Crypto Academy Week 7-Homework Post for @stream4u

Hello people,

Thanks to this community and the professors for the support, lessons and upvotes given to us all. We appreciate y’all.

After reading the lesson note, I’m soo confident I can partake in @stream4u week 7 homework.

image.png

source

Money is essential to human day to day activities, so we spend all our life trying to acquire it. Money is the means of exchange for what we need or the service we need. Since money it’s hard to get, it is important we manage it well so we don’t misuse it.

WHAT IS MONEY MANAGEMENT

Money management is the act of tracking and planning a person money or peoples money.

For you to manage your money properly you need to budget, save, invest, and spend.

Money management could be good technique used to make money multiply to the very best interest. We spend money that never was included in budget, could be spent on hospital, school, cravings or maybe lost money. For good money management, we need to get it back as quick as possible. Money management techniques has been brought to existence to to get back the amount spent on individuals, firms and institutions spend on goods which has no important value to their lifestyle, long-term portfolios and assets.

With crypto, money management is a financial way which determines how a trader invest his assets in cryptocurrency.

WAYS TO MANAGE MONEY IN CRYPTO TRADING

RISK TOLERANCE

Risk tolerance is the ability of an investor to accept loss while making an investment decision. There are factors that determine the level of risk a person can take.

An investor need to know the risk tolerance level to know how to plan their entire portfolio and will help how they invest. If an investor risk tolerance is low, he need to take low risk investment and avoid high risk investment.

Factors affecting Risk tolerance

There are factors that you need to pay attention to when taking a risk;

Timeline

An investor need to know the amount of money he or she needs in a period of time before taking a risk. An investor who need an amount of money in ten years time can take more risk than an investor who needs the same money within 2 years time. Therefore more risk can be taken if there is more time. The market has gone upwards over the years while there are lows in between the short terms.Goals

Every individual have their own financial goals. The amount required to attain certain goals is calculated while an investment plan to deliver such returns is usually pursued. Goals have affect on the level of risk an individual takes. So we can say the higher the goals of an investor the higher the risk.Age

Young individuals can be able to take more risk than the older individuals. Young individuals have more time to make money to handle market fluctuationsPortfolio size

The bigger the portfolio, the higher tolerant to risk.an investor with $30 million portfolio will take more risk than an investor with $5 million portfolio. The percentage loss is much less in a larger portfolio when value drops when compared to smaller portfolio.Investor comfort level

Every individual have their level of risk they can take so each investor handles risk differently. The behavior of an investor while taking risk says how comfortable there are. The market volatility is soo stressful most at times, so every individual have how they handle that.

GoogleCC BY 2.0

Types of Risk Tolerance

There are three main categories on how much risk investors can tolerate.

The three categories are:

Aggressive

Aggressive risk investors are skilled with the market and take huge risks. These types of investors are used to seeing large high and lows movements in their portfolio. Aggressive investors mostly are wealthy, experienced, and usually have a broad portfolio.

Because of the amount of risk they take, they reap higher returns when the market is doing good and also face huge losses when the market performs poorly. they do not sell at times of crisis in the market as they are used to fluctuations on a daily basis.Moderate

Moderate investors takes lesser risk than the aggressive risk investors. They take a reasonable amount of risk that’s to say they set an amount of risk that they can handle. With this approach, they rarn less compared to aggressive investors when the matket is doing well and does not suffer huge loss when the market gets bad.Conservative

Conservative investors do take the least risk in the market. They usually go for option they feel the safest and not have much to loose. They think about avoiding looses than making gains. These categories of investors, invest are limited to a few, like FD and PPF, where their capital is protected and safe.

Stick to and Follow your Trading Plans

This is an important strategy. Most of latest traders will toss their plan within the ashcan when the hell breaks loose, and that they lose a few of trades.

The panic therefore making mistakes in trades is always closely followed by a group of revenge trades where a trader seeks to regain all that he or she has lost by carrying uncoordinated trades. The investor mostly result to more loss

it's always essential to stay to your plan. You are advised to write down your strategy on paper and go with it. The written note shouldn't be changed and will be adhered to religiously.

