Steemit Crypto Academy Contest / S6W2- Centralized Cryptocurrency Exchange Platforms and Its Risks

Questions

How do you agree with this saying “Users may be surprised to learn that in a bankruptcy scenario, they may not consider the cryptocurrencies and funds deposited in their accounts as their own”?

Explain, from your point of view, why did the FTX platform go bankrupt? how did you find it? What are the other consequences of this accident?

If you are so pessimistic, what do you think is the worst thing that could happen to cryptocurrency after the FTX incident? And what will be its impact on Bitcoin?

Could this incident reinforce the view that cryptocurrencies are outdated and unstable because they do not have collateral, unlike state currencies such as the euro or the dollar?

Do you think that Binance's decision to buy FTX will reassure the previous investors of this platform and what is the future of the FTT cryptocurrency?

Greetings to all and welcome to week two of season six of the engagement challenge. I hope everyone is fine. I will be taking part in this week’s contest topic which is "Centralized Cryptocurrency Exchange Platforms and Its Risks".

In this post, I'll talk about the dangers associated with retaining assets in a centralized exchange and the most recent developments with the FTX exchange. Thank you for reading!

Question 1

How do you agree with this saying “Users may be surprised to learn that in a bankruptcy scenario, they may not consider the cryptocurrencies and funds deposited in their accounts as their own”?

Answer

An organization files for bankruptcy when it is unable to pay its creditors or honor its financial commitments. All of the company's outstanding debts are calculated and paid off, if not entirely, from the company's funds, according to a petition that has been filed with the court. This simply means the institution or exchange has lost the assets that the users have kept with them.

Funds that are kept with exchanges are also used by them to invest to make profits, these investments can sometimes bring huge losses to these exchanges causing them to lose users’ funds.

When this happens to cryptocurrency exchanges how are its investors treated? what happens to them? The possibility of loss is the main risk of investing in cryptocurrencies, and it is considerably harder to control when a cryptocurrency corporation is keeping your coins.

Crypto investors are very restricted in their assets when their crypto exchanges go bankrupt. Most traditional financial institutions have their assets insured in case they find it difficult to pay back their debts owned to investors, for instance, if a bank goes bankrupt, the government or an insurance organization ensures the assets of their users are paid back to them, however, cryptocurrency assets or exchanges do not have these kinds of protection. This causes investors to lose all or part of their funds.

There is no institution that will reimburse crypto investors for their funds if their cryptocurrency exchange goes bankrupt as it is done in traditional financial institutions.

There have been instances of cases like this. A crypto exchange known as Celsius network filed for bankruptcy in July this year, it halted all forms of transfers from users’ accounts including, withdrawals, swaps, etc. It was later disclosed that they had over $1,200,000,000 more in debt than what it can pay. Readers can read more about it in techbullion. com

Crypto investors should know that they do not own their funds in a bankruptcy scenario as there is no law that protects, insures, or guarantees investors of their funds in the light of investors in this exchange (celsius network) being prevented from withdrawing their funds as the exchange went bankrupt.

In light of this, it has become imperative to undergo extensive research before investing in cryptocurrencies and doing further analysis before choosing the crypto exchange to trade or store coins.

Question 2

Explain, from your point of view, why did the FTX platform go bankrupt? how did you find it? What are the other consequences of this accident?

Answer

FTX was known to be one of the largest cryptocurrency exchange platforms in the world, however, it went bankrupt this year and a lot of users lost their funds. From my point of view, these are some of the reasons why.

Herding behavior of investors this is when people make decisions based on the actions or decisions of some people. A lot of investors make deposit and withdrawal decisions based on whether other investors in the same network are withdrawing or depositing.

These investors can collectively withdraw their funds for the reason that others are withdrawing and there might not be many funds remaining to credit their accounts. As people follow others who have chosen to withdraw, this action tends to reach a lot of investors and cause them to withdraw, this increases to a certain level and leads to a discrepancy between the number of funds available and the high demand for withdrawals. FTX money became scarce as they were unable to provide the assets for withdrawal.

