Technical Analysis - Why You Can't Ignore It and Where To Start

This post is dedicated to strong proponents of Fundamental Analysis (FA) who either have a very poor understanding of Technical Analysis (TA) or who think it is all bogus.

People who debase TA as just a bunch of lines and triangles which are sometimes accurate and sometimes inaccurate remind me a lot of old white people like Warren Buffet who debase Bitcoin while simultaneously saying they don't really understand it. Anyone who has spent a decent amount of time in the cryptocurrency space and who has taken the time to understand some of the complicated concepts as well as the many variables at play understand the potential of this market.

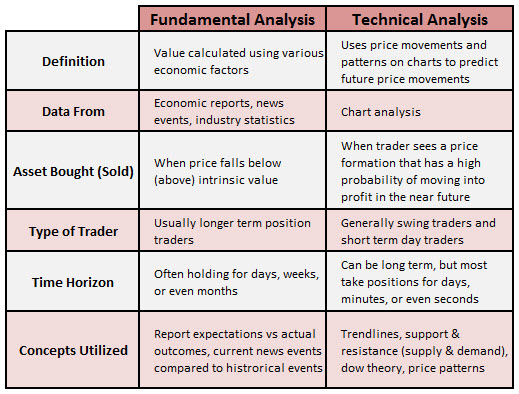

Exactly the same goes for TA. You won't find anyone who has spent months and months learning TA who tells you that it's all a bunch of rubbish and that there is no way to make money from it. If you're not quite sure about what FA or TA is, I suggest you read this article by the Samurai Trading Academy

When I started dedicating myself full time to cryptocurrency investing, research and writing back in June 2017, I must admit that I knew next to nothing about TA. Neither did I want to learn about it, it reminded me too much of the deeply theoretical and numerical teachings which I forced myself to learn when I was playing poker professionally for the four years prior to this. I was passionate about the technology and it's potential to change the world so sketching lines and triangles did not seem aligned with that passion.

That being said, making money was a strong secondary goal to my venture into the cryptocurrency space and anyone who is serious about making money in this space absolutely has to have at the very least a basic understanding of TA. You could easily spend your whole life investing spending only 10% of your time doing TA, but if you ignore it completely, you will definitely be missing out on a lot of profit which will compound over the years.

It's all very well being confident that a project is undervalued and that you figure a decent profit holding a position in a coin for the medium to long term. The problem is that the market is irrational and some days you will find people getting overexcited while others they will be overly fearful. Taking advantage of these irrational swings can be extremely profitable and even a very basic understanding of TA will help you in this regard.

To those who are just starting out, I would recommend you learn about the following topics:

Trend support & resistance lines which can be horizontal or diagonal

As well as the hyperlinks covering those particular topics above, I suggest you watch this introduction to technical analysis from TheChartGuys which covers most of those topics as well as trends, indicators and some basic chart elements.

I'm curious to hear your thoughts regarding TA. Does it bore you to death? Did you get to like it after making the effort to study it? Who are your favourite TA experts?

Disclaimer: This is not investment advice, trade at your own risk.

—

Feel free to follow me on Twitter or on Steemit and upvote this post or share it with your friends if it provided you with value.

My goal with this blog to connect with other crypto investors and traders but also to help inform newcomers to the crypto sphere. So I’d be delighted to hear your opinions, questions and substantiated counter arguments in the comment section below.

Image sources: investopedia.com and samuraitradingacademy.com/fundamental-analysis-vs-technical-analysis/

Great content, I have started to follow you on twitter you really have a nice way of presenting things.

Might want to see this my latest https://steemit.com/blog/@tusharraina23/is-the-cryptocurrency-just-going-to-end-up-reenforcing-the-financial-system-it-was-supposed-to-disrupt