Canada Implements GLOBAL TAX RACKET! UN TAXATION IS THEFT!

On April 27th, 2016 World Alternative Media broke the news on a proposed tax treaty policy written by the OECD, IMF, World Bank and the UN. We said at the time that the Panama Papers were used as a false flag to push a UN Agenda of a One World Taxation System. If you want to look into it, it was called "Supporting the Development of More Effective Tax Systems" https://www.oecd.org/ctp/48993634.pdf

The working group proposed to create a global cooperation system to report wealthy individuals and corporations hiding from the government theft called taxation. At the time people were saying we were crazy for proposing this plan. What we did have was the document linked above from the 2011 working group. This, of course, comes from the G20's push to move back to state authority as Stuart P. M. Mackintosh wrote about in his 2015 book The Redesign of the Global Financial Architecture: The Return of State Authority. https://www.amazon.com/Redesign-Global-Financial-Architecture-Globalizations/dp/B01FJ12NFE

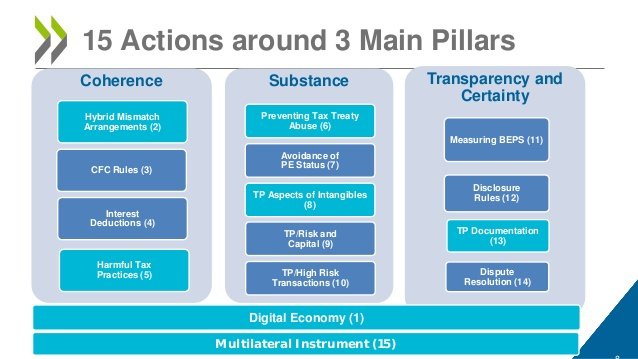

Stuart is the Executive Director of an organization called G30 which is a global "think tank" more like a policy creation group for the G20. The above legislation came out of the Bank of International Settlement funded Financial Stability Board. It is getting a bit complicated, but I think you deserve to hear the story behind the now adoption of BEPS or Base Erosion and Income Shifting as the G20 calls it.

http://www.oecd.org/tax/flyer-inclusive-framework-on-beps.pdf

https://www.oecd.org/ctp/BEPSActionPlan.pdf

http://www.oecd.org/tax/beps/beps-inclusive-framework-progress-report-june-2016-july-2017.htm

Let's get back to how the Panama Papers was a false flag to ease people into accepting the treaty to work hard to close the gap of tax havens where individuals found shelter from government theft! After the Panama Papers came out, the BEPS was proposed in October 2015 and had 100 signatories in January 2016. There was no real news about this until late 2016 when covered the news: http://www.oecd.org/tax/treaties/multilateral-convention-to-implement-tax-treaty-related-measures-to-prevent-beps.htm

The 100 signatories are in this documents Canada doing it on May 11th, 2016 the US has not signed on, and there are officially 68 countries, not 100 as they claim. The US has their FATCA which tracks down their US citizens anywhere in the world to steal money from them.

The Panama Papers were created to make people angry about tax evading elites to make it simpler for implementation of the BEPS. There are connections between the ICIJ passed the information down to the OCCRP (Organized Crime And Corruption Project) to be sorted through. The OCCRP is also sponsored by the Open Society Foundation and has been writing up hit pieces on Putin for years. And the funder behind the Open Society Foundation is none other than George Soros.

After publishing the Panama Papers, the ICIJ also put out the Paradise Papers to further to push the global taxation cooperation and collection agenda. The One world Money push comes out of the IMF, and the One World Taxation push comes through the UN as they are the international government structure in place to control the world as a Global government when the collapse comes. If you think this is a conspiracy I think you should look at the report Josh and I did at the UN!

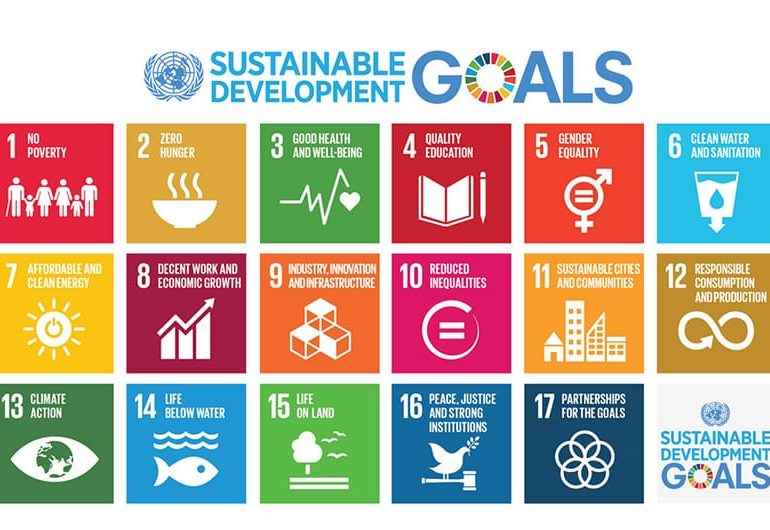

The global government is in place and ready to roll. Before I get into the BEPS implementations in Canada, I think it is crucial for you to understand that the so-called New World Order is the UN controlled by 100's of non elected officials with political backgrounds from their home countries. The UN is "sitting on the fence" waiting for the chance to implement themselves as a world government. If you don't believe the UN and its many sisters or under groups write policies for the world look at Canada's budget for 2018 on page 163 Implementing the 2030 Agenda for Sustainable Development. It is a policy created by the UN to tax more people on CO2 which is a naturally occurring gas!

