REPOST: ETC/USDT Buy - Steemit Crypto Academy - S6T4 - Team Trading Contest Post for Investors-Team

Here is the LINK to the post that was graded but has not been curated.

Hi guys

This is my first trading post I will be making for the week. This week am joining the Investors-Team, which lead by professor @pelon53. The trade for today is a pair of ETC/USDT. Without much time wasted, lets go straight in to the business of the day.

This is my first trading post I will be making for the week. This week am joining the Investors-Team, which lead by professor @pelon53. The trade for today is a pair of ETC/USDT. Without much time wasted, lets go straight in to the business of the day.

The name and introduction of the project token, and which exchange can be traded on, project/technical/team background, etc

ETC token simply means the Ethereum Classic token, which has it's own native token as the ETC token despite being on the ethereum block chain, and it was launched in the year 2016 with the main aim of acting as a smart contract network. The ETC token has a significant difference from the ETH token and it's development was as a result of the theft that took place on the ethereum block chain where about 3.6 million ETH was stolen. So the ETC is like a security measure which aims at maintaining the integrity of the ethereum block chain.

The development of the ETC token was not made from outside I.e all those who worked to build the ETH token are same persons who worked alongside to build the ETC. They saw the lapses associated with the theft of the ETH token so the provided more measure in other to maintain the integrity of the said block chain. The algorithm use by miners of the ETC token is the proof of work algorithm. This algorithm helps to secure the ETC network. Just like I have mentioned earlier, the original authors of the ETC token are Vitalik Buterin and Gavin Wood who are authors of the Ethereum token and network as well.

The next block reward for miners which will take place within the month of April 2022 is going to be reduced from 3.2 ETC to 2.56 ETC for each block mined. This means that currently miners receive 3.2 ETC for each block they successful mined. From the coingecko.com website, I found out that the ATH of the ETC token was seen on the 6th day of May, 2021 which is about 11 months ago where the price of ETC hit $167.09. More also, the ATL of the said token was seen on the 25th day of July, 2016 which is about 5 years ago where the price went as low as $0.615038. From the price difference, you will agree with me that the asset is really making a progress.

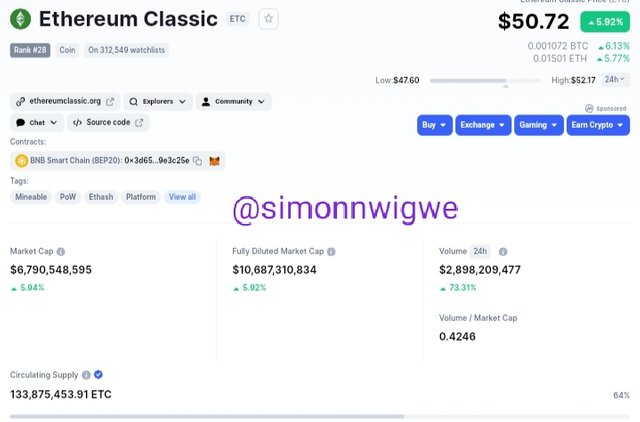

There are numerous exchanges where we can purchase the ETC token and among which include Binance, OKEx, Huobi Global etc. From coinmarketcap, information about the ETC token as at the time of carrying this task are as follows.

| Parameter | Value |

|---|---|

| Rank | #28 |

| Price | $50.72 |

| Marketcap | $6,790,548,595 |

| Volume | $2,898,209,477 |

| Volume/Marketcap | 0.4246 |

| Circulating Supply | 133,875,453.91 ETC |

| Contract | 0x3d6545b08693dae087e957cb1180ee38b9e3c25e |

Why am I optimistic on this token today

I am optimistic about his token today when I saw the significant increase on the price chart. Going through the details of how the ETC token has raised within this shortest possible time, I decided to dive into the chart and when I preview the chart on a 15 minutes time frame from the tradingview.com website, this is exactly what I saw.

The Image above shows that the asset is moving again in an upward direction after has experienced a downfall. From the chart you will notice that the RSI indicator is seen above the 50 threshold which is a good signal to place a buy order. The price as well is making series of higher high movement.

Analysis of the Token

Here on this section, I used the trading view platform to perform my technical analysis. Looking at the price moving upward, and also the appearance of one bearish candle stick, I decide to use the Fibonacci tools both the retracement tool and the extension tool. To know how far the price of the asset will pullback after that movement, I decided to apply to Fibonacci retracement tool as you can see in the image below. I also marked to possible point of support where I except price to bounce back if it eventually moves downward. See screenshot below.

After doing that, I also used the Fibonacci extension tool to see the level at which the trade will travel if it moves in an upward direction. I also marked the point as my resistance point I.e the first pint and that happens to be my take profit level if the trade finally goes my way. The level I marked as support using the Fabonacci retracement acts as my stop loss level. See screenshot below.

