Crypto Academy Season 2 Week 6 Homework Post for (@stream4u) - Technical: Reverse Strategy | Crypto Prices & Market Source: Review Of COINGECKO by @sadiaanayt

I am thankful to the professor @stream4u and @yousafharoonkhan for this amazing lecture. In this week, the reverse strategy have been discussed. The second topic which is covered in this lecture is a tool which is most commonly used tool among traders. It is known as Coingecko. I learnt a lot from the lecture and after doing a some research on the given topics, i am now able do my homework task.

.png)

What is Reverse Strategy and How it works?

What is Reverse Strategy

We know that crypto world is versatile. The ups and down are the part of market. You may have a high lose of gain a good profit in these rise and fall of market. But one cannot survive in crypto world without have proper knowledge and strategies to adopt in the market ups and down. Many strategies are being used by investors. The most commonly used strategy by the investors is Reverse strategy. This strategy is a part of technical analysis. It is used to detect the market high ups and down. It help the traders to detect the bearish and bullish period of market price of any crypto asset. You then are enable to take the correct decision in that bull and bear market time.

It is used The traders get good profit in bearish and bullish period of market by using the Reverse strategy. It is very hard to take decision when market moves are very sharps. Most of the people take the wrong decisions in market sharp rise and fall, and face the lose in some way. We need to be very patient while trading, especially in market sharp rise and fall. Sometime when people see that market is down trend, they buy the coin at that price. But lately it is noticed that market is falling continuously. So it was wrong decision to buy coin at that time. Sometime when we see a rise in market price, we sell our coin but lately we realized that it was not a good decision as market is rising continuously. So we have to be very carefull in these markets high movements.

This strategy helps the investor to do the counter trading. The investors do opposite of market trend. Using this strategy, the investor detect the bull period of market and buy the coin. In bear period, the investors decide to sell their assets to get the high profit.

How the Reverse strategy work

When the investors do the technical analysis of an asset, there may be some bearish and bullish trends. These are the market high moves. In such situations, it is hard to decide whether to sell the assets or place an order to buy the assets. The reverse strategy help us in that situation to get the full benefit of bear and bull period of market.

It is compulsory to complete a full day before taking decision in reverse strategy. At the end of the day, if the investors see that the opening market price is close to closing market price, they should buy the coins if its the bearish period or they should take the decision of selling their assets in bullish move. another thing to understand is always account those market where the change ratio is 20% up or 20%down.

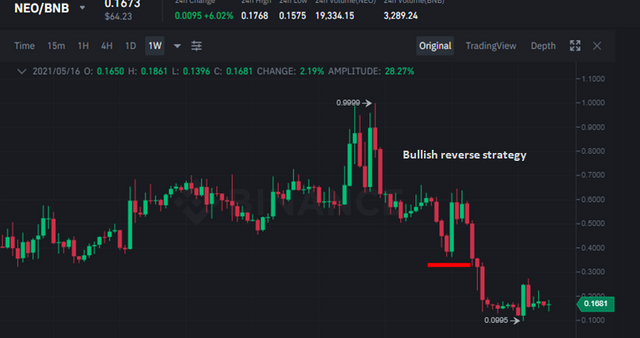

.png)

In the above graph, we can see that there is a very sharp fall in market price. Here the closing price is equal to opening price. In such situations, the reverse strategy direct the investors to buy the coins on the closing price of asset of the previous day.

.png)

In the above graph, we can see the sharp rises in market price. Here the opening price of previous day is equal to closing of this day. At this point, you should place an order to sell your assets.

What is CoinGecko?

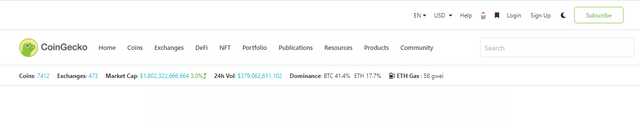

CoinGecko is most commonly used website by investors. It provide all the important data about any crypto assets to the trader. It has become most famous among the investors. They use this to keep track of market activities. CoinGecko provide the user with a lot of information about assets like crypto market capitalization, the exchanges available, volume of different cryptocurrencies etc. The Coingecko is available more than 20 languages. User is able to get data of almost 7412 crypto assets. www.coingecko.com

Key Points:

i) Not every crypto asset is listed in CoinGecko.

ii) Some certain conditions need to full to be listed in CoinGecko list

iii) Not a exchangeplatform.

iv) Cannot deposit money on this Coingecko.