Back to the other "UN / G20" policy the BEPS tax treaty. Canada will implement parts of the cross-border reporting mechanism to stop big multilateral corporations and ultra-wealthy. Meanwhile, this is in my point of view a hidden agenda to create a global taxation racket for the UN to be able to function as it seems their biggest funder the US is pulling hard towards nationalist policies instead of corrupt globalism and control. Although I don't like any government, let's hope that people wake up to these evils and see how taxes are used to extort the populace to enrich corrupt politicians and now with BEPS an unelected political elite at and under the UN!

Let's see what Canada has in store for their parts of BEPS implementation in 2018. First I wanted to say that Canada is slowly killing itself from taxation of everyone. While their significant pledge of the 2018 budget is to reduce taxation on the Middle Class while hiking taxes on "the rich." With the implementation of the Carbon Taxing and credit schemes the middle class "tax cuts" will be tax hikes for the middle class. The Canadian government are spending mass amounts of money on international help to implement Agenda 2030 in other countries. It is just a way to say hey we would like to have some influential people in the new world government!

The BEPS in Canada will be implemented like this:

Combatting Aggressive International Tax Avoidance - Strengthening Canada’s International Tax Rules

The Government is also taking action to fight aggressive international tax

avoidance by introducing measures to protect the integrity and improve the

fairness, of Canada’s international tax system. This system includes rules to

prevent taxpayers from avoiding Canadian income tax by shifting property

income into foreign resident corporations. It also includes rules aimed at

ensuring that non-residents pay their fair share of tax on income derived from

Canadian sources.

To strengthen Canada’s international tax rules, the Government is proposing measures to:

• Ensure that these rules cannot be avoided through the use of so-called “tracking arrangements” (which allow taxpayers to “track” to their specific benefit the return from assets that they contribute to a foreign

resident corporation).

• Prevent unintended, tax-free distributions by Canadian corporations to non-resident shareholders through the use of certain transactions involving partnerships and trusts.

Update on International Tax Avoidance—Base Erosion and Profit Shifting

The Government is committed to safeguarding Canada's tax system and has been an active participant in the Organisation for Economic Co-operation and Development/Group of Twenty (OECD/G20) project to address both the inappropriate shifting of profit offshore and other international planning to avoid tax by corporations and some wealthy individuals, known as the Base Erosion and Profit Shifting (BEPS) Initiative. The Government will continue to work with its international partners to improve international dispute resolution, and to ensure a coherent and consistent response to fight cross-border tax avoidance.

Growth 71

Improving Domestic Rules That Affect Cross-Border Activities

Strengthening the Controlled Foreign Corporation Rules

Canada has long had a robust set of rules to prevent the avoidance or deferral of tax through the use of foreign affiliates.

The Government continues to monitor the effectiveness of these rules and to adapt them as needed, including through the introduction in Budget 2018 of proposals to address “tracking arrangements.”

Reinforcing Substance Requirements

Preventing Treaty Abuse

Canada intends to adopt new rules in its tax treaties to more effectively address treaty abuse, such as treaty shopping.

These include anti-treaty abuse provisions that may be adopted under the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting or in the process of negotiating new, or renegotiating existing, tax treaties.

Aligning Transfer Pricing Outcomes With Value Creation

Canada has adopted the revised OECD Transfer Pricing Guidelines and has played an important role in developing additional guidance on issues identified in the course of the BEPS project. These issues include the attribution of profits to permanent establishments, the use of the profit split method, and the treatment of hard-to-value intangibles. Additional guidance is due to be published over the course of 2018.

Improving Transparency and Certainty Country-by-Country - Reporting

Large multinational enterprises in Canada and elsewhere are now required to file country-by-country (CbC) reports containing information on their global allocation of income and taxes, as well as the nature of their global business activities. These reports are exchanged with other tax authorities with whom Canada has a bilateral exchange agreement or with whom an exchange relationship has been activated under the OECD multilateral competent authority agreement for the exchange of CbC reports. CbC reports are an important tool in combatting BEPS by providing the CRA and other tax authorities with new information to better assess transfer pricing risks. Harmful Tax Practices The CRA spontaneously exchanges information on certain tax rulings with other tax administrations. Such exchanges form part of a coordinated international effort to counter harmful tax practices.

