Crypto Trading with Price Action - Crypto Academy / S6W2- Homework Post for @reminiscence01

Hello Everyone!

This is Sami Zuberi , hope you all are well. I am exceptionally hope set aside a few minutes for perusing my post for @reminiscence01 and valued it. Here i am going to impart my views on "Crypto Trading with Price Action". So how about we begin

Question 1.

Explain your understanding of price action.

Price action is a simple but powerful market analytical technique in which a trader utilizes their understanding of price movements to read and interpret not just market movements but also the emotions that the market is experiencing at the time. Price action is a sort of fundamental indicators that is extremely simple. It simply entails looking at charting patterns and making sound trading selections without relying on technical analysis. Price action marketers feel that the market and price movement have already minimized just what they want to comprehend.

Price action could be utilize to identify the existing price growth and function properly into it to find satisfactory entry and exit positions. This really uses the most accurate statistics which can be seen on the chart to generate assistance levels and can also be used to identify the current price trend and work through it to locate appropriate inlet and outlet positions. Because charting are essentially a visual reflection of market sentiment, the price pattern approach has shown to be quite efficient.

To forecast market demand patterns, Price action operators prefer tools for trading such as supporting and rigidity, charting patterns, market technical indicators and much more on the graph. Market participants are able to track price changes thanks to the usage of price action. All chart analysis of a cryptocurrencies is generally built on the premise of price action. Depending on the info in the charts, we may design a decent trading strategies including effective risk controlment using price action. On chart, price actions allow you to locate inlet and outlet chances.

Question 2.

What is the importance of price action? Will, you chose any other form of technical analysis apart from price action? Give reasons for your answer.

Importance Of Price Action :

Price action aids traders in determining how to initiate a trade and when to quit a transaction. It provides trade-related data including such assistance levels of resistance and support, marketplace situation, and so on.

Price action doesn't at all employ statistical information instead, it leverages the record of a cryptocurrency duo's fluctuations to provide a plausible prediction of the price's fluctuations within the charts.

Price action is significant because it depicts the interactions between buyers and sellers. Certain patterns reveal that market participants are up to at any one moment.

Another important aspect of price activity is risk or hazard management. We can readily find ideal positions to initiate a trades, make more profits, and limit order once we employ price action.

Because you have knowledge of temporal past, price action helps you to predict what could occur in the future. Depending on your trading strategy, price action may be used across any time period, short and long.

Yes. Aside from price action, I would use several types of technical analysis. It is commonly stated in the marketplace that no one indicator or trading strategy can provide precise results. Because traders might have involvement with the direction of the price of the cryptocurrencies at various moments, price action will not always produce correct findings. As a result, combining two or more trading techniques to discover trading opportunities in the market is always crucial to obtain efficiency in trading signals.

Question 3

Explain the Japanese candlestick chart and its importance in technical analysis. Would you prefer any other technical chart apart from the candlestick chart?

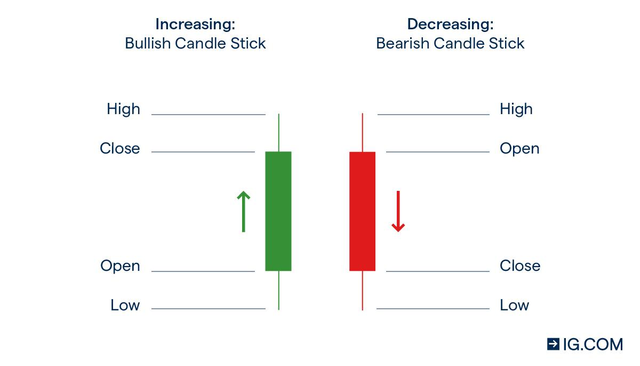

In terms of technical analysis, the Japanese candlestick graph is one of the most extensively utilized charts. Traders frequently use this chart since it is simple to read and comprehend, and it also provides a wealth of data regarding the current status of the marketplace. The Japanese candlestick chart is comprised of two distinct candles, namely the red and green candles. Each candle, whether red or green, is made up of the high, low, open, close, body, and shadow. Observe the illustration below.

The red and green candlesticks may be seen in the photograph above. The red candlestick indicates a bearish swing in the market for securities, while the green candlestick indicates a bullish rise in the asset's price. The Japanese candlestick chart is widely used when it displays a plethora of data by utilizing the high, low, open, and close values contained on it.

The Japanese candlestick chart also displays market volume as well as market activity. You can see in the previous image that in the green candlestick, which is the bullish candle, the closing price is always higher than the opening price, and in the red candlestick, which is the bearish candle, the opening price is always higher than the closing price.

Would I prefer any other technical chart pattern?

