HOW TO MATHEMATICALLY DESTROY CURRENT CAPITALISM AND BEGIN A NEW ANARCHIST ERA

It is so easy. It is necessary to make “certain” the “uncertain” pricing system. If we can know the price formation patterns with certainty, then, being prices of all factors known in advance, speculation, the fundamental basis of capitalism, would not have too much reason to exist.

If all players know what the “possible” prices may be for all production factors, then how could anybody speculate on a “profit margin”? The profit is what allows the capital accumulation, so that, eliminating the profit, capitalism is death. It’s that simple.

All decisions in economics are taken based on an imperfect knowledge of the situation. What if we give certainty through discovering that there is a “market genome” which shows clear coordinates of “order” in an apparently imperfect “chaos”?

a) Business atomic physics

Models involving “soft” curves and surfaces have a great advantage: they are susceptible to mathematical analysis. The geometry that we use daily, which is currently taught in school, was created more than 2.500 years ago by Euclid, and resorts to representative elements such as straight lines and circles, which allow study “soft” edged and surfaced objects.

However, the simplest observation of the real world shows that this “soft” abstraction has little to do with exquisite natural forms. A mountain is not a perfect cone with a smooth surface, and a cloud does not look like an ideal soft ellipsoid. The coast of an island and a lightning in a stormy night are other examples of fractures of the theoretical “softness” of Euclidean geometry.

It is necessary to consider other types of curves, incorporating greater complexity structures, with multiplicity of wrinkles, convolutions and irregularities in different scales. These forms are fractals, and the traditional geometry does not serve to fight with them, thus, it is necessary to develop another kind of geometry.

In the same way that the average man moves in his daily environment without understanding almost anything about the universe, the businessman takes dozen of daily decisions without understanding anything about the “atomic physics” of business. Almost no one devotes at least a few minutes a day to wondering about the mechanism that generates the sunlight that makes life possible, or about the gravity that binds us to earth and that, if it did not exist, we would be thrown into space, or about the multiple atomic structures of which we are constituted and whose stability and exact functioning, according to a genetic plan (genome), depend fundamentally to stay alive.

Something similar happens in the business world. Few businessmen, even those most educated in strategic matters, spend time thinking in a rigorous and scientific way about the stability of their industrial sector, about the changes in its valuation that one or several companies undergo when changing “irrelevant” variables, or about the genesis and evolution of the most powerful information system that exists for any market, which is the pricing system. Rather these things are relegated as “irrelevant” to the concrete urgencies of producing results and cash.

This article is an approximation to the imminent challenge that awaits management scientists in the face of the need to apply the new scientific tools to situations that today are not even considered when making decisions.

However, the science of complexity developed over the last 50 years and also known as Chaos Theory, and the rapid development of hardware and software technology and computer simulators, allowed to accelerate almost all models and the evaluation of results en probabilistic terms.

The evolution of Chaos Theory is impressive. Since the scientists discovered that it was impossible to describe the natural phenomena with the geometry that was studied in the last 2.500 years (!?), and realized that they had tools such as personal computers that allowed them to quickly solve the extraordinary complexity of the new equations, the science of complexity has not stopped developing.

Conventional Euclidean geometry ignores the exquisite natural forms. Newtonian reductionism is based on the belief that the universe is composed of parts that can be studied separately. On the other hand, Chaos Theory starts from considering a strong interdependence between the observer and the observed. All our education was governed by the models of Euclidean geometry. We are accustomed to consider forms such as lines, parallels, circles, triangles, squares, cubes and prisms. But precisely, these forms do not exist in nature and can only be manufactured by direct action of the human being. They are themselves models that simplify reality. Let us think for a moment. If you squeeze a sheet of paper –which can be considered as a two-dimensional object, as we are simplifying- you get something like a three-dimensional solid. But here again we are simplifying. Actually, what we obtained is an object that does neither belong to the realm of two-dimensionality nor to the realm of three-dimensionality. The object has a dimension between both of them, for example, a dimension 2.3. A fractional dimension! This is a hard blow to the geometry we all know. It would seem that the human being is not capable of reasoning in terms of fractional dimensions, which is logical after millennia of reasoning on the basis of the simplified Euclidean geometry. Hardly a human brain can imagine a fourth dimension, or more dimensions, talking about integer numbers. How could you imagine a fractional dimension? And yet, the reality is so, complex in terms of Chaos Theory, and if we do not treat it that way, we cannot expect good results.

The development of linear and Euclidean models to explain reality resembles zoologists trying to discover animal life in the jungle, having only a seismograph that cannot detect anything other than elephants’ footsteps.

The Chaos Theory is based on the concept of “complexity” which, for our linear educated minds, would be an intermediate path between certainty and uncertainty. It incorporates a large number of elements that we use in our daily conversations. The words “encounters”, “attractors”, “fractals”, “feedback”, “turbulence”, were introduced bay chaos theorists and then took public status. In the example of the squeezed sheet, the squeezing hand is a “strange attractor” that generates “turbulence” and gives rise to an object of a “fractal” dimension.

