Why the Cryptocurrency Market Will See New Highs and What Coins to Buy During the Dip

(Scroll to the bottom of the article if you want to see my top investments for massive returns; please read the description for each type of investment and my rules for investing before you consider buying anything)

I'm a big fan of alt-coins because of the potential that they have to create massive returns for investors. Last month I saw Verge (XVG), Tron (TRX), Shield (XSH), and other altcoins yield returns as big as 12500%; which would have turned each dollar invested into as much as $125. That means that a $500 dollar investment in Tron at the beginning of December could have turned into as much as $62,500! Returns like these could be life-changing to say the least. That is why I dedicate most of my free time to studying the cryptocurrency market; so that one day I may be on the receiving end of these returns.

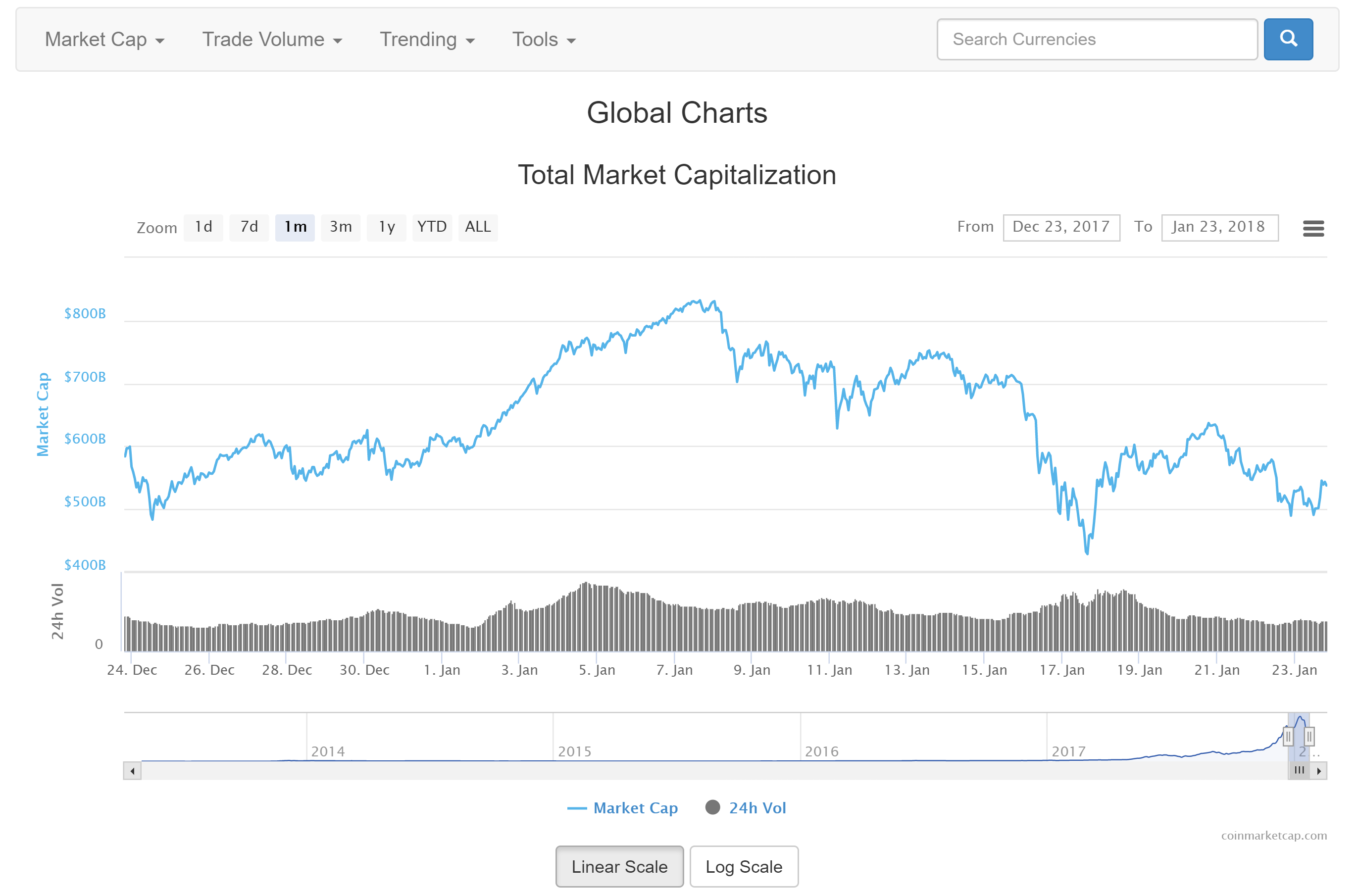

Since returns like these happened at the pinnacle of the crypto-craze, it could be said that similar returns are unlikely and may never happen again. In December of 2017, we were seeing tens of billions of dollars flood the crypto market each day, which led to a massive increase in the value of almost every alt-coin. In months like this you could have thrown a dart at a board to decide which alt-coin to invest in, and you would have made respectable gains. Now the market is displaying a more bearish sentiment as we have seen one of the largest market corrections to date. Starting on January 8th 2018, the market abruptly lost nearly 50% of its value in the matter of days. During this correction I watched as my portfolio lost nearly 50% of its value. This shakeout frightened many new investors out of the market and even tested the resilience of some of the most seasoned crypto-investors.

I was tempted to sell my holdings as I watched billions of dollars come out of the market each day, but I held on because my research tells me that the crypto market still has plenty of room to grow. It's not a matter of if the market will rebound, but when. Many crypto veterans have explained that January and even February have historically been bad for the cryptocurrency market. Annual holidays paired with large amounts of fear and expiring futures contracts could be to blame, but this could also simply be a much needed correction for the recently displayed marketplace exuberance.

With such massive volatility in the cryptocurrency market it can be difficult for investors to take a step back from the daily number crunching to remember what we are investing in. Block-chain technologies and cryptocurrencies have the potential to change the world as we know it. If you believe this to be true then you should realize that the market still has plenty of room to grow. The dot-com bubble of the 90's is perhaps the most comparable market that crypto investors can analyze. If we look at the dot-com bubble which was comprised of internet companies much like the crypto-companies of today, we can see that the market hit a high of about 7 trillion dollars.

