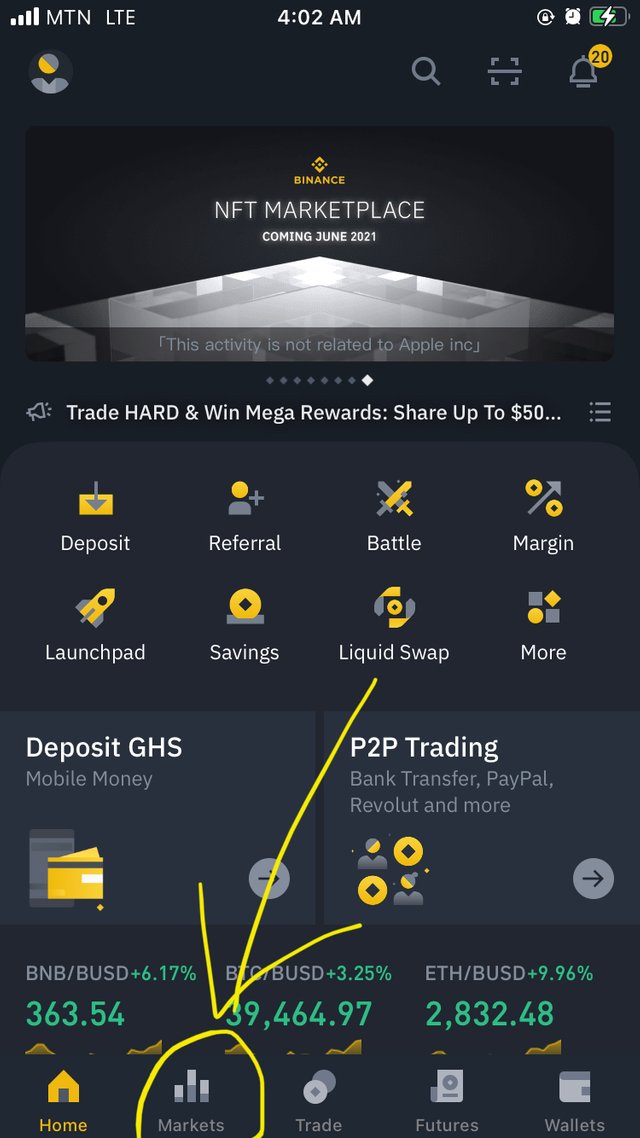

With all my trading i have been using the binance App. I will use the Binance App to show a step by step on how to Find the Order Book.

