"Fear and Greed Index - Crypto Academy / S4W5 - Homework Post for @wahyunahrul "

logo made on Wix logo maker

Hello Steemians!

I hope you are doing well in your life. I hope you are keeping your health in this pandemic as first priority. So this is my homework post for @wahyunahrul. The topic today is Fear and Greed Index - Market Emotion Measuring Indicator, so let's get started.

QUESTION 01

1). Explain why emotional states can affect cryptocurrency price movements?

ANSWER:

Human emotions have always been an interesting and a subject that can't be fully understood by anyone ever. Human psychology is so confusing and the attributes of it are just so sudden and unexpected that no area of life though professional, religious or any else isn't affected by it, so there comes no point where we can say that the crypto world isn't targeted by human emptions and behaviors. As we already know that the crypto market depends upon three factors; the fundamentals, technicals and "sentiments". Sentiments is the factor which relates directly to human emotions and sentiments, and among the most important traits that can affect the market are "fear and greed". Crypto market being heavily volatile and involving a whole lot of money can create panic and chaos in human behavior thus, resulting in panic buying and selling of the assets directly and ultimately affecting the price movements of the market. Fear can cause the traders to panic sell in massive losses and Greed can cause traders to panic buy at all time highs. FOMO (fear of missing out) as we call it in crypto language, a good trader believes in this motto that there is always an opportunity available in this market and we should keep control of our emotions to be the undisputed champions of this market and always make the best decisions amid the given situation, no matter what the sentiments of the market says.

QUESTION 02

2). In your personal opinion, is the Fear and Greed Index a good indicator of the market's emotional state? if not, try to give reasons and examples of other similar indicators for comparison.

ANSWER:

Fear and Greed index is quite a good indicator in my opinion. It shows the sentiments of the market which is equally important as fundamentals and technicals of the market. This indicator have different criteria of collecting data and then providing a much trusted result of the market's emotions. Many of the investors/traders are emotional and sentimental and take decisions based on the sentiments. Market in result moves in the direction of the sentiment, if the market is greedy, you can also say that the market is bullish and the investors are investing their money being a prey of FOMO and when the market is in fear, you can also say that the market is in bearish trend and the investors are taking their money out of the market fearing of what they might lose. But, a good investor/trader always look for opportunities and make the right decisions. Fear and Greed index represents the market's emotional state and can be a very useful indicator for trading. For example, a trader will look for when the market is in extreme greed so he will know that this is the best time to sell his/her assets and exit the market in profit, same goes for the buying of assets when the market is in fear. It depends upon you and how you chose to use the fear and greed index.

QUESTION 03

Give your personal opinion on what data should be added to the Fear and Greed Indicator.

ANSWER:

I personally think that the fear and greed index would be much better and efficient if it will also include the altcoins too, as of now it is too one sided. We all know that Bitcoin is the big B which dominates the market but as we are advancing in crypto market, investors have already been testing out other crypto projects for investment and good rate of returns. Ethereum is an example as it is solving many problems regarding the digital currency world and you can easily say that it can be the next store of value coin after bitcoin, with that being said it is safe to say that altcoins may dominate the market in near future as we have seen before. So, I think altcoins data should be added to the Fear and Greed indicator.

QUESTION 04

Do a technical analysis for 2 to 3 days (maybe more) using the Fear and Greed Index and the help of other indicators. Show how you made the decision to enter the cryptocurrency market and explain the results of your trade (Screenshot Required)

ANSWER:

