Crypto Market Analysis 2017/2018

2017/2018 Crypto Market Analysis

Some stats about 2017

.

- The total market cap of crypto grew from $18 billion to $800 billion.The market grew 3,550%

- Bitcoin was $972 on Jan 1st. By December 31st it was at $13,411, with a 2017 all-time high of $20k

- Litecoin grew by 5,300%. £2,500 invested in Litecoin from Jan 2017 to Jan 2018 would have returned you £132,500. £19k would have made you a millionaire!

- Ethereum grew by 10,000%. £2,500 invested in Ethereum from Jan 2017 to Jan 2018 would have returned you £250k. A £10k investment would have made you a millionaire!

- Ripple grew by a whopping 43,000%. £2,500 invested in Ripple from Jan 2017 to Jan 2018 would have returned you a cool £1million by the end of the year.

These are some of the major alt coins. Many of the smaller market cap coins returned 10,000%+ over the course of the year.

The Big Stories of 2017

Public Awareness -

2017 was definitely the year the world finally heard about Bitcoin. It was all over the papers, making headlines, featuring on the news and a topic of conversation at social gatherings everywhere you went.

Bcash

The Bitcoin Cash (or Bcash as we like to call it) fork that happened on August 1st 2017 was a hot topic for sure. The true Bitcoin “Maximalists” (people who think Bitcoin is the only crypto worth owning) were not happy at all. The creators of Bcash seemed to want to centralise and monopolise the market and even made an attempt at something called “The Flippening”.

The Flippening is where a new fork of Bitcoin gets all the mining power moved over to it and makes that new fork of Bitcoin become the “real” Bitcoin. You can have a flippening with good intentions. If everyone running the Bitcoin network believes a new update is needed to better the performance of Bitcoin then they would all apply the software at the same time and mining power moves over.

Wall Street Futures Contracts

We saw the first traditional financial instruments implemented in December 2017 - the Bitcoin futures contracts. Up until this point it has not been possible for the powerhouses of the financial world to get exposure to Bitcoin due to lack of regulation.

The futures contracts allow investors to get exposure to the price of Bitcoin without having to buy the underlying asset. This also allows the big money to short (bet on the price going down) the price of Bitcoin. Normally, futures contracts allow the person buying them to take delivery of the underlying asset. However, the Bitcoin futures contracts only settle in cash.

The Bitcoin Bubble

The “Bitcoin is a bubble” narrative is actually nothing new. Ever since Bitcoin was a wee little nipper at $0.23 per Bitcoin people have said it is a bubble, it won’t last, it’s doomed to fail. One of our favourite websites is a site called “Bitcoin Obituaries” https://99bitcoins.com/bitcoinobituaries/ Every time a major article has beenwritten about the death of bitcoin, it is added to this site. Currently “Bitcoin has died 229 times”.

Whats In Store For 2018?

Is It Over?

Although it feels like everyone and anyone is on the crypto bandwagon these days, participation is still extremely low. This has a lot to do with two things…1 - The insane percentage increases we have seen. We cannot find anything that comes close to this in all of history. Anyone sat on the sidelines today looking at past returns can easily feel they have missed the move. The second thing is access to market….

Access to Market

Access to market is extremely fiddly. Buying most of the alt coins requires buying Bitcoin first, then moving it to a badly run exchange to buy the alt coins with your Bitcoin. This is extremely off-putting to people. In fact, most people are not even aware yet that this is what you have to do.

So, what will encourage people to buy these smaller market cap coins? .... Easy access