Log in to your Binance App

At the bottom Panel of the home page click on Market

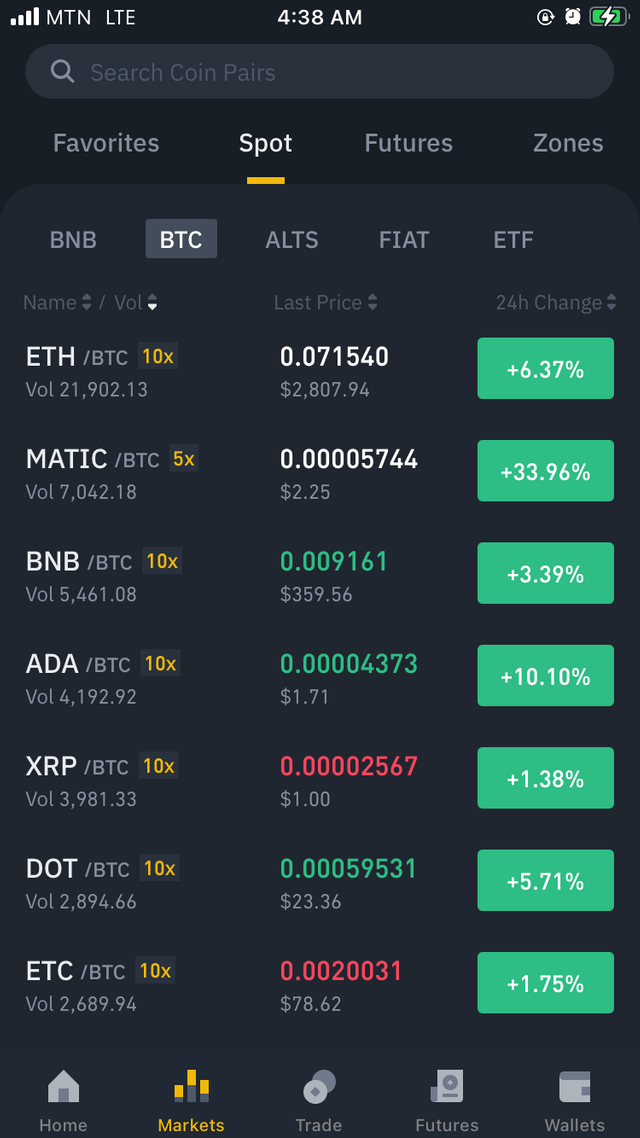

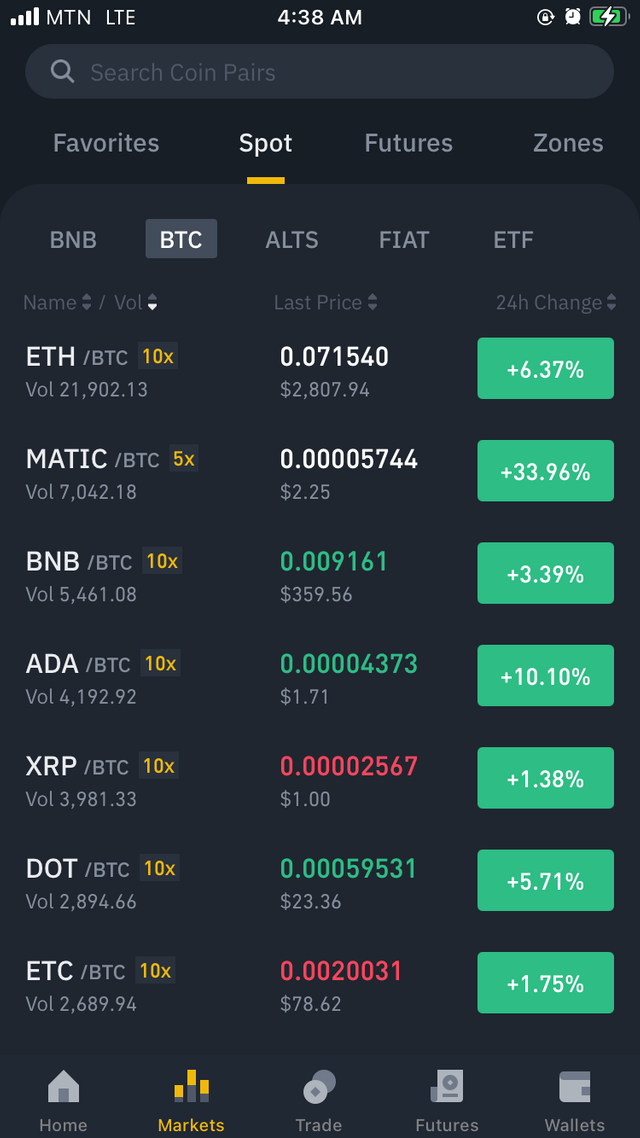

On the next page you have multiple trading pairs select one. You have the option to search for your ideal one

Click on your preferred pair. The next page will appear with details of the pair. On this page we can find Order Book just below the pair chart as seen in the screenshot below. They contain orders with their respective time and amount.

Pairs

They are crypto currency assets that can be converted or exchanged to each other. Example is ETH/BTC which means we can convert Etherium to Bitcoin or Bitcoin to Etherium in this pair. We have two types of crypto pair which are Crypto to Crypto pair or Crypto to Fiat pair. Crypto to Crypto pair example can be BTC/ETH pair and Crypto to Fiat example is BTC/USD pair.

Support and Resistance

Support is a price level in an asset chart where a downtrend is paused due to the demand or buying rate of that asset. When the price of an assets decreases in a downtrend, traders make entry to take advantage of the fall in price of the asset to make profit. This pause the downtrend and expected to make a reverse to uptrend. The support line is formed when the buying rate of an assert increases.

Resistance is a price level on an asset chart where an uptrend is paused due to the demand or buying rate of that asset. Just like the support which is the opposite of resistance. Traders make an exit off the market when they have make some profit after a period of uptrend movement of the price. The uptrend pauses and expected to make a reverse to fall back down. The resistance line is formed when the selling rate of asset increases.

Limit Order

A limit order is a target price set to sell or buy an asset at a specific price different from the current price. This means a buy order can only be executed if the targeted price is reached. For example if i want to buy Etherium and its current price is $2800 which i want to buy it at cheaper or lower price of $2500. I will set my limit order to $2500 so when the price fall to the targeted price it sells automatically. This also applies to Sell orders, I will set my limit order $3000 so that it sells automatically if the prices reaches the amount.

Market Order

Market order is a buy or sell of an asset at the current price of the market. This order is executed immediately as the buyer or the seller is willing to sell or buy at the current price of the market. It is simplest of all the order types because there is quick and easy transaction in this order. If the current price of Etherium is $2500 and i place a market order. It will sell immediately with the current price of etherium.

Question 3.

Features of order book

Crypto Order book keeps record of a buy or sell order pairs including their volume, supply, market capitalization etc. Below is an example from my Binance

In the screenshot above the orders at the left written in green are the buy offers and those in Reds at the right side are the Sell orders. We can clearly see the buy and sell orders that are being occurring in the market by different traders with different prices. The transactions execute very fast that's why we can see the market changes trades every second.