There was a liquidity problem at FTX. The CEO tried to calm down the investors but it did not work as they demanded withdrawals of over $6BN.

Also, FTX leveraged its own cryptocurrency (FTT) using customer funds. Customer tokens are not supposed to be used as collateral. When the FTT started to lose its value, a lot of investors started to sell their tokens which lead to a bearing market for the FTT tokens since they used investors' assets for leverage, they could not get back up until the liquidation of the crypto.

They are over-leveraging users' assets without any asset being used as a reserve, which is a major setback, this led to the investors losing their trust in the exchange. This bankruptcy occurred as a result.

The exchange was hacked just a few hours after declaring bankruptcy, and this continued daily until the hacker fled with over $500M worth of funds which paralyzed the exchange further.

The recent plummet in the value of cryptocurrency also played a role in the bankruptcy of FTX, they lost a significant amount of money due to this. As a result, the exchange was unable to deliver on the about $5BN daily withdrawal demand of investors.

How I found it

I had this information from a couple of sites online.

One of the is known as Cornel

It analyzed the bankruptcy through some methods.

I also found some information on the official Twitter page of FTX FTX official Twitter

Lastly, I visited Investopedia for some information too.

Consequences of this accident

It will take time for the wider effects of the FTX disaster on the crypto world to become apparent.

The investors losing their assets is one of the major consequences of this accident, losing funds that, have spent years to acquire in a matter of days. Some of my friends used FTX as their exchange and this accident came as a big blow to them. Their finances have been destabilized and they had to start right back from the ground.

There are also beginners who are now investing or learning about crypto, some of them who lost their funds through this accident will give up on cryptocurrency investment and they will keep in mind that investing in cryptocurrency is not safe.

There are a lot of skeptics or doubters about cryptocurrency who do not want to invest due to its safety and accidents in the crypto sector like this one. This will give them more proof to prevent them from investing.

This accident will cause cryptocurrency regulatory agencies like the SEC to increase their scrutiny of cryptocurrencies, also the government may be forced to intervene and pass new legislation to regulate cryptocurrencies.

The FTX exchange had a substantial trading volume and its collapse will bring some consequences to other crypto exchanges as their users will also try to withdraw their funds due to fear when they hear of the FTX accident.

Question 3

If you are so pessimistic, what do you think is the worst thing that could happen to cryptocurrency after the FTX incident? And what will be its impact on Bitcoin?

I am someone that will believe in cryptocurrency no matter what. It has a huge market cap of over a trillion dollars which is more than that of other financial ventures.

One of the worst that a lot of other pessimists think could happen is the ripple effect of the FTX accident could cause huge withdrawals from users that will cause markets to lose buy volume and further cause a plummet in the value of cryptocurrencies this could lead to market crashes and some exchanges going bankrupt after FTX.

Also, other pessimistic people will be thinking there will be higher highs when we plummet down, surely there will be lows coming but I also believe there will be some bullish trends after that.

We can only hope that the upcoming years will develop cryptocurrency towards the high trends and lead to the establishment of the market, as it has frequently been seen that bullish trends have often followed bearish trends in the past.

The BTC itself will not lose value on itself; it will only change with respect to the fiat currency we have. Bitcoin lost about 16% of its value which brought it down to about $15,000 which was the lowest in recent times, around Nov 2021, it went further down to about 75% from the highest value it has ever gained. The FTX accident will no doubt cause the other crypto coins to decline in value and Bitcoin is not an exception. Even though it is going to lose some of its value temporally it will still have the dominance it had in the cryptocurrency world.

Question 4

Could this incident reinforce the view that cryptocurrencies are outdated and unstable because they do not have collateral, unlike state currencies such as the euro or the dollar?

Answer

Since its inception, due to its high price fluctuations, cryptocurrencies have been having difficulties being accepted in many nations. The FTX accident has made matters worse as it might confirm to skeptics who already believed cryptocurrencies are a scamming scheme to strengthen their stance.

