Steemit Crypto Academy Contest / SLC S23W3 : Advanced DeFi – Liquid Staking and Real-World Asset Integration

Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community . So, without any further delay, let's dive right in! Shall we ? ........, Okay , Okay😊! .

Question no 01: Understanding Liquid Staking |

|---|

Liquid staking lets users stake crypto while keeping it accessible for trading or lending. Unlike traditional staking, where funds are locked, liquid staking issues derivative tokens that represent the staked assets, enhancing liquidity.

This method boosts capital efficiency. Users can stake Ethereum tokens through Ethereum’s liquid staking system which provides them with stETH (a liquid token) that they can use in DeFi. Lido along with other liquid staking protocols maintains possession of more than 30% of all Ethereum staked assets.

You get to occupy your real estate property yet liquid staking enables you to simultaneously earn rental income from its value. The system follows financial independence concepts in a similar way to U.S. Constitutional property rights.

The combination of decreased liquidity challenges with yield accumulation has turned liquid staking into a transformative force for DeFi. The innovation serves investors who seek passive revenue together with operational freedom as financial frameworks adapt to boost individual power.

How it differs from traditional staking ?

The traditional staking method restricts asset liquidity through time-based asset locking. The liquid staking system enables investors to generate staking rewards through tradable tokens that represent their staked assets allowing them to engage in DeFi protocols using their available funds.

When you stake 10 ETH traditionally the funds remain frozen until the protocol enables withdrawal options. Through liquid staking you obtain 10 stETH tokens that function both as tradable assets and collateral instruments. This increases capital efficiency.

A total of $30 billion in assets stakes through protocols Lido, Rocket Pool, and Frax. Lido currently controls 31.4% of all Ethereum staked supply positioning it as the major stakeholder in the network.

Through liquid staking users obtain access to their cryptocurrency deposits that continue generating interest in a manner similar to standard banking systems. The system provides adaptability in a manner similar to financial institutions which developed liquidity protection features that mirror constitutional freedoms.

Discuss its advantages and risks, using relevant examples from platforms like Lido, Rocket Pool, or Frax.

Advantages of Liquid Staking

Increased Liquidity

By conventional staking methods users lock up their assets so they become inaccessible for other purposes. Liquid staking offers a solution through its staking derivative products such as stETH from Lido and rETH from Rocket Pool along with sfrxETH from Frax. The staking derivative tokens users receive enable them to trade and lend as well as participate in DeFi while maximizing their capital utilization.Compounding Yield Opportunities

Liquid staking tokens offer investors the possibility to put their stakes into lending protocols and liquidity pools and yield farming strategies. Users gain optimal returns through the integration of stETH deposits into Aave lending protocols which provides simultaneous earning of additional yield and staking rewards.Decentralization & Accessibility

Users who want to stake Ethereum through Rocket Pool can start with minimal amounts of 0.01 ETH even though Ethereum validators need at least 32 ETH to operate. This makes staking more inclusive.Network Security Contribution

The active participation of validators through liquid staking protocols enhances blockchain security because of their operation. The Lido platform distributes its users' staked ETH across several professional node operators which helps to decrease centralization threats.

Risks of Liquid Staking

Smart Contract Vulnerabilities

The complex smart contracts which power liquid staking create vulnerabilities that permit hackers to steal large amounts of funds. The 2022 DeFi protocol vulnerability exposed contract bugs which caused millions of dollars worth of losses. Audits help reduce such risks but they cannot completely eliminate vulnerabilities.Liquidity & Depegging Risks

The relationship between staking derivatives and their base assets should stay equal but can become unaligned when severe market conditions arise. StETH lost value by 4-5% relative to ETH during the FTX bankruptcy period due to user withdrawals.Centralization Concerns

The centralization issue arises because Lido maintains governance over 31.4% of Ethereum’s staked supply. A single entity with excessive staking power threatens decentralized blockchain governance because it opposes the core philosophy of decentralization.Regulatory Uncertainty

The regulatory authorities across governments now conduct more thorough reviews of liquid staking operations. Some staking services faced classification as securities by the U.S. SEC which has led to future compliance uncertainties. The regulations in certain jurisdictions might affect the operation of protocols including Frax and Lido.

Cointelegraph snapshot Cointelegraph snapshot |

|---|

Question 2: Opportunities in Real-World Asset Tokenization |

|---|

Tokenization of real-world assets enables simple trading of real estate and bonds together with commodities and other assets. Using blockchain technology enables property owners to execute instant trades of fractional ownership just as they would execute stock trades.