Buy Order

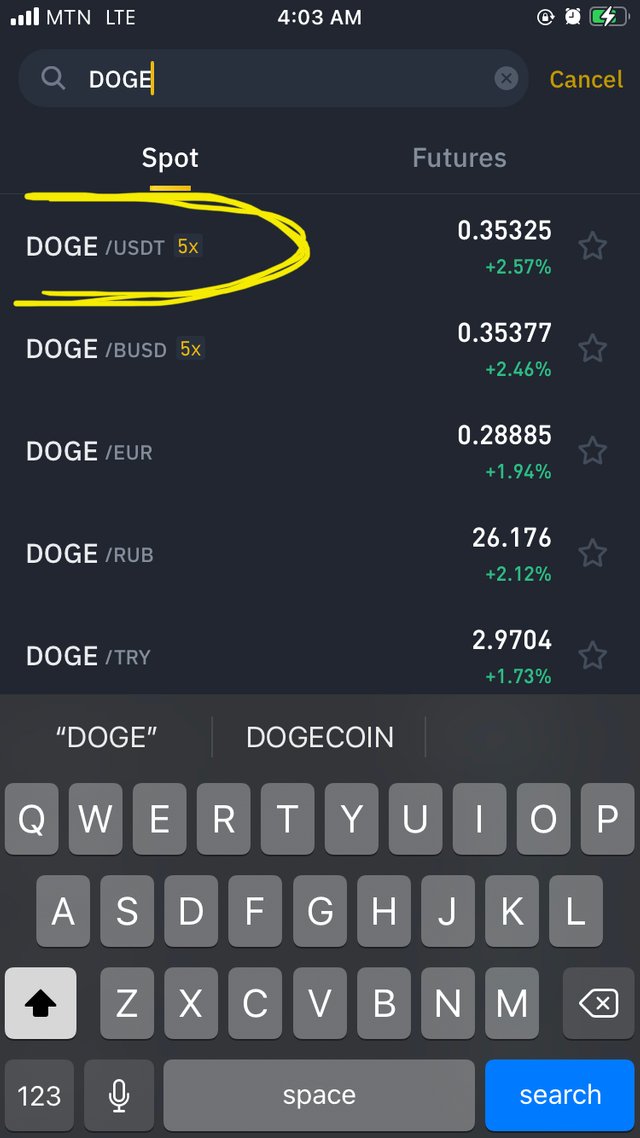

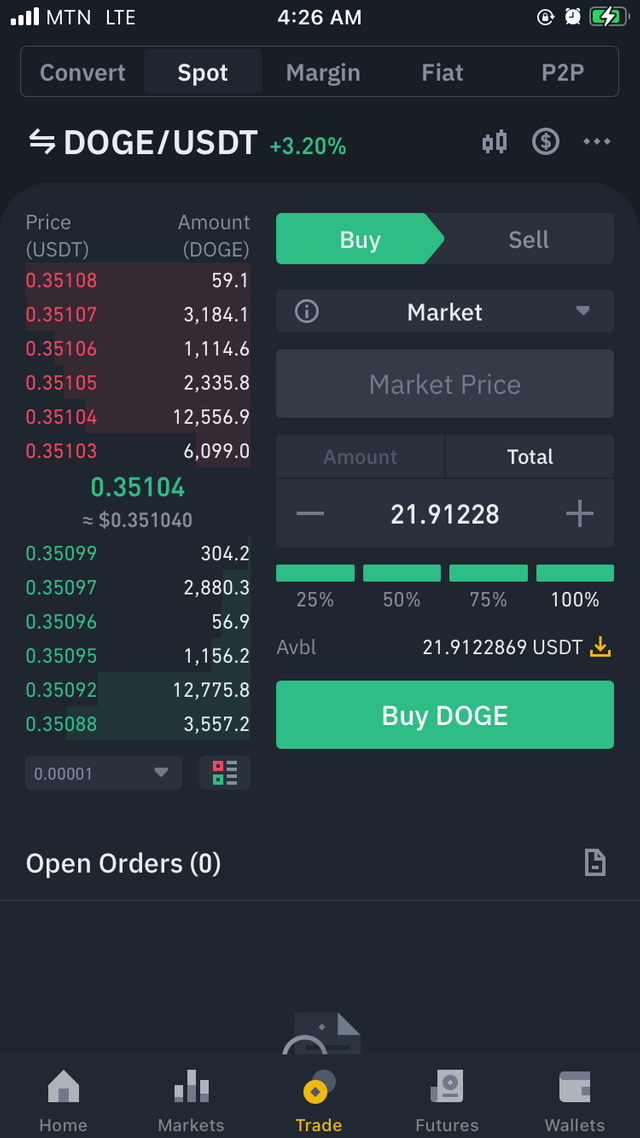

Buy order is the exchange of an asset for other cryptocurrency. This buy order can be an exchange for other tokens or fiat. To make this order you have to choose a pair of your choice which you want to covert from or to. Lets take an example with my binance account. I want to buy DOGE with my stable coin USDT. I will have to choose a pair of DOGE/USDT.

