Steemit Crypto Academy Contest / S13W2 - Triangular arbitrage.

|

|---|

INTRODUCTION |

In our local markets, there are differences in the price of goods across different stores where store A sells particular goods at a different price to store B, and we all tend to go to the store with the lower price to either save money or make a profit.

This also happens in the financial market, bringing about the topic for this week's engagement challenge; Triangular Arbitrage.

EXPLAIN IN YOUR OWN WORDS, WHAT IS TRIANGULAR ARBITRAGE. |

|---|

Triangular arbitrage is a method of trading that involves taking advantage of the price differences between three different cryptocurrency pairs to make a profit.

For example, let's say we have three coins, coin A, coin B, and coin C, below is an example of how traders benefit from the triangular arbitrage method;

Step 1: Exchange Coin A for Coin B

On Exchange X, 1 Coin A is equivalent to 2 Coin B. So, we exchange our Coin A for Coin B.

Step 2: Exchange Coin B for Coin C

On Exchange Y, 1 Coin B is equivalent to 3 Coin C. Again, we exchange Coin B for Coin C.

Step 3: Exchange Coin C back to Coin A

Finally, on Exchange Z, 1 Coin C is equivalent to 2 Coin A. Finally, we exchange Coin C back to Coin A.

By completing the above steps, we end up with more coin A than we started with, allowing us to make a profit through the triangular arbitrage.

So then, let's look into a more realistic example using cryptocurrencies. Below is an example of how triangular arbitrage works in the cryptocurrency market:

Let's say there are three cryptocurrency pairs:

BTC/USD

ETH/BTC, and

ETH/USD.

Also assuming their current exchange rates for these pairs are as follows:

- BTC/USD: $30,000 per BTC

- ETH/BTC: 0.05 BTC per ETH

- ETH/USD: $1,500 per ETH

Based on these rates, we can determine the implied exchange rate for BTC/ETH:

- ETH/BTC: 0.05 BTC per ETH

- 1/0.05 = 20 ETH per BTC

- ETH/USD: $1,500 per ETH

- 20 ETH per BTC x $1,500 per ETH = $30,000 per BTC

From the calculation above, the implied exchange rate for BTC/ETH is the same as the market rate for BTC/USD.

However, if the market rate of BTC/ETH is to be lower than the calculated implied exchange rate (i.e., BTC/ETH is undervalued). Then, the following trades can be executed to make a profit:

- Buy 1 BTC for $30,000

- Sell 20 ETH for 1 BTC, receiving 20/0.05 = 400 ETH

- Sell 400 ETH for $600,000

The above trades, if executed perfectly will bring about a profit of $570,000 from $600,000 (final amount) - $30,000 (initial amount/capital) = $570,000 (profit).

As interesting as this mode of trading appears to be on paper, like every other financial and cryptocurrency market some challenges come with it and these challenges include:

EXECUTION SPEED:

Triangular arbitrage requires quick and timely execution of trades to take advantage of price differences. Delays in executing trades can result in missed opportunities or reduced profits.

MARKET VOLATILITY:

Cryptocurrency markets as known by us now are very volatile markets as prices change rapidly in a short time. The sudden change in prices can make it difficult to execute profitable triangular arbitrage trades.

TRANSACTION FEES:

Each trade in the arbitrage process incurs transaction fees, which can eat into potential profits. Therefore, it is important to consider these fees and ensure that the potential profit justifies the costs.

LIQUIDITY AND ORDER BOOK DEPTH:

Triangular arbitrage depends on the availability of liquidity and depth in the order books of different currency pairs. Therefore, If there is any insufficient liquidity or shallow order books, it can be challenging to execute trades at desired prices.

TECHNICAL CHALLENGES:

This method of trading requires advanced knowledge of trading platforms, APIs, and order execution. Therefore, technical issues, such as connectivity problems or glitches, can hinder trade execution and hinder profitability.

EXCHANGE RESTRICTIONS:

Some exchanges have restrictions on trading volumes and withdrawal limits. Some may even suspend trading activities during periods of high volatility. Therefore, these restrictions can cause hindrances in the execution of triangular arbitrage strategies

HOW TO DO TRIANGULAR ARBITRAGE TRADING? |

|---|

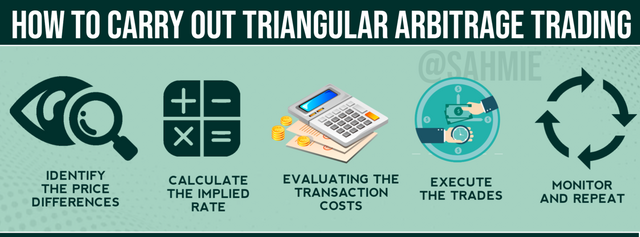

From the above examples, we can see that to carry out a triangular arbitrage, certain criteria are looked into, criteria such as;

- Price differences between pairs in different exchange platforms

- Different exchange platforms

- Calculating potential profits, and

- Swift execution of trades.

