Steemit Crypto Academy | S4 Week 1 | Homework post for @allbert | Trading with Strong, Weak and Gap levels.

1. Graphically, explain the difference between Weak and Strong Levels. (Screenshots required) Explain what happens in the market for these differences to occur.

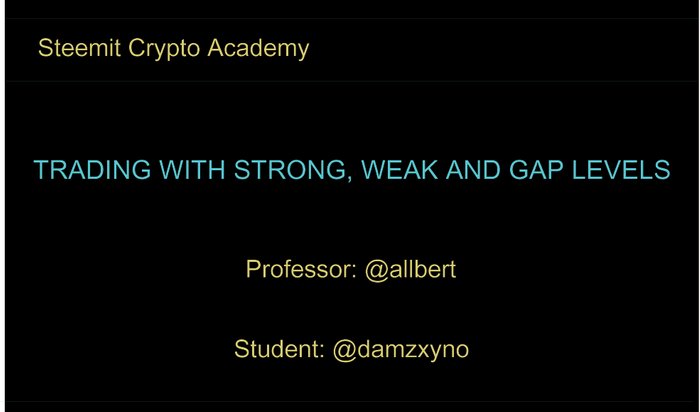

Strong and Weak Resistance Level

A resistance level is a level in a crypto price chart whereby the value of a crypto asset is finding it difficult to cross above (break) before pulling back. This level is indicated with an imaginary line across similar occurring resistance level. The resistance level is said to be strong when there is a tremendous pull back or retracement of the crypto asset value when it reaches this level. In other words, a strong resistance level is a point at which the value of the crypto asset pull back severally.A strong resistance level can help guide crypto traders as they would always expect a pull back as the crypto asset value rises to wards a strong resistance level. Traders won't place a sell order above this level except there are other positive speculations.

A weak resistance level on the other hand is a resistance level which has been broken a lot of times. Also, weak resistance level are swift to becoming support level. This level exist, however, it can not be relied on compared to a strong resistance level.

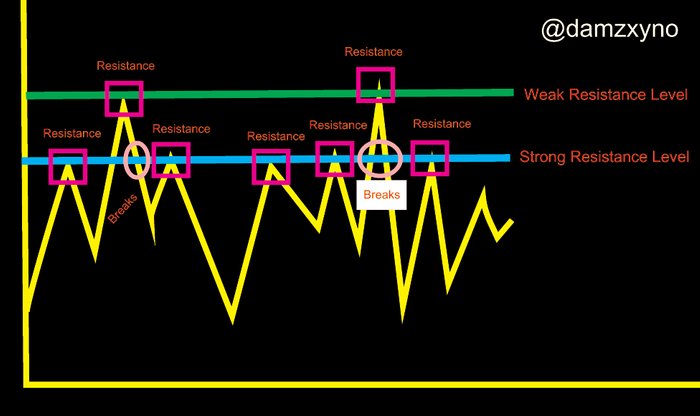

Strong and Weak Support Level

A Support level is a level in a crypto price chart whereby the value of a crypto asset is finding it difficult to cross below before pulling back. This level is indicated by an imaginary line across similarly occurring support levels. The level is said to be strong when there is a tremendous up pull back or retracement of the crypto asset value when it reaches this level.A strong support level can help guide crypto traders as to placing sell order because they would always expect a pull back as the crypto asset value lowers toward the strong support level. Traders won't place a buy order below this level except there are other positive speculations.

A weak support level on the other hand is a support level which has been broken a lot of times. Also, weak support level are swift to becoming resistance level. This level exist, however, it can not be relied on compared to a strong support level.

2. Explain what a Gap is. (Required Screenshots) What happens in the market to cause It.

A gap is a place where no trade took place between one moment to the next. It is created in a crypto price chart when the value of a crypto asset jumps from the closing price of one candle to the opening price of another candle directly creating a gap between them.

Gaps are caused as a result of sudden large buy or sell orders following a period of no trade order. This means a trader with large amount quantity of a crypto asset entered into the market. Gaps often are seen in not so popular crypto asset, their low trading activities tend to result in creation of gaps.

3. Explain the types of Gap (Screenshots required, it is not allowed to use the same images of the class).

There are 3 major types of gaps present in a crypto market chart, they are the breakaway gap, runaway gap and exhaustion gap.

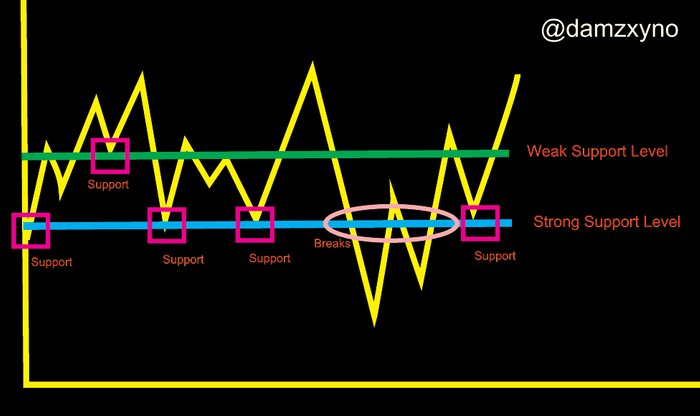

BREAKAWAY GAP

This is a type of gap that occurs in a crypto market chart as a result of tremendous acquisition of crypto asset causing the price of crypto asset to break out of a trading congestion. It is confirmed by the presence of a high trading volume and confined by a descending triangle pattern. It marks the beginning of a new trend also representing a support or resistance level.

