Bitcoin fell below 60000 US dollars, focus on whether the trend line can be maintained, and how to look at the follow-up market?

In the afternoon, bitcoin fell through the $60000 mark again. Seen from the chart, it fell below the rising wedge since March 10, and reached the lowest level of around $57400, 23.6% of Fibonacci.

From the past experience, we should be vigilant when we generally fall through this long-term formed figure. Next, we will see the confirmation of the backdraft. If the backdraft does not stand up, it will face depth adjustment. if the backdraft can stand on the figure, it will continue to go up along the graph again.

Judging from some other data, the number of bitcoin in the exchange has increased significantly and turned upward.

This is a bad phenomenon, and there is a potential possibility of selling shares. Observe whether the data will continue.

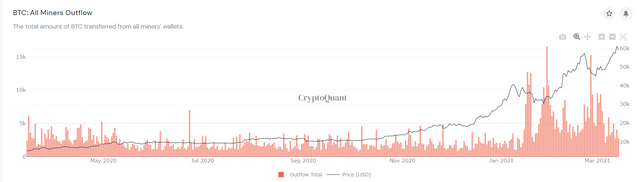

The number of bitcoin that miners turn out of their wallets remains at a low level, which is a good thing for the market.

In the past, every big drop has been accompanied by the pressure of miners.

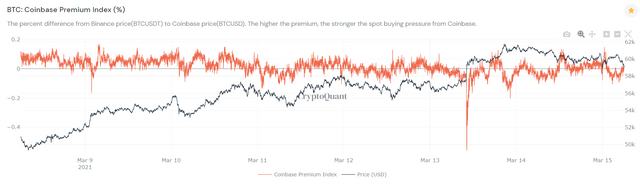

From the perspective of coinbase's premium rate, it has been maintained near the 0 axis recently. However, there is one point that deserves special attention, that is, during the process of breaking through 60000 US dollars, the premium rate has decreased significantly, indicating that it is the pull of domestic funds.

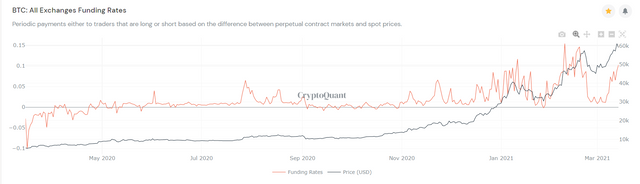

From the perspective of the capital rate of bitcoin contract, it is at a high level, but there is some difference compared with the last time. However, it is above the historical average value, which indicates that there are many people who look forward to the contract market.

In addition, according to the official data disclosed by grayscale on March 13, its bitcoin trust position is worth US $37.25 billion, and the Ethereum trust position is worth $5.651 billion.Last week, grayscale bitcoin trust reduced 253 BTCs and Ethereum trust reduced 1480 eth.At present, the price of GBTC per share in the secondary market is $49.98, and the price per share in the primary market is $53.8 (the price of buying the same amount of BTC shares from the market). There is a - 7.1% premium in the secondary market compared with the primary market.

In March, we focused on the situation of the US dollar index. From the chart, it is a good thing for bitcoin to temporarily miss the important pass of 92 and consolidate at a low level.

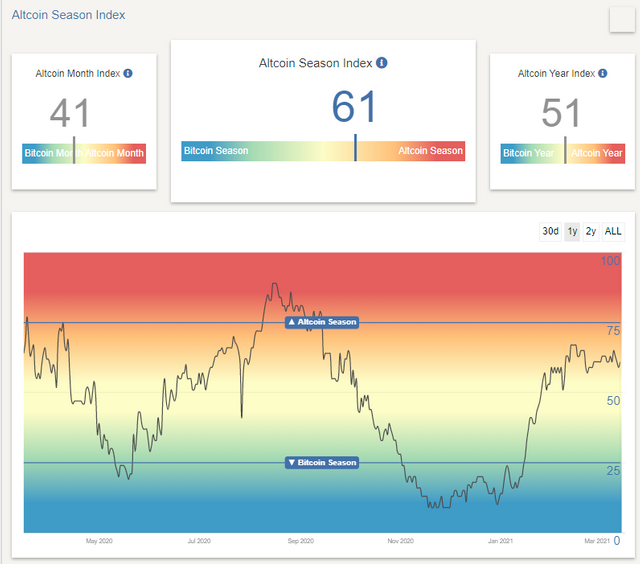

From the perspective of the seasonal index of altcoins, it is currently at the level of 61 and has not reached the extreme value of 75, which is good news for the market, and the larger altcoins market has not appeared.

Recently, the reason for the weakness of the concept currency of defi is obvious. Since the middle of February, the overall defi has encountered a bottleneck, and the lock up fund has begun to fall. At present, it is still in the process of adjustment, which undoubtedly limits the rising momentum of related concept currencies.

Funds in the market are always the most sensitive. Once they find that the hot spots are fading, they will leave and look for new ones.Recently, NFT's concept currency and Boca's concept currency have risen strongly, and they have begun to take the lead.

Bull market is like this, hot spot switch is fast, many times, investors have not responded, the market has begun a new hot spot switch, therefore, want to make money, you have to learn in advance, once the opportunity comes to grasp.

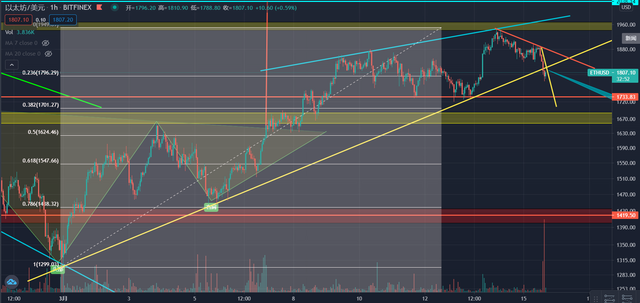

From the chart of ETH, we can see that it has also fallen below the trend line of this rebound. Next, we will look at the result of backdrawing. If we can stand on the trend line, we will continue to run up the wedge. if we can't stand up, we may usher in a greater level of adjustment.Invest in digital currency and pay attention to microblog

From the chart, we come to the conclusion that when the market is in the key direction of choice, if it can be reversed to the top of the trend line, then the market will continue. If it can not be reversed to the top of the trend line, the market will face a greater level of adjustment.