BITCOIN IS BOOMING - MY FAVORITE COIN - LITECOIN (LTC) : LET'S COMPARE IT WITH BITCOIN (BTC)

source

With several cryptocurrencies flooding the markets, knowing which coins are worth investing has become extremely vital, now more than ever. In the decision making process of an investor to choose a preferred currency, several factors such as its price, market cap, chart, all-time high, and market dominance are taken into account. Due to the high volatility of cryptocurrencies, investors also consider coins that exhibit some degree of stability with respect to their growth. Undoubtedly, one of such coins is Litecoin.

Created by Charlie Lee in 2011, it has managed to maintain a solid ranking amongst the top ten crypto currencies in the world. Litecoin is a peer-to- peer open source digital currency that offers instant payments at very low costs. The notion behind its creation was to have a silver version of Bitcoin hence, basing it on the bitcoin protocol. However, it focused on transaction speed and differs from bitcoin in other aspects such as maximum supply, hash algorithm and hard cap.

KEY FEATURES OF LITECOIN

The litecoin blockchain is able to handle large volumes of transactions due to its frequent block generation.

It has a fast transaction confirmation and processing rate resulting in lower transaction costs.

It is well integrated various sectors in of the world such as exchanges, ATMs, etc.

Its Scrypt hashing algorithm is much safer and produces an effective processing power than most algorithms.

It provides a great profit margin in its mining as it has 84 billion coins in existence.

It is quite flexible with many trading pairs and compatible with several exchanges.

LITECOIN's PERFORMANCE

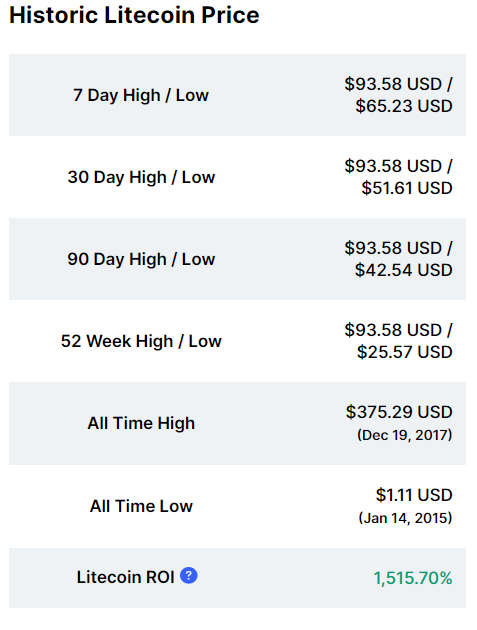

With Litecoin's price at $69.47 around the time of this post, it sends it ROI to 1,515.70%. This means that if an investor purchased it at the time of launch, they would have had a 1,515.70% return on their investment today. It is currently ranked #8 in among all cryptocurrencies. It has exhibited great potential as we have seen in among the top 5 crypto currencies in 2017 and set an all time high record of $375.29 later that year.

LTC rose to a high of about $93 within the week and witnessed a low of $51.61 USD. At the time of this week's high, Litecoin observed a market cap of over $6 billion with a 24 hour trading volume of more than $8.7 billion. This is an indication of its willingness to rise based on current market conditions.

Exchanges

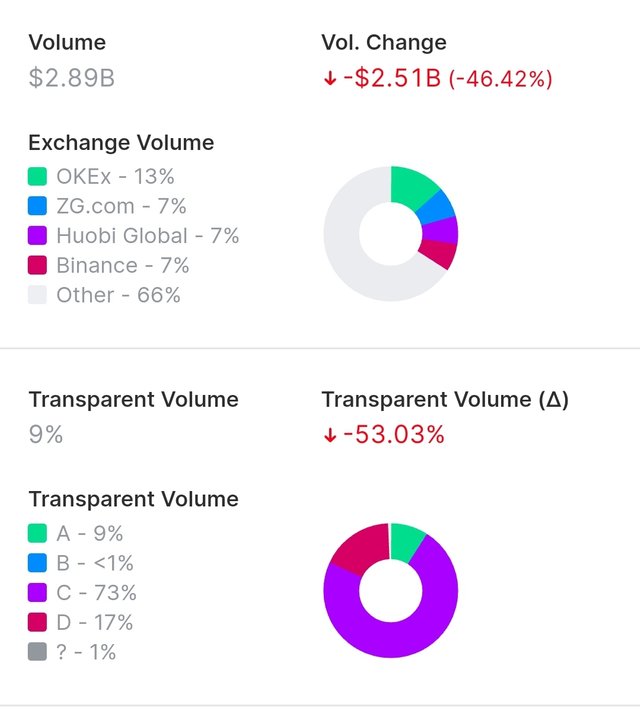

Currently, litecoin is traded on about 300 exchages with about 2,437 active markets. Top litecoin exchanges with their trading volumes are as follows;

- OKEx ($582.39M)

- ZG.com ($320.19M)

- Huobi Global ($303.23M)

It also has USDT, USD, and BTC as its highest volume trading pairs.