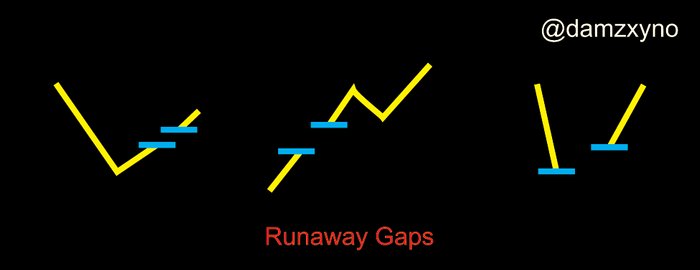

RUNAWAY GAP

This gap occurs as a result of increase in interest of a particular crypto asset. It is similar to the breakaway gap but instead of a downward trend, the gap leads way to the up side. The runaway gap represent traders who didn't participate in the initial uptrend in a crypto chart market who while expecting a pull back discovered it was not going to happen, so they entered the market anyways. Anything that creates positive sentiments creates runaway gap.

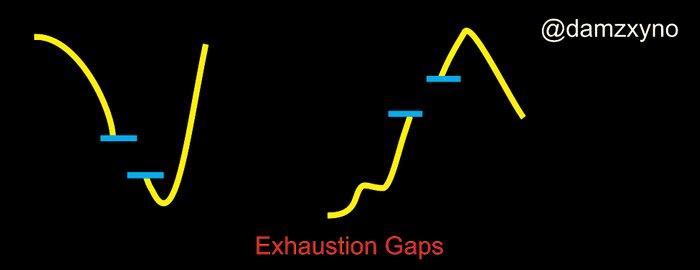

EXHAUSTION GAPS

These are gaps that occur near the end of a good up trend or downtrend. It is extremely risky to take decision based on the gap if you are still new to spotting them correctly. Exhaustion gaps occur when prices shoots up very high and then jump to form a gap or when it goes very low and then jumps down only to bounce up almost immediately. The key characteristic of this type of gap is how swiftly price reverses.

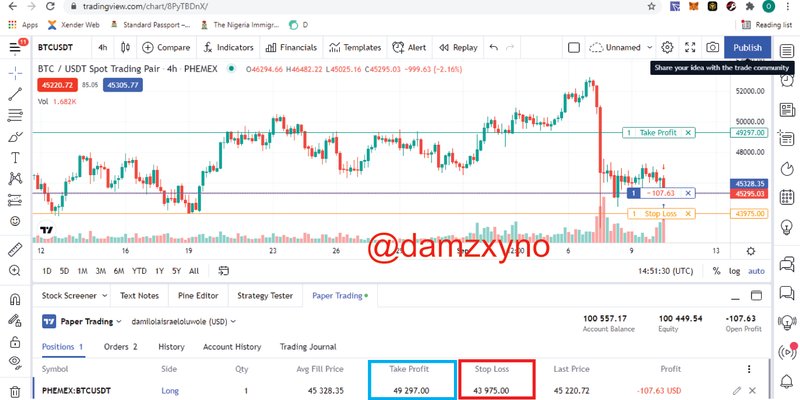

3. Through a Demo account, perform the (buy/sell) through Strong Supports and resistances. Explain the procedure (Required Screenshots).

Using my trading view demo account. Using the BTC/USDT pair. I placed an OCO (once cancel the other) order while the value of BTC was 45,295 usdt.

I set a stop loss at the value of 43,975 based on a strong support level of 43,970 and a take profit at the value of 49, 297 based on a strong resistance level. My profit margin is therefore 9% while the loss margin is 3%. My profit to loss ratio is therefore 3:1.

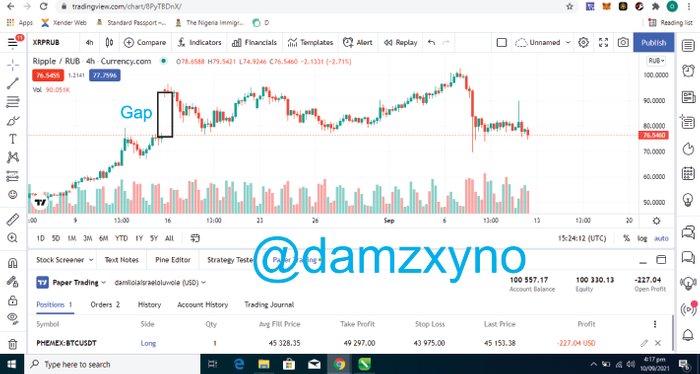

4. Through a Demo account, perform the (buy/sell) through Gaps levels. Explain the procedure (Required Screenshots).

Using my trading view demo account, I perform a transaction through gap level for the XRP/RUB pair. I

I placed a sell order immediately after the gap before the market experienced a bullish turn. It was obvious the market was about to experience a downward trend as this was a exhaustion gap.