Steemit Crypto Academy | Season 3: Week 1 || Staking || Homework post for @imagen| by @shahab1998

HELLO STEEMIT members, I hope you all are fine and doing well, so this is my homework given by the honorable professor @imagen , First of all, thank you so much, professor.

Crypto academy professors are doing their utmost to help steemit users learn about various topics by sharing their expertise and information to help them make better use of this environment and helping us to not only learn but also enhance our skills here.

QUESTION 01: Research and choose 2 platforms where you can do Staking, explain them, compare them and indicate which one is more profitable according to your opinion.

STAKING:

Before choosing and discussing staking platforms we must know what Staking is. Staking is basically an act of saving and making secure the cryptocurrency tokens that are stored in an exchange. The distribution of staking incentives is determined by the ratio of assets staked by users as well as other parameters. Staking commodities requires the participation of users because the block's growth is based on the value of commodities staked. Staking is the act of storing your possessions in a digital wallet in aims to assist a blockchain run more smoothly. Not only this there are two ways of performing Staking one is Soft Staking while the other one is CRO staking.

PLATEFORMS FOR STAKING:

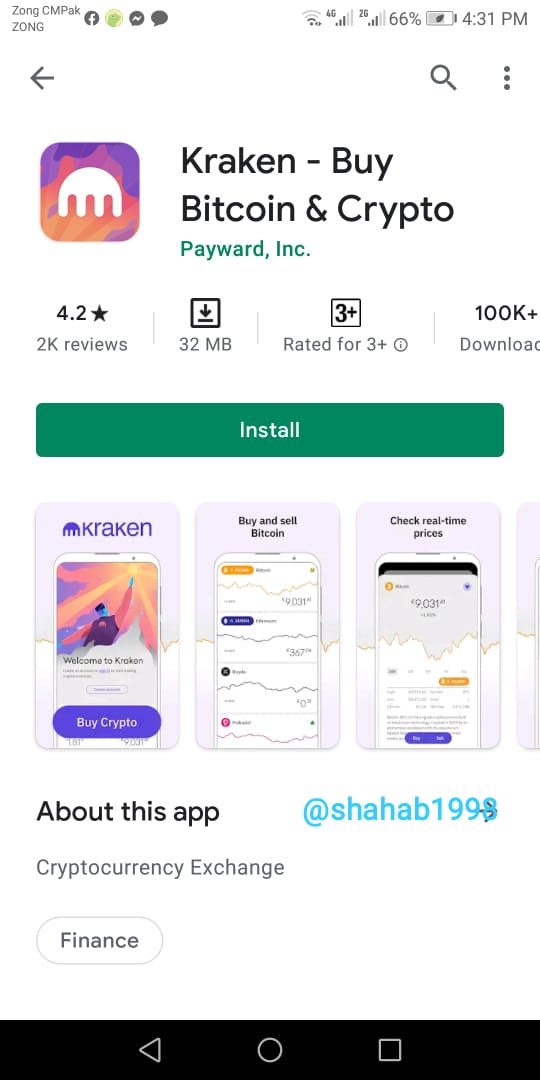

KRAKEN:

Kraken is basically a digital currency exchange where market participants can trade cryptocurrency. Kraken teamed up with the world's leading graph service provider. In Kraken, Users have the ability to buy and sell cryptocurrencies using various paper money. Kraken was founded in late 2011, and the exchanging tasks were officially issued in 2013.

There are good staking rewards on Kraken with a Maximum of 12% per annum You can withdraw your asset at any given period of point. The best part of this exchange is that skating payouts are quite good and also you have the option to withdraw your asset at any time and according to me this is the best thing about this exchange.

We can access Kraken by simply downloading its application on our smartphone and install it as you can in the below screenshot as I have done.

Staking is very easy and simple, you just have to deposit and purchase on you want to perform stake, and then you will keep winning stake rewards from it.

TRUST WALLET:

