Surviving Hyperinflation Through Cryptocurrency

My wife spent a year in Brazil in the late 1980s. One of the stories she shared was of her trip to the post office to send letters or postcards back home. It seems that the country was in the middle of a couple monetary crises; the value of the cruzado, their currency at the time, was tough to calculate. (They also lopped a bunch of zeros off the currency when she was there, creating the cruzado novo, so that added to the confusion.)

So she and her friends would have to wait in line at the post office. And wait. And wait.

Finally, someone would emerge from behind the counter with the day's number - just how much it would cost today for a postage stamp.

The next day, the number might be different; a week later, different still.

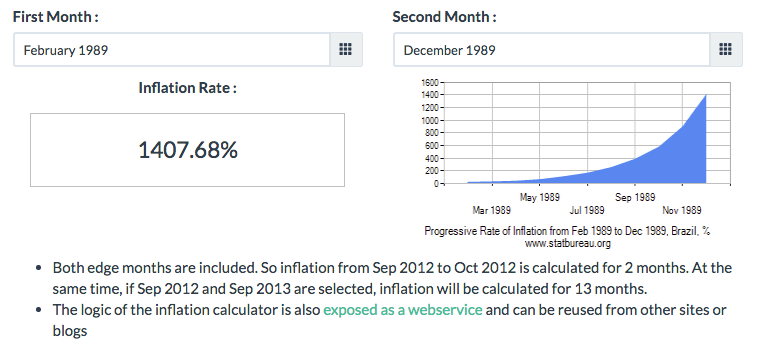

I thought this story was crazy...then I looked at the charts

A quick trip to StatBureau.org and I was able to confirm that she wasn't kidding.

Brazil was able to stabilize over the years, creating the real in 1994, and it has remained somewhat stable in the grand scheme.

But not too far away, Venezuela's hyperinflation story is a lot worse.

Venezuela And Crypto

Since my firm, Metacoin, has been working with POW, a digital currency that launched in October, I've been interested in how certain kinds of cryptocurrencies could conceivably leapfrog (or sidestep) country currencies in places like Venezuela. Note that Venezuela's own boilvar has an inflation rate that makes Brazil's look tame by comparison.

Before we look at POW's case, though, let's look at a couple other crypto developments - and see how they intersect with what's going on in Venezuela.

Venezuela's Own Crypto

This crypto, called the petro, was a bad idea from the get-go. Bloomberg wrote about it - one of the better places for financial journalism - and what was interesting is the Catch-22 going on here. First up, the bolivar is the official currency. The exchange rate is pegged by the government - so the only way to get real value for your bolivar is to go to the black market and trade it for dollars. Then, you could trade your dollars for the official crypto - if you believed that the government had pegged its value to oil, as they had said they would.

But the US government told Americans that they cannot invest broadly in Venezuela - because of sanctions - and specifically in the petro - because its value was tied to Venezuela's oil.

Maduro, the dictator in charge in Venezuela, cooked the books on the petro - telling the world it sold some crazy amount in its ICO. It didn't.

What About Bitcoin?

Well, it seems that Venezuela is already on board. This article from December from an Australian site called news.com.au tells us that the bitcoin market has been alive and well. This is refreshing: bitcoin is pretty much the gateway coin, and, while other coins might be used semi-widely, BTC pairs are going to be the way to go for a little while. Right?

Maybe Others Can Take Off, Too

There needs to be a market. A use case. Fungibility. Divisibility.

Bitcoin is already there, ether is there, too, and DASH and quite a few others could follow suit.

POW - which we talked about at length on our Metacoin site a few months ago - is on its way, with 300,000 users and counting (many of whom have already been exchanging their currency for goods and services through the site).

We'll be following this story, of course, in the months to come...

But we're curious - are you in an economy that is struggling? Have you seen crypto used as a solution to everyday problems? Let us know in the comments!