There is an evident identity between this process and a market process in which several companies compete for profit generation. In Hayek terms (Frederick von Hayek), companies are entities of “created” order, but when they mix between each other to compete, they give shape to an entity of “uncreated” or “spontaneous” order, which is the market. By the dynamics of chaos, the market is subject to the laws of complexity, and therefore, it moves according to certain attractors, certain turbulences, certain instabilities, and certain fractal patterns that, if they could be described, would conform what I call the “market genome”.

According to system dynamics, the market system is non-linear (variations in one variable generate non-proportional variations in the others), complex (it is composed of a large number of variables), dynamic (its states depend on time) and stochastic (its states are subject to the laws of probability).

The philosophical idea of chaos theory is that small variations in some of the components of a system, however “irrelevant” they may be, can grow in successive interactions causing a catastrophe. This implies that the system must be carefully defined using non-linear equations and giving participation to all variables in play. The traditional example to explain this question is the so called “butterfly effect”. Lorenz coined his famous expression “butterfly effect” to reveal the systems extreme sensitivity to the initial conditions: the beating of the wings of a butterfly in Amazonas, could produce a very small alteration in the atmosphere state, that, if it were amplified by doubling every couple of days, it would cause more and more to be diverted from what would have happened without the butterfly, so that, several weeks later, a hurricane would appear in the Caribbean which never have appeared if there had been no butterfly. (1)

When market processes are observed, in which several competitors play its role, it is possible to say that there is something like an intrinsic “own instability” to each market. Classical economists continue to think that markets tend to balance, and in fact, the theory of equilibrium in economics is based on a false analogy with physics. Physical objects move as they move, no matter what anyone thinks. But markets try to predict a future that is contingent on the decisions that people make in the present. Instead of simply passively reflecting reality, markets actively create the reality they are reflecting on.

Soros calls “reflexivity” to this bidirectional connection between current decisions and future events, and argues that this concept is more important for markets than the concept of equilibrium on which the conventional economy is based. (2)

According to Soros, the concept of equilibrium is very useful for classical economics because it allows concentrating on the final result, instead of focusing on the process that leads to that result.

The position accepted almost universally is that markets are always right, which in other words means that their prices tend to accurately anticipate future developments. However, the concept of reflexivity indicates that prices are always erroneous because they present a biased view of the future, but what is most important, according to the theory of chaos and its concept of feedback, is that distortion operates in both directions: not only the participants operate with certain inclinations but, in addition, these can influence in the course of the events.

The concept of reflexivity is very simple. The connection between the mental attitude of the participants and the situation, in which they participate, can be subdivided into two equations to which mathematics calls “recursive functions”. If we call “x” the situation we want to discover, and “y” to the mental activity of the participants of that situation, we can propose a system of equations:

Y = f (x)

X = g (y)

This implies that:

Y = f [g (y)]

X = g [f(x)]

As can be seen, the two recursive functions do not produce equilibrium but a process of change that never ends. This change, by means of feedback, produces even more change. How can somebody speak of equilibrium? Keynes once said that he had written a general theory, because classic economics was applicable to only one case. This seems to be a similar situation.

Benoit Mandelbrot, probably the greatest mathematician of chaos, conceived the fractal and the concept of self-similarity derived from fractal geometry, observing the exquisite forms of nature and appealing to his reason in the face of the evidence that the clouds are not spheres, the mountains are not cones, the coastlines are not circles, the earth’s crust is not smooth and the lightning does not travel in a straight line.

Broccoli, an exquisite natural form

Mandelbrot suggests that self-similarity is the most powerful means of generating forms, and that fractal geometry, when explaining the complex relationship between the object and the observer, has the same status as the other scientific discoveries of the twentieth century –relativity and quantum theory- which also discovery an interdependence between the observer and the observed. Excited with his theory of fractal geometry, Mandelbrot developed a theory in the universe of pure mathematics, known as “Mandelbrot set”, and baptized, with some fear, as the “polymer of the devil”, as it is recognized as the most complex object of mathematics so far.