Therefore, these and more are the foundation of triangular arbitrage works. It is no secret anymore that this method of trading targets the difference in price among trading pairs in exchange platforms.

However, Triangular arbitrage in the cryptocurrency market is known for taking advantage of price differences between three distinct cryptocurrencies on different exchanges. Therefore, the following procedures are needed to perform a triangular arbitrage.

|

|---|

IDENTIFYING THE PRICE DIFFERENCES:

This involves looking for price differences among cryptocurrencies listed on different exchanges. This involved looking at the prices of a cryptocurrency across different exchanges to see if there are any price differences.

CALCULATING THE IMPLIED RATE:

This is all about calculating the likely profit of buying a cryptocurrency let's say X on Exchange A, exchanging it for another cryptocurrency, Y on Exchange B, and then converting it back to the first cryptocurrency, X on Exchange C.

EVALUATING THE TRANSACTION COSTS:

Traders need to take into account all transaction costs associated with each exchange, in other to maximize profit. Therefore, it's important to consider fees when evaluating an arbitrage opportunity.

EXECUTING THE TRADES:

After calculating the potential profit and seeing it outweighs the transaction costs, you can now proceed with executing the trades swiftly. To do this, you've to buy the first cryptocurrency on Exchange A, transfer it to Exchange B, exchange it for the second cryptocurrency, transfer it to Exchange C, and finally convert it back to the original cryptocurrency.

MONITOR AND REPEAT:

After a successful trade, does it end with one trade? I don't think so, so keep an eye on the market and be ready to take advantage of new arbitrage opportunities as they arise.

However, knowing that triangular arbitrage requires fast execution and constant monitoring of market conditions to benefit from price differences which could be difficult to keep up with, brought about tools and strategies to help users make the most of this trading method.

Some tools and websites that can assist users of triangular arbitrage in the cryptocurrency market include;

COINIGY:

Coinigy is a platform that provides real-time data and trading tools for multiple cryptocurrency exchanges. It can help one identify and monitor price differences across different exchanges, which is crucial for triangular arbitrage.

TRADINGVIEW:

This is a commonly used platform among traders that provides charts, analysis tools, and real-time data for various financial markets, including cryptocurrencies. It can be useful in identifying and analyzing arbitrage opportunities and price movements.

ARBITRAGE CALCULATORS:

As the name implies, they help users calculate potential profits and identify triangular arbitrage opportunities by analyzing price differences across different trading pairs. Hence, helps a user save time and simplify the process of identifying profitable trades.

WHAT IS THE DIFFERENCE BETWEEN ARBITRAGE AND TRIANGULAR ARBITRAGE?. |

|---|

Even though both triangular arbitrage and arbitrage methods are similar as they share the common goal of taking advantage of price differences in financial markets to make a profit they have some key differences. Such as;

| Category | Arbitrage | Triangular Arbitrage |

|---|---|---|

| DEFINITION | Arbitrage involves buying an asset at a lower price in one market and simultaneously selling it at a higher price in another market to profit from the price discrepancy. | Triangular Arbitrage is a specific type of arbitrage that involves taking advantage of price differences between three different currencies or assets to make a profit. |

| NUMBER OF MARKETS | Arbitrage commonly involves two different markets, where the asset is bought and sold. | Triangular Arbitrage involves three different markets or currencies, forming a triangular relationship. |

| COMPLEXITY | Arbitrage can be relatively straightforward, as it focuses on exploiting price differences between two markets. | Triangular Arbitrage can be more complex, as it requires analyzing and executing trades across three different markets to capture profit. |

| TIMEFRAME | Arbitrage can be executed quickly, as it aims to take advantage of immediate price discrepancies. | Triangular Arbitrage usually requires faster execution due to the need to exploit price differences across multiple markets simultaneously. |

| PROFIT POTENTIAL | Arbitrage profit potentials may be smaller, as the price differences between the two markets are often smaller and more quickly corrected. | Triangular Arbitrage profit potential may be higher, as it involves exploiting price differences between three markets, which can lead to larger profit opportunities. |

DO AN EXAMPLE OF TRIANGULAR ARBITRAGE, HAVING 10,000 STEEM AS THE FIRST CRYPTOCURRENCY. YOU CAN CHOOSE THE REMAINING 2 CRYPTOCURRENCIES |

|---|

To carry out a triangular arbitrage we need 3 different cryptocurrencies, whereas we are given Steem as the base currency, I will be picking the other two cryptocurrencies to be Bitcoin (BTC) and Ethereum (ETH).