Another factor to consider is that the dot-com bubble was an investor-driven market that was only open to investors in the United States. The cryptocurrency market is a global phenomenon. This means that the potential for new money to enter the market far exceeds the dot-com bubble. With that being said, it is very possible that the cryptocurrency market could surpass a market cap of 7 trillion dollars in the coming years. If this is true, then investing in the right cryptocurrencies now will make you very rich.

Great Cryptocurrencies to Buy:

From my research I have gathered a handful of short, mid, and long-term investments that you should be interested in if you want to make money in the cryptocurrency market. If you want short-term gains they will usually be more risky and less rewarding in the long run but potentially game-changing for your portfolio. If you choose to invest in a short-term pick please be aware of the risks you are taking. Mid and long-term investments are less risky but all cryptocurrency investments pose some risk.

Rules you should always follow when investing in cryptocurrencies:

- Only invest money that you can afford to lose.

- Buy low, sell high: (now is a good time to buy, the market is down from its recent highs)

- TRP (take regular profits). This holds especially true for short-term investments. If you see that you are up on one of your investments consider selling it for Tether (USDT) and waiting for the market to dip to buy back in, or buying another crypto.

With that being said, my favorite short-term picks (hold for 2 months or less) right now are:

- onG.Social (ONG): Preferred Exchange: EtherDelta. Buy at $2 or less. Price target: $20. Sell much sooner if you prefer less risk.

- HelloGold (HGT): Preferred Exchange: EtherDelta. Buy at $0.30 or less. Price Target: $5. Sell sooner for less risk.

Favorite Mid-Term Investments (6 months or less):

- Tron (TRX): Preferred Exchange: Binance. Buy at $0.08 or less. Price target: $0.75. Sell sooner for less risk.

- Verge (XVG): Preferred Exchange: Binance. Buy at $0.10 or less. Price target: $1.00. Sell sooner for less risk.

Favorite Long-Term Investments (2 Years or Less):

- Cardano (ADA): Preferred Exchange: Binance. Buy at $0.75 or less. Price target: $50. Sell sooner for less risk.

- EOS (EOS): Preferred Exchange: Binance. Buy at $15 or less. Price target: $200. Sell sooner for less risk.

Let me know what you think of my picks and what your top picks for 2018 are.

Disclaimer:

I am not a professional financial adviser and cannot legally give investment advice. The purpose of this article is not to get people to invest but simply to share my opinion. The crypto-currency market is highly volatile and can cause investors to lose money. Do not invest anything in the market that you cannot afford to lose and please do your own research before investing into anything.

Great read....lots of good information...thanks

Thanks for reading and commenting I appreciate your feedback.