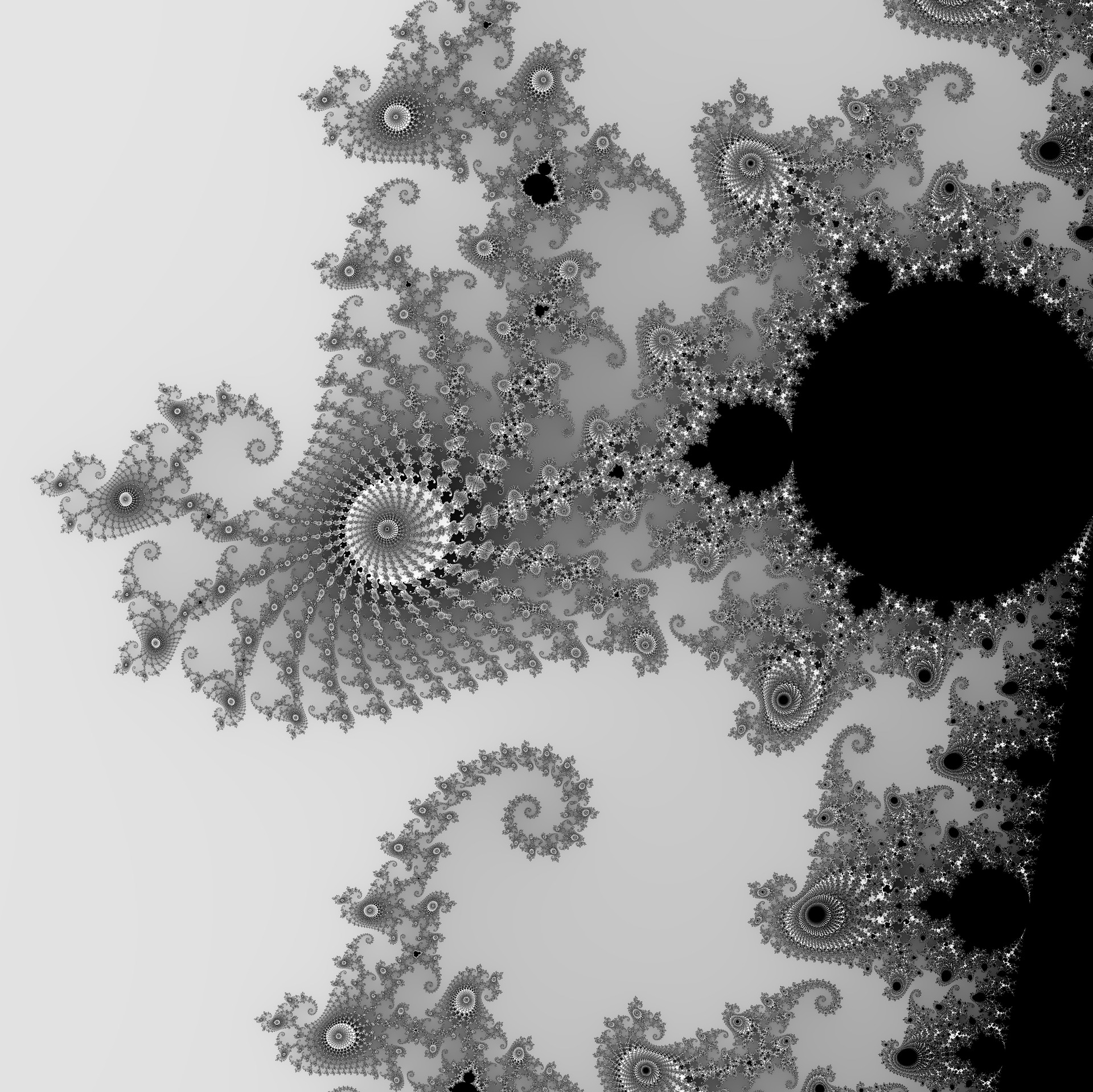

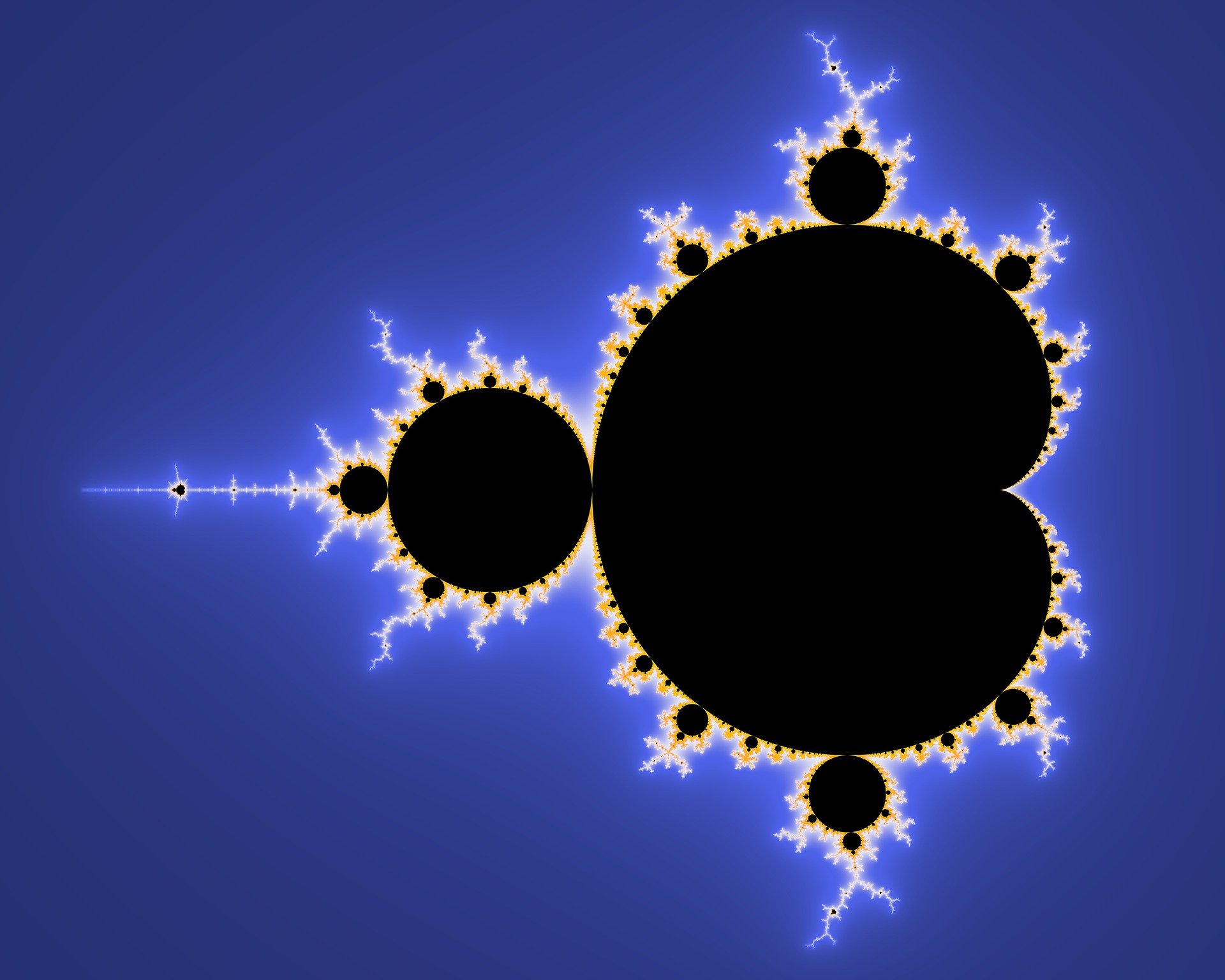

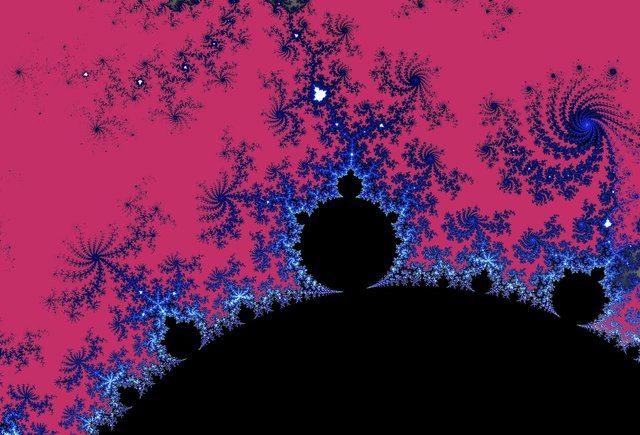

The fascination that awakens in anyone who observes the fractal drawings that the computer makes from the “Mandelbrot set” is almost paralyzing. It is a difficult sensation to explain, as if you were seeing the primordial algorithm of Creation. Mandelbrot began by iterating a simple algebraic expression on his computer, in the early 80’s, when the first personal computers began to develop. The result was like digging up a diamond, although in this case, the diamond was an astonishing strange mathematical attractor. The propulsion system that takes the computer to the Mandelbrot set is the term (Z² + C), where Z is a complex number that can vary and C is a fixed complex number. When you enter these complex numbers into an equation, the computer is told to take the result of the sum (Z² + C)and the next time (and the next time after that and so on), and put it in the place of Z.

The polymer of the devil

.jpg)

I think it is possible to find algorithms that allow drawing fractals of the marketplaces, given certain scenarios, and also of the industrial sectors, composed by several companies of “created order” that orbit each other within a spontaneous order. I call this the “market genome”.

If a grain of pollen is placed in a container with a liquid at a constant temperature and is observed under a microscope, it can be seen that the grain is not at rest but jumps and moves continuously, like taking steps in a zigzag with random addresses. The path that the grain takes can be described by a polygonal curve which is not precisely “soft”. This phenomenon is known as “Brownian motion”, as it was discovered by the Scottish botanist Robert Brown. The liquid molecules are in permanent motion, as long as the set is above 273ºC below zero, and collide against the pollen particle millions and millions of times per second from all directions, causing Brownian motion. If you zoom on each side of the polygonal, you see that it is not a line but a new broken polygonal, and so on.

Any business decision generates a Brownian movement within its respective industrial sector, and, by extension, within the whole marketplace system. We do not see it and we do not study it because we do not have time to zoom. When a company launches a new product, or changes a price or a condition of sale, or changes its debt/equity ratio, or any change, it begins to receive collisions from its competitors and its stakeholders, and from its competitors’ stakeholders. The whole marketplace is shocked at a microscopic level in a sort of Brownian motion that can be described by a “quasi-soft” curve of polygonal trajectory. But there are other phenomena in which a type of curve of grater complexity is manifested.