Now, with the 3 cryptocurrencies determined, let's assume that the three cryptocurrency pairs are listed in exchanges as follows:

- STEEM/BTC: 0.000023 BTC/STEEM

- BTC/ETH: 42.890520 ETH/BTC

- STEEM/ETH: 0.000437 ETH/STEEM

To determine if there is an opportunity for triangular arbitrage, going by my explanation in the previous section on how to carry out triangular arbitrage, we need to find the implied exchange rate for the STEEM/ETH pair using the BTC/ETH pair as our bridge currency by multiplying the STEEM/BTC rate with the BTC/ETH rate as follows:

From the figures of our assumption earlier, as shown below;

STEEM/BTC = 0.000023 BTC/STEEM

BTC/ETH = 42.890520 ETH/BTC, and

STEEM/ETH = 0.000437 ETH/STEEM

We then, substitute the values into the equation;

STEEM/BTC x BTC/ETH = STEEM/ETH

Doing so gives us;

0.000023 BTC/STEEM x 42.890520 ETH/BTC = 0.000985 ETH/STEEM

Therefore, 0.000985 ETH/STEEM is the implied exchange rate for STEEMS/ETH based on the BTC/ETH pair.

Since the actual market rate of STEEM/ETH from the assumption is 0.000437 ETH/STEEM, which is lower than our calculated implied rate of 0.000985 ETH/STEEM.

This therefore means that STEEM is undervalued relative to ETH, hence, we can take advantage of this price difference through triangular arbitrage.

Hence, here is how the triangular arbitrage using 10,000 Steem would work:

Buy 10,000 STEEM for 0.23 BTC (10,000 STEEM x 0.000023 BTC/STEEM)

Sell 0.23 BTC for 9.86978280 ETH (0.23 BTC x 42.890520 ETH/BTC)

Sell 9.86978280 ETH for 22,573.9579 STEEM (9.86978280 ETH / 0.000437 ETH/STEEM)

After executing these three trades, we would have ended up with 22,573.9579 STEEM, which is an increase of 12,573.9579 STEEM (22,573.9579 - 10000 STEEM).

We can then sell the 22,573.9579 STEEM on a cryptocurrency exchange for ETH or BTC and repeat the process if there are still opportunities for triangular arbitrage.

Note: All figures and pair rates used are based on assumptions as they in no way resemble the actual pair rates.

CONCLUSION |

By taking advantage of price differences, traders who use the triangular arbitrage trades across multiple markets to generate profits. However, it's important to note that triangular arbitrage requires careful analysis and quick execution and the examples used were mere imaginary attempts to justify my points.

I wish to invite @anasuleidy, @ninapenda, @ruthjoe, @drhira and @suboohi

Thank You for your Time

NOTE: Always have a smile on your face, as you are never fully dressed without one.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Thanks for explaining triangular arbitrage in cryptocurrencies. It's a cool strategy to make money. Your post made it easy to understand. Keep it up!" 😊👍

hey dear friend @sahmie detailed explanation of the process and tools involved in triangular arbitrage, along with the distinction between arbitrage and triangular arbitrage, is thorough and well-presented.

best of luck...

Your article provides a clear and detailed explanation of triangular arbitrage in the cryptocurrency market. It's well-structured and informative, making this complex concept easier to understand. Your example using Steem, Bitcoin, and Ethereum helps illustrate the process effectively. Keep up the good work in making crypto trading strategies accessible to readers! 👏📈💡

Hello @sahmie.

You have really explained well about this concept. I really liked the images which you have added in your post as these images had made it easy to understand the topic.

Great Post.

you have successful in answering all the questions in required way as well as I am happy that you have clear understanding about the definition of triangular arbitrage as you have also suppose a b and c , 3 coins and then you implement definition of triangular arbitrage on them

Secondly I am happy to see cryptocurrencies which are very famous that you include for creating a practical example as well as you have also mentioned some of the clear differences among arbitrage and triangular arbitrage

You have explain in a very clear way that both these are very different from each other I wish you good luck and success in this engagement challenge

Thank you for your wonderful feedback, I believe we are happy with the state of cryptocurrencies.

Your welcome

Keep on steeming

Good luck again 👍

Hola Sahmie 😊

Hiciste una explicacion magistral como siempre, de verdad que esto es algo que se te da muy bien, tienes mucho conocomiento al respecto. El arbitraje triangular creo que es una gran estrategia de inversion.

Asi que si quieres arriesgarte, me avisas como te vas.

Saludos

Like you, I just do my research and present my findings. I'm not really that good in the field of trading as you think I am. I am still learning and that explains why I am here. But I can't say I am a novice when it comes to cryptocurrency