Bitcoin Booms Above $10k as Next Wave Starts

Bitcoin is finally beginning to test $10,000 again, a level we haven’t seen since the end of January. Since this past crash was quite substantial and lasted longer than previous recent crashes, people are actually excited again when Bitcoin reaches each $1k milestone, leading to more reporting by media and more FOMO.

Transaction fees for Bitcoin are declining as on-chain volume is decreasing – these fees are anticipated to further decline as Coinbase adopts Segwit addresses. Hopefully in the future they also decide to implement batching as well.

Ethereum has slid slightly against Bitcoin, falling below 0.1 BTC a few days ago. There is heavy debate going on right now regarding EIP 867, or Standardized Ethereum Recovery Proposals. These discussions touch on the subject of how much authority Ethereum developers should have and touch on subjects such as legality, Ethereum’s philosophy and general governance concerns.

The concerns over governance in Ethereum has been an opportunity for other platform cryptoassets like EOS, which boast different governance structures. At this stage, I’m still invested in Ethereum but no longer picking up anymore because I feel it has gotten rather frothy in relation to Bitcoin.

Litecoin has been the real story in the past 48 hours due to a number of catalysts. Charlie Lee has been hyping upcoming events, including a quote-on-quote “huge unexpected surprise.” Coinbase Commerce is a new product offering by Coinbase which will help adoption for cryptoassets listed on the platform, currently Bitcoin, Bitcoin Cash, Ethereum and Litecoin.

This has led to some excitement for Litecoin, but the primary catalyst appears to be the announcement from Litepay (missed opportunity, Litpay would have been so much cooler!) will be operational for accepting Litecoin as payment similar to what Bitpay does starting on February 26th.

There’s also an upcoming hard fork of Litecoin called Litecoin Cash which will occur at block height 1,371,111 or roughly somewhere around February 18th to 19th. There’s some speculation that people are buying in for this fork, but realistically it seems like another joke fork that likely won’t even be worth claiming the coins for so I heavily doubt that. There’s also a 1% premine, always a wonderful sign.

Moving forward, I might be considering a more income-based approach as this is a more conservative way to take-profits in a rather risky market. Might make a video on that in future (along with my million other ideas currently sitting in limbo). What are your thoughts on the market?

Regarding Tether - I'm wondering why everyone seems to judge Tether based on whether each Tether in circulation is backed by an actual dollar. The US dollar value of any cryptocurrency is based on its circulating supply and the demand for the token, no?

With this in mind, does Tether not adjust its total supply based on the demand for Tether in order to keep the price of Tether at 1 USD - in effect tracking the US dollar?

How does being backed by physical US dollars affect this in any way? Even if people started massively selling off Tether, couldn't Tether developers "burn" excess supply to make it more scarce and keep the value at $1 regardless?

Being that you have discussed this issue in the past, I was curious to know your response to this. I welcome any other readers thoughts as well. Thanks.

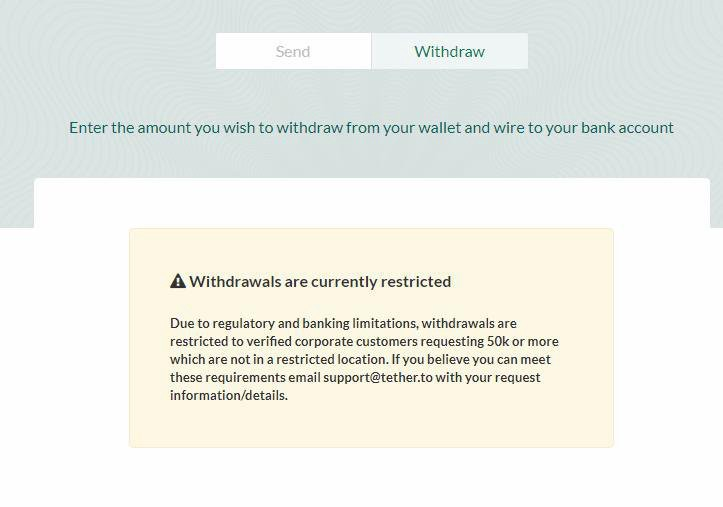

A normal bank would maintain fractional reserves, and is insured and backed by the U.S. government. But Tether has a problem, the backbone of Tether's business is to exchange one USD for one USD₮. Now Tether must prove it has that money, in case people people would like to withdraw. It is possible to "burn" Tether to maintain the price, unfortunately that is not the case. Since Bitfinex lost it's ability to bank, no one has been able to withdraw Tether, therefor maintaining the price within 10 American Pennies.