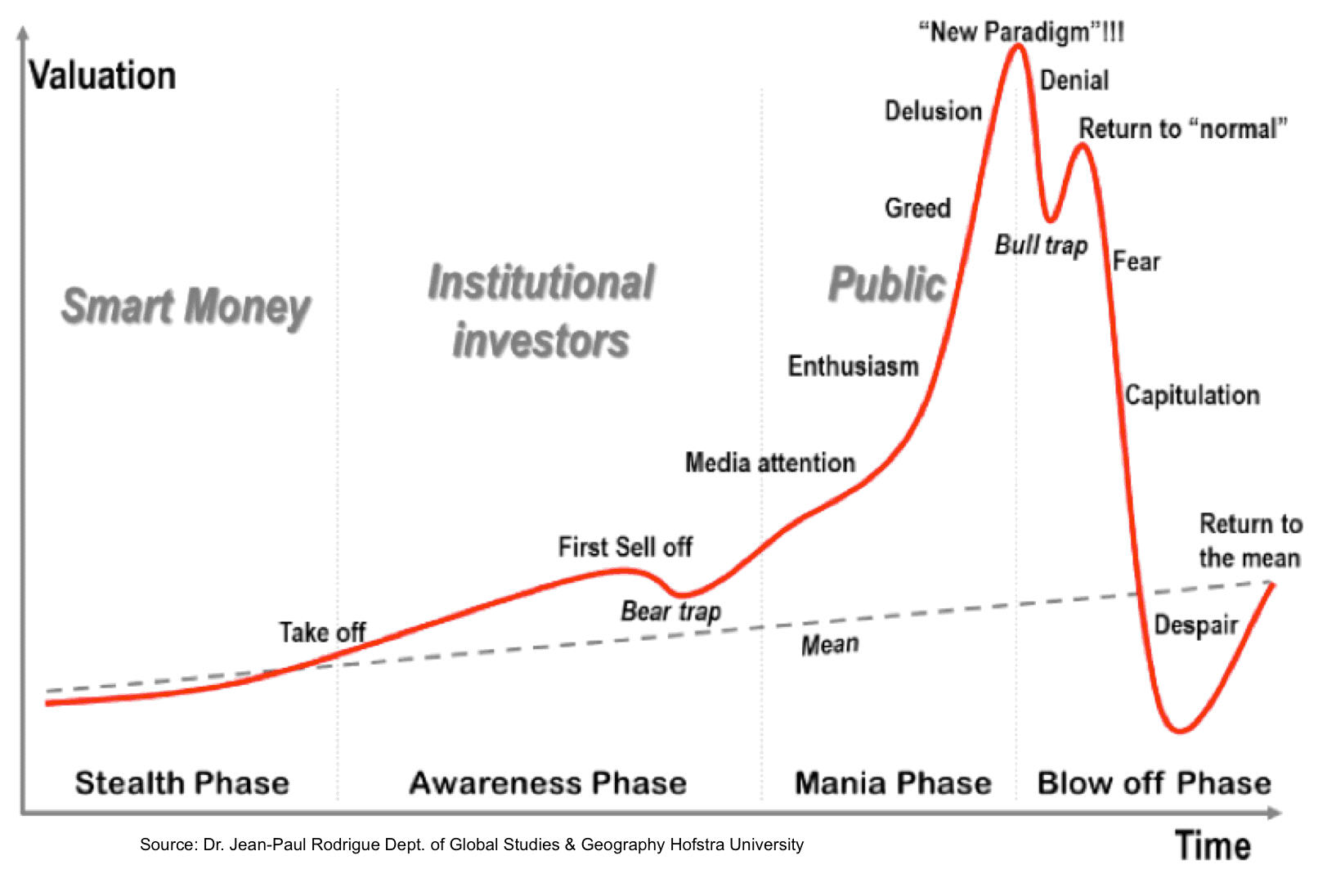

2018 will see much easier ways of buying these alt coins. There are companies in the process of setting up (e.g. fairx.io) that will allow you to buy hundreds of coins with your debit card. This will finally open the floodgates for the masses to get involved. People will start with £100 here and there, experience 3x returns and start to spend larger amounts as the greed phase of the mania kicks in, pushing the market to dizzy heights. Hold on to your hats, this will be one hell of a roller coaster ride.

Wall Street

As we mentioned above, Wall Street has only just entered this game and they have all the money. They are only really accessing Bitcoin at the moment via futures contract. We predict 100s of new investment vehicles will emerge, not only for Bitcoin, but all crypto. Goldman Sachs mentioned setting up a crypto trading desk. We will likely see the first Bitcoin ETF this year with many other crypto ETFs to follow as well a crypto index. This will allow the Wall Street money to flood in on an unprecedented level.

Think price rises were crazy in 2017? You haven’t seen anything yet! We are estimating a multi trillion-dollar market cap for the crypto space throughout 2018.

Speculation vs Sound Investment

Make no mistake, now is the time of the speculator. In the last 3-4 months, most people we meet outside of our education space have no idea what crypto really is. They are just interested in the price rise. From 2011 to the end of 2016 the space only had “believers”. People that could see how world changing this technology could be.

We have to be sensible and realise that anything that goes upwards at such a steep curve...always has a crash at some point. We have seen a multi-year bear market in crypto before (2013-2015) and we will see them again. It’s extremely hard to call a top in something so we have to work based on what we know at the time.