Your written note should include clear exit points. In case you lose, don't alter the stop loss point within the hope of recovery, unless it's provided in your strategy.

Secondly, you ought to highlight all the amount at which you propose to enter new contracts, and therefore the volume desired, just in case of a positive outcome.

This money management strategy is one of the most difficult for all traders. Investors panic, when the markets gets bad. Not many can withstand the thought of losing money and ultimately concede to pressure. If you'll master this strategy, combined with the op

My money management will always be based on the above assumptions. What I earn every month or year will always be allocated some percentage to invest into cryptocurrency. I see soo much my future with crypto. I will always try to buy differend tokens. Example, I buy one ETH coin,I need to monitor if it’s going in a downward direction or going to rise using my portfolio. I do this because it can lead me to the next coin I should invest in. This will help me manage my money without taking big risk of losing.

Portfolio Management

Portfolio management is the act of taking benefits and profits from an investment.

With this type of management style, the strengths and weaknesses and how streaks rise and fall are compared and opportunities checked and also falls in an investment. Portfolio management is in two phases, thats, active and the passive portfolio management.

The active type is about buying and selling of goods and other assets in other to beat the larger market. With the passive type it seeks to compare the returns of the market by imitating the makeup of a particular index.

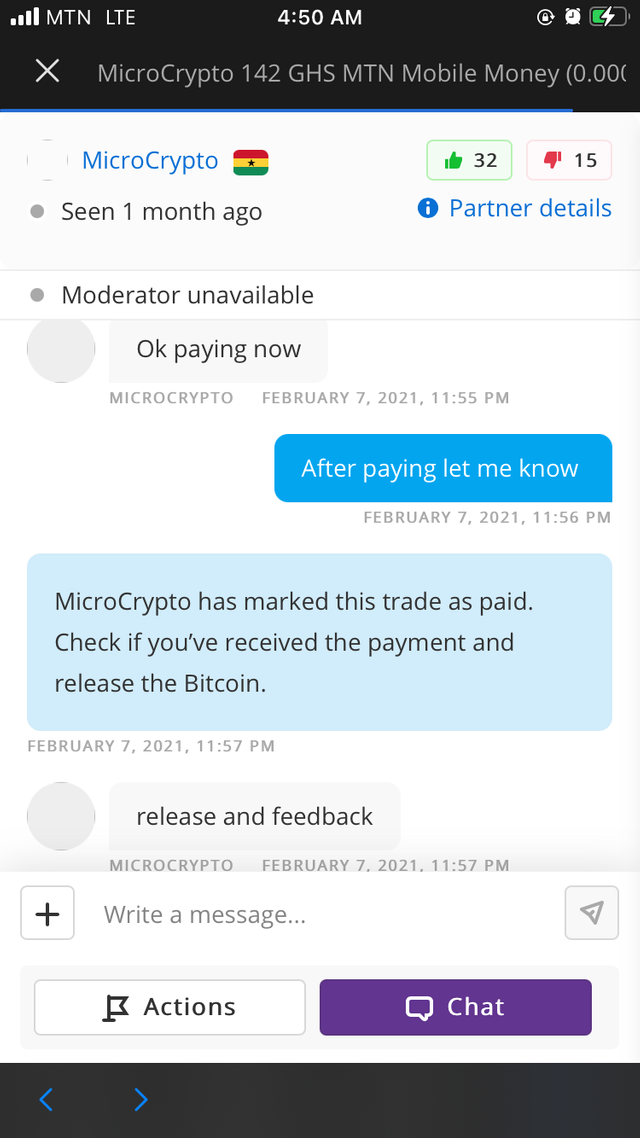

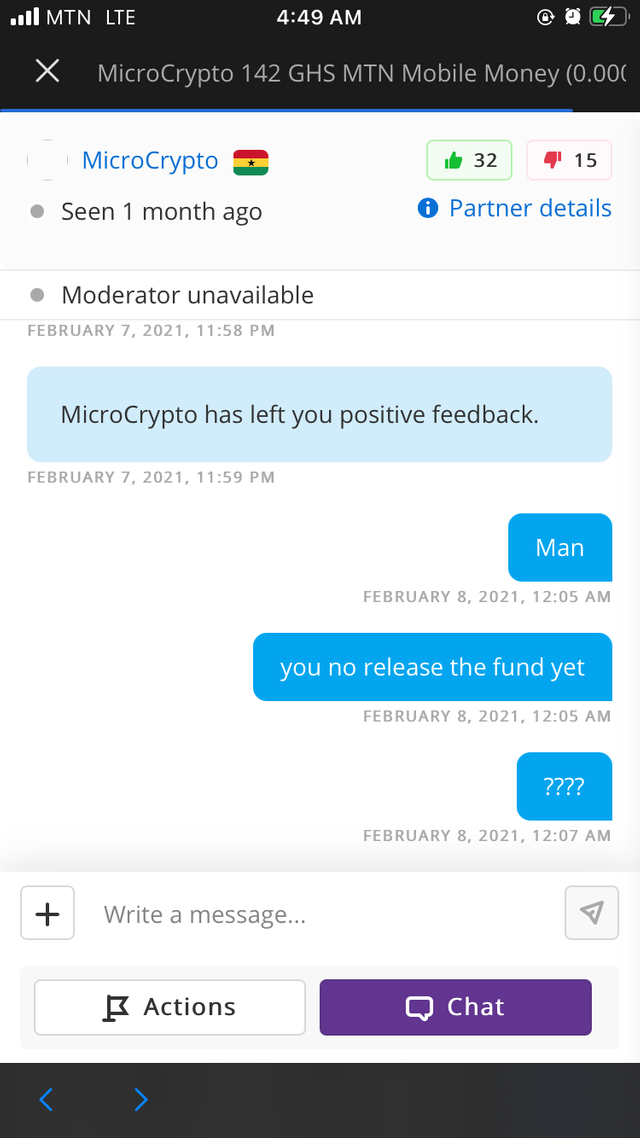

Personally, I lost money when I invested into BTC while I didn’t have enough knowledge about it. I used paxful wallet. I did wanted to sell so I can make soome profit. A guy was interested texted me and we begin the trade. Thee trade went on well, then I released the token to him. I didn’t double check if he actually send the money. Later I realized he sent an empty message, just like that I was robbed.

I’m actively taking this course seriously so I can learn more about crypto and be a pro, so nothing like that can happen again.

