Markets Update: Bitcoin Recovers to Test $10,000 Area

The BTC markets have ramped up to test the $10,000 USD area on leading exchanges following a break above resistance at $9,000. Bitcoin has recovered by more than 60% since testing the $6,000 area on February 6th.

Bitcoin Tests $10,000

Bitcoin has made optimistic action in recent days, forming associate degree inverse head and shoulders pattern on the 4-hourly chart before breaking on top of resistance at roughly $9,000 space yesterday.

.png)

The pessimistic action of recent weeks saw bitcoin lose just about sixty fifth of its worth – falling from just about $17,000 at the beginning of Gregorian calendar month to the recent low of lower than $6,000 on the sixth of Feb. compared with the incomparable high of roughly $19,700 from Gregorian calendar month seventeenth, the sink to $6,000 comprised a seventieth loss within the worth of BTC in exactly seven weeks.

Bullish Recovery Signs for BTC

The recent optimistic momentum has seen bitcoin break on top of the twenty three.6% retracement space of the crash once measure from the incomparable high space of $19,000 – $20,000. several traders area unit anticipating that BTC could presently take a look at the main descending trendline stemming from the incomparable high ought to the markets continue on their optimistic mechanical phenomenon.

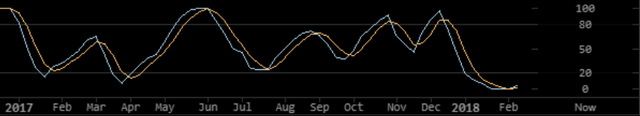

When gazing the weekly chart, the random RSI seems poised to retest the twenty threshold when having born below such for the primary time since mid-2017.

According to Cryptocompare, Japan’s markets ar out and away the foremost dominant – with JPY/BTC trade presently comprising over fifty one of the full volume of BTC listed globally throughout the last twenty four hours. USD and USDT trade is calculable to represent about thirty seventh of world trade combined, followed EUR/BTC trade with just below five-hitter. The shifting restrictive sands in Republic of Korea have considerably reduced the dominance of the KRW/BTC markets – that presently contains simply three.5% of BTC listed within the last twenty four hours.

Altcoin Markets Correlated to BTC

The dollar-value of most altcoins have shown a robust correlation to BTC in recent months, with nearly each cryptocurrency manufacturing a robust bounce in unison with bitcoin throughout Feb.

Among the simplest performing arts altcoins self-praise a high capitalization are Litecoin and Ethereum Classic – each of that seem to own benefited from FOMO leading up to their various forks, gaining over one hundred since early Feb.

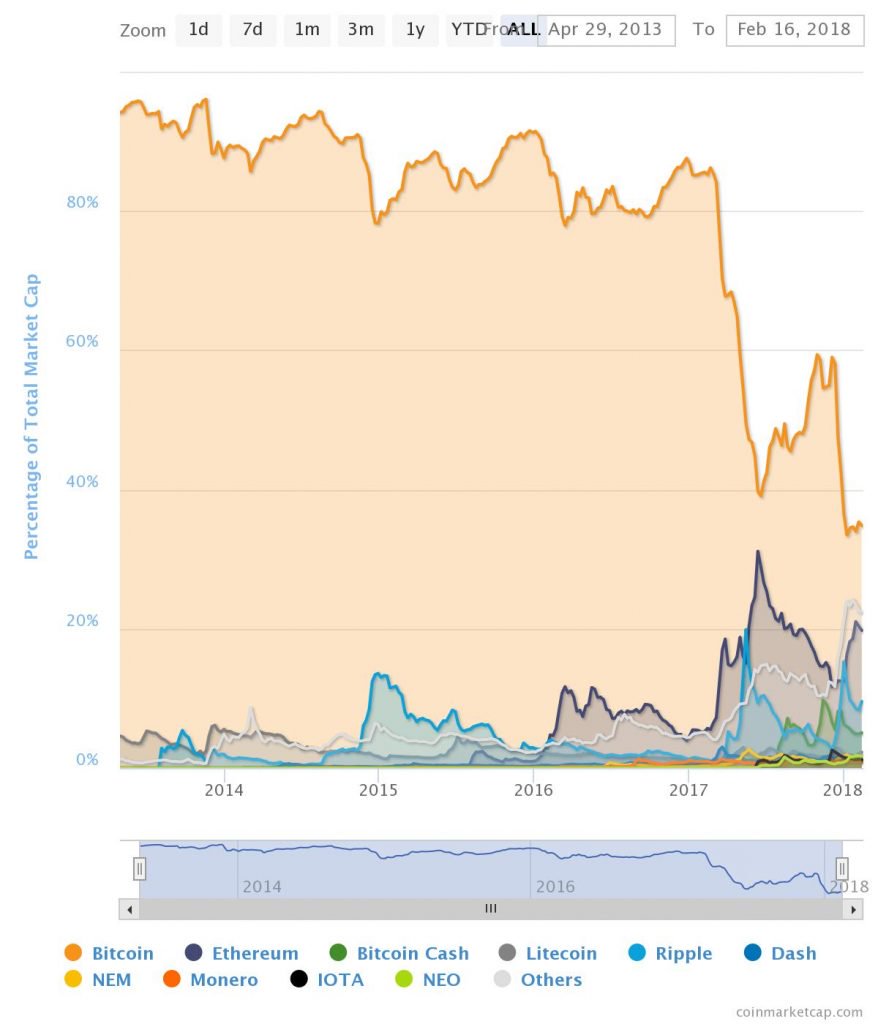

According to Coinmarketcap, bitcoin is presently exerting a market dominance of roughly thirty fifth. Ethereum is second largest cryptocurrency market, self-praise a nineteen.5% market dominance, followed by Ripple with nine.5%, and Bitcoin money with nearly five-hitter.

.jpeg)

Do you think the bitcoin markets will continue to recover? Share your thoughts in the comments section below!

This post has received a 0.45 % upvote from @booster thanks to: @salahsteem.