Steemit Crypto Academy Week 7 // Decentralized Finance Systems and Yield Farming //Homework submitted to @gbenga

Weldone Prof. @gbenga, am delighted to be part of your class this week 7 in Steemit Crypto Academy.

Decentralized Finance puts us a step forward in the world of finance where you can transfer and receive money within the shortest possible time without even the need of a middleman or a central body. There are so many project within the DeFi ecosystem and for this home work, I will be dwell on the Lending Protocol.

Introduction to DeFi Lending Ecosystem

The DeFi Lending protocol handles anything about lending and borrowing. Unlike in our conventional banks where we have to wait for weeks, sometimes month and most time even years to get a loan, DeFi makes it easier to get loan in seconds. In this ecosystem, we will be considering the AAVE Project.

AAVE Protocol

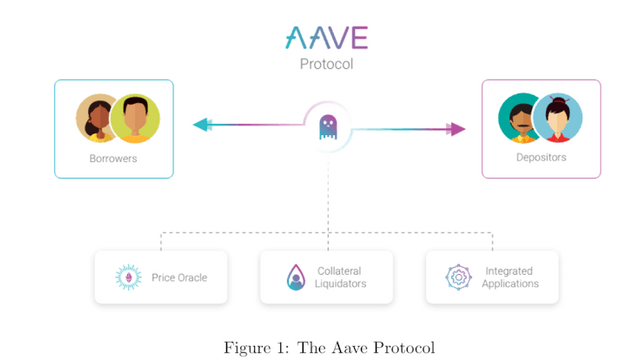

AAVE has been described as an open sourced, non-custodial money protocol in which users can participate either by depositing or by borrowing. Depositors paying money into the protocol provides liquidity as well in return for a small token incentive. In the same vain, borrowers inturn borrowers to pay back with some interest on top of it. AAVE makes lending and borrowing cryptocurrency easy as it does not request for KYC just like other protocol of its category and It operates on the Etherum blockchain through smart contracts.

How does it work

In other to participate, users must first make deposits your money into the liquidity pool where users can now borrow from that pool. While depositors are earning on their deposits, borrowers are paying interest on their borrowed assest. The borrowers can do so in an overcollaterised or under collaterised methods respectively. Each pools makes provisions for reserves to protect against volatility, perhaps, a lender needs to withdraw his money from the pool.

The Lending pool interact with the reserve using the following process:

a)Deposit

b)Borrow

c)Rate swap

d)Flash loans

e)Redeem

f)Repay

g)Liquidation

For you to borrow cryptocurrency at AAVE, the borrower must first lock up some collateral which must be greater that the intend funds to be borrowed, however, the protocol provides a ratio that must be strictly adhered to, failure to do this will give any user the leverage to liquidate the funds. Irrespective of whether you are depositing or lending AAVE protocol awards an atoken which is usually referred to as an interest-bearing tokens.

Finally, the right to the AAVE protocol is governed by the Lend token which has just being migrated to AAVE. It is being traded by over 100 exchanges and currently no. 22 on the on coin market. It's usage is very needful in the DeFi ecosystem.

See you next week.

Thanks for being a part of my class and for participating in this week's assignment. I hope you learned from the class as the aim of the school is to teach and allow people to learn alongside.

I was expecting an extensive explanation of Aave and how it interacts with its smart contract. For instance the Deposit, Borrow, etc.

Rating 5.5