Of course Tether might have the money, and is stuck with incompetent auditors, OR Tether has essentially created fake money propping the price of Bitcoin up.

Thanks for the response, but again - what relevance does a bank have to do with the Tether token? If Tether the company is making this their business model, then I certainly see your point. Clearly the Bitfinex exchange has problems.

I'm more referring to the concept of a stable coin in general. If you have a stable coin, whether or not you have fractional reserves in a centralized entity is irrelevant to the dynamics of supply and demand for the token itself. Whether or not people can cash out their crypto is the responsibility of the exchange you are using, or other type of selling/exchange method used by the holder.

So, if Bitfinex screwed something up, and can't give people their money - is that not an exchange issue? Theoretically a "flex-supply" stable coin should be able to have its value stabilized without regard to fiat backing in any way, no? And accordingly - regardless of the condition of the company Tether, the Tether token should have value relative to its usage and its ability to stabilize the price at 1 USD.

The whole premise of Tether is that it's backed 1:1 by fiat USD so if they're not then they're lying to Tether users, quote from their website

"Every tether is always backed 1-to-1, by traditional currency held in our reserves. So 1 USD₮ is always equivalent to 1 USD."

I see. That is important then. I wonder if another stable currency could upend this requirement though in the manner that I described above.

check out my post. https://steemit.com/crypto/@cryptoautonomy/crypto-currency-has-a-secret-weapon

Best possible income with crypto is holding steem power and self upvoting, or delegate to bidbots.

Nice video I think that particularly with the entry of wall street into the crypto market there will be many more peaks and troughs in terms of price to come. Focusing on crypto income and investing in good tech teams is a smart move in my opinion.

Ethereum has still to address its scalability issues. I don't think ETH-BTC flipping is happening anytime soon, unless they address those issues.

While BTC also has issues, a platform coin the ETH should never ever display such performance problems. That is not the hallmark of a good product.

One thing a recent crash has taught to people is to not invest blindly into anything. I am seeing people are now doing more research, collaborating than they did in December and early Jan. Overall its good for the Crypto market. Such crashed only bring out quality products. I am sure there will be more such crashes in future and thats when quality projects will stand apart from crap ones.

That was the most bullish video I saw from you in a long time. You talking about other cryptos than BTC or ETH was really nice to hear.

I did also looked at income focused cryptos, because it is hard for me to sell anything, unless I get it on top free.

You didnt mentioned NEO. I like it. Not because it is centralized, but because they try to build a big ecosystem around it with Ontology and its centralized nature, could make it a good option to be supported by China, if they decide to open up a little to it.

With Cardano I do have a really bad feeling. They are so far away from anything they can show. They not only need to catch up to Ethereum, but they need to develop it quicker than the Ethereum team. I would like EOS more, if they wouldnt have that disclamer, that the EOS token isnt usefully to anything and that you dont have a right to redeem if for the EOS Mainnet tokens (though I know they do it, to be sure to be not seen as a security).

Agree with you completely. NEO suffers from high gas fees to add new coins, but new ICO's are rolling out on the platform anyway:

https://www.reddit.com/r/NEO/comments/7qfkpf/coming_neo_ico_schedule/

EOS has a proven team and if the earlier Larimer projects (Bitshares, Steem) are a guide, it will be incredibly fast yet stable. It'll also finally move out of the environmentally-unfriendly mining to staking.

I expect EOS to pump once their token sale ends since that removes selling pressure.

Coins mentioned in post:

What about the Ripple(?)

Thanks for the video.

Do you think this 'next wave' could potentially beat the market cap of the previous? I.e. could bitcoin get to 20k anytime in 2018 realistically?

I think it depends on what you count as the 'next wave' Even if we have a bull run going up to 15k in the next month, I doubt the market cap is going to reach new all time highs without at least one more pull back in between.

Do you consider the recent announcement by LitePay to be a catalyst in the bump this week? If they are able to deliver on their promises, LTC will be able to be spent anywhere that Visa is accepted, with a mere 1% fee. I am somewhat skeptical on whether they will be able to deliver, but it is an encouraging thought for many.

Based on what I saw, LTC seemed to start this next wave off by getting into the upswing several hours before the other major Alts.

I mention it in the video and description - it's a bump for Litecoin certainly.

I literally skipped that whole paragraph! That's what I get for not watching the video and trying to read while on a conference call. >_>

My apologies.

Hi! Thanks for your support, @growingpower just upvoted your comment ;) Hope you have a great day