In ferromagnetic compounds, which are iron alloys, each molecule behaves like a small magnet, and all tend to align, that is, to “order”, and this order overcomes the disorder of Brownian agitation. But if the material is heated (that is, external energy is introduced in the system), molecular agitation increases, and even before reaching the melting of the material, a critical point known as the “Curie point” is reached (for iron 770ºC), from which the thermal agitation predominates, the magnetization disappears, and the molecules move independently and disorderly. The Curie point therefore marks the change from a magnetic to non-magnetic state. It is the border between order and chaos. In that region of transition, it coexist order and disorder. From my point of view, the discovery of a region of space in which there it is a transition between order and disorder is the most revolutionary philosophical concept of science in the twentieth century. In addition, the contribution of fractal geometry to describe this area becomes the most powerful mathematical tool of the last forty years. In fact, when analyzing the thermal edge of the iron at the point of Curie, it is observed that it is not smooth but quite the opposite: endless filigrees appear inside one another, like Russian dolls, giving rise to the concept of self-similarity. An arbitrarily small piece of this transition zone shows the structure of the complete system. (3)

In this zone of transition that separates order from chaos, extraordinary things happen, the most remarkable of which is the fact that tiny variations in some variable can cause dramatically large variations in the total system. Within the area of order, small variations of some variable will produce perfectly predictable variations in the system, using the traditional mathematics of Newton and Euclid. But in the transition zone, the one that has a fractal structure, things change a lot, and thus, new tools are needed. Under these conditions, not all Caribbean hurricanes are caused by butterflies flapping in the Amazon, but only those in which the butterfly fluttered in the vicinity of this transition zone.

In the case of iron, there are two notable temperatures. One is absolute zero (-273ºC), corresponding to a state of total order as molecular motions cease, and the other is a very high temperature corresponding to total disorder. Both temperatures compete with each other and try to “attract” the system to them. The theory of dynamical systems, better known as Theory of Chaos, calls these points “attractors”.

Almost 150 years ago, the German mathematician Karl Weierstrass discovered a very strange and very interesting “curve”. Working with “non-soft” curves, endowed with high roughness, he conceived a curve that was only composed of “sharp points”. From this, the super spiny curves were baptized as the “Weierstrass function”. The interesting thing from the mathematical point of view is that these curves have neither tangent nor derivative. This discovery caused a stir in the mathematical circles of the time, being them in love with mathematical calculus of Newton and Leibniz elaborated in century XVII, and these curves were considered like “mathematical pathologies” difficult to frame in a general theory. The general scientific opinion was that these curves had an academic and theoretical interest, but little served to explain the nature (?!)

However, by 1970, adverse views on these curves began to change. Of course, the great change was brought about by the advent of computing, and, according to my criterion, because of our proximity (I mean, mankind proximity) to a phase of fractal transition. Probably, if the computer had been invented sooner or later, things would not have changed so much…

Computation revolutionized the power of numerical calculus and allowed us to work with hitherto inaccessible problems, such as irregular mathematical objects of great complexity, such as Weierstrass function. Mandelbrot showed that nature does not seem to be displeased with “roughness”, but quite the contrary. In 1975 he baptized these forms with the name of “fractals”, a term that comes from the Latin “fractus” meaning “fractured”. The Weierstrass function became one of the earliest mathematical fractals.

b) Complex numbers

At first, men needed to count, and natural numbers appeared (positive integers). But then they needed to measure lengths, areas of land, weights of materials, and volumes of liquid, and they had to resort to other more general numbers containing the former. These numbers can be represented geometrically by the points of a line, and are called “real numbers”.

As humanity became more complex and freed itself from obscurantism, those who studied mathematics realized that on the line representing the real numbers R, they could not find a number Z such that squared, had as result the negative number -1.

Then somebody defined the number “i” that complies with the equation:

i multiplied by i = -1

The number i is not real, and it is called an “imaginary unit”. From this definition emerges a new class of numbers known as “complex numbers”, which have a real part and an imaginary part, and which are represented in general terms with the notation:

Z = a + bi

Where a and b are real numbers

Just as each real number is represented by a point on the line R, each complex number (a+bi) corresponds to a point on the plane. The complex plane C is then associated with two perpendicular axes or lines, where the horizontal is called the “real axis” and the vertical “imaginary axis”.

Complex variable theory is richer than real variable theory. The complex numbers allow us to describe situations that real numbers cannot explain, and the application of this theory allowed, in my opinion, the spectacular technological revolution of the last hundred years.

When complex variable theory is applied to fractal geometry, really remarkable situations appear.

