Why Owning Bitcoin Reduces Risk

Do you make the mistake of thinking bitcoin is risky?

Working with family offices I learned that risk reduction is the key to wealth preservation.

How do you reduce risk? Step number one is to ensure your assets don’t move up and down at the same time.

Said in another way — risk is largely driven by correlation.

When we look at risk from the perspective of our entire portfolio we find that correlation plays a bigger role in portfolio risk than the volatility of individual assets.

Interestingly enough — adding assets like bitcoin that have HIGH volatility but are not correlated to the other assets in your portfolio actually REDUCES your total portfolio risk.

This might seem like an oxymoron and it reminds me a bit of low fat diets.

It took me years to get people to believe that adding fat to their diet would actually help them lose weight.

‘So you are telling me adding fat makes me lose fat?’

Yes!

ELI5: Movement is risk. The more things move the riskier they are.

Imagine your portfolio is a box suspended in space with bouncing golf balls inside. 100 balls bouncing slowly in rhythm will move the box considerably.

Adding 5-10 fast moving balls that are moving in random, non-correlated, directions will tend to reduce the overall movements of the box.

Even better yet would be to add fast moving balls that are moving in the exact opposite direction of the slow moving balls. This is known as negative-correlation - now the box is moving even less.

Bitcoin & fiat currency have some amount of negative correlation. We are mostly seeing this relationship in emerging markets but it's reasonable to think that Bitcoin will become significantly negatively correlated with the dollar, euro, and other major currencies in the future as well. I'll cover more on this topic in a future post.

Wall Street’s Budding Love Affair with Bitcoin

Like family offices, there are many people and businesses that pay large sums of money to financial institutions to help them reduce their risk and preserve their wealth.

As mentioned above, reducing correlation is a great way to reduce risk.

When talking about bitcoin note that this CNBC reporter leads with ‘non-correlated’:

"a non-correlated, new asset class with very high returns… there’s an absolute wall of money ready to come towards this market."

A wall of money is coming indeed.

But it’s not here just yet because the legally permitted instruments (Bitcoin ETFs, Futures, Derivatives, etc) don’t yet exist.

But they are coming:

Once these instruments arrive bankers will make their client’s ears bleed talking up bitcoin’s benefits as a new non-correlated asset class that reduces their risk (while at the same time providing the potential for high returns).

The marketing about the coming Wall Street invasion of bitcoin is ramping up. Here’s another:

I think bitcoin is an under owned asset with potential for huge institutional sponsorship coming,” Fundstrat co-founder Tom Lee. (source)

Benefits of Buying Bitcoin Today:

It reduces your risk for the same reason the professionals are going to sell it to you.

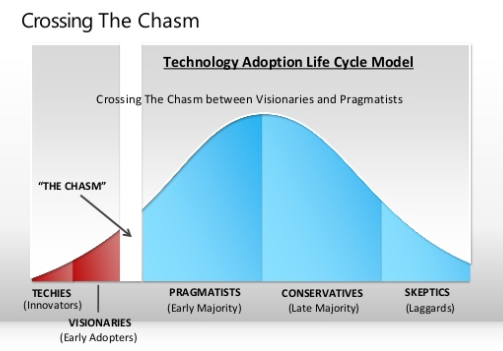

It lets you front run all the folks that have to wait to go through institutions (you still have time to be a member of the pragmatic early majority!)

Another Tried & True Way of Reducing Risk: 'Averaging In’.

Bitcoin can rise or fall dramatically at any moment.

It's the August 2017 and the price of bitcoin has risen aggressively recently. While I think there is plenty of more room to rise in the mid and long term, anything is possible in the short term. It is very common for bitcoin to pull back significantly after big gains. As a result I’d think twice before putting in a significant one-time bet unless you can stand large swings.

An easier, less stressful, and less risky way to get exposure is to buy in slowly.

This is easy to do — just set an automatic monthly buy on Coinbase for X$s or X% of your salary.

It’ll go up (a lot), it’ll go down (a lot) but just forget about it for 2-5 years and watch your risk waistline fade away.

You might even need to buy a new pair of pants.

Disclaimer: This is just my opinion; not advice or ‘investment’ advice of any kind (assuming this is even legally considered an ‘investment’). Do your own research, listen to varied opinions from informed people, then form your own opinions and don’t put any more into crypto than you can afford to lose.

PS > One more step the ‘intermediate’ bitcoin investor should consider if looking to further reduce risk is holding some amount of BitcoinCash. My thoughts on that are here.

PPS > This article also posted on Medium; connect with me on LI or Twitter.

I do agree that it acts as an investment hedge as in the event of a Cyprus style scenario no one can gain access to your BTC without the private keys.

Great info! Thanks for sharing! Cheers!

I have zero knowledge or experience in finances. Diversity seems key to me as well as being active with my assets. Also, silver seems low, especially when it hit 14 bucks per ounce.

Congratulations @dustinbyington! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @dustinbyington! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!