This opens new ways to earn. The platform Goldfinch enables users to borrow money through digitalized invoices which generates new revenue sources. The process allows your unused funds to operate efficiently through a system that bypasses traditional banking procedures.

Transparency is another game-changer. Supply chain invoices become easy to understand and fraud-proof when Centrifuge handles their tokenization process. Blockchain secures ownership digitally in the same way that the U.S. Constitution protects property rights.

The system has a major drawback because rules have become a complex web to navigate. The SEC has recently shown interest in tokenized securities which creates difficulties for DeFi platforms to operate. The RWA tokenization process is transforming finance by introducing TradFi stability to the DeFi revolution.

Provide examples of platforms enabling RWA tokenization

Ondo Finance provides users with the capability to convert U.S. Treasury bonds into tokens which enables DeFi participants to generate stable yields from conventional financial assets. This solution links TradFi components with DeFi systems while providing users with low-risk investment potential.

Through its Centrifuge platform real-world invoices and supply chain assets obtain tokenization which allows businesses to access liquidity through alternatives to traditional banks. A decentralized marketplace on this platform enables transparent and effective borrowing opportunities between investors and borrowers.

Goldfinch provides credit financing for real-world assets through tokenization which enables emerging market businesses to obtain loans without traditional crypto security. This expansion enables DeFi to serve assets outside the realm of cryptocurrency.

Maple Finance delivers institutional lending service through tokenized assets which streamlines capital access for businesses. The transparency capabilities of blockchain help Maple Finance lower credit market counterparty risks and increase trust among users.

RealT provides users the ability to invest in fractional ownership of real estate properties through its tokenization system. Users receive rental payments directly through blockchain operations which resemble REIT property share ownership but have enhanced speed and lower operational costs.

Discuss potential benefits and challenges.

Real-world assets (RWAs) get tokenized through blockchain-powered systems that convert physical assets such as real estate and bonds as well as commodities into digital blockchain-based tokens. This process offers several benefits but also presents notable challenges.

Potential Benefits:

The tokenization process transforms illiquid assets into liquid digital assets which can be divided between investors for smooth trading operations. Investors can easily acquire and dispose of property shares following real estate tokenization due to simplified real estate trading processes.

The tokenization process makes markets accessible to smaller investors who before had no way to invest in high-value assets. The democratization of investing enables numerous people to buy assets including art, real estate as well as exclusive funds.

Blockchain framework and smart contracts improve transaction efficiency by lowering expenses and removing middlemen thus delivering rapid safe transactions across networks. The asset management organization Janus Henderson evaluates tokenization as a solution to optimize their funds operations better.

Challenges:

The legal framework for tokenized assets remains in flux because different government agencies throughout countries impose diverse rules and regulations. The current regulatory ambiguity hampers widespread adoption of tokenized assets by causing problems with compliance for investors along with issuers who face difficulties in implementation. The European Union seeks to create unified cryptocurrency regulations through the development of Markets in Crypto Assets Regulation (MiCA).

Low scalability together with security holes emerge as current technological challenges which face promising blockchain systems. The security of smart contracts together with the underlying infrastructure needs to be made robust because this prevents potential financial losses which could originate from system failures or security breaches.

The acceptance of tokenized RWAs requires institutions and traditional investors to establish trust to adopt this approach on a broad scale. Disciplines in education together with successful demonstration examples become fundamental for achieving widespread adoption.

The future success of DeFi tokenization depends on addressing regulatory confusion combined with resolving technology-related risks alongside developing marketwide adoption of the system.

Question 3: Practical Applications of Liquid Staking in DeFi |

|---|

New DeFi users benefit from liquid staking as it lets their staked crypto assets be tradable and they can earn staking rewards simultaneously. Due to its flexible nature liquid staking tokens let users combine them with various DeFi approaches such as yield farming, lending and leveraged staking.

Through the Lido protocol any user who deposits 10 ETH can earn 10 stETH. The yield farm solution on decentralized exchanges (DEX) allows users to store their stETH deposits and collect trading fee benefits as well as exchange-based incentives.

The stETH token serves as security assets for borrowing stablecoins or diverse digital assets on loan services through Aave allowing investors to retain staking return benefits. The borrowed capital functions as a basis to establish a leveraged staking mechanism.

The combination of liquid staking and DeFi protocols enables investors to optimize their capital usage leading to the multiplication of rewards between different earning opportunities. Users need to recognize impermanent loss, liquidation, and smart contract vulnerabilities before using these techniques.

Use an example of a strategy involving liquid staked tokens (e.g., stETH, rETH) and describe potential risks.

