Recently, Wall Street has been stacking spot ETH a lot.

ETHE is Grayscale's existing spot ETH(Ethereum) ETF.

ETHA is BlackRock's iShares ETH ETF.

ETH is newly launched Grayscale's ETH ETF due to the high operation cost of existing ETH ETF.

FETH is Fidelity's ETH ETF.

Existing spot ETH holdings of ETHE have been moving to ETH(Grayscale's ETH Mini Trust) for the last 3 months. I assume this process will last more than 8 months.

I think BlackRock and Fidelity has not started buying ETH in earnest yet, which means ETH might be pretty much potential to go up rather than BTC(Bitcoin).

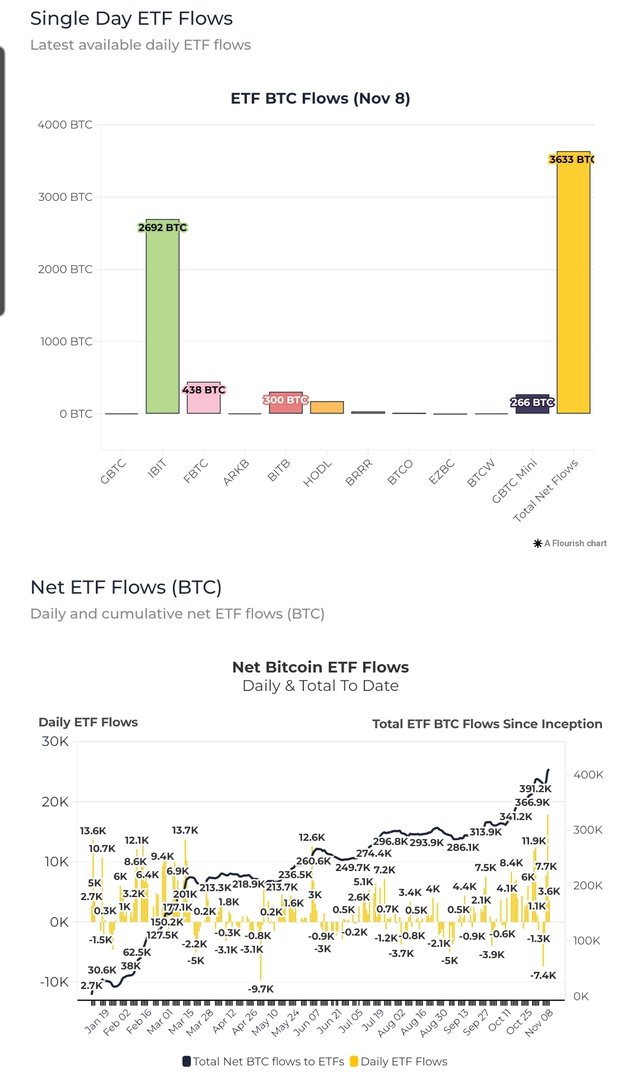

BTC holdings by Wall Steet records a new ATH(All Time High). Some retail investors and newbies may think 'oh, there will be a dip soon. I sold. I'm waiting for the next dip.' Don't you remember? Take a look at the last phase of the previous cycle. Most dips were the opportunities to buy BTC. So, that's the reason why I don't much buy and sell a lot for the short-term.

2 years ago, I said "Someone who bought in $15.5k and other who bought in $18k will make profits when BTC price surpasses $100k, and the difference of profits won't be much different." That's the reason why I hold assets for the long-term.