I've Waited All Year for This!

On the Road to Riches, cash flow sets you free from a j-o-b and the daily grind. This is your bread and butter.

I've covered this ad nauseam in prior posts, but there are certain times of the year when you have the closest thing to a lay-up trade you'll get all year!

If you're interested in the chance to DOUBLE your money..

not in 10 years, not in 2 years, but IN THE NEXT 3 MONTHS, you're going to want to read this!

Now there are many ways to double your money, but on a risk AND time adjusted basis I can't think of an easier trade than what I'm about to share with you.

Now sure you could buy some BTC and hope and wait. But who knows how long that will take. BTC is already hovering around $8,000 as I type, how long would it take to get to BTC $16,000?

A lot longer than 3 months that's for sure! Sure you could speculate with a riskier more volatile crypto or ico, but you could also just as easily go to a CASINO and double (blow) your money there.

Blown out sectors

As regular readers know, I'm a big proponent of devastated, left for dead sectors where battered and bruised investors have long since packed up their bags and left for greener pastures. At the bottom of these highly cyclical sectors is where savvy investors can step in and buy assets for fire sale prices.

Companies that traded for $100 - $50 million market valuations can be picked up for HALF THAT. Sometimes a quarter that, or even a less. Nothing has changed, they still have the same assets, same equipment, buildings and people. Only investor sentiment has changed.

And right now nothing is more out of favor than the..

Mining Sector

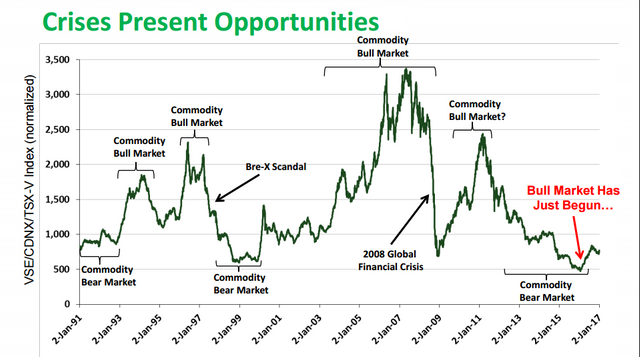

As measured by the TSXV a Canadian exchange that trades resource companies, this sector has been absolutely devastated, but is starting to show signs of life.

Today though, I'm not writing to tell you about the coming commodity bull cycle in copper, gold, silver, uranium among others.

Today I want to share with you a predictable trading OPPORTUNITY that presents itself EVERY year like clock work!

You see, inside of the multi- year cycles that present themselves every decade, also lies seasonal opportunities to profit throughout the year, particularly in the gold/ silver small mining cap space.

For instance: January and February are typically strong periods for the sector, while the Summer is historically weak. September, and October are generally strong and DECEMBER is the weakest period of all.

Making it an exceptional BUYING opportunity.

But why does this happen? Three words:

Tax Loss Selling.

Let's say you're invested in a small mining/ exploration company that you bought in March. You paid $.50 a share for it, and for most of the year it trades for just that. However metal prices slide for one reason or another and your stock falls too... all the way to $.35 in October.

Disgusted that your investment isn't working out and hoping to off set some of your capital gains from your (hopefully)more successful investments , you sell in December before the end of the year.

Gwen Preston of the Resource Maven explains it best here:

This phenomenon works best with sub $100 million dollar companies, preferably even less. You can buy these stocks in December (historically the second week of the month works best), and quickly turn them around in February for a quick double!

As you can see in this next chart of First Majestic Silver (AG), even though the predominant trend of the last few years is bearish, AG continues to hit it's yearly low in December and it's peak in the first few months of the following year.

Now it's important to note that AG is a billion dollar company, so the December to new year bounce is much smaller on a percentage basis at 30%, 50%, and 80% respectively. Still crushing the average annual return of the S&P 500 in all of those years, but in order to double our investment and more we'll need to venture into the small cap mining space.

My Picks

Remember, for the best gains we're looking for something very specific. We want a sub $50 million dollar market cap gold/ silver preferably optionality play, with fewer than 150 million shares. In addition we'll want a company with legit assets that has lost at least half (hopefully more) of it's market cap recently along with the metals slide.

Here are some of the companies on my watch list, along with my ideal buy targets:

- GoldMining Inc. (GLDLF) $1.00

- Minco Silver Corp (MISVF) $.50

- K92 Mining Inc. (KNTF) $.35

- First Mining Finance (FFMGF) $.40

- Golden Predator (NTGSF) $.50

- Winston Gold Corp (WGMCF) $.02

- Aben Resources Ltd(ABNAF) $.06

- Triumph Gold (NFRGF) $.20

In Conclusion

Next month I'll be cherry picking the cheapest companies that sell off the hardest during the first two weeks of December. The logic behind this trade is banking on the predictability of mining seasonality. Buying low, when this sector is cheapest, and selling high into strength, statistically this occurs in February.

Now for all you gamblers, this trade is not without risk. The mining sector is very volatile and you can lose all of your money very quickly in certain environments. I am not a financial adviser and this should not be considered investment advice. Do your own due diligence!

Having said that, this is what I'll be doing with my money this December, if you do decide to follow a long with my trade, let me know, I'd be happy to help with any questions you might have! :)

Until next time.

It's your move.

JESS

*If you enjoyed this article, send it to all of your friends. If you hated it, send it to all of your enemies!

Thanks for reading, if you enjoyed this rant, you might also enjoy some of my

Recent Articles:

Why I Stopped Writing about Finance..

How to Invest Like a Two Year Old...

Death of the Petrodollar Imminent as China Moves to Undercut U.S. Hegemony

Top 10 Things that Change Once You Become Rich

This Indicator has Predicted the last 7 U.S. Recessions. What's it saying now?

Well, I am not a trader but this post is fucking well written and formatted.

Good Job mate, and thank you for your support.

Will resteem this.

Thanks man, and I know these sorts of things arent for everyone, but if it helps even one person make money, it was worth it!