Crypto Trading Trends For 2020

In January 2009 the first Bitcoin block was mined by the creator Satoshi Nakamoto. Bitcoin is a digital currency system that allows money to be sent online from one party to the other without relying on a centralized entity such as a bank or other financial institution.

Ever since Bitcoin reached the all-time highs at the end of 2017 people have been looking into different ways to acquire Bitcoin and other digital currencies.

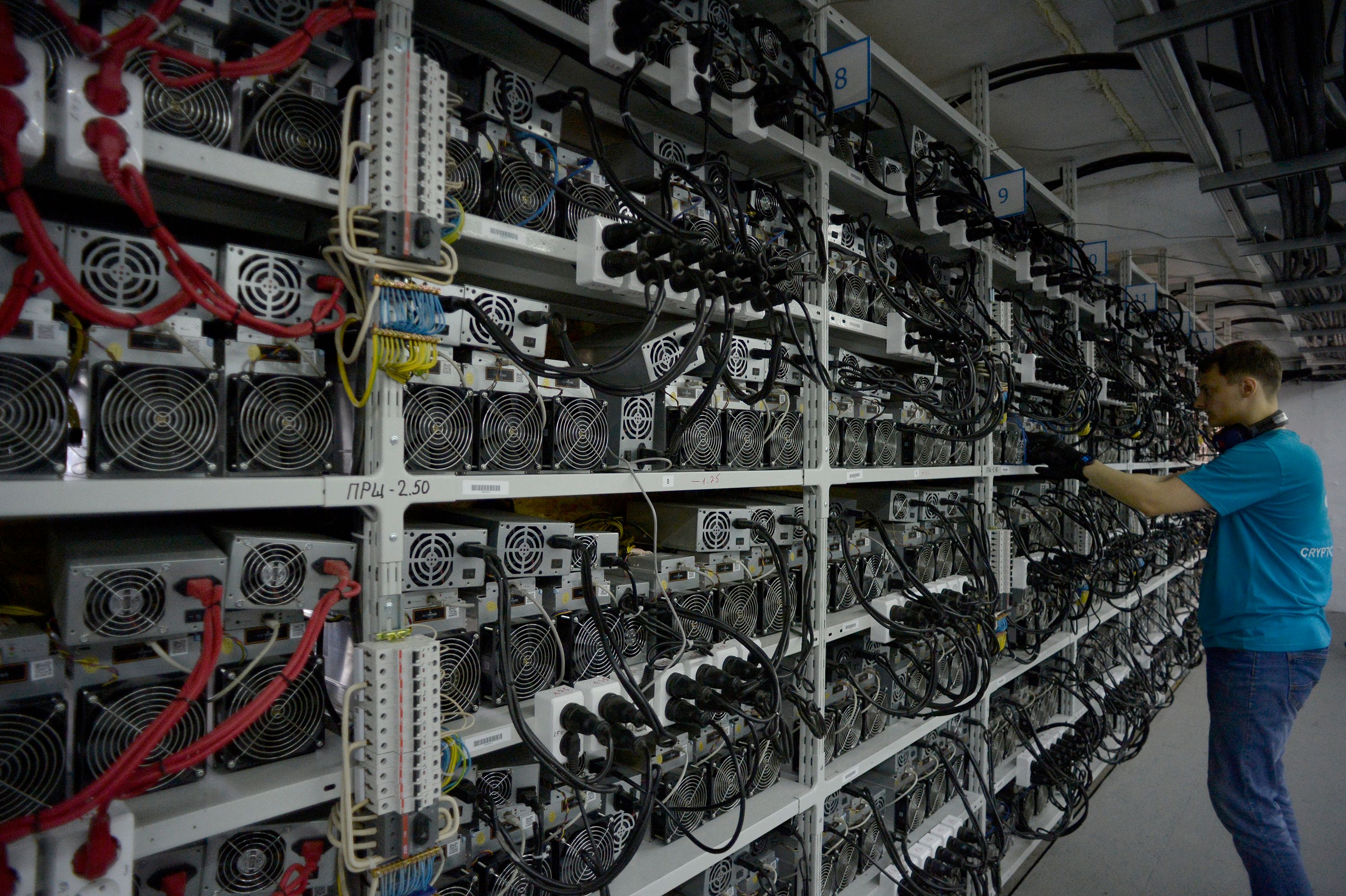

Bitcoin Mining is a popular option but it requires an investment in specialized hardware (miners), PC building experience, some coding and editing skills as well as time and patience. Mining Bitcoins today is not as easy as it was in the past because of the existence of large mining companies located in countries where electricity is cheap. People are therefore looking into other ways of collecting cryptocurrencies.

1. Buying Cryptocurrencies on Exchanges

The most popular way to purchase digital currencies is by buying them yourself on a well-known exchange. This can be accomplished by using fiat currency (USD, EUR) and trading it for a cryptocurrency of your choice. Different payment methods are available for the traders to choose from, such as direct bank payments or the use of credit cards. The other way is via a Crypto-to-Crypto trade where the investor purchases one cryptocurrency in exchange for another.

Several factors should be taken into consideration when choosing the right exchange. An investor needs to check if the exchange operates and is available for users in his area. What is its overall reputation and how safe is it to use? How have they been handling security-related incidents in the past? Does the exchange have enough liquidity for the trades he wants to make and are the desired trading pairs available there?

2. Using a Crypto Trading Bot

Trading bots are becoming more and more popular because of the advantages they offer to traders. The crypto market is a volatile market and good buy and sell opportunities arise all the time. But the average user can't be on the market 24/7 to take advantage of those windows of opportunity. This is where a trading bot is very handy.

A trading bot is an automated software that performs automatic trades based on the instructions you give to it. It is connected to an exchange via an Application Program Interface or API. If you don't know what APIs are and what they do please visit https://tradingbot.info/bot-101/crypto-trading-bots-and-api-keys/#So_what_is_an_API_key where you will learn what API keys are and why bots require access to them.

The biggest mistake that users make in connection with trading bots is that they purchase a certain bot without knowing what it is, how it works and how to set it up. https://tradingbot.info/#What_is_a_crypto_trading_bot offers a very detailed guide on everything you need to know about trading bots. How to choose the best bot that works for your preferences, how to set it up and use it in a way that it generates profits for you.

3. Bitcoin Futures

Bitcoin futures are contracts between two parties where those involved agree to buy or sell Bitcoin at a set price and on a set date. The parties can either enter a long or short position. Long means that the two parties agree to buy an asset at a set price on a set date. Short or shorting bitcoin, a term that can often be found in crypto circles, is the contrary. It is an agreement to sell Bitcoin at a set price and on a set date.

Bitcoin futures are traded on regulated exchanges usually for two reasons. Either to speculate on the future price of Bitcoin or as a means of protection against the volatility of Bitcoin. Investors dealing with Bitcoin futures don't have to own the Bitcoins themselves. They can remain in the possession of the trading platform so that investors don't need to worry about storing the coins themselves.

Source:

https://tradingbot.info/

I nice refresh of info on Bitcoin, some times we tend to forget the origin after so many altcoins popping up.

Bitcoin is the one and original revolutionary digital currency. Everything else is either based on Bitcoin or influenced by Bitcoin in some way to try and make a similar payment method.

Yup, just like steem.

Congratulations @bernardos! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

This is a good introduction, but I think you left off two very important trends - crypto lending and decentralized exchanges. I think both will be big trends in 2020.

I agree with you. Those trends deserve to be mentioned as well. Thank you for your suggestions!