Click on Market at the panel below

Choose you pair of choice. in my case DOGE/USDT

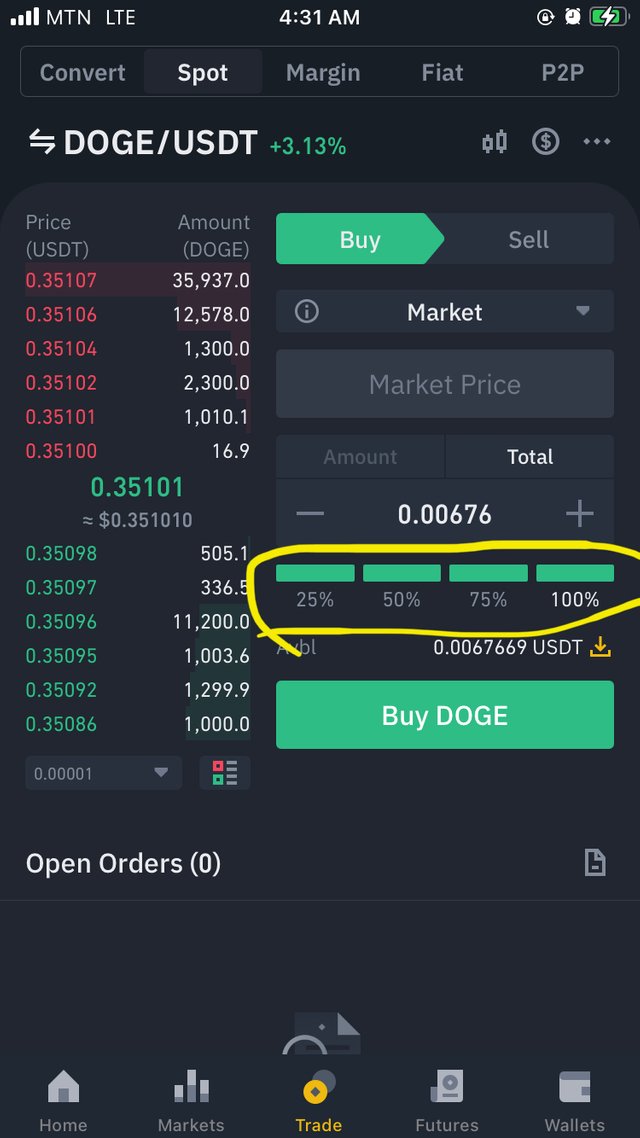

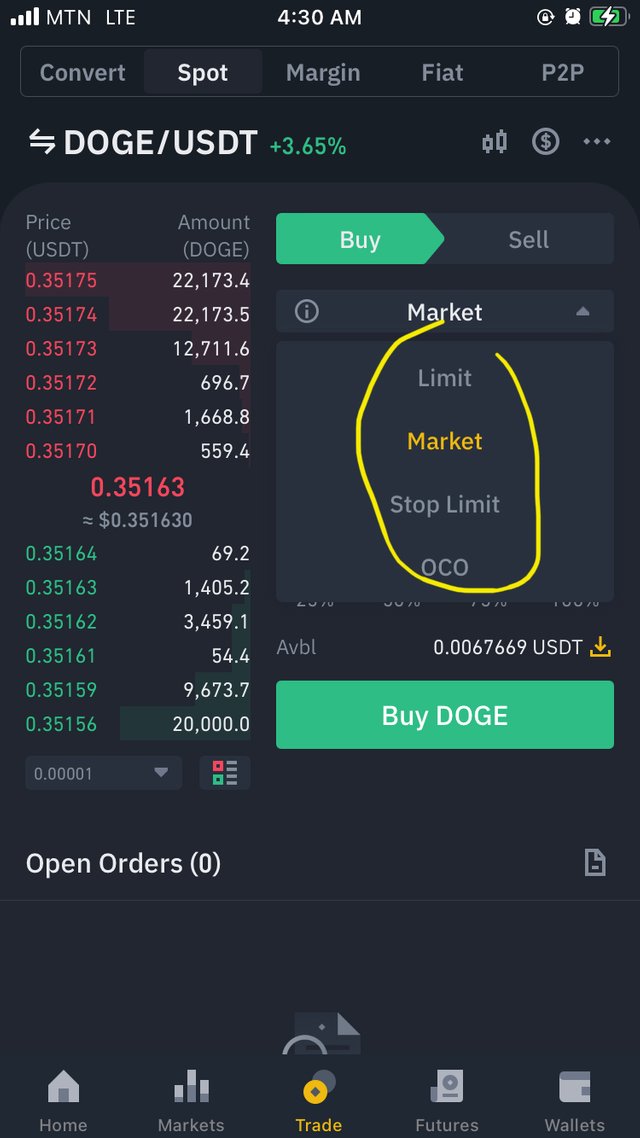

now click on Buy

Here i have the option to sell some amount of percentage of USDT or all. I can also set to sell at the market price or set my own buy limit.

I have requested to sell 100% of my USDT to DOGE. Then click on Buy to place your order