If the operation “square of a number” with a real number R is iterated, a path called “orbit of R” is obtained. Depending on which R the process starts, there are four possible cases:

Case 1: R a real number greater than 1, for example R=3

The orbit obtained will be {3, 9, 81, 6.561 …} which tends to infinity when the number of iterations is very large

Case 2: R a real number less than 1 and greater than -1, for example R=1/2

The orbit obtained will be {1/2, 1/4, 1/16, 1/256 …} which tends to zero when the number of iterations is very large

Case 3: R = 1

The orbit is a single point {1}

Case 4: R = -1

The orbit is composed of two points {-1, 1}

Now, what happens if instead of iterating the operation “square of a number” with a real number R, we do the same thing with a complex number Z?

Spectacular changes occur.

Let us suppose the quadratic polynomial:

P (Z) = Z² + C

Where Z and C are complex numbers

Suppose that we are going to iterate this polynomial. We can do it in two different ways. The first is to feed the polynomial with different complex numbers Z and keep constant the complex number C, called “parameter”. The second is to leave the complex number Z fixed and modify the parameter C.

CASE 1: Z is modified and C is kept constant

We begin with any complex number Z, and resolve the polynomial P. The result P(z) feeds again the polynomial and then P(P(Z)) is obtained. The third iteration will result in P(P(P(Z))), and so on.

For different initial values of Z, the same polynomial P will produce different orbits. For example:

C=0

Z=0.5 (a complex number whose imaginary part is null, Z=0.5 + 0i)

It will give an orbit {0.5, 0.25, 0.062, 0.0039 …} which tends to zero throughout the real axis. The interesting thing is that this same happens for all complexes smaller than 1, which are all within a circle of radius 1, with center at the origin of the complex plane.

If we take another complex number to start iterations, for example Z=2, its orbit will be {2, 4, 16, 256, 65536 …} which grows without limit to infinity through successive iterations. Any complex number greater than 1 will tend to infinity through successive iterations.

Finally, if we start with the complex number Z=1, the result will always be 1 whatever the number of iterations. As a conclusion of this simple analysis, we can deduce that by iterating the values included in a circumference of radius 1, the results remain within it. All the initial values of Z that are inside the circumference are directed with their orbits towards the zero, and all the values that are in the outside, are directed with their orbits towards infinity. The circumference of radius 1 is a “repulsor” (he who causes repulsion) set of points or complex numbers, those inside are “attracted” by zero and those on the outside are “attracted” by infinity.

The circumference of radius 1 is known as JULIA set, in honor of the French mathematician GASTON JULIA (1893 – 1978), a pioneer in the study of iteration processes and transformations of the complex plane.

But when the quadratic polynomial of the previous example is slightly modified by placing instead of C=0 a complex number C near zero, something extraordinary happens.

There is still an attractor inside the JULIA set, although it is no longer a zero but a complex number close to zero. But now, if we zoom in on the new set of JULIA, we amazingly see (and not without some kind of fear!) that it is no longer a smooth circumference, but its complexity is so great that it has a fractal structure: the set of JULIA is now a toothed and rough circumference! It is as if, with small variations of parameter C, the spirit of Weierstrass is present in our circumference, crumpling what was once a perfect circumference.

The delicate quasi-equilibrium of a market in which competitor and stakeholders are embedded, once again appears as a weak phantom, susceptible to be altered by complex fractal structures, unknown but which could be explained by the theory of the complex variable.

On the set of JULIA the system present chaotic behavior and outside it, its dynamics is stable. This is the same as saying that the set of JULIA represents the border between order and chaos. Whether we are inside or outside the set of JULIA, we will face conditions of stability, but on it, the conditions are chaotic, that is to say, the system depends in an extremely sensitive way to the initial conditions: if you start from two very close points, during the occurrence of an iterative feedback process, the points can be separated so much, that it will become very difficult to predict the behavior of the system. How much does this have to do with Hayek’s concept of “spontaneous order”? Could it be that the “spontaneous order” depends on a faint fractal line, upon which, the order disappears?

CASE 2: Z is kept constant and C is modified

In this case, different sets of JULIA are obtained. We start with the initial value Z=0 (called the critical point of a quadratic polynomial) and we study the orbit obtained by successive iterations for different values of C.

The first iteration will be P (0) = 0² + C = C

The second one P (P (0)) = C x C + C

And the third one P (P (P (0)) = (C x C + C) x (C x C + C) + C, and so on

During the successive iterations process, it is observed that there will be values of the parameter C for which the orbit of Z=0 tends to infinity and others for which this does not happen. If all the values of parameter C for which the orbits of Z=0 do not go to infinity are marked in a complex plane, we get the so called MANDELBROT SET, which we mentioned above in the previous section. Let us analyze it a little more in detail since I believe that this mathematical spawn can explain many of the questions of the “spontaneous order” that we see every day in the several-competitors-composed-market, in which they battle for a competitive position, giving shape to the so-called capitalist system.