How COINGECKO Can Be Helpful for you in a Crypto Market?

CoinGecko provide the information almost 7412 crypto assets. It is available in more than 20 language. It helps the trader a lot in many ways like;

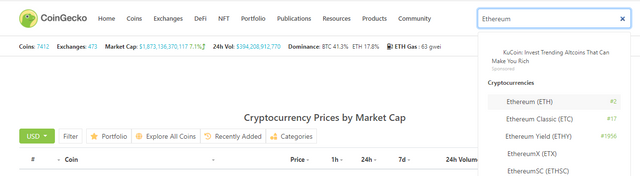

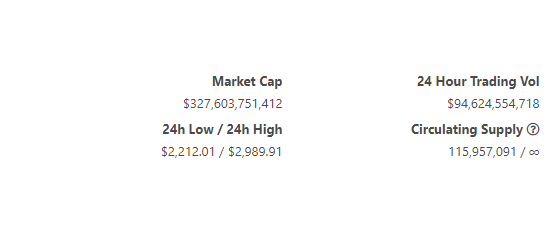

Volume: The volume of all the project is shown on CoinGecko website. So you would be able to observe the market behavior of any asset. Search for the currency you want to know the market volume on Coingecko website. For example i want to know about Ethereum.

.png)

I would be able to see how much Ethereum are being produced in total. What is the market capitalization of Ethereum. On which exhanges the Ethereum is avalable.

.png)

The Wallet, website, Prices and Ranking of Cryptocurrencies: The price of every asset is shown on the Coingecko website. Moreover the rank of that specific asset by the market capitalization is also shown there.

.png)

Historical Chart: The historical chart of Ethereum is also available on the coingecko site.

_LI.jpg)

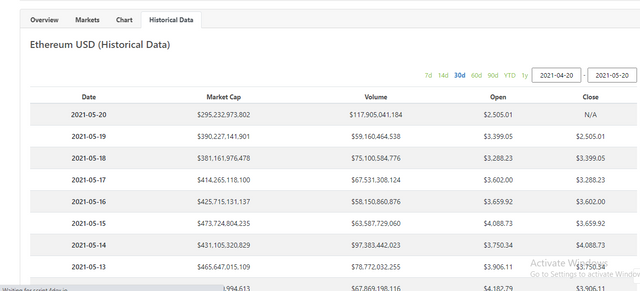

Future prediction: The coingecko show the performance of assets. It show how the assets are performing in market. This help the trader o take decision whether they should invest their money in that asset or not. Click on the "Historical data" and the history of that asset will be shown there.

.png)

Exploring COINGECKO features with information

Categories: In this page, you will find the different crypto currencies categorized in centralized, decentralized Exchange token, Binance smart chain ecosystem etc. You will see the top seven coin of each category with their volume, market cap, history of last week.

.png)

.png)

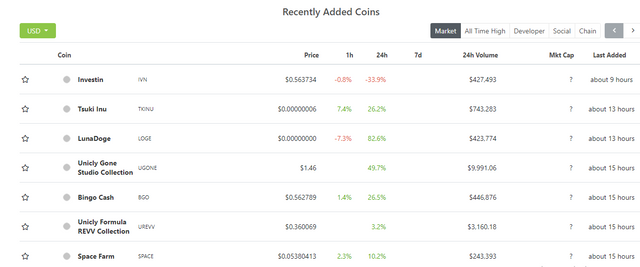

Recently Added Coins: This feature allow the user to find out all the coins which are added on coingecko site recently.

.png)

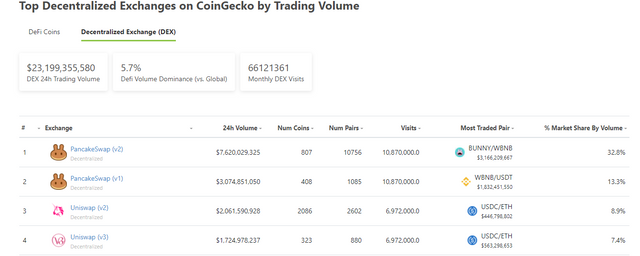

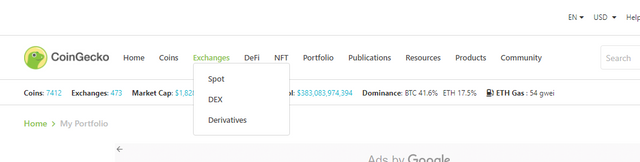

Exchanges: Exchange is a section which has mainly three heading; Spot, Derivaties and DEX. When you click any on these headings, all the exchanges belong to that will be appeared.