Supplementary Actions - Multilateral Instrument

In 2017, Canada, along with 71 other jurisdictions, became signatories to the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (known as the Multilateral Instrument or MLI). The MLI is intended to allow participating jurisdictions to modify their existing tax treaties to include measures developed under the OECD/G20 BEPS project without having to individually renegotiate those treaties. The MLI is a high priority for the Government and an important tool in combatting international tax avoidance. In 2018, Canada will be taking the steps necessary to enact the MLI into Canadian law and to ratify the MLI as needed to bring it into force. Canada continues to expand and update its network of tax treaties and tax information exchange agreements. As one example, Canada will seek to bring into force the tax treaty with Madagascar that was signed in November 2016.

72 Chapter 1

Common Reporting Standard—Sharing of International Tax Data

The recent implementation of the OECD/G20 Common Reporting Standard that allows jurisdictions to exchange information on financial accounts held by non-residents automatically will help advance the Government’s commitment to promoting compliance and combat tax evasion. To ensure that the information received is adequately leveraged to address the highest-risk population of tax evaders, the Government will provide $38.7 million over five years to the CRA. It will allow the CRA to expand its offshore compliance activities through the use of improved risk assessment systems and business intelligence and will facilitate the hiring of additional auditors.

You can find this information on pages 70-72 in the proposed 2018 budget! https://www.budget.gc.ca/2018/docs/plan/budget-2018-en.pdf

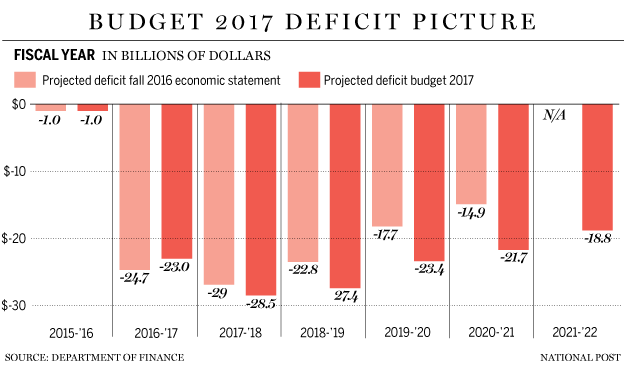

It is time to stand up against these hidden implementations of a global government into the Canadian economy and a war on prosperity! It is time to expose the flawed governmental system and move away from the failing bankrupt system of the Canadian Dollar. Move away and insure yourself against the failure of the government that will continue to accumulate debt and have the Bank of Canada buy it!

Bond Buyback Programs

The Government plans to continue conducting regular bond buybacks on a switch basis and cash management bond buybacks. Two bond buyback operations on a switch basis are planned for 2018–19. These operations would occur for bonds that were originally issued with terms to maturity of 30 years. The dates of each operation will continue to be announced through the Quarterly Bond Schedule that is published on the Bank of Canada’s website prior to the start of each quarter. The cash management bond buyback program helps to manage government cash requirements by reducing large bond maturities. Weekly cash management bond buyback operations will be continued in 2018–19. A pilot project to increase the flexibility in the maximum repurchase amount.

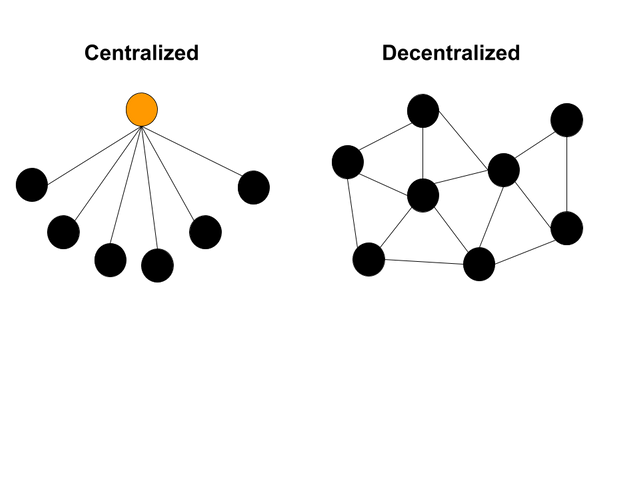

Move into gold, silver, crypto and become self-sufficient as the government will not be able to save you in a natural or a financial disaster! It's time to decentralize to get away from the global centralization towards a global government. Eventually, people will get mad when the system collapses!

Please make sure if you haven't yet to get my book: Canada, The Greatest Economy In The World?

To get all of my opinions on Canada, It's politics and the economy. All of the above is my opinion mixed with tons of facts!

Peace, Love and Voluntaryism,

John

Posted in Good Have Power You Will

The old guy in the thumbnails for the videos looks creepy. He looks evil lol

Best of luck with the book. Thanks for the valuable information.

Back to politics