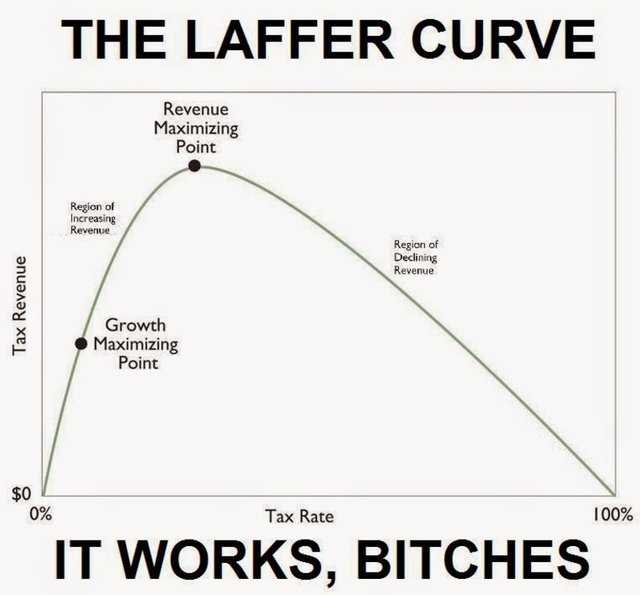

Why LOWER TAXES mean more income for the government.Explaining the LAFFER CURVE.

This post is about the importance of the Laffer Curve.An ecomic concept named by the man who invented it.

This curve illustrated the two most important aspects of taxation.

1 : How much money the government can raise from taxes.

2 : At what level of taxation the government will start receiving less taxes.

The laffer curve is illustrated here as an example and can change forms.

For example.If tax rate is 0 and we pay 100% of it then the revenue is 100% x 0 = 0$ which is the first point of the graph.

As we increase the tax rate at least at the low levels more revenue will be received.When tax rates start growing to much we create the "hump" which means that more people start not paying and therefore the total revenue is decreased.

If the tax rate is 100% then no one would pay it therefore 0% x 100 = 0$

All the points between those to form the laffer curve.

THIS HAS HAPPENED BEFORE.

During the great depression the government passed the HAWLEY - SMOOT TARIFF BILL which raised taxes on all imported goods but the revenue went down.

During the 80's with REAGAN's TAX CUT ON THE RICH which cut taxation from 70% to 50% the income from the rich only increased.

Even the most LEFT economists agree on one thing.The Laffer curve has a "hump" which means that at some point the tax increased hurts the actual revenue.

What they disagree on is WHERE exactly this hump is.Meaning which is the golden point where most revenue can be raised.

Up until a few years back even the econimist's textbooks reported that this hump occures arounf the 70% taxation,but apparently this was wrong.

According to most recent publications by Christina Romer who was the chairman of pres.Obama's council of economics suggest that the curve occurs around 33% .

This publication focused on how national income responds to tax rates.

Doing the math,proves that 33% is the golden point.

The meaning of this post is that no matter what you vote left or right,the Laffer Curve works and should be taken into account.

Follow for more!

The next step woulb be the revolutionary but logical one... NO TAXES and private workout in every section. Taxation is theft!

Personal AND macroeconomical.

utopic scenario

I quote you: "it works, bitches!"

Yeap,it does.

Thanks for the Post. As I understand it the Laffer curve is provided as support for supply side, neo-liberal economics that has dominated the last 3 decades. It is not a 1+1 = 2 type of truth. 'Demand side' or Keynesian economics is an alternative evidence based story. The most famous demonstration of its potential success being the US Government responding to the Great Depression and investing in infrastructure and jobs, which kick started an economic boom. The argument for lower taxes states that "the rising tide lifts all boats", if the capitalists and so called 'wealth creators' have more money, this will trickle down to everyone else. However the current state of the Global economy, and the huge increases in in equality since supply side economics has taken root suggests otherwise. Cheers

Of course it is up for interpretetion.personally i do believe it.in any case there is no doubt in my mind that it is better than the current state

The government doesn't "invest" - it redistributes money from the private sector to areas with a naturally lower pull for those resources. Neither supply side nor demand side tweaks will ever match the efficiency you can get just letting price signals do their job.

Fair point, invest is the wrong word. Efficiency to do what though? help the majority of society, I don't think so. The countries with the highest standards of living, and lowest negative social indicators (e.g. teenage pregnancy, social support, parental leave, low unemployment) are those typified by the Social democratic model of Capitalism that dominates in Scandinavia. Taxes are higher, but the state works together with Capitalism to ensure fairer outcomes for all. Where capitalism has historically not been controlled and supported by the state it runs riot, fails and no one wins. The British and US economies were built in the 19th century by completely protectionist trade policies that the World Bank and other global lenders now ensure are not adopted by countries trying to develop in the same way.

One problem with the Laffer curve is that is doesn't have any time dimension to it. The biggest problem is that it acts as if the government obtaining more "revenue" is somehow a good thing! Since the government is a band of thieves and murderers, they deserve NO wealth of any private individual.