I have successfully buy 62.4 of Doge coin

Sell order

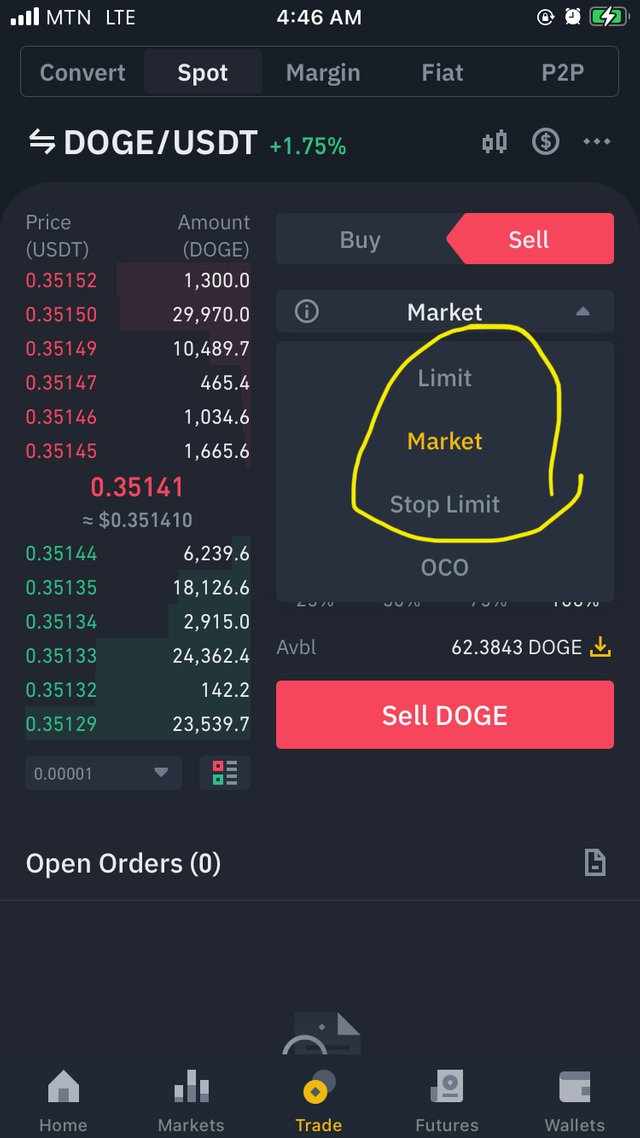

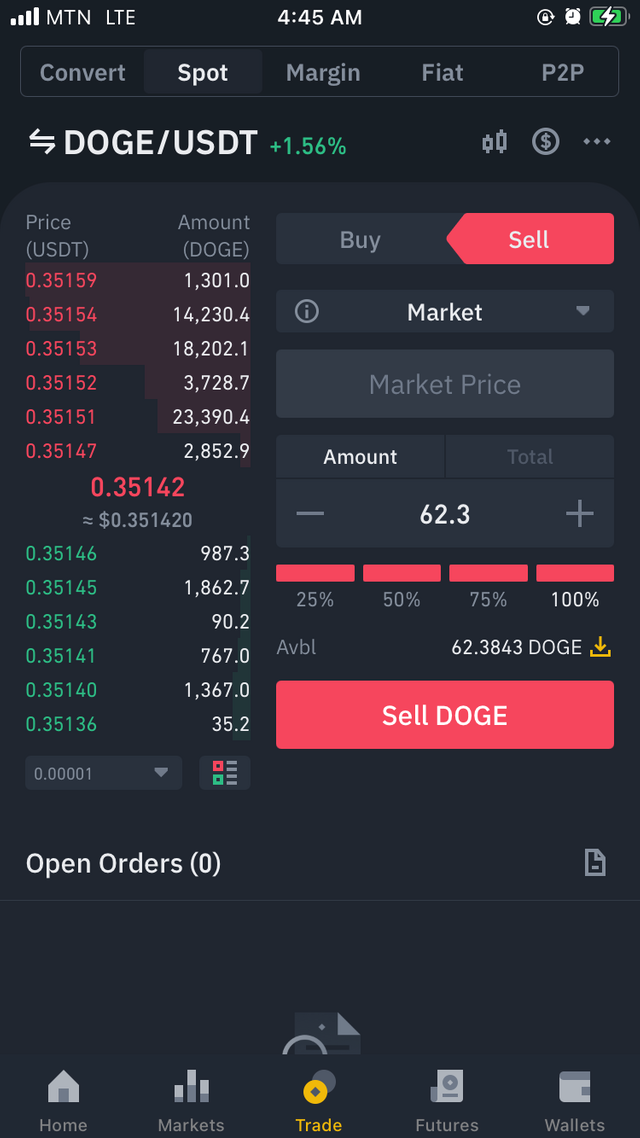

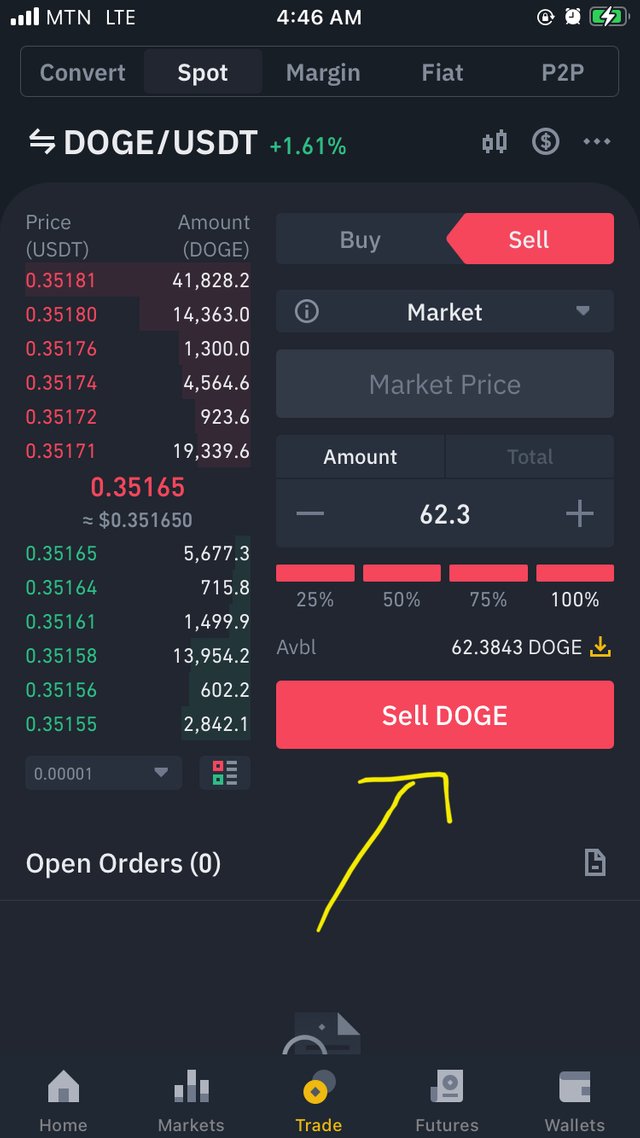

Sell order is the exchange of crypto asset to other cryptocurrency or fiat amount by selling what you have to get what crypto asset or fiat amount you want. To make this trade you will have to select your trading pair containing the asset you want to sell with what you want to buy. Let use the same pair DOGE/USDT for my practical example.

click on market on the panel below the homepage.

click on your preferred pair

click on sell

You can either sell with the current market or set your order limit

I have requested to sell 100% of my USDT

then I click on sell Doge

Question 4

Stop-limit Order is an important feature of a crypto exchange market. It helps a trader to have full control of his or her assets. When we sleep over night or busy with work, we don't have knowledge of what is going on in the market so we can set a price stop limit to execute or sell your asset when it hit a particular price. Lets get to know how to trade with stop-limit.