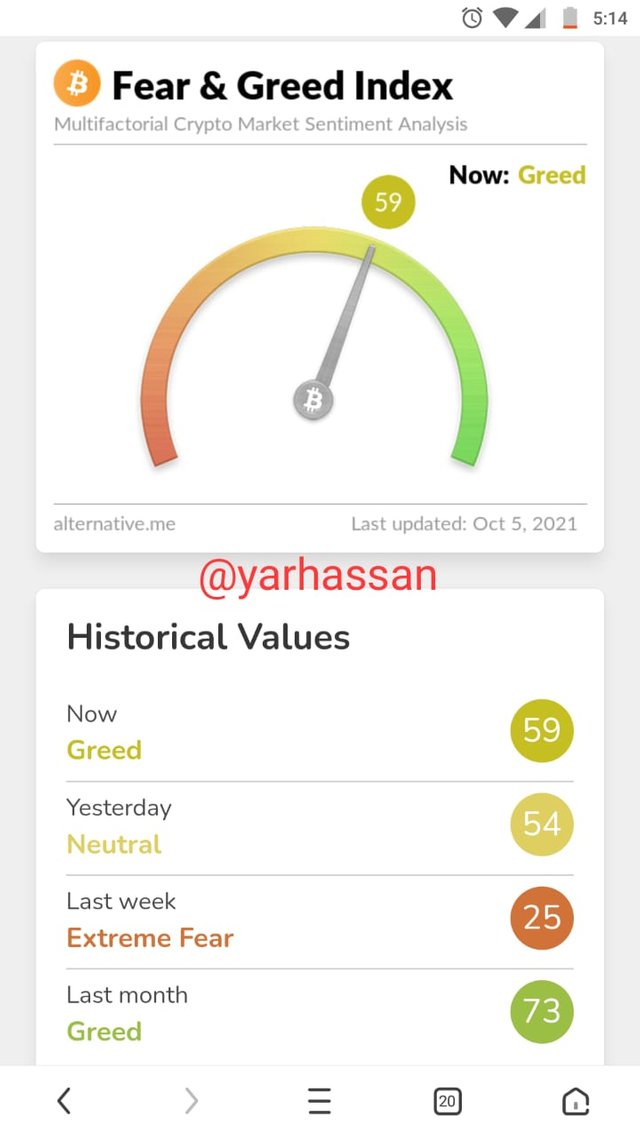

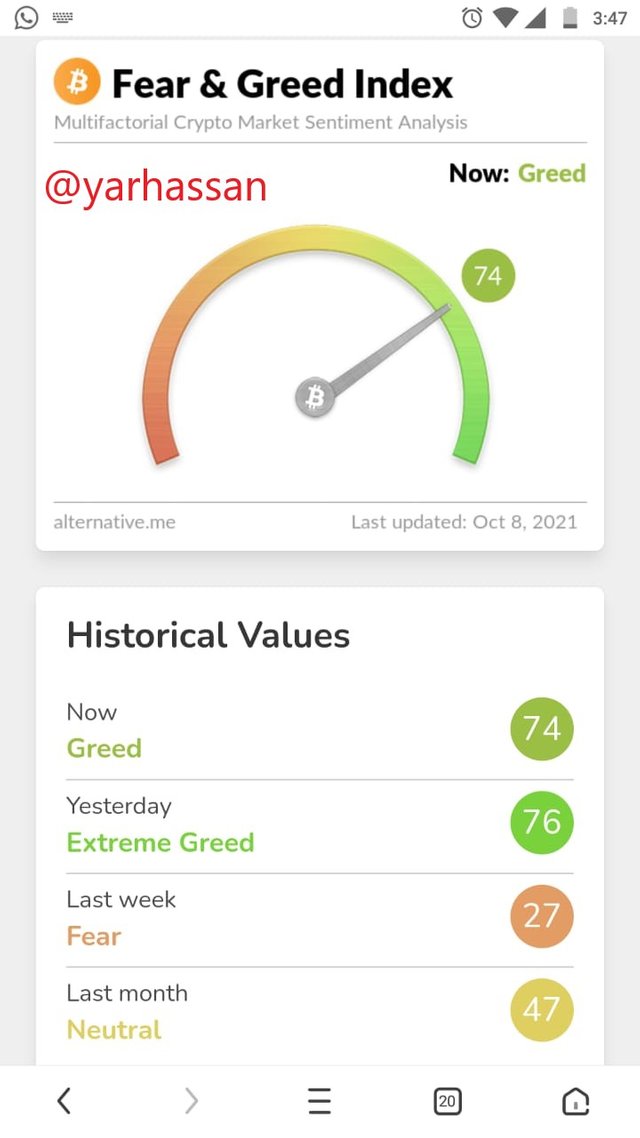

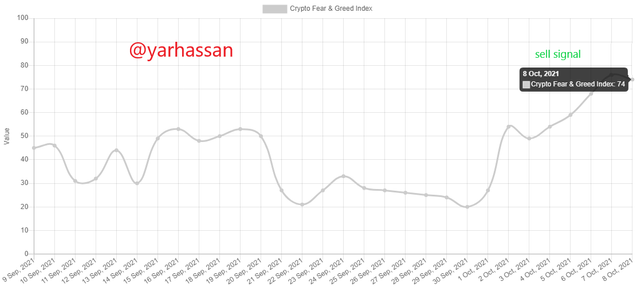

I had some Matic that I bought a while ago. Now, as the month of October has almost every year been a good (bullish) month for crypto market I might sell it in profit. For that I have been keeping a track of fear and greed index for a 2-3 days now and here is the result of that.