Aside from the Japanese Candlestick chart pattern, there are many other types of chart patterns, such as line charts, bar charts, Heikin Ashi charts, and so on. The Heikin Ashi charts, in my perspective, have a similar appearance to the Japanese Candlestick pattern. Consider the image below and see how these charts appear when compared to the Japanese candlestick chart.

Japanese Candlestick

Heikin Ashi

Both charts seem similar in the images above, and in my opinion, the Heikin Ashi chart is clearer when it refers to presenting the data on the chart. As a result, I would choose the Heikin Ashi chart as my second alternative because it clears the chart and eliminates any noise and misleading indications.

Question 4.

What do you understand by multi-timeframe analysis? State the importance of multi-timeframe analysis.

In simple words, multi-timeframe analysis seems to be the observation of a cryptocurrency over many timeframes to gain a fuller picture of the currency pair and make educated judgments. The use of many time frames in the graph to forecast market movement and entry points for starting trades is known as multi-timeframe analysis.

The primary goal of multi-timeframe analysis is to determine the market's underlying trend. While it is correct that using a lengthy timeframe will provide clearer and powerful signals, the wide timeframe may be split into smaller timeframes to obtain the overall trend. Traders employ several time periods to determine the market's direction or a future trend's direction, as well as the exact entry points for a trade. Multi-timeframe analysis is ideal for establishing a traded market's directional with higher periods being utilized to determine the general trend direction.

Importance of Multi-timeframe analysis:

- This analysis aids in the removal the disruption from the chart, which is extremely beneficial to traders. If the chart has an accumulate area, we may use a longer period of time to understand better the trend's tendency.

Traders can find significant response points on a price figuring graph by using Multi-timeframe analysis. As greater the timeframe, the stronger the analysis, as we've seen with price movement.

Using different period analysis during trading can assist traders decrease risk. Getting rid of the noise. The multi-timeframe further aids investors in removing marketplace noise and allowing them to make better trading selections.

Due to the obvious notion of multi-timeframe analysis, trading strategies such as timescale association are available. When the entire normal trading timeframe aligns to a trading feeling, this occurs.

Question 5.

With the aid of a crypto chart, explain how we can get a better entry position and tight stop loss using multi-timeframe analysis. You can use any timeframe of your choice.

Technical Analysis includes multi-timeframe analysis. The majority of experienced traders employ this method to identify critical support and resistance levels on assets by examining charts in many timeframes.

This form of analysis is extremely useful for day traders and swing traders in determining entry and exit positions.

We can readily determine the market trends as well as critical support and resistance levels with our Multi-Timeframe approach.

Applying this analysis is quite easy; before entering, simply examine the chart in multiple time frames to determine the general market structure, and then check lower time frame charts to determine the optimal entry times.

In general, trades should look at the chart in the 1-day time frame, then 4 hours, 1 hour, 5 minutes, and so on. If they don't gain any clarification on market structure, they should look at weekly or monthly charts as well.

For example, if we look at a 1-day chart of sushi/USDT from we can see that the Dot price rises from $14.07 to $8.984

Those ranges that we learn can be identified in a daily frame chart.

If we look at the same period chart in a 4-hour time frame, we can see that

We can't pinpoint the exact amount of support and resistance, hence we can't pinpoint entry/exit positions either.

However, if we go to a lower frame of 1 hour or 30 miles, we can find another support/resistance level, making it possible to identify entrance and departure locations quite readily.

So it is critical to examine the Price Action chart throughout several time periods before making a trading decision. Because of this, we can examine the overall market direction and quickly identify entry and exit locations.

Question 6.

Carry out a multi-timeframe analysis on any crypto pair identifying support and resistance levels. Execute a buy or sell order using any demo account. (Explain your entry and exit strategies. Also, show proof of transaction).

In this, I will use trading view to complete my assessment, and then I will execute my trade on the trading view paper demo account. Take a look at the image below.

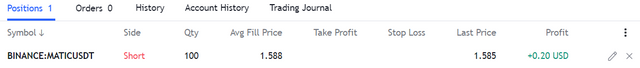

A bearish movement was observed, and because I am using a high period of 4 hours, it was evident to me that it had broken through the major resistance, therefore I executed the order at that moment. I watch the chart movement and note that the price has just broken out, so I seize the opportunity. Resistance and support, which are the chart's primary support and resistance, have also been noted. The trade's execution is seen in the screenshot below.

Conclusion.

When it comes to trading, price action is quite crucial. This has helped traders make a lot of money since it includes everything a scalp trader needs to make a profitable transaction. Fundamental analysis, like technical analysis, should always be factored.

I'd want to express my heartfelt gratitude to the lecturer, @reminiscence01, for such a beautiful and interesting talk. As the season progresses, I expect to learn even more from you.