Steemit Crypto Academy | Homework for @yohan20n ~ RISK MANAGEMENT IN TRADING by @shahab1998

HELLO STEEMIT members, I hope you all are fine and doing well, so this is my homework given by the honorable professor @yohan2on , First of all, thank you so much, professor.

Crypto academy professors are doing their utmost to help steemit users learn about a variety of topics by sharing their expertise and information in order to help them make better use of this environment and helping us to not only learn but also enhance our skills here.

My Name is Shahab Khan ( @shahab1998 ) and this is my homework post of great Professor @yohan2on .

QUESTION 01: Define the following Trading terminologies;

Buy stop

Sell stop

Buy limit

Sell limit

Trailing stop loss

Margin call

(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)

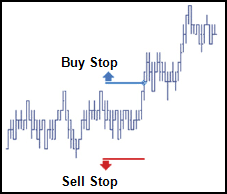

BUY STOP

Let's start with the Buy Stop, It is basically a function available used in trade systems that are used for trading purposes. The reason for using Buy stop is to put an order more than the price of the existing market and when the price of that respective token or market reaches that specific threshold so that order is approved and the request is accepted immediately.

Order placement in buy stop is very simple and easy, When a person places an order more than the price of the existing market so when the price reaches the point where we placed our order, the order will be executed. When you place a buy stop, the trade will be performed instantaneously as a market order that can be filled for the next available price whenever the prices reach this level.

SELL STOP:

Now, After Buy Stop let's discuss what Sell Stop is, Basically the Sell stop is always set below current market levels and you can also consider it as the opposite of Buy Stop. As in the preceding method, the sell stop will instruct the broker to acquire a security. Once the prices reach this level, the deal will be completed immediately as a trading strategy that can be executed at the next possible cost.

As discussed earlier that Sell stop is totally opposite of Buy stop so in Sell stop the first consideration for a good sell stop order is the change and trend of exixting market. We set our order lower than the market price when the trend is bearish. If the market price does not reach our sell stop order point, the order will remain pending in the trade volume.

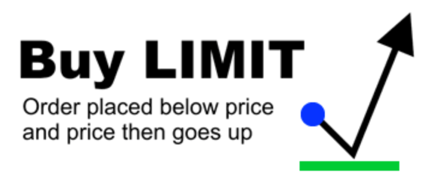

BUY LIMIT:

The third one is Buy Limit, Buy limit is nothing but a form of order, A buy limit order is an order to purchase a coin at or below a specific price, known as the current market price, which allows traders to choose how much they want to pay. People believe they will buy a coin at a cheaper price than it is now. Traders believe that after the buy order is executed, the price will rise to the same level or higher.

SELL LIMIT:

The actual usage of the Sell limit to make a purchase above the prevailing market prices, which is the polar opposite of the buy limit. The order will be activated if and only if the price reaches that specified threshold otherwise order will not be placed. A sell limit is an order put by an investor to trade a cryptocurrency at a price higher than the existing spot price. When a sell rate is reached, the transaction can only be filled if the price reaches the specified threshold.

When the trend is negative, a sell limit order has been placed above the existing spot price, and here in Sell limit placed order is always above the existing spot price because the trader believes the trend will retest the resistance point.

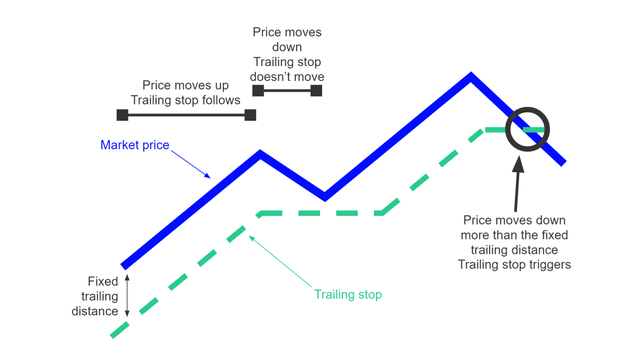

TRAILING STOP LOSS:

Trailing Stop Loss is a very simple technique, It is basically a sort of order which helps to reduce the risk of the dropping of trade, and also it is canceled after the price rises above that point by defining the position. But this order way or technique can be risky and for the people who are investing as it allows them to reduce their losses. We can use the trailing stop to set a stop at a proportion of the current market price. If the price of a currency decreases dramatically, the system protects you by selling your assets at the price you specify. With a market order, the program sells your tokens.

MARGIN CALL:

A margin call level is a percentage that a broker sets that initiates a demand when it is at some specific level. Here is a margin call, customers will notice positions being sold when we get this call, or when this threshold is achieved. The majority of brokers have the respondents at 100%.

Not only this Margin call is not that simple, it can also create an impact on under process trade as the dealer can stop all sort of trades immediately so that it could reach some specific threshold or promotion which is required of the margin call, and the user will be unable to perform trades until the account is replenished with cash.

Question 02: Practically demonstrate your understanding of Risk management in Trading.