With liquid staking users can maintain their assets available for use by holding derivative tokens for staking purposes. Users can use their acquired tokens to enter DeFi protocols such as lending and yield farming and collateralized borrowing in order to maximize their returns. Below is a detailed demonstration.

Example: Integrating Liquid Staking into Yield Farming

Step 1: Stake ETH and Receive Liquid Tokens

A user stakes 10 ETH in Lido Finance and receives 10 stETH (liquid staking tokens).

The protocol offers a 5% annual staking reward, meaning after one year:

10×0.05=0.5 ETH (staking rewards)

Step 2: Utilize stETH in DeFi Protocols

- The user deposits 10 stETH into Aave as collateral and borrows 5 ETH at a 3% interest rate.

- Borrowing cost after one year:

5×0.03=0.15 ETH (interest paid)

Step 3: Deploy Borrowed ETH into Yield Farming

- The 5 borrowed ETH is paired with 5 stETH in a Curve Finance stETH-ETH liquidity pool, offering a 15% APY.

- Yield farming returns after one year:

10×0.15=1.5 ETH (yield farming rewards)

Step 4: Calculate Total Earnings

- Staking rewards: 0.5 ETH

- Yield farming rewards: 1.5 ETH

- Borrowing cost: -0.15 ETH

- Net Profit:

0.5+1.5−0.15=1.85 ETH

Final Portfolio After One Year:

- 10 stETH (original stake, now worth 10.5 ETH due to staking rewards)

- 1.85 ETH profit from yield farming and staking

- Total Value: 12.35 ETH (before market volatility considerations)

Risks & Considerations

- Impermanent Loss: If stETH and ETH prices diverge, yield farming rewards may be lower.

- Liquidation Risk: If ETH price drops significantly, the Aave loan could be liquidated.

- Smart Contract Vulnerabilities: Bugs in protocols like Aave, Lido, or Curve could result in losses.

Conclusion

Through liquid staking users gain access to DeFi strategies which enable them to stake their assets while allowing liquid trading. Using this system in yield farming operations generates improved returns yet requires strategic management of risks to prevent unfortunate expenses from loss of assets and price changes.

Question 4: Building a DeFi Strategy with Liquid Staking and RWAs |

|---|

This approach maximizes yield while preserving liquidity and stability by combining real-world asset (RWA) tokenization with liquid staking. It strikes a balance between low-volatility traditional blockchain assets and high-yield cryptocurrency payouts.

Step 1: Stake & Unlock Liquidity

- Stake 10 ETH in Lido or Rocket Pool to receive 10 stETH (liquid staking tokens).

- Earn 5% staking yield while keeping stETH usable in DeFi.

Step 2: Leverage stETH in DeFi

- Deposit 10 stETH into Aave as collateral to borrow 5 ETH (50% Loan-to-Value).

- Use 5 ETH for yield farming in a stable LP pair (e.g., ETH-USDC) on Curve to earn 10%-20% APY.

Step 3: Allocate to Tokenized RWAs

- Convert 50% of farming rewards into Ondo Finance tokenized U.S. Treasury bonds.

- These RWAs provide 4%-5% APY, reducing volatility risk while maintaining a steady yield.

Step 4: Compound & Reinvest

- Periodically claim staking, farming, & RWA yields, reinvesting back into the strategy.

- Adjust ETH exposure based on market conditions, shifting rewards between RWAs & DeFi protocols.

Projected Returns & Risk Management

- Liquid Staking (stETH): 5% APY

- Yield Farming (ETH-USDC): 10%-20% APY

- Tokenized RWAs (Treasury Bonds): 4%-5% APY

- Total Estimated APY: 15%-25% (variable based on the market conditions)

By combining crypto-native and traditional asset yields, this strategy balances risk and maximizes returns while offering high capital efficiency.

Explain how this strategy can optimize yield, reduce risk, and adapt to different market conditions.

The hybrid DeFi investment strategy achieves optimal yield with risk reduction across liquid staking investments together with yield farming and tokenized real-world assets for market condition adaptation. An investor who implements these elements builds a mixed investment portfolio that gains from DeFi yield returns yet maintains stability through reduced market volatility.

Optimizing Yield

The staking mechanism called liquid staking provides users with uninterrupted staking rewards and enables them to use their staked assets (such as stETH) throughout DeFi applications.

Investors who transfer stETH to Aave lending services can take out more funds to perform yield farming activities that produce between 10% to 20% APY returns.

The U.S. Treasury bond tokens accessible through Ondo Finance deliver constant 4%-5% yield return in all market conditions and bear events.