And it is true in some way as the high price volatility of cryptocurrencies played a role in the bankruptcy of the FTX exchange which was a multibillion-dollar venture. But that does not affirm the statement that cryptocurrencies are outdated. Yes, it is true that they do not have collateral like the traditional fiat currencies like the dollar or euro but cryptocurrencies are being improved every day, we see new tokens and coins being made to address previous problems that cryptocurrencies faced.

Cryptocurrency is still a work in progress, there are already solutions to stabilize them like the use of stablecoins and I am sure there will be more solutions in the future for its stability and collateral problems too. Those fiat currencies also had problems and underwent major changes to address them, cryptocurrency is also doing the same and it will get there soon.

Question 5

Do you think that Binance's decision to buy FTX will reassure the previous investors of this platform and what is the future of the FTT cryptocurrency?

Answer

Binance twitted on 8 Nov 2022 that FTX has come to them for help to redeem their exchange platform. they claimed they signed a non-binding agreement that was to aim to completely buy FTX after they had conducted their due diligence.

Source

Source

Binance hope to be able to provide liquidity to FTX customers but they turned around the following day deciding not to proceed after they found out through reviewing the company’s finances and completing their due diligence that FTX was mismanaging users’ funds and “had other issues that were beyond their control”.

Binance is the world’s biggest exchange platform, it is trusted by a lot of its users so buying FTX would have given assurance to investors that a more reputable, transparent, and trustworthy platform is acquiring FTX.

The Future of FTT coin

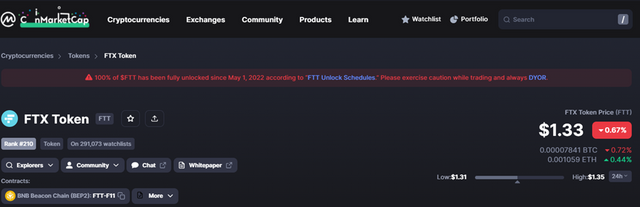

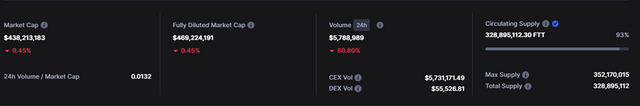

The FTX token (FTT) is currently ranked 210th on Coinmarket cap with a price of $1.33, a market cap of $438,213,183, a 24hr market volume worth $5,788,989 and a circulating supply of 328,895,122.3 FTT.

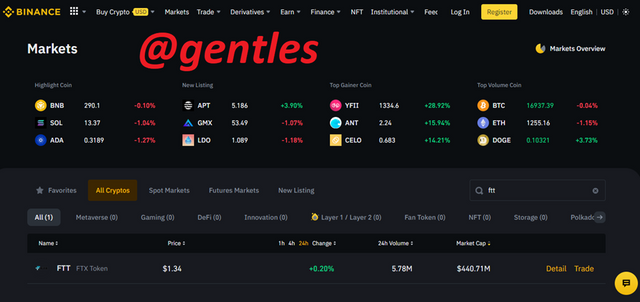

As we can also see here, it is still listed on some major exchanges like Binance

This is to tell you that the FTT token is still alive, it is not dead yet. It is still being traded and who knows? It might gain a lot of trading volume or liquidity in the coming years to recover back to its previous glory so there is still hope that the coin might bounce back again.

Conclusion

This post is to inform users about the dangers or risks involved in using centralized exchanges and trading as a whole. Investors are advised to take extreme caution and do extensive research on their trading platforms to understand the risk they are facing and prepare for them.

Bankruptcy in crypto exchanges is simply when the exchange does not have enough money to pay for the withdrawals of its customers, FTX trading platform underwent the same, and users were restricted from withdrawing their funds which affirms that in a bankruptcy scenario, the users may not consider the cryptocurrencies and funds deposited in their accounts as their own.

The FTX exchange failed mostly due to many users withdrawing their funds because they lost trust in the exchange due to their overleveraging of users’ funds and also some users were withdrawing just to follow the behavior of other users.