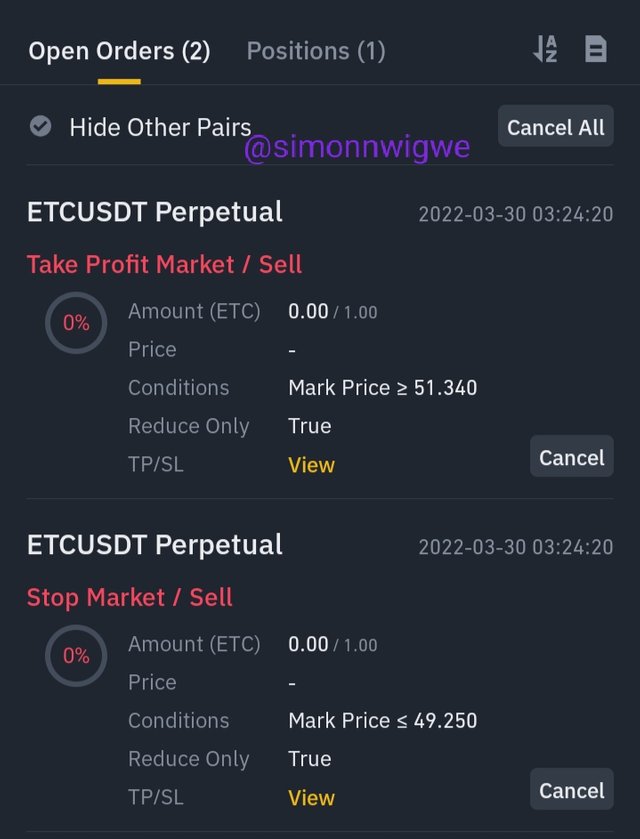

The table below shows the entire details of my trade I.e entry price, stop loss and the take profit level.

| Data | Amount |

|---|---|

| Entry price | 50.806 |

| Take Profit | 51.340 |

| Stop Loss | 49.250 |

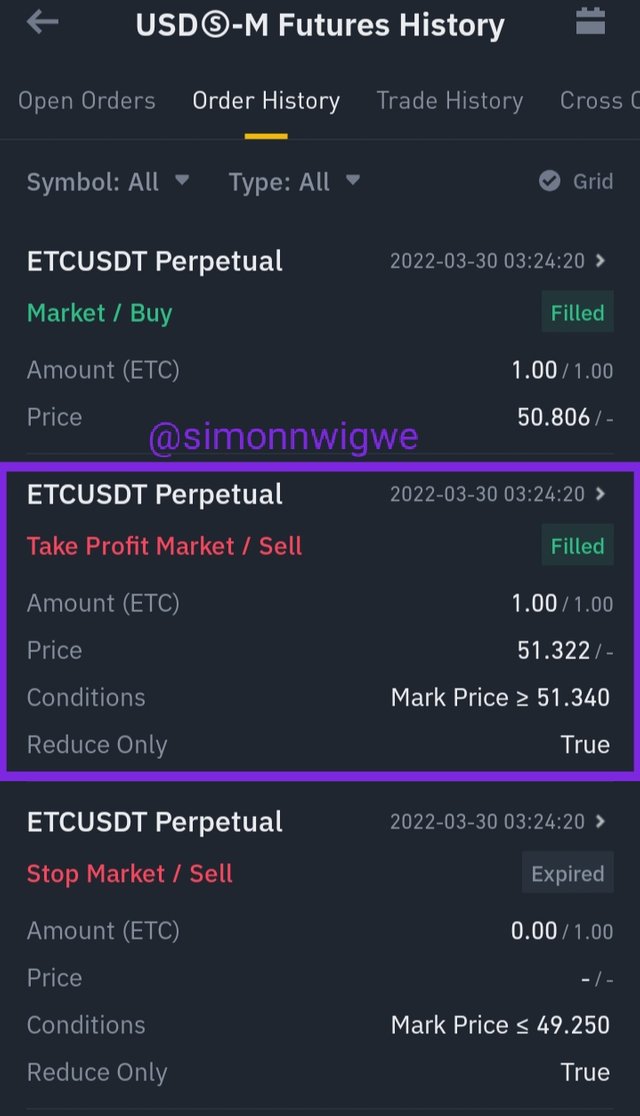

After my analysis using the tradingview.com platform, I then executed the trade using my verified binance exchange account. In my kind of trade, I used the future trading to execute my trade. I traded a future trade, using the isolated margin mode and the 20x adjusted leverage. See the screenshot of the position and the open order below.

Source

My position

Source

Open Orders

After about some minutes, the trade executed. The trade broke the level of resistance where I placed my takeprofit. So it terminated exactly at the point I set to take my profit. The stoploss at this time expired and the takeprofit was filled. The screenshot below shows the details of the trade I carried out.

Source

Order filled

My Plan to hold ETC long or sell

As a scaple trader, I do not have intention of holding the ETC token for a long time. My pattern of trading is such that once the level is hit either the take profit or stop loss, the asset is then converted to it's equivalent value in USDT and then my money returns in form of USDT. Though, it is good to hold the ETC token because it has a significant future raise. Since I don't have much asset right now I tend to always use the little I have to trade other tokens as well and that is why I won't be holding the ETC token.

Would I recommend people to buy ETC

Yes, I sure will recommend both long term and short term traders to buy the ETC token and either sell it when the prices rises a bit or hold it for a longer period to make more profit. For this who might have bought it as far back as 2016, in 2021 they made a lot of profit in it. So I recommend those who have money to buy and hold the ETC token.

Fibonacci tools are really quite an interesting tools that most traders use in their day to day trading activities. The strategy help traders to know how far a trend will go before a pullback and also how long will the pullback go before another impulsive movement. As a trader, I have been able to combine the Fibonacci tool along side the support and resistance strategy to make my trading decision. It is not recommended that we use this tools as stand alone and that is the reason you should use it with a technical analysis indicator.

My gratitude goes to professor @pelon53 for his constant guidance and correction all through the lecture period and I believe, more insight will be reviewed to me as I join with you this week in the trading competition.

Cc:

@pelon53

Written by @simonnwigwe

Here is the LINK to the post that was graded but has not been curated.