COMPARING LITECOIN TO BITCOIN

SIMILARITIES

- They are both decentralized cryptocurrencies : Meaning, their entire operations such as circulation, market value determination and control are not backed by any central banking systems as seen with fiat currencies.

- They both follow the same halving schedules : As we may already know, the block reward of BTC undergoes halving every 4 years starting at 50BTC. Same principle applies to LTC as it saw its first halving on the 25th of August, 2015 and the second on the 5th of August, 2019. The current reward per block for litecoin miners is 12.5.

- Both require digital/cold storage : In order to hold either of these coins, you must have a wallet(storage) for safe storage of your transactions. These wallets usually have a master seed which must be preferably stored offline to enable the retrieval of one's assets when lost.

- Both are proof-of-work ecosystems : They generate a unique digital imprint known as hash which are long set of numbers used to detect any altering. Both LTC and BTC networks sets a difficulty level which may be adjusted so that a valid hash is generated for every block that is mined.

- Both are volatile currencies : The prices of both BTC and LTC are subject to rapid changes. This is because price determination is the perceived value of the markets mostly influenced by supply and demand. Also, factors such as governments' regulations on cryptocurrencies could play a major role in price fluctuations.

DIFFERENCES

- Market Cap : As of the time of this post, BTC has a market cap of $316,599,669,068 whiles that of LTC is $4,550,235,297. This makes the market cap of BTC about 79 times that of LTC. In theory, the market cap of a coin tends to correlate to its price as we can see bitcoin rising in this time frame just as it did in 2017 at a $326 billion.

- Transaction Speed : Perhaps the most famous quality of litecoin, its transaction speed is about 4 times faster than Bitcoin. This is largely due to the confirmation time of both coins on their networks. The average confirmation time of a block on Bitcoin's network is 10 minutes (subject to changes during traffic) whiles that of Litecoin is 2.5 minutes. This attracts lots of merchants towards LTC as they need not wait for longer periods.

- Maximum Supply/Distribution : Bitcoin's protocol allows for there to be a maximum of 21 million BTC. However, that is not the case with Litecoin as it can produce up to 81 million LTC. This may appear as a great advantage over BTC however, it tends to have negligible impact on the value of the currency as investors can hold either BTC or LTC in little quantities as indicated by the decimal figures in their respective wallets.

- Address Configuration : Bitcoin addresses begins with either of these three: 1, 3 or bc1. For litecoin, its address may be Segwit-enabled which would start with M whereas a non-Segwit address would start with a L.

- Proof-of-Work Algorithm : In the generation of the unique hashes created during mining, different hash functions/algorithms are used by the two. Bitcoin uses the more complex SHA-256 algorithm whiles LTC uses a memory-hard algorithm known as Scrypt. The scrypt algorithm is newer, safer and provides a more effective processing power than the SHA-256 algorithm.

CONCLUSION

The advantages bitcoin has over litecoin is quite obvious considering its huge market cap and demand. However, due to Litecoin's significant transaction speed resulting in lower costs, it tends to attracts lots of crypto merchants causing constant curculation of the coin. Personally, I believe it could lead in terms of real world market integration and would top all other coins in trading volumes in the near future.

Thank you for your attention.

References

- https://coinmarketcap.com/currencies/litecoin/

- https://www.investopedia.com/articles/investing/042015/bitcoin-vs-litecoin

- https://blockpublisher.com/key-features-benefits-of-litecoin/

- https://www.coingecko.com/en/coins/litecoin/

- https://nomics.com/assets/ltc-litecoin#highlights

REWARDS : 100% POWER UP

10% OF REWARDS WILL GO TO @STEEM-GHANA

Cc:

Twitter Share : https://twitter.com/bananmuni/status/1332680979392196610?s=19

The Litecoin blockchain is capable of handling higher transaction volume than its counterpart.

LTC is one of the great coins which maintains his rank on 8, it has a circulating supply of 66 Million coins and a max supply of 84 Million coins.

Nice post from you.

#onepercent #india #affable

Yes friend this gives it a great advantage over many other coins at the moment.

Thank you.

#affable

Well done Charlie Lee, he created a good cryptocurrency!

Yes please, he was a former google employee who had such great visions and implemented it really well 😀.

#affable

yeah

Thank you for taking part in the Bitcoin is Booming Crytpo Challenge.

Keep following @steemitblog for the latest updates.

The Steemit Team

Thank you for the support.