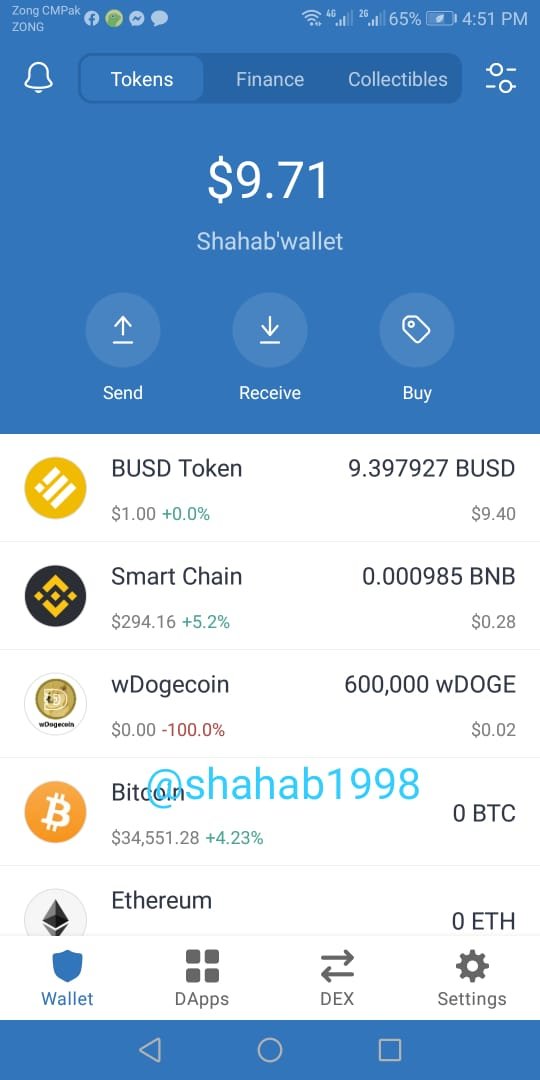

Basically, a Trust wallet is a cryptocurrency wallet that is completely secure and allows its users to use any third-party platform that is not registered, unlike Binance. In Trust wallet, you may buy and use third-party services, and while the customer's private key is not secure, one can instantly buy a newly issued coin at a low price, but in Binance, one must wait for it to be published, during which time the value of that coin rises.

Staking on Trust wallet:

To perform staking on Trust Wallet you have to download its application first, then follow the followings steps

