[CRYPTO TRADING STRATEGY WITH MEDIAN INDICATOR]- Steemit Crypto Academy- Homework post for Professor @abdu.navi03 by @stealthog

Hello Steemians, I hope you all are doing well. It's a new week and week 4 of season 6 of the crypto academy, and it's a pleasure to be here. This week prof @abdu.navi03 gave a lesson on the median indicator, and I will be doing the homework task from the study.

1. Explain your understanding with the median indicator.

Median Indicator

It is said that trends are traders' best allies, as it is advisable to go with the trend and catastrophic to against it. For this reason, trend-based indicators are popular among traders because they help identify the current trend in the market. The median indicator is a technical analysis tool traders use to identify trend direction and volatility. The median indicator is a trend based indicator that shows the median value of the high and low points in a chart. It uses the average true range ATR deviation from the middle range to form a channel.

The median indicator has a clouded coloured median line that changes to green when in an uptrend and to purple (violent) when in a downtrend. The cloudy coloured median line is compared to an EMA of the same length. When the median line crosses above the EMA line, it shows an uptrend and gives a green colour. Also, when the EMA line crosses above the median line, or the median line crosses below the EMA line, it indicates a downtrend and gives the purple colour. Using different colours to identify trend direction is good. It makes it easier for a trader to know the presiding trend and traders' psychology by merely looking at the shade given by the indicator.

2. Parameters and Calculations of Median indicator. (Screenshot required)

Median Indicator Parameters

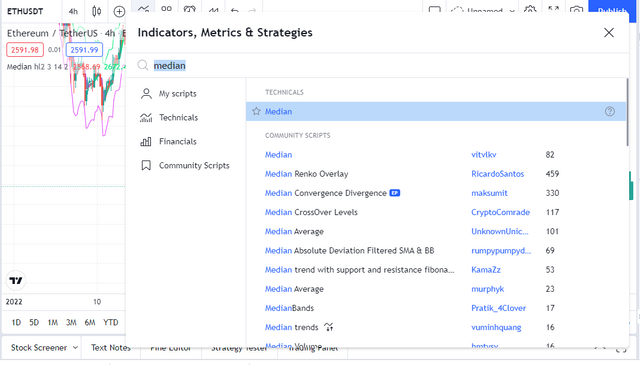

The parameters of the median indicator can be identified and customized on the chart. I will be using the tradingview chart platform in executing this task.

On the tradingview homepage, click on the chart and click on the indicators and strategies button. On the indicator pop-up section, search median, and the median indicator option will display. Click on it to add it to the chart.

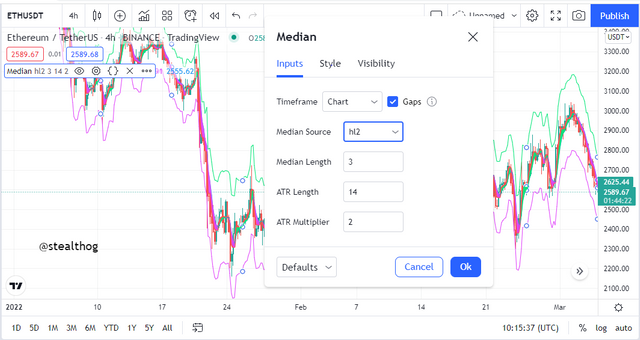

After adding the indicator to the chart, click on the indicator settings. We see the various median indicator default parameters listed below on the input section of the indicator settings.

Median source = hl2

Median length = 3

ATR length = 14

ATR multiplier = 2.

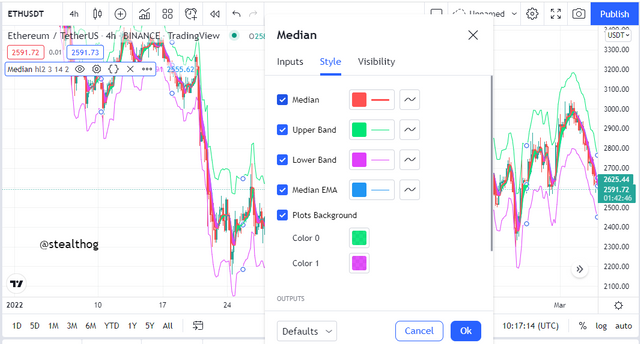

The various colour bands on the style section of the indicator settings are given and can be customized to choice.

Median Indicator Calculations

The median calculations can be derived by calculating the difference between the median line and the EMA line at the same length. When the difference in the EMA value is higher than the median value, the median indicator gives a purple colour to indicate a downtrend. When the median value difference is higher than the EMA value, then the median indicator shows a green colour to indicate an uptrend.

