Will Cryptocurrency Mark the Downfall of Stocks or an Integration of Both?

According to a recent article published by CoinTelegraph entitled 'Investors Pull Billions from Stocks As New Bitcoin, Crypto Options Appear' the past 10 weeks have seen massive shifts in capital leaving stocks and entering the cryptocurrency markets.

The larger question at hand is....

Are cryptocurrencies and stocks at odds with each other or will we see the combination of both of them in the not too distant future?

Here are a few important details that may help us answer this question:

CNBC has reported that the stock market has seen the largest withdrawal rate since 2004, with more than $30 bln being taken out of the markets over the past 10 weeks. The major withdrawal also included a huge abandoning of precious metals.

Personally I understand the fleeting capital in stocks but I think treating precious metals in the same manner is a big mistake. Most people I know that invest in cryptocurrency also see the value in precious metals and they are keeping their holdings of both gold and silver.

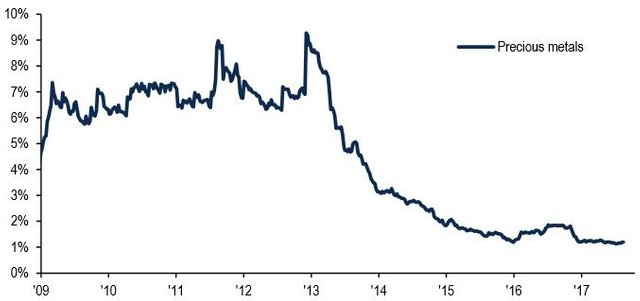

Private client allocation to precious metals has seen a massive reduction, with portfolios holding 10 percent in 2013 being reduced to below two percent in recent weeks.

Keep in mind that paper IOU's dominate the precious metals commodity markets and so this may not be an accurate reflection of what is taking place with physical gold and silver markets.

Blockchain technology is producing new investment opportunities. Companies like LAToken and MyBit have developed methods for tokenizing investments, making it possible for large-scale investments to be purchased by smaller scale investors.

The decentralized platform of these companies makes it possible for investors to participate without the higher fees associated with traditional markets. LAToken has even produced a system where shares of Apple, Amazon and other blue chip stocks can be ‘tokenized’ and purchased in part by investors. CEO of LA Token Valentin Preobrazhenskiy says:

“We build a NASDAQ on Blockchain with a wider range of tradable assets, blurring the boundaries between crypto- and real economies, and offering our clients a dramatic reduction of listing costs, settlement time, and transaction costs.”

This last few paragraphs confirms what I believe will become a greater trend in cryptocurrencies and stocks. The line will be blurred even further and each day that passes we will see a more solidified consolidation of both investment vehicles... This may or may not be bad for large banks and stock brokers but they will still be able to play a roll in helping people choose the best cryptocurrency stocks to meet their goals and preferences.

Stock brokers will be replaced with cryptocurrency brokers as we enter a new technological age of blockchain investments.

Techblogger Wrap Up

It's clear that stock markets are being affected negatively as cryptocurrency and stocks are not complimentary at the moment but rather in direct competition for the same investment dollars. Companies have seen this trend are trying their best to bridge the gap between cryptocurrencies and stocks while being careful not to get into trouble with the SEC.

I'll leave my readers with this final question in hopes of sparking a discussion...

Do you think cryptocurrency will bring the downfall of stocks or will they both find a way to co-exist and both possibly transform into one in the same?

Please leave thoughts and comments below.

Thanks for reading!

Sources:

Investors Pull Billions from Stocks As New Bitcoin, Crypto Options Appear - CoinTelegraph

Cryptocurrency Trading Helps Make Traditional Wall Street Traders Millionaires - CoinTelegraph

Stocks will lose as the cryptocurrency enters the financial markets .

But it will take more than a decade

You don't want cryptocurrency to become "legally traded" this is because as soon as it becomes a security or an asset it will be liable to be taxed outrageously.

Very much educational.

Follow for follow 😄

I think the stock market will always survive in one way or other, but it's influence on the economy will be significantly reduced, because the proportion of capital going into stocks will decrease over time.

Stocks will find a way to co-exist with cryptos and survive.

I am planning to sell half of my gold bar and investing it in cryptocoin. I believe the future of it

great post buddy,, nice

keep it @techblogger

visit my post if you like about cryptocurrency, and please help be upvote and resteem.

https://steemit.com/cryptocurrency/@wahyue/how-to-mine-litecoins-and-dogecoins-is-it-worth-your-time-to-mine-for-cryptocoins

An economic downturn will put strong upward pressure on Bitcoin and cryptos. Think in terms of wealthy investors, who control a large proportion of available investment capital. If the stock market goes down, they pull out of it, (making it crash even more.) If there's fear that the dollar or other govt currencies may crash too, they look for safe havens. Gold, real estate, and now cryptos have a fixed or predictable supply, making demand the main variable in their price. Cryptos have some amazing advantages over the other safe havens since you can buy and sell instantly, transfer them anywhere in the world, and easily hide them from govts, spouses, and debt collectors.

Put yourself in the mindset of someone who has $10 million in the stock market and is looking for somewhere to hide it through the next recession.

nice