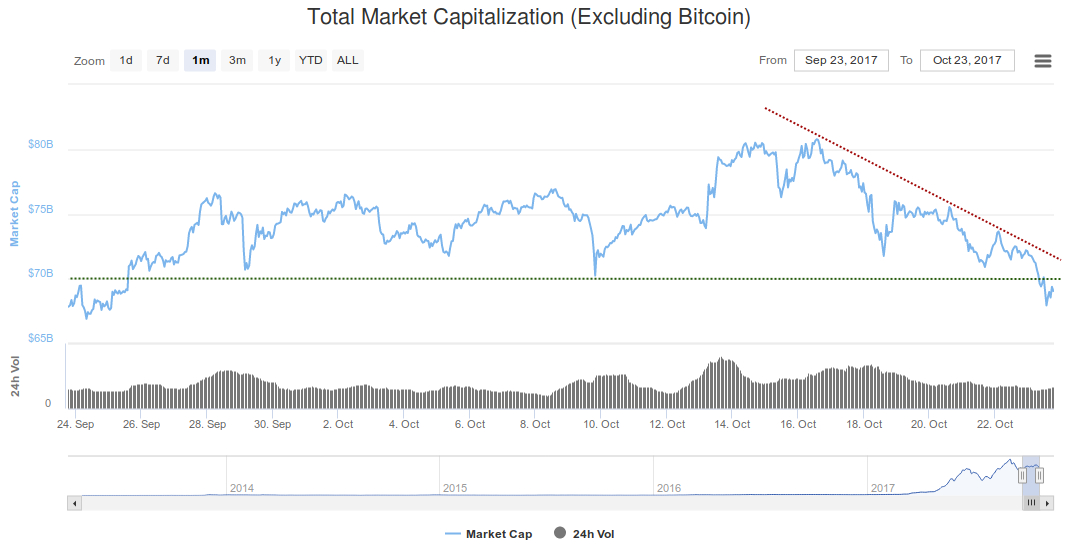

Altcoin Market looks set for major correction as $70bn support level is broken

The Altcoin Market today broke the crucial $70bn support line that's been keeping it alive for the past month. The past 6 days has seen a drop of $80bn down to $70bn during Bitcoin's volatile period.

It'd be easy to think that the altcoin market will swiftly recover following an anticipated major correction of BTC that now looks possible prior to the hard fork, as opposed to afterwards as originally presumed.

However, what appears to be more concerning is that Bitcoin's decline in the past three days hasn't reduced the loss in the altcoin market capitalization. As the graph above shows, there has instead been a steady decline from the 16th up until today.

Incase you thought it's just been a bad week, the broader long term picture doesn't look any better at the moment. With the potential to still make major gains this month, such as Vertcoin, BitConnect and ZenCash to name a few, it'd be easy to miss and overlook and what looks like the beginning of a major correction targeting the year-to-date support trend line at $60bn if not lower.

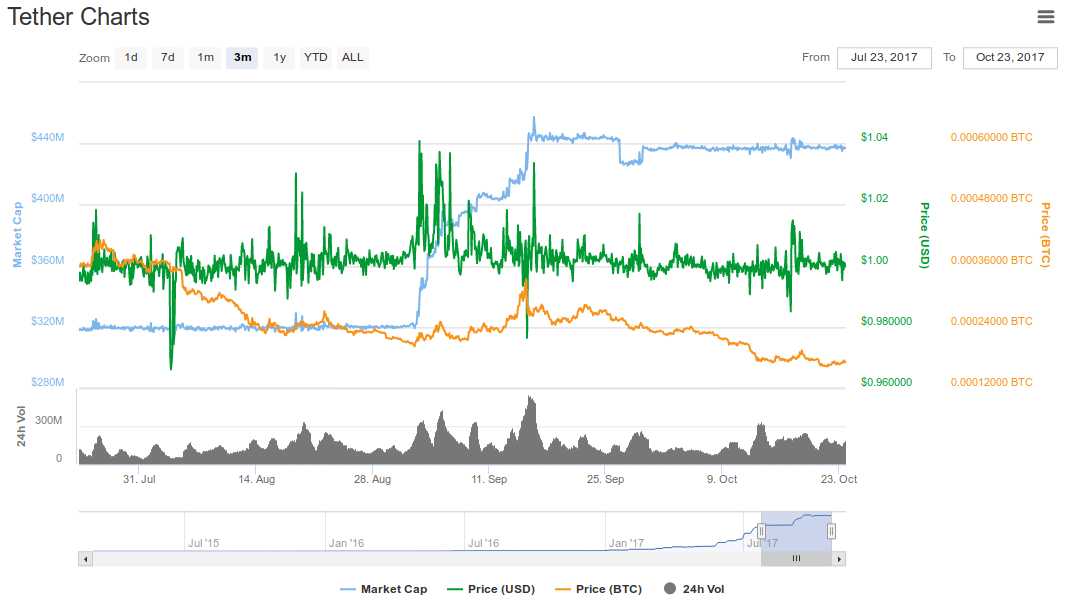

As an option during volatile high risk moments, Tether (USDT) has served panicked investors during the mid-September crash, increasing its market capitalization from $320m to $440m within two weeks, an increase of 37%. While not showing any notable major incline as of yet and is instead maintaining a tight margin, it could see a notable increase in the short term.

Whilst considered by some to be a risky manoeuvre, Tether looks like a potential investment during this volatile period that's likely to get worse for altcoins. Trading within a small margin around $1, the US dollar tethered cryptocurrency's volume is today the third largest after Bitcoin and Ethereum with $184m in 24 hours.

There is always the potential that the altcoin market will swiftly recover any day now, but with the current odds stacked against it, it's a risky manoeuvre that might result in breaking even overall as opposed to continued gains with diverse investment.

If you're profits are up, you might want to keep it that way.

This post was randomly resteemed by @funaddaa!