Median Indicator = Change in ATR (difference in EMA value and Median value)

Where;

EMA value = Closing price x multiplier + EMA (previous period) x (1-multiplier)

Median value = (High price + Low price)/2

3. Uptrend from Median indicator (screenshot required)

identifying an Uptrend using the Median Indicator (Buy Signal)

The median indicator, as earlier stated, is a trend based indicator that works by using colour codes to signify trends. The uptrend can be identified when using the median indicator. This is done when the median line crosses above the EMA line, and the difference is green. When the clouded colour median line is changed to green, it is a buy signal or the start of an uptrend.

On the LUNAUSDT chart above, an uptrend and buy signal was identified when the median line colour changed to green to indicate an uptrend. The median indicator is a trend based indicator, and as such, the green colour will continue until the uptrend ends. Stop loss and take profit are set at the start and end of the trend when the colour changes to purple. For the more cautious traders, stop loss might be placed at the previous low and use a risk to reward ratio of 1:1 or 1:2.

4. Downtrend from Median Indicator (screenshot required)

identifying a Downtrend using the Median Indicator (Sell Signal)

The median indicator, as earlier stated, is a trend based indicator that works by using colour codes to signify trends. The downtrend can be identified when using the median indicator. This is done when the median line crosses below the EMA line, or the EMA line crosses above the median line, and the difference is shown as a purple (violet) colour. When the clouded colour median line is changed to purple, it is a sell signal or the start of a downtrend.

The ADAUSDT chart above identified a downtrend and sell signal when the median line colour changed to purple/pink to indicate a downtrend. The median indicator is a trend based indicator, and as such, the purple colour will continue until the end of the downtrend. Stop loss and take profit are set at the start and end of the trend when the colour changes to green. For the more cautious traders, stop loss might be placed at the previous high and use a risk to reward ratio of 1:1 or 1:2.

5. Identifying fake Signals with Median indicator(screenshot required)

Identifying Fake Signals with Median Indicator

The median indicator is used to identify false signals given by other indicators. The median indicator is trend-based, making it an excellent indicator to determine the current trend in the market. Some indicators give false signals, and the median indicator can be used to identify the false signal and confirm accurate trade signals.

An example is shown on the chart above when the RSI indicator gave a false signal. The RSI indicator gives a buy signal when the RSI line crosses above the 50 point level and a sell signal when the RSI line crosses below the 50 point level. On the SOLUSDT chart, the RSI indicator gave a false signal when the RSI line crossed below the 50 point line to give a sell signal.

The median indicator was used to identify the false signal. The median line changed colour to green to indicate an uptrend or a buy signal, and price action went on an uptrend to confirm the signal given by the median indicator.

6. Open two demo trades, long and short, with the help of a median indicator or combination that includes a median indicator (screenshot required)

Buy Order

On the GALAUSDT chart, the median indicator and the MACD indicator was paired to give trade signals. The MACD indicator gives trade signals when the MACD line (blue) crosses over the signal line (orange) to indicate a buy signal, and when the signal line crosses over the MACD line, it is a sell signal.

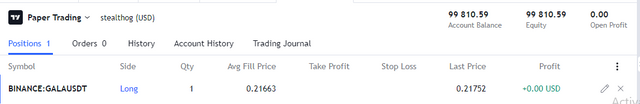

The buy signal was given when the MACD indicator signal line crossed above the MACD line. The median indicator confirmed the order as the median line was green to indicate a buy trade. The buy order was entered, and the trade was initiated.

The trade move in the intended direction after a while, as seen below.

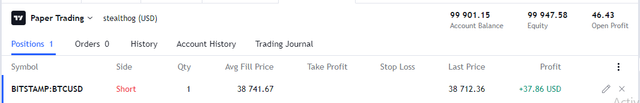

Sell Order

On the BTCUSD chart, the median and MACD indicators were paired to give trade signals. The MACD indicator gives trade signals when the MACD line (blue) crosses over the signal line (orange) to indicate a buy signal, and when the signal line crosses over the MACD line, it is a sell signal.

The sell signal was given when the MACD indicator signal line crossed above the MACD line. The median indicator confirmed the order as the median line was purple to indicate a sell trade. The sell order was entered, and the trade was initiated.

The trade was entered using the trading view paper trade and was in profit as of this writing.

Conclusion

The median indicator is a trend based indicator that helps traders identify trends by using different colours to identify an uptrend and downtrend. The median indicator also helps identify false signals given by different indicators. The median indicator follows the trend, so it is a good indicator for a confluence of technical analysis tools to identify trade signals.