Reducing Risk

The risk reduction occurs because this approach adds diversification to the mix. Allocating funds to RWAs while participating in yield farming presents risks from impermanent loss and liquidation but establishes a low-volatility cash flow.

Staking rewards continue uninterrupted through the use of liquid staking tokens (stETH) during market declines. The borrowing strategy remains limited through enforcing a maximum Loan-to-Value ratio of 50%.

Adapting to Market Conditions

A bull market situation prompts investors to transfer their capital toward yield farming activities for better returns.

During bear markets stakeholders should move their funds to Real World Assets (RWAs) as a way to achieve financial stability and generate passive income. Leverage should be reduced to minimize risks and still receive staking rewards.

The strategy allows for maximum returns protection and flexible operations which benefit from crypto growth phases as well as distribution phases.

Question 5: Lessons from Real-Life DeFi Innovations |

|---|

The Decentralized Finance (DeFi) brought up has introduced new opportunities for smarter investment methods, merging the power of liquid staking with the tokenization of real-world assets (RWA). Investors who realize the art of effectively integrating these tools can achieve maximum returns while effectively managing risk.

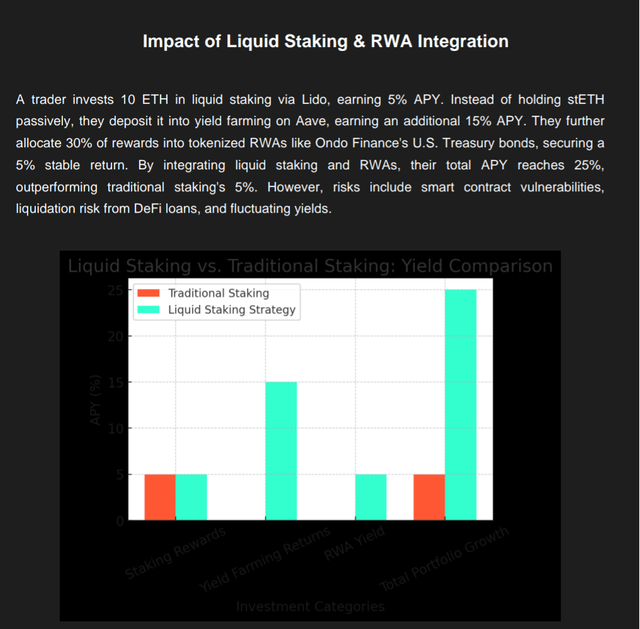

Envision a trader who has 10 ETH. Rather than using conventional staking, with idle assets & zero liquidity, they use liquid staking through Lido, receiving 10 stETH & still getting 5% APY. But hey there is more to it.

They lock stETH in Aave, utilizing it to take out 5 ETH on loan & carry out yield farming, acquiring another 15% APY from trading fees. In order to ensure stability, they invest 30% of rewards in tokenized RWAs, like U.S. Treasury bonds on Ondo Finance, earning 5% stable return.

This multi-layered approach maximizes capital efficiency, compounding returns on both DeFi and traditional assets. Traders need to exercise care, however, against impermanent loss, liquidation risk, and volatile yields.

Impact of liquid staking and RWA intigration Impact of liquid staking and RWA intigration |

|---|

The blockchain economy, like any financial system rewards those who behave sensibly while managing risk.

Reflect on key takeaways for future investors.

Traders can now use more advanced investment strategies following the development of Decentralized Finance (DeFi) due to the integration of both liquid staking and real world asset (RWA) tokenization. Effective traders know how to blend these strategies to maximize returns and reduce losses.

Consider a trader having 10 ETH. Instead of traditional staking, in which the assets are locked and cannot be accessed anyway, they choose to liquid staking via Lido and receive 10 stETH for their asset while earning 5% APY. Then, they don’t stop there.

They deposit stETH into Aave and use it as collateral to borrow 5 ETH, which they use for yield farming and also earn extra 15% APY from the trading fees. They also wanna manage their risk by putting 30% of rewards into tokenized RWAs like U.S. Treasury bonds through Ondo Finance, receiving a 5% stable return.

With this kinda implementation of these multi-layered strategy capital efficiency is improved while compounding returns from both DeFi and te traditional assets in both . But traders need to be careful of impermanent losses, liquidation risks, and changing yields. The blockchain economy, similar to other financial systems, provide incentives to those who mitigate risks and adapts smarter.

kind Regards

@artist1111

Adieu, folks!

May the winds of fortune

carry you to greatness!

May the winds of fortune

carry you to greatness!