.png)

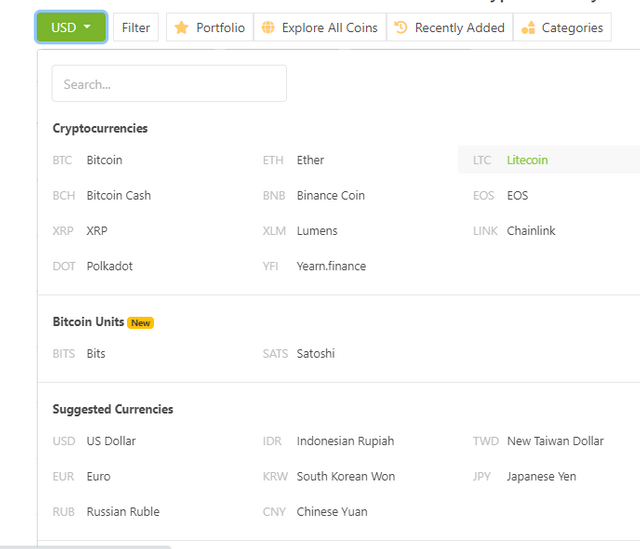

Local currency: The coingecko allow you to convert any crypto currency into your local currency.

.png)

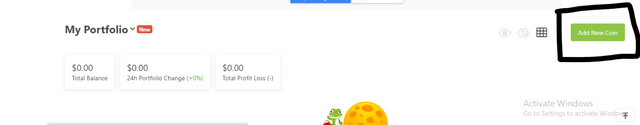

Portfolio: You can add the coin which you want to examine and want to find out each and every thing about that coin in detail.

.png)

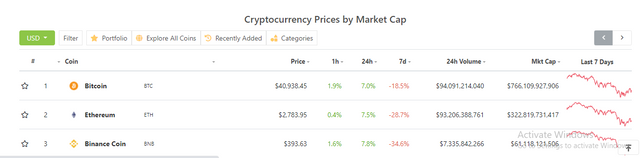

Explore All Coins: You can explore all the available coins on coingecko site.

.png)

Top 100 Coins: The Coingecko shows the coin with respect to the market capitalization

.png)

Weekly Price Forcast For BTC/USDT Pair

For weekly price forcasting, i have choose the BTC/USDT pair. BTC is crypto coin which effect the other currencies by rising or falling its price. The market price of BTC influence the market price of all other crypto coins. BTC is now analyzed highly technically because of its recent downtrend. It was introduced by Satoshi Nakamoto in 2008 and start its usage in 2009. At that time it was also a penny coin. But later on, the investors invest in this coin and now it is the largest crypto currency of crypto world. It value is $40749.00. Its market capitalization is $762,564,598,727

. It market trading volume for last 24 hour is $81,220,728,186

.

Technical Analysis of BTC/USDT Pair

.png)

I am going to perform the technical analysis to predict the future of this coin. I will do the analysis to predict whether the market will go up or down in upcoming week. Here a new technology which i have learnt from this lecture, reversal strategy, is going to be used for prediction of BTC/USDT future. I will try to spot the bearish or bullish point. It will help to point out the entry and exit spots. So let's start.

.png)

In this technique, i will use the support and resistance to predict the future price of my selected coin. Below graph shows the BTC/USDT history. Now bitcoin price is 40749.00$. So it is good point to sell the coin and earn the profit. When the market start bull, then it will be a good point to purchase the coin at low price.

Conclusion

In this lecture, i try to explain the reversal strategy which is extremely beneficial for investors. It help the investors to predict the best coin to invest in future. It help to minimize the risk of lose and maximize the profit chances.

.png)

Thank you for joining The Steemit Crypto AcademyCourses and participated in the Homework Task.

Provided information are explained in very short. In Reverse Strategy, you could try to explore more in detail based on understanding.

COINGECKO Features, so there still many left which you could try to mention and explore with details.

Price Forcast For Crypto Coin , you need more research to explore this point, it is not very much well explained ,

look fine home

thank you very much for takin gparticipate in this class

Grade :6

Thank you @yousafharoonkhan

Next time inshallah i will try to fulfil your expectations.

REGARD