The simplest case to draw the MANDELBROT SET in the complex plane is given when we start from C=1

After the first iterations, the orbit {1, 2, 5, 26, 677, 458.330 …} is obtained. It is observed that in this case, the orbit evolves towards infinity. In conclusion, the point C=1 does not belong to the MANDELBROT SET.

Instead, for C=-1, the orbit will have two points {-1, 0}. As it does not escape to infinity, C=-1 belongs to the MANDELBROT SET.

During successive iterations, the black points C that are inside the set move but remain there. On the other hand, those on the outside tend to escape to infinity, but not all at the same “speed”, depending on the real and imaginary components of the corresponding complex number C.

Once again, the complex plane is divided into two sets: the MANDELBROT SET and the rest of the plane. Inside the MANDELBROT SET, things seem stable and out of it, the system behaves with some “different-speeds” instability.

In our analogy, there are prices “that can be” and prices “that cannot be”

But again, the important thing to make decisions about this system as a whole is the fractal boundary of the MANDELBROT SET (M). Right on this border, again we see remarkable things happening. This border is fractal in nature and contains smaller copies of M. This is really remarkable and we see once again the emergence of the concept of self-similarity. It is as if, as we move away from the stable sector of M (black core) and into the ocean of chaos, we can expect to see “islands of stability” still appearing in “oceans of chaos”, new “minimandelbrot sets” that auto-reproduce its shape in the middle of the chaos that tends to completely destabilize the system, leading it to infinity.

The last frontier

At each point C of M, it corresponds a set of JULIA of the polynomial Z² + C, with that specific parameter C, represented in another complex plane where Z is modified and C is kept constant.

In Figure 8, the computer program that draws the MANDELBROT SET is instructed to paint in black in the complex plane the points that belong to the set, and to paint in other colors the points that diverge towards infinity, according to the speed with which they do it. The permanent appearance of MANDELBROT SETs, and their versions “dwarfs” or “minimandelbrots” is observed, which represents neither more nor less than the “order within the chaos”, the “spontaneous order”.

It is necessary to think of the boundary of M as a fractal zone that lies between the black finite and solid interior world of the set and the unstable infinity of the areas of other colors. However, we see that in the latter, “islands of order” appear, new spontaneous orders where, in normal and incomplete analysis, only disorder and instability conditions could be predicted.

c) Examples

The MANDELBROT SET generated by a simple quadratic polynomial P (Z) = Z² + C is important because any complex quadratic polynomial can be brought to that form. Therefore, many problems of corporate capitalism can be studied with the MANDELBROT SET and its fascinating complexity. Everything consist of the way the problem is posed, with the aim of finding those “islands of order” that we know that theoretically appear. Here some examples.

PROBLEM 1: Capital structure of a company

The capital structure of a company is usually expressed by the debt to equity ratio (D/E). This relationship will determine the company’s so called WACC or average weighted cost of capital, according to the formula:

WACC = ke x (E/(D+E)) + i x (1-T) x (D/(D+E))

Where

ke is the cost of stock

i is the market average interest rate

T is the tax rate

We see the direct influence of the company’s stakeholders in the previous formula, modeling the market risk (ke), the market credit (i) and the government regulations (T).

The corporate manager must make decisions about D and about E to achieve a WACC that allows him to have a good valuation of his discounted cash flows. In doing so, he tries to maintain certain parameters of stability, a sort of market “fundamentals” or “standards” similar to those of his competitors.

It is as if the market players strive to remain within the MANDELBROT SET, since outside they can suffer severe instabilities. But we have already seen that in the midst of instabilities there are islands of order materialized by minimandelbrots, which can be perfectly detected by a computer. The possible advantage of occupying one of these islands of order will give to the company that does it a great differentiation, even if it does a risky move, although this move does not compromise the company’s stability. How to raise the problem?

The formula:

WACC = ke x (E/(D+E)) + i x (1-T) x (D/(D+E))

Can be written as:

ke x (E/(D+E)) + i x (1-T) x (D/(D+E)) = WACC

And also

[(ke x (E/(D+E))^1/2 ]^2 + i(1-T) x (D/(D+E)) = WACC

With what we approach to the quadratic polynomial studied before to draw the JULIA and MANDELBROT sets.

Considering for example ke, E, D and T as constants, we can modify “i” in the complex plane, considering this variable composed by a real value and an imaginary one, and after doing a series of iterations, we could obtain a graph of the MANDELBROT SET, in which the black dots would mean the values of the term

i x (1 – T) x (D/(D+E))

that give stability to the system. The point is that outside of that core or cocoon that constitutes the MANDELBROT SET, there are also points of stability that correspond to values of “i” different from the standards, but still stable.

Most of the competitors will be indebted to “i MANDELBROT”. It may be that borrowing at “i minimandelbrot” is a great competitive advantage while the company does not lose stability. This could be materialized through a very innovative borrowing tool.