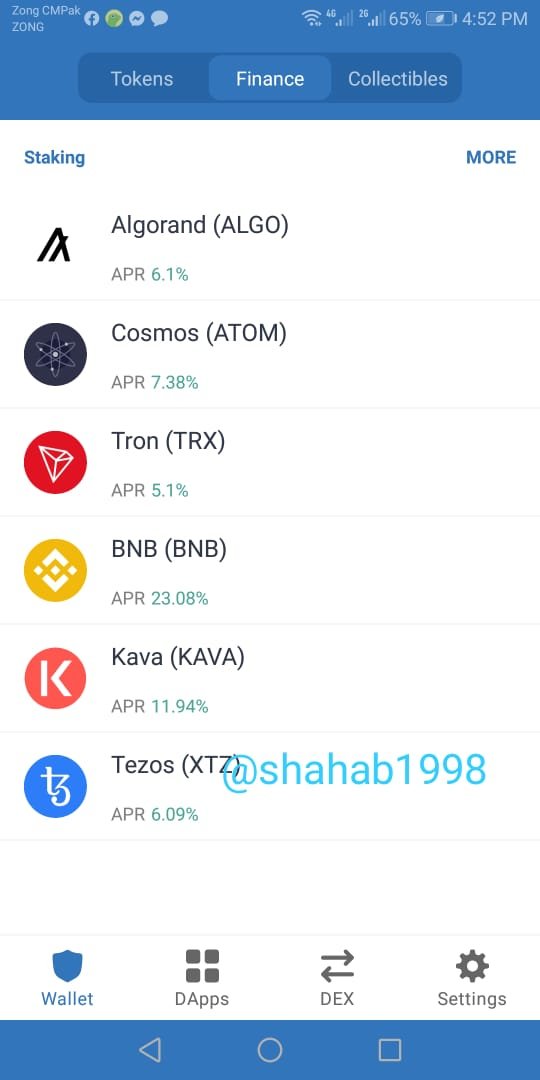

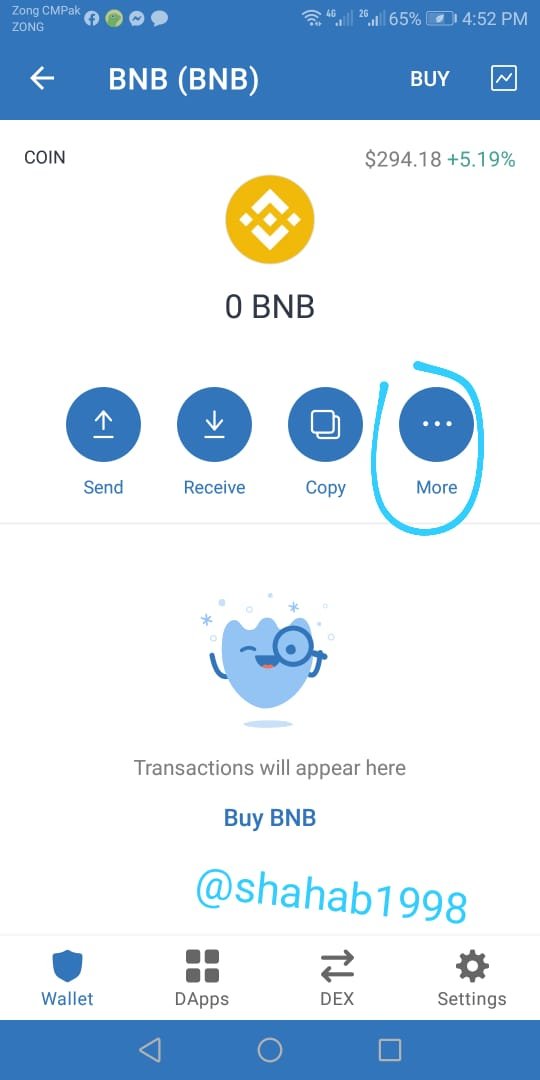

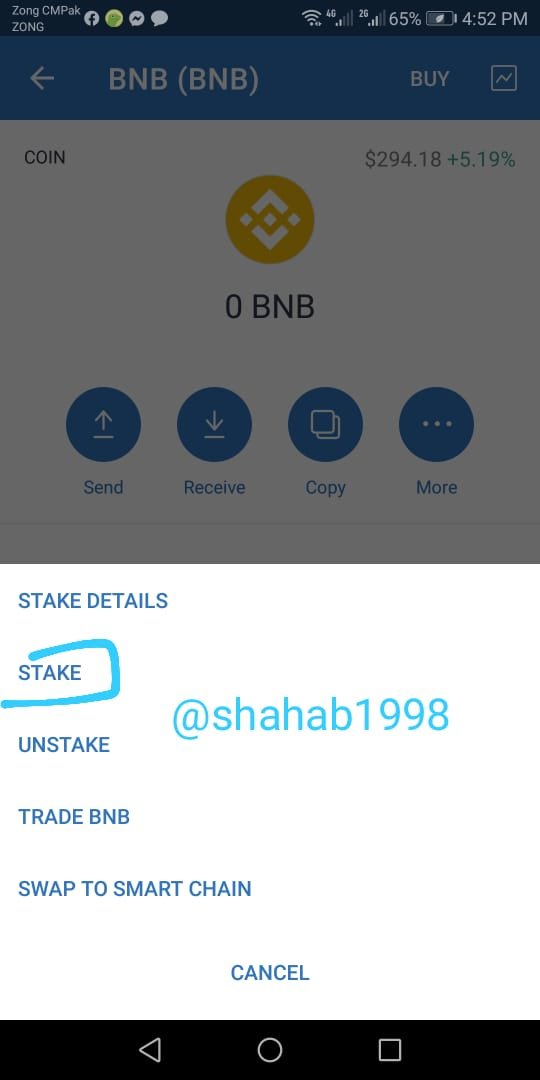

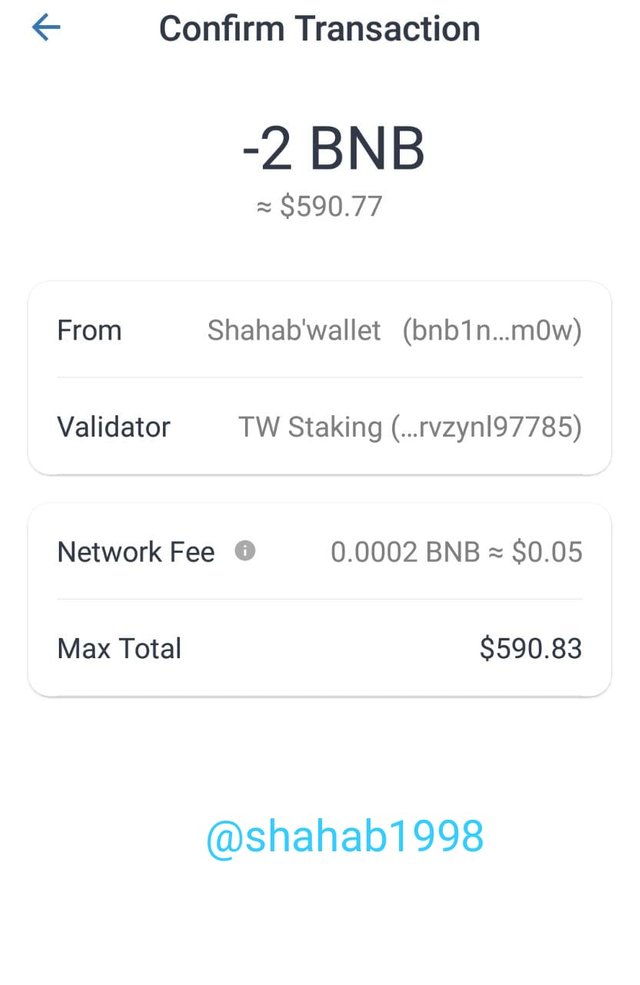

First Open the Trust wallet, and choose the finance option from the top pop-up.