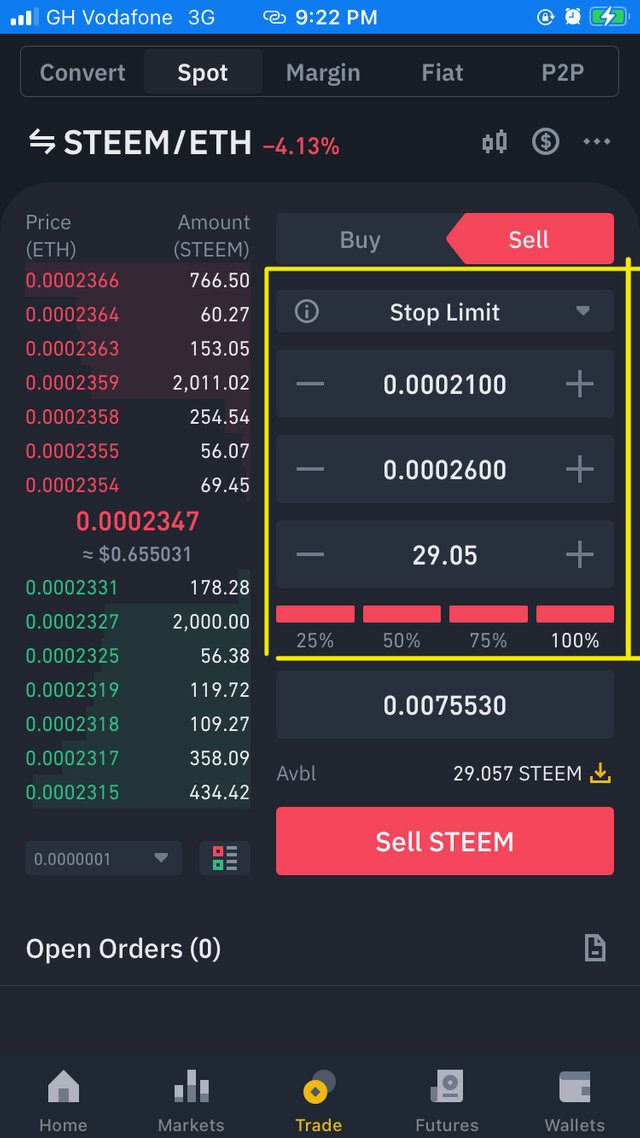

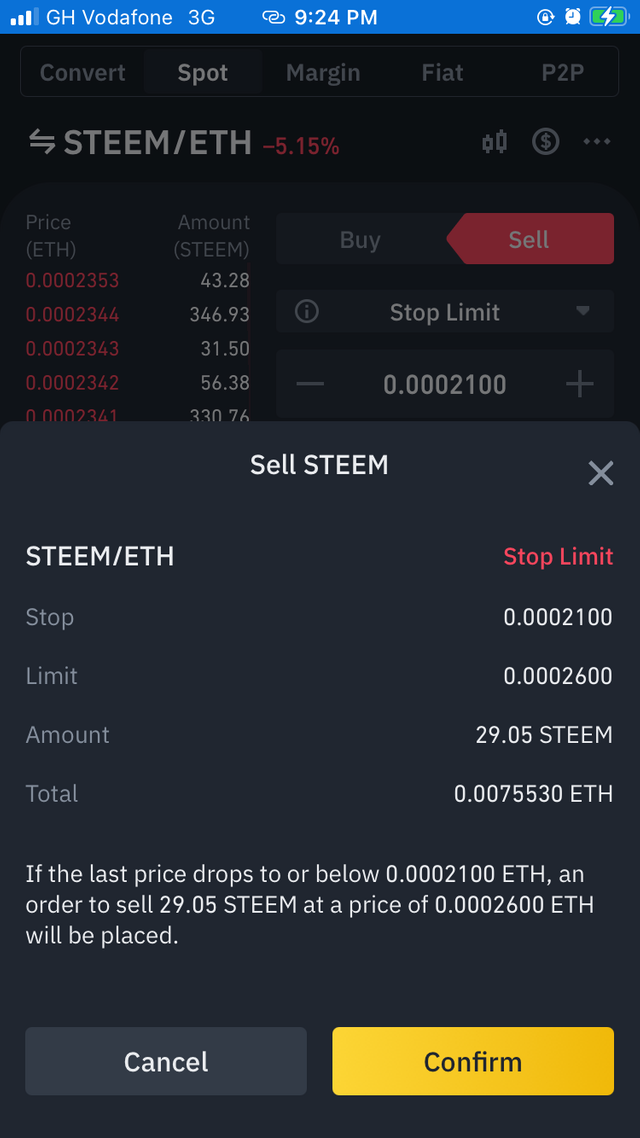

Select the trade pair of your choice. in my case STEEM/ETH on binance spot trading

Select the Stop-Limit in the pair

Input your Stop limit. in my case Stop-limit is 0.0002100 and limit order price 0.0002600 I also selected 100% of my asset to be traded with

Now click on sell steem and confirm to place order.