Below is a screenshot

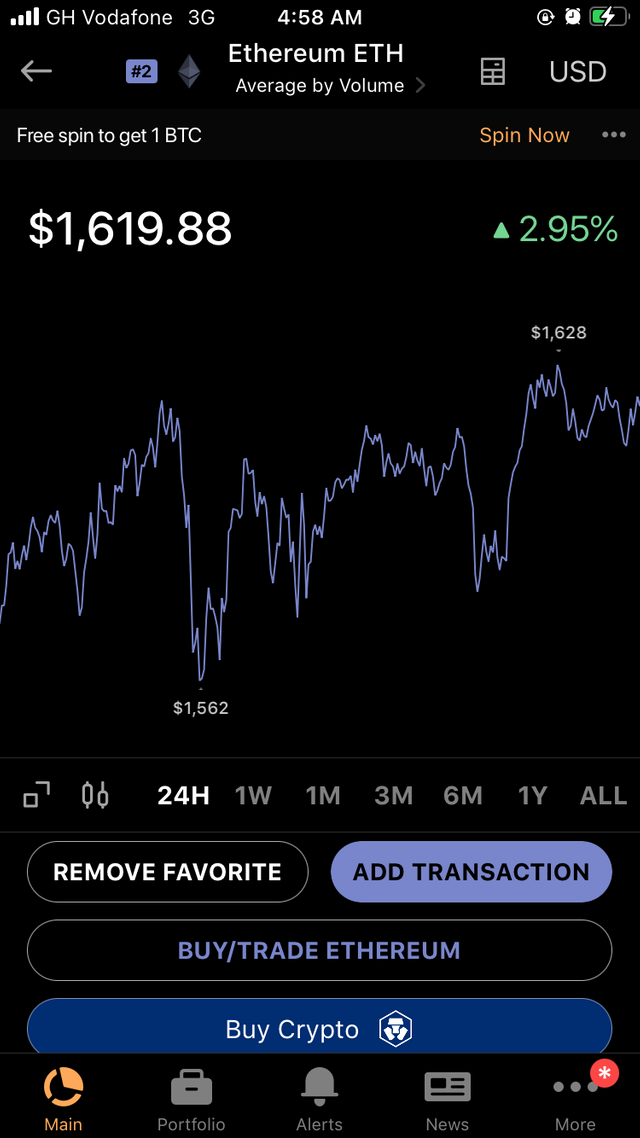

I have aim to get back into crypto and buy some of the coins. Currently I am monitory some few coins thus reading about them, expects foresight about them, and more. I have soo much hope in ethereum coin with the stats I have gathered about it. It’s has the potential of competing with BTC. Also I have more other coins I have been monitoring thus dogecoin and tether. Below is a screenshot of its streaks

ETHEREUM

DOGECOIN

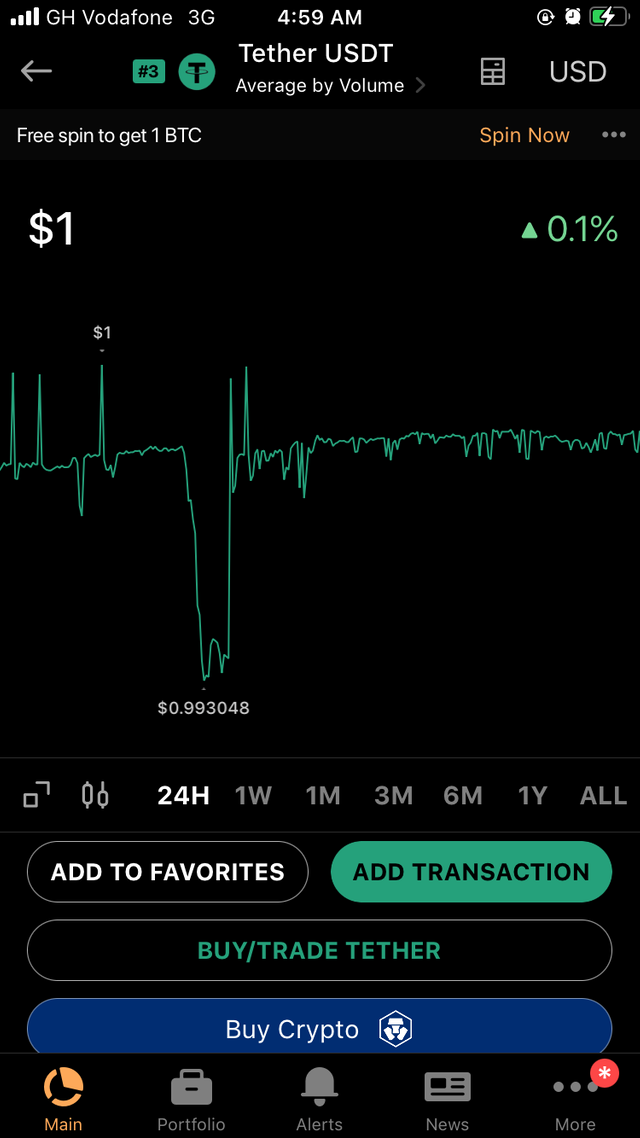

TETHER

In conclusion, to invest in crypto you need to know what you are getting into. Know the risk, advantages and disadvantages. You also need to be self discipline, trust and willing to risk and invest.

I will like to thank professor @stream4u and hope my answers provided for this week’s homework on money and portfolio management will be taken into consideration. Hope I get some upvotes and I’m down to learn more in the upcoming weeks.

Hi @roma078

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 7.

Your Homework task 7 verification has been done by @Stream4u, hope you have enjoyed and learned something new in the 7th course.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Thank you

Will take your remarks into consideration 👏🏽

Professor @stream4u, please when will I get curation ?

The curation team is working on it.

Okay and thank you 🙏