Then choose any token to perform stake, I am selecting BNB.

After that press the MORE button.

After that, you will see a button Stake press it to perform stake as shown in below screen,

COMPARISON BETWEEN TRUST WALLET AND KRAKEN:

Trust Wallet is very easy to use and human friendly while Kraken is not that easy to use and is not for the newbies or beginners.

The main difference between Trust wallet and Kraken is that in trust wallet there are thousands of coins listed while 50 to 60 coins are present in Kraken.

Trust wallet gives rewards to the users on staking and on some transactions while Kraken is not as rewarding as Trust wallet which the main difference between these two.

Performing Staking is quite easy in Trust wallet while in Kraken staking is that much easy which makes a great difference.

So Although both coins are best in their own ways, I will prefer the Trust wallet for usage because the Trust wallet is easy to use and with that, there are a lot of coins and tokens which are listed on the Trust wallet so in the Trust wallet we have a large variety.

QUESTION 02: What is Impermanent Loss?

IMPERMANENT LOSS:

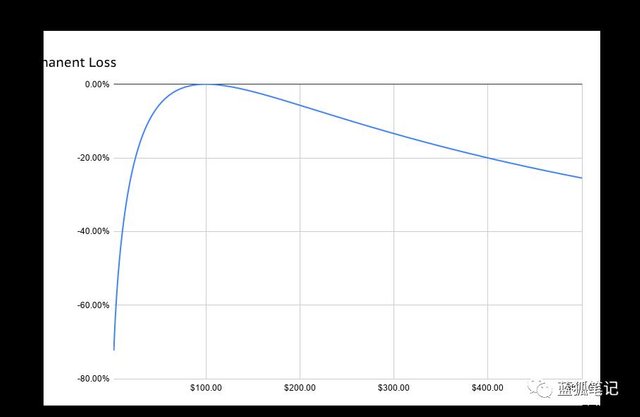

Impermanent loss is a type of loss which take place whenever the value of early saved commodities drops which means value of your assets gets down than the value you saved or deposited in the begining. Economic uncertainty is usually to blame for this. This is true for market makers as well. As a result, the wider the price drop, the greater the loss. When someone provides liquidity to a liquidity pool, it occurs. This results in a discrepancy between the present value of your commodity in your wallet and the amount you originally placed. The variation in price is directly proportionate to the impermanent loss.

It occurs and it is because of the reason and occurs when price is not stable and fluctuating and it happens because of traders. Also only those people are involved in it and sustain who deals in liquidity staking and store and hold then for long time and sells when they reciver their losses.

What is Delegated Proof of Stake (DPoS)?

DELEGATED PROOF OF STAKE:

Delegeted Proof can be concidered as a form or type of Proof of Stake in which voting power is dependent on collected coins or tokens and also with tht in Delegeted proof of stake customer has access to vote with their token holdings.

In Delegated proof of stake , User has an access to select and choose the one who verify the transactions and it is very helpful as with help of this all transactions are being processed at very high speed aproximately at rate of ten transactions in a single second. It allows the infrastructure to level to include solely devoted clusters that are highly efficient and specialised while remaining under the control of the shareholders.

QUESTION 4: CONCLUSION:

This lecture of professor @imagen was really helpful for me. It helped me in understanding what Staking is and i learnt that staking is basically an act of saving and making secure the cryptocurrency tokens that are stored in an exchange. The distribution of staking incentives is determined by the ratio of assets staked by users as well as other parameters.

Also i learnt about the exchanges on which Staking take place and i also discussed and did comparision or two exchanges above. I also learnt about Impermanent loss, Impermanent loss is a type of loss which take place whenever the value of early saved commodities drops which means value of your assets gets down than the value you saved or deposited in the begining. Economic uncertainty is usually to blame for this. And in the end we diccussed Delegated proof of concept and delegeted Proof can be concidered as a form or type of Proof of Stake in which voting power is dependent on collected coins or tokens and also with tht in Delegeted proof of stake customer has access to vote with their token holdings. In this way this lecture helped me in understanding a lot of things and cleared my doubt and concepts about staking, impermanent loss and delegeted proof. Thankyou so much dear professor.

That's all, This is my homework professor @imagen I hope you like it, and once again professor thank you so much for this informative lecture, This post is totally plag free.

Please share your valuable feedback.

Hi @shahab1998. Thank you for participating in Steemit Crypto Academy Season 3.

You did a good job and you show mastery of the topics requested in this assignment, however, you missed to add information regarding the APY and/or APR rate offered by the selected platforms, to perform a deeper analysis to determine their profitability.

I hope to continue correcting your next assignments.

Rating: 7.5

@imagen thankyou dear professor for your evaluation.