We can see in the above three screenshots how the market went from extreme fear last week to neutral and then to extreme greed yesterday. Fear and Greed index over time also helps in recognizing the signals and take the decisions accordingly. Here is a snapshot of that too

and here is a screenshot of BTC/USDT at 4h chart just to understand the current market trend and market's sentiments.

now that the market is greedy and it is the best time to sell my asset which I've been holding as I was not sure to sell it. Here is a screenshot of MATIC/USDT chart at 4h timeframe

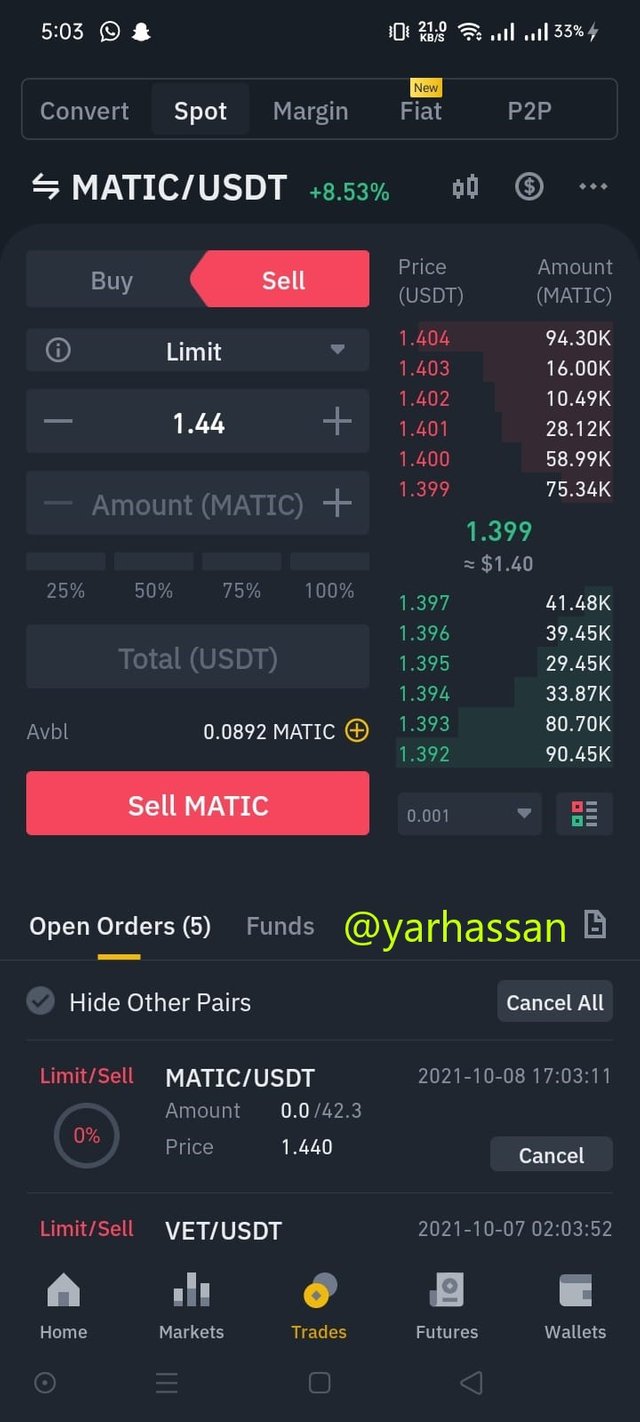

as it is quite clear here Matic today broke its critical resistance level at around 1.35 and it is shown on the RSI too and the Parabolic SAR also gave out the signal, it then broke the Fibonacci resistance at around 1.39 and casted a shadow on another critical resistance level 1.44 and then the 4h candle closed at around 1.39. So, that I'm in profit now I'll set my stop loss limit at 1.35 which will still give me profit if it is hit and will set my sell limit at 1.44.

I've set my sell order to take my profit no matter what the conditions are. Moreover, here is a screenshot of the current market situation Matic's price is hovering above the Fibonacci resistance level.

CONCLUSION

Market's emotions and sentiments is one the great tools that help the traders and investors to take the right decision. We discussed and analyzed the importance of the Fear and Greed index and we also looked at the data that is included in making the indicator better and efficient. We also took a trade using the indicator's signals that helped us spot the right price action of the market. Overall Fear and Greed index is a great indicator.

Hi @yarhassan, Thanks for taking my class.

Based on the homework that you have made, here are the details of the assessment you get:

My Reviews and Suggestions:

You have completed the given task very well.

In the explanation of question number 1 you should show a real example of how emotional conditions can affect the cryptocurrency market.

In question number 4 you have shown how you make trading decisions using the Fear and Greed Index. But still I want you to show the results of the trades you have made. Regardless of profit or loss, because I want the opinion you get after trading using the Fear and Greed Index.

The paragraphs you have made are too long. Try breaking it up into shorter paragraphs to make it easier to read.

Thank you!