Can You Still Afford It? - Understanding the Basics of TRAIN Law: Part 1 of 2

Many of us have saved at most 50-60% of our salary for our car loans and a few had actually saved long enough to purchase their cars in cash. But last year, many of us had a shopping spree to avoid extra taxes this year. And this have been confirmed by by industry executives as their stocks have been largely sold off.

Now that President Duterte, already signed the Tax Reform for Acceleration and Inclusion (TRAIN) into a law as Republic Act 10963, we can now have accurate prices and comparisons of the most sold cars in the Philippines.

Understanding TRAIN Law (The Basics)

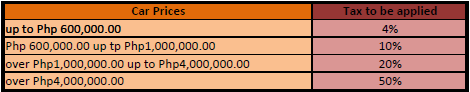

With TRAIN Law, the taxes for each sold car will be in four categories/tiers. And this should amuse all the mathematically-inclined people. And I must say that the bicameral conference really did a great job for diminishing the previous tax computation for automobiles. Now, we only have to deal with rates (in percent) which will be applied on the NMISP of a paricular vehicle.

it only has a rate (in percent) that is applied on the NMISP or at-cost price of the manufacturer or importer before taxes is applied to a particular vehicle.

"TRAIN also made some specific exemptions to the excise tax such as pure electric vehicles (EVs) and all pick-up trucks. Hybrid electric vehicles will only see 50% of the excise tax rate applied." -- Source

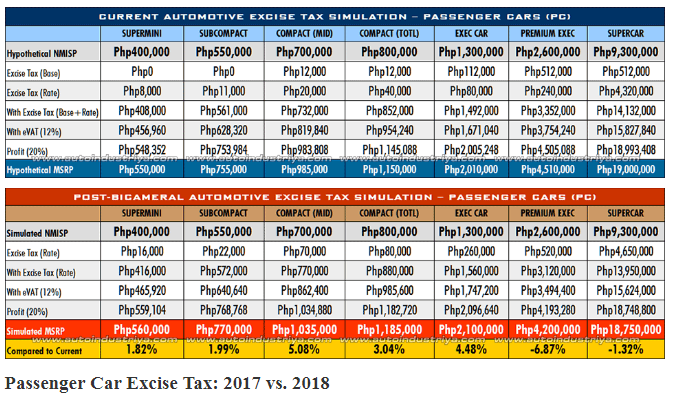

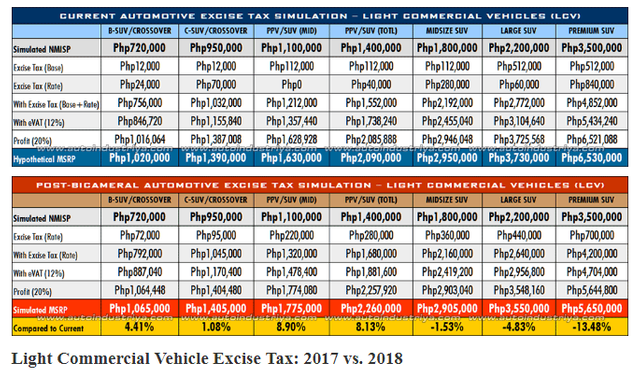

General Presumption:A computation derived by AutoIndustriya

So, I was scrolling my feeds when I suddenly clicked on something, must have been some typo as I was really sleepy last night. You see, I am highly interested in cars and motorcycles based on my previous blogs and it thrilled me to know that I may be able to compute the possible market price of the "cars" I might wanna buy. Eherm. Hehehe. So here's a tabulated computation of some cars you might wanna be interested in. Of course, all credits given to AutoIndustriya.

A little disclaimer though, the derived amount for each different vehicle classes is just a rough estimation in order to explain the TRAIN Law. If you are still confused then you can refer to this blog. And if you think that is still insufficient, then check this out.

Observation

It's still a bit confusing to produce a concrete solution to the application of TRAIN Law. What will have to do is wait. Hehehe. But one thing I did understand about all these is that the resulting tax structure leads to a rather odd result, according to AER. “The automobile excise taxes in the final version of TRAIN effectively provides a discount for luxury cars, while ironically raising the effective tax rates on lower end cars,” says Montessa. Then that would hurt the consumers who purchased last year if all these computations turn out to be true. Nevertheless, it is expected that the distributors/manufacturers would use the opportunity to increase their profit margins. Because they said, "a reduction in price will be bad for business." Hmmm. How about you? What is your stance on the matter? Let me know by commenting down below.

References:

https://www.autoindustriya.com/features/excise-tax-simulation-how-expensive-will-the-cars-of-2018-be.html

https://www.topgear.com.ph/news/industry-news/afraid-the-new-tax-law-will-jack-up-car-prices-maybe-not-if-you-re-buying-the-really-expensive-model-sa00222-20171219-src-entrep

https://www.bir.gov.ph/index.php/train.html

.gif)

your post is very good.i love your post...

If you have a higher take home pay then you will have more money to spend. But, since, prices of some commodities will be higher….but again if you learn to minimize your consumption, there will be some money left for savings. In short, pag magastos lifestyle mo, tatamaan ka talaga 😂 but its a balancing act for the benefit of those who have less in society.