This brought enormous consequences on the crypto markets as it reduced the credibility of the crypto world, and caused the decline in value of some cryptocurrencies like Bitcoin which fell by about 16% in value.

Cryptocurrency is unstable but measures are still in place to address this issue, like stablecoins. It also lacks collateral and I am sure solutions for that will also come soon.

Binance is a very reputable and transparent exchange platform and this would have given assurance to investors if they had acquired the FTX platform but they could not due to some reasons like FTX mismanaging users’ funds and some other reasons.

The FTT token is still functioning and it is our hope that it bounces back to its glory days.

I invite @phlexygee, @solexybaba, @verdad and @josepha to partake in this contest.

@tipu curate

Upvoted 👌 (Mana: 6/7) Get profit votes with @tipU :)

Thanks very much

Your have explained this post in a very impressive way. I really like your ideas that you have given here. Great research work is the only key for such a great post.

Such events are actually the reminders of the high risk that are always linked to the high volatility of the crypto markets.

I also agree with you at this point. We all know that the cryptocurrencies are still not much older as they are introduced about 11 to 12 years ago.

So, there are many flaws and drawbacks that could be solved with the passage of time and we strongly believe on the bright future of cryptocurrencies.

Although this incident has caused a lot of misunderstanding among the investors but we can never ignore the impressive benefits of the cryptocurrencies.

Thanks a lot for sharing your Quality post with us and wishing you a very good luck for the contest.

Thank you very much for your kind comments

Your explanation is on just next level you really cover the whole topic in a very precise and accurate way.

In other reason I want to add a thing which is the trust that FTX losses by using the users fund in thier own investment. I think this is a crime that they use user funds In Almeda research.

I also don't think that FTX and FTT have any future because they broken the trust and without trust Cryptocurrency is nothing.

FTX left a significant bad impact on the Cryptocurrency and I think it will take long time to eliminate it's effect from Market.

You're explanation is outstanding and you have impressed me by your entry. Thanks for sharing such quality and Informative Post.

Good luck in this contest visit my article too

@cryptobitcoins

Thank you very much @cryptobicoins for your comment.

You have done justice to the task here friend. Of a truth centralized exchanges are risky and we have seen an example of it's risk in the downfall of FTX. I prefer Decentralized exchanges and platforms for saving my assets.

Decentralized exchanges are cryptocurrency exchanges that do not rely on a central authority to manage funds. Instead, these exchanges operate on a peer-to-peer basis, allowing users to trade directly with each other without having to go through a third party.

This makes them significantly more secure than centralized exchanges as they reduce the risk of a single point of failure.

The FTX exchange was a centralized exchange, meaning that it relied on a centralized authority to manage funds. This put the exchange at a greater risk of mismanagement, as the central authority had total control over user funds.

Thanks for sharing, and goodluck in this contest friend.

Thank you very much @preye2 for your comment.

It's true, when there is a problem at the core of centralized exchanges it affects everyone but the peer to peer system of decentralized exchanges prevents such problems

Dear @gentles,

Your post is very much informative for me and you write very beautiful lines that will help me in the future.

You have said true that the bankruptcy of such popular exchanges always hurts the investors because they have invested large amount of their assets there.

Yes that is the case because many of the states has not accepting and relaying on the crypto technology and this is a dark side of it that can only be improved by its use cased in different areas.

The negative situation that has been created in the market should be solved as soon as possible to avoid any large loss.

I wish many success for you in this week of the contest.

Thank you very much @cryotoloover.

It is very true that crypto has a dark side and i hope these issues will be addressed soon

Of late the crypto space has become very alarming.

I have learned a lot in this article concerning centralized crypto exchanges and their associated risks.

Thanks for the insight bro.

@phlexygee, i really appreciate your comment. I am glad you learnt from my post

A great piece you have shared here my friend, Binance was intending to go into the situation and help FTX from the big mess but after series of research, they found ou the the money was much hence the back down. This is clear evidence that the management of FTX was a very poor one because they never took many things into consideration. I wish you success my friend.

Yh that is very true, there was a mismanagement of funds according to the due diligence of Binance