3 Things We Know

- Less than 1-2% of the population are currently invested

- Access to market is difficult, but about to change

- Wall Street money hasn’t come in yet.

Regulation

Regulation is coming. The IMF is beginning to take cryptocurrency very seriously. They are coming round to the fact that a decentralised currency system could have a huge effect on the current centralised banking system. Be prepared for big changes this year. Remember to store your cryptos safely. This year we could see exchanges shut down and accounts on those exchanges frozen. Only keep what you are willing to lose on an exchange.

Price Bias

Newcomers to the world of cryptocurrency look at the price of Bitcoin sitting at $12k and then look at something like Ripple at $1.20 and assume Ripple is extremely cheap. They say to themselves, "Imagine if I buy Ripple and it goes to $15k a coin, I can get 7,500 Ripple coins with $15k and only 1 Bitcoin for the same price"

They are unaware that price is being dictated by total coins in circulation. Bitcoin has 17million and Ripple has 38billion.

It's the market cap that's the most important thing to pay attention to when working out the value of a coin. Ripple is currently the 3rd most expensive coin on the market after Bitcoin and Ethereum, based on market cap.

Newcomers won't understand this and they will flock to what they perceive as "cheaper" coins. In the December 2017, the coins that have had the most percentage increase were somewhere between 10 cents and $1 a coin.

We have always said it is extremely important to understand and believe the project you are investing in but we are now also taking into account that the majority of people entering the space are not doing this, which means all projects, good or bad will rise as new money enters.

Price Analysis For 2018

We believe more money will flow into this space in 2018 than it did in 2017, which ultimately will push everything up. If we see a $2trillion market cap for the whole of crytpo in 2018, then Bitcoin’s market cap would at least double, putting it at $30k-$40k. If many of the $5-$25billion market cap coins were to break the $100billion market cap, this would put coins like Litecoin well over $1,000 a coin, Dash at $4-5k a coin and Stellar Lumens at $3-4 a coin. The point is, as money pours in, everything will be affected.

After Bitcoin’s crazy run from $7k to $20k, we saw a pull back and the alt coins take over. This seems to be a common trend over the last 12 months. Bitcoin rises, the alts fall then the trade turns back to the alt coins moving up.

Bitcoin’s dominance of the market is currently at an all time low of roughly 33% although it still holds the number 1 spot in terms of market cap. Will we see it taken of the top spot by one of the major alts in 2018? Possibly, but it’s hard to tell. Just when you think Bitcoin is finished and the alts are about to take over, Bitcoin roars and takes back market share.

We think February to May will see big moves in the market generally. Our next price target for Bitcoin is currently $25k. Our 2018 price target for Bitcoin is anywhere between $50k - $100k.

Our Investment Strategy

HODL - For those of you that have only just done our first course, you may not be familiar with this famous crypto mantra. A simple spelling mistake of the word HOLD on a Reddit post a while ago has now become the major word when markets correct....HODL. The acronym now has an official meaning “Hold On for Dear Life”.

Our portfolios grew thousands of % in 2017. We traded most days, researched constantly and stayed up until the sun rose watching the markets. At the end of 2017 we looked back at the year and assessed our progress.

We all worked out that if we had just stayed in the positions we had on Jan 1st 2017 we would have far exceeded our returns. Imagine that? We could have left our positions where they were and not endlessly chased the market, we could have gone to bed at reasonable times, seen our families and made much higher returns without all the extra stress and effort.

The point is, holding a position you believe in can actually be a lot more profitable as well as being a lot less stressful than relentlessly chasing the next big rising coin. We now look at our holdings as individual projects and not coins. Believe in the projects you have invested in.

Thanks for reading. This is not financial advice. Always do your own due diligence before you invest in something and don't be lead by anybody.

One of the best and well put together blogs I have read on this platform. Very informative and a great overall perspective on the crypto space. Thank you so much! I resteemed this blog and will make a point to read all of your posts. Thank you again! Cheers!!!

Interesting article, how did you derive your 2018 price predictions? 50k-100k is a pretty big range. Thanks for sharing.

Hey thanks for your comment. We are assuming more money comes into this space this year than did last year with the possibility of a multi-trillion dollar market cap industry in 2018. $50k is our target but what we learnt from last year is that everyone underestimated Bitcoins price hugely. I guess the point is, no one knows how far this can go. :)

good

Vote back me... :)

Congratulations @ed209uk! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!