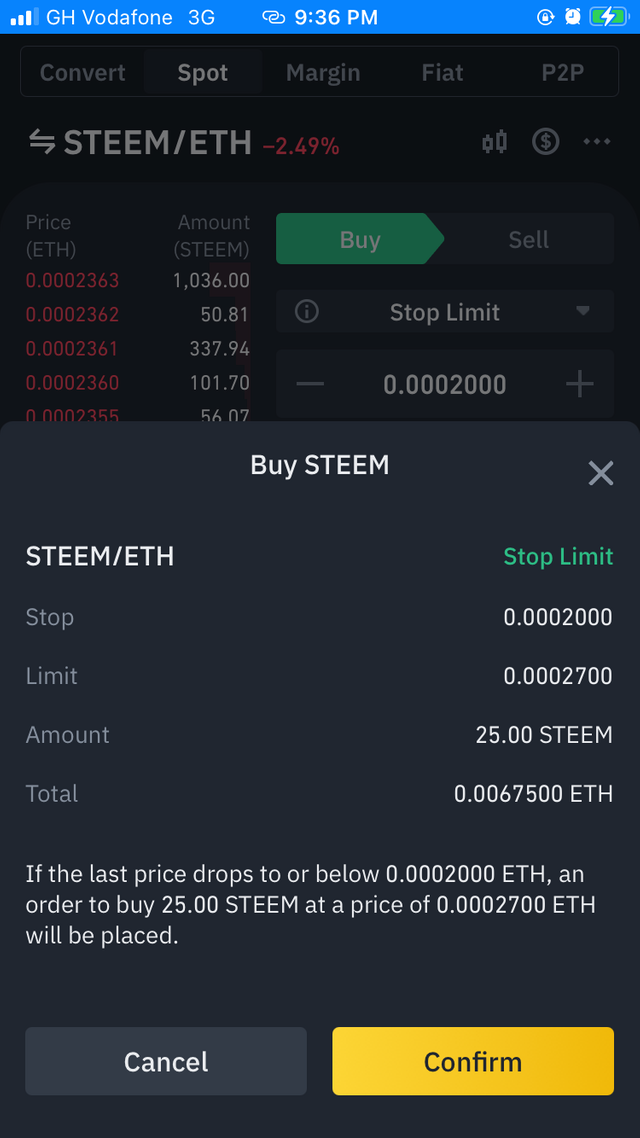

Again Select the trade pair of your choice. in my case STEEM/ETH on binance spot trading

Select the Stop-Limit in the pair

Input your Stop limit. in my case Stop-limit is 0.0002000 and limit order price 0.0002700 I also selected 100% of my asset to be traded with

Now click on sell steem and confirm to place order.