PRACTICAL DEMONSTRATION OF RISK MANAGEMENT:

The strategy used by traders to control earnings and losses during trading is known as risk management. Setting stoploss and take profit points, as well as the risk-to-reward ratio, are all part of risk management. Risk management refers to a set of processes employed by traders to limit losses and keep accounts from exploding.

STOP LOSS AND TAKE PROFIT:

First lets talk about Stop loss, basically in stop loss when we begin trading, we establish a stop loss point to protect ourselves in case the trade does not go our way. When we begin trading, we set take profit points to optimise our profit. We set our purchase price, stoploss, and take profit points when we begin a trade.

Our goal is to maximise our profit and minimise our loss. stop loss is a feature mostly seen in the Trading/Broker platforms, it is placed below a buy order so that when there is a price reversal the losses would be limited also when it is placed above the sell order it would limit the losses when there is a reversal in price trend.

To illustrate this idea, we should not choose stockdale for our maximum profit and stop loss before even analyzing the numbers in order to adhere to the risk-reward ratio of 1:1.

Most beginner traders simply enter figures for Stop loss and Take gain, and as a result, they lose money or do not make enough profit because their stop loss may be greater than their final profit, violating the 1:1 rule.

RISK MANAGEMENT IN MY COINS:

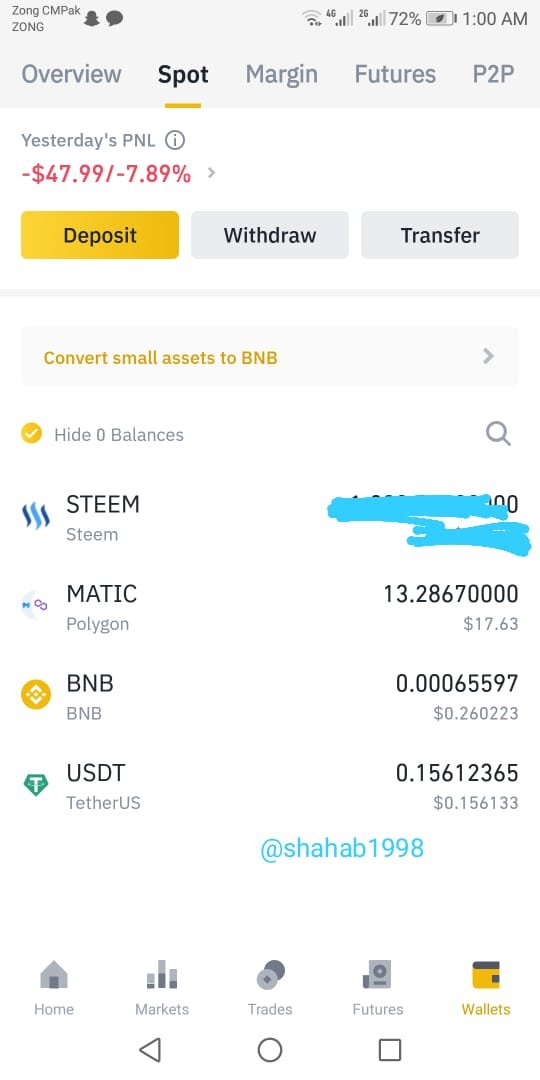

As discussed above risk management is very necessary in every aspect of life especially in crypto currency as we are investing our assets here. i also have many coins , a few of them are getting used for trading while some of them are just on hold for later on profit as cryto market is currently unstable and prices of coins and BTC are fluctuating.

I have not invested in a single coin but I have invested in multiple different coins that if one of coin gets devalue of all of my asset of money did not get waste and according to me putting all of your money into a single coin is a significant gamble. This is completely incorrect. The greatest approach to defend against pump-dump is to split your investments, especially in a world where manipulation is common, such as cryptocurrency.

I have invested in 7 different coins as you can see in below screenshot as I have attached screenshot of my Binance and Trust Wallet.

CONCLUSION:

Professor @yohan2on Thank you so much for this wonderful and informative lecture. In this lecture, we discussed about Buy stop It is basically a function available used in trade systems that are used for trading purposes. The reason for using Buy stop is to put an order more than the price of the existing market and when the price of that respective token or market reaches that specific threshold so that order is approved and the request is accepted immediately. while Sell stop is totally opposite of Buy stop and Buy limit is nothing but a form of order, A buy limit order is an order to purchase a coin at or below a specific price, known as the current market price while A sell limit is an order put by an investor to trade a cryptocurrency at a price higher than the existing spot price. When a sell rate is reached, the transaction can only be filled if the price reaches the specified threshold. We also discussed Margin call , margin call level is a percentage that a broker sets that initiates a demand when it is at some specific level while Trailing stop loss is basically a sort of order which helps to reduce the risk of the dropping of trade, and also it is canceled after the price rises above that point by defining the position.

That's all, This is my homework professor @yohan2on I hope you like it, and once again professor thank you so much for this informative lecture, This post is totally plag free.

Please share your valuable feedback.

Hi @shahab1998

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content. Well done with your practical study on Risk management.

Thankyou!