Treasury Yield Spreads

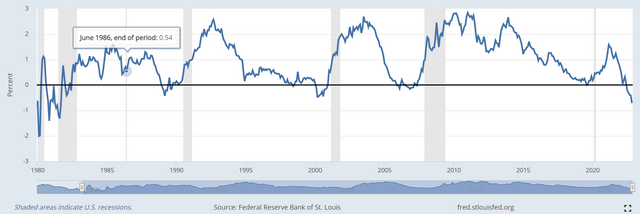

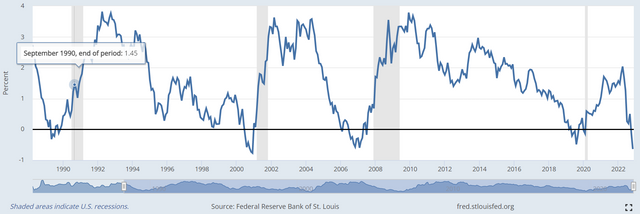

The Treasury yield spread is a useful indicator of a recession.

Usually, there is a difference between 10-year and 2-year bonds, or 3 months of 10-year bonds, but there is no exact theoretical basis yet.

Powell has a different view of the yield curve inversion than the general idea.

The yield curve that Powell takes consideration is the 3-month forward rate 18 months later, which is obtained by inversely calculating the interest rate traded in the market. (18m/3m - 3m)

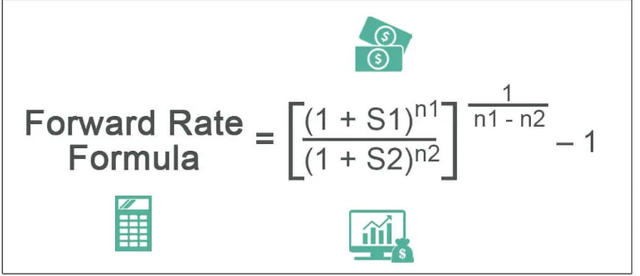

The inverse calculation is based on the assumption that there is no risk-free arbitrage.

This rate is usually expressed as 18m/3m and can be obtained as follows.

Here, S1 is the 21-month interest rate as of now (spot) and S2 is the 18-month interest rate seen as of now (spot).

n1 is 21 months or 1.75 years, n2 is 18 months or 1.5 years. n1-n2=0.25.

The problem is that there is no 21-month spot rate and 18-month spot rate in the Fed data.

If you use the 1-year and 2-year rates to obtain a linear relationship, you can get more or less similar values.

If the 1-year interest rate is a and the 2-year interest rate is b, the 1.5-year interest rate uses the average (a+b)/2 of the two as S1.

The interest rate for 1.75 years is (a+3*b)/4 to find S2.

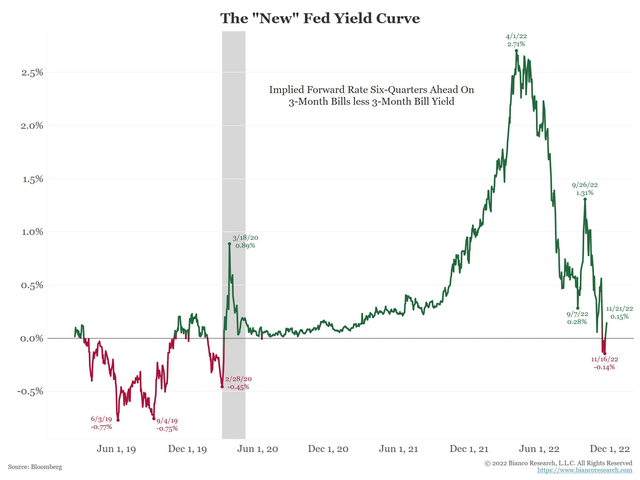

After going through this process and putting it into the above formula, you can get a value close to 18m/3m. The yield curve divergence that Powell likes is 18m/3m - 3m, so plugging it into the equation and doing the math gives us the following figure:

It is highly recommend not to take this result as a serious investment action basement.

Even with small asumption of a few variables, the result could make very theoritical data that doesn't reflect high fluctuated market and policy changes. It is required to consider other index that make this more reliable.

Source: Youngbin Yang, economy21

Upvoted! Thank you for supporting witness @jswit.