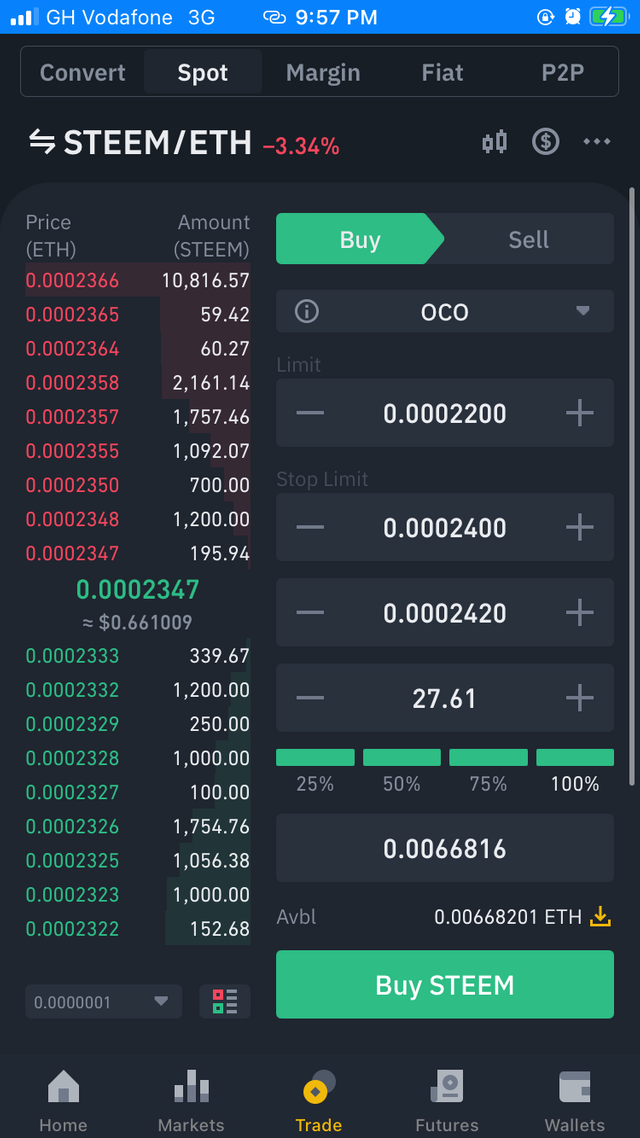

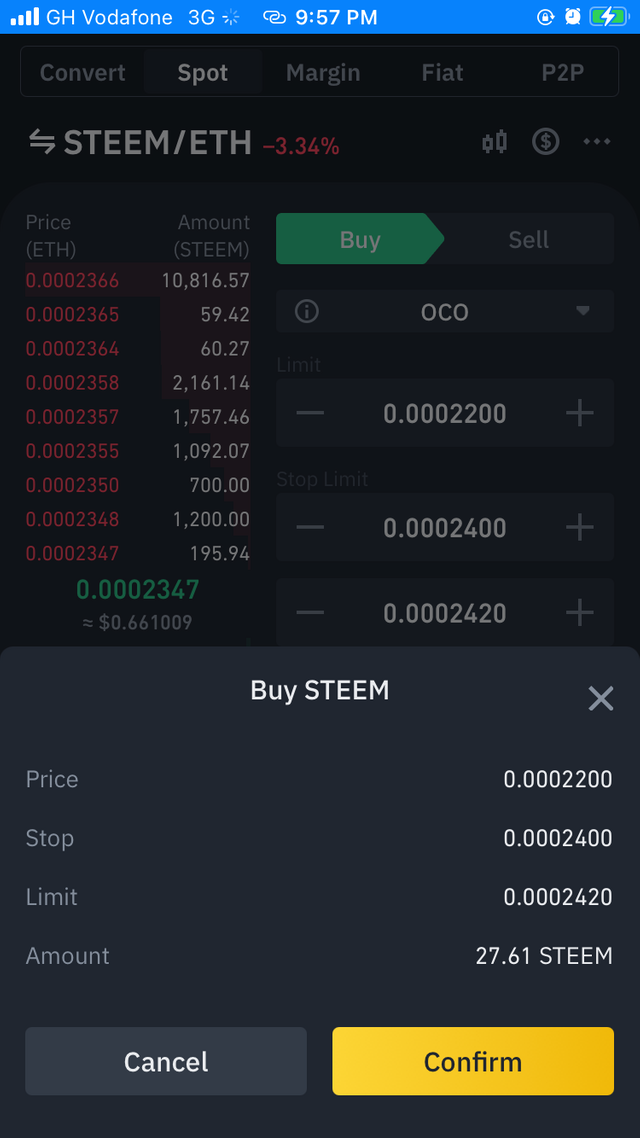

The full meaning of OCO is One Cancels the Other which allows traders to set a stop limit other and limit order at the same time. In this trade one order is executed and the other get canceled automatically.

- Select OCO on the trading options

- Set your limits

- Click on buy steem and confirm to place your order

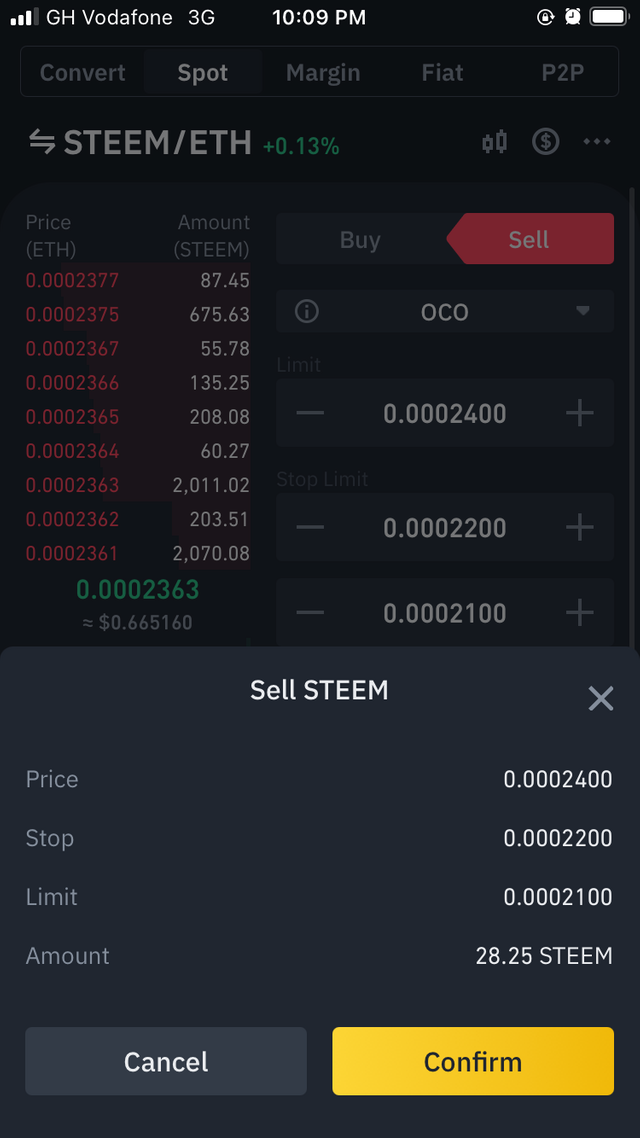

- Select OCO on the trading options

- set your limits

- Click on sell steem and confirm your order

Question 5.

The order book has options to use to take profit from crypto market. This options are Limit Order, Market Order, Stop Limit, and also OCO is another way to take profit.

The Limit Order helps traders to take their profit even when they are not with their phone or exchange. This order is created with a target price to execute and take profit automatically. With this feature a trader don't have to sit all day to check on the price of the crypto asset.

Market Order is another great and important feature. This order is executed instantly in a buy/sell order at the current price of the token. it doesn't need to wait for a specific price target.

Stop Limit orderhelps traders to limit price for a trade and also set a stop-loss order to control both profit and loss in a trade.

OCO is an important feature which allows traders to create two orders at the same time. The order automatically cancel when one of the order is executed.

The order book is a transparent feature that displays buy/sell orders, completed transactions, volume etc. This transparency of the order book helps traders to make Technical analysis to get a good entry and exit point of the market. The Volume of buy/sell order gives me a hint on how the price will go in the next minute or hours. i can be ale to determine which is dominating the market either majority of traders are buying or selling. With the use of Indicators of the order book such as the RSI and MACD indicators helps in a technical analysis. With the RSI indicators when its at 30 it means its overbought and when its at 70 it means it oversold

Order book is very important in trading. Every trader needs to know how to use these features. Easily help traders to make decisions whether to make entry or exit. For the purpose of going to bed traders needs to know how to set limits to manage their profits and loss

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

If you look at feature in the order book, you will see a lot of technical and simple advance feature. You have not searched for futures in detail. it is very much important to explore the order book to use the feature that will help you in trade

look fine home work

thank you very much for taking participate in this class

grade :6.5