We can conclude that it is possible to know all possible debt prices in advance…

PROBLEM 2: Corporate brands

During the competitive battle that takes place in massive consumption through the variations of the economic cycle, there is a niche for retail owned brands. Although the products sold by big stores with owned brands are manufactured in many cases by the same players that compete with their brands, it is expected that the owned brands are profitable and not simply strategies of niche occupation.

When big stores enter with their owned brands, they cause mutations in the previous genome, rearranging the whole sector.

The “new” sector responds according to its fractal structure, which can be described by the corresponding MANDELBROT SET. Finding a quadratic polynomial that allows successive iterations for the product price, it would be possible to find the stability prices of the main MANDELBROT SET, and the stability prices of the minimandelbrots that navigate the complex plane. These prices can set a competitive advantage for an owned brand.

We can conclude that it is possible to know all possible owned brands prices in advance…

PROBLEM 3: Stock Price in Merger & Acquisitions

It is usual to see that when a big player threatens to buy a company from a given industrial sector, the stock of all companies of that sector collapses.

How much should companies’ shares fall (stable zone)?

The MANDELBROT SET could show the main and minimandelbrots stability zones.

We can conclude that, given a threat of merger or acquisition, it is possible to know all possible companies’ stock prices in advance…

PROBLEM 4: Abandonment of a sector

When a big player withdraws from a sector, taking into account that markets abhor the vacuum, it is expected that another competitor will quickly occupy that abandoned position.

The entry of a new competitor causes a very intense battle with large resources invested in communication and promotional campaigns in a lot of channels. However, a relatively simple matter could change those budgets.

If we are able to set a quadratic polynomial that takes into account the market shares of the sector and its relation with the marketing investment, and iterate enough times to obtain as a result in the complex plane the corresponding MANDELBROT SET, it would be possible to know in advance the main stable zones and the mini stable zones predicted by the theory, and surely the marketing investments would be more rational, responding to the primordial plan we know to be there, underlying the sector.

We can conclude that, given a new entry, it is possible to know all possible values of investments that should be made for the overall system to remain stable in advance…

d) Conclusion

Who does predictable capitalism serve?

Fractal geometry brings at the beginning of the 21st century a new stream of philosophical thought, which gradually constitutes the collective unconscious of researchers and technologists.

The science of management, which is the underlying theory of corporate management, which in turn is the basis of corporate capitalism that governs the allocation of monetary resources on the planet, that is to say, the international economy and by extension, our whole lives, and which began to develop in the second half of the 20th century, has been making in my view, an excessive emphasis on the “artistic” qualities and on “experience” of managers (method of the case) to handle the companies’ strategic and tactical issues. When you do not know what can happen, you better turn to magic.

A mathematical view of what Hayek called a “spontaneous order” would definitively eliminate the trickery and destroy the capitalist system by giving certainty to all inhabitants of the planet. If all companies know the coordinates of the minimandelbrots that improve their capital structure without jeopardizing the stability of their operation, then, all companies would be indebted in the same way and there would be no competitive advantage at all. The only way would be the merger or acquisition into a clumsy and lazy mega monster. But if all companies know what the price of the company’s shares should be, it will have been definitively eliminated the speculative game that governs such transactions and that gave shape to this capitalist system since its origins.

If all companies could know with mathematical certainty the prices of the products that give stability to the system, or the investments in marketing and communication that they have to do when the competitors move, capitalism would become a simple robot game.

Any kind of economic decision in this capitalism system is made based on imperfect knowledge of the situation. What if we give certainty through discovering that there exists a market genome based on the MANDELBROT SET that shows clear coordinates of order in an apparent and imperfect chaos?

I recently read that a very influential businessman predicted that the price of one Bitcoin will be around $500.000 by 2020. If we could draw the MANDELBROT SET for that market, we could know if that value is within the coordinate of some minimandelbrot lost in the ocean of the complex plane infinity and therefore if it is true or if it was only an attempt to influence the participant’s behavior, speculating that they will never have all the information.

The market genome is out there, operating silently, with rules that, only for the moment, only he knows. This article may for a long time be a simple guess. I know it. The passage from a capitalist society with codes engraved on fire for almost 300 years, to another society based on anarchy, in which there are no monetary authorities, central banks, governments and corporations of created order that monopolize food, medicine, energy, information, technology, money, the media, is not expected to be very simple and peaceful. But if we do not push it, the price will be our soul.

NOTES

(1) MOISES JOSE SAMETBAND, Entre el orden y el caos: la complejidad, Fondo de Cultura Económica, 1994, pág. 95

(2) GEORGE SOROS, La crisis del capitalismo global, Editorial Sudamericana, 1999, pág. 26

(3) GUSTAVO HERREN, FRACTALES: LAS ESTRUCTURAS ALEATORIAS, Longseller, 2002, pág. 27 y siguientes.

Congratulations @sirgerardthe1st! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @sirgerardthe1st! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPThanks for sharing your genius thoughts and for echoing Mandelbrot's unique perspective of nature :)

Thank you Sir!