Bitcoin TA - summary of analysts - 26. Feb 18

Regular daily update on BTC ta analysts opinions.

Own comment:

- @haejin is only slightly bearish as he expects us to break out of the wedge to the upside. @ew-and-patterns expects the wave C down to 8'000 before going up.

- @lordoftruth remains bullish.

- No updates from Tone and @philakonecrypto

Analysts key statements:

- Tone: - no new update until now -

He comments the iSHS several other analysts see. He thinks that pattern is to early to be called. If bitcoin is back at the neckline that would be the right time to talk about it.

Weekly is officially neutral (candle stick gave a reversal - downtrend and number count bearish).

Daily looks ugly. Reversal candle at the rejection of the triple resistance. We are on a 5 of nine which means likely 4 more bearish days to come.

4hourly - we are blow the 200ma - the 50 ma has totally flipped (down). We look like we will go down to new swing lows. Next decent support is fib line at 8'900 expecting a bounce from that area. From there at least to 9'500. - @haejin: The wedge chart (see below) becomes his primary count. This would lead as a next step to 8'989 and than bringing us back up again towards 12'527.

- @ew-and-patterns: White wave 3 should be next - he expects a sharp decline for today. Target remains 8'000 for end of wave 5.

- @lordoftruth: Price moved back up - he is expecting the SHS pattern to be in play and bitcoin moving up. It might be that we decline towards the 8.7 level (test support) though. Bitcoin at 14'500 to 15'000 by end of March is still his call. Expected trading for today is between 8'700 support and 10'700 resistance.

- @philakonecrypto: -no new update today - he got hacked and therefore has troubles posting -

Signals are mixed. He sees major resistance at 10'130. He sees a channel (on the 15 min chart) and a possible move up to the upper barrier line. General he waits for new signals from the market for a confirmation of mid term trend.

Overall sentiment: bearish

(last: bearish)

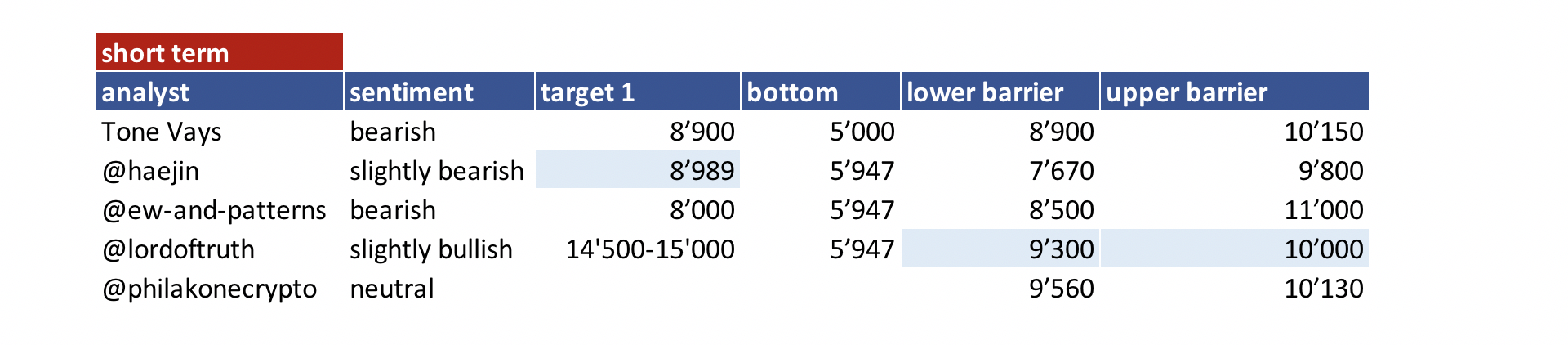

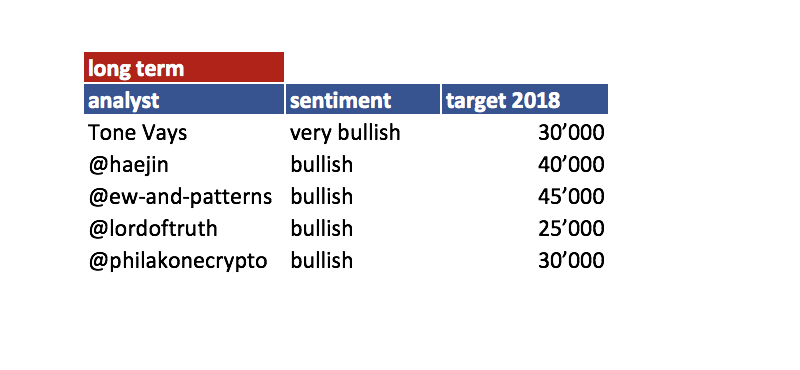

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 25. Feb | here |

| @haejin | 26. Feb | here |

| @ew-and-patterns | 26. Feb | here |

| @lordoftruth | 26. Feb | here |

| @philakonecrypto | 23. Feb | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely)

- target 1 = the next price target an analysts mentions

- bottom = price target analyst mentions as bottom

Both target are probably short term (so next few days/weeks) - lower/upper barrier = Most significant barriers mentioned by the analysts. If those are breached a significant move to the upside or downside is expected. It does not mean necessary that the sentiment will change due to that (e.g. if upper resistance is breached it does not mean that we automatically turn bullish).

If you like me to add other analysts or add information please let me know in the comments.

Hi @famunger,

It seems you got a $20.1117 upvote from @famunger at the last minute before the payout. (23.61h) and this comment is to make everyone aware.

Please follow @abusereports for additional reports of potential reward pool abuse. Thank you.

I'm not 100% sure, but I don't think this happens very often. After 20 minutes I'm the 5th upvoter and have your post $0.10 value.

Then back to the summary. Just like a little while ago I had a look at their predictions 1 week ago. Just before the market turned from bullish to bearish. And 7 days ago all analysts predicted a short term bullish market. It turned out to be bearish.

Did they all have it wrong? Or is there another explanation?

You are right - sentiment generally turned out to be different to what most of the analysts expected a week ago.

It might be also that my "sentiment" isn't so well defined in terms of time period. For example they could be bullish on a 4-6 week basis but expecting a dip in the next week. That is not so easy to cover. But I have ideas how to improve my report to be more precise in the future.

I was actually also thinking about writing posts when the sentiment is changing. But then I first need to dig in to all their predictions.

I think I read that scientific research proceed that nearly all forecast models have issues with forecasting when there will be a turn around in sentiment. So perhaps it's almost impossible to do so.

None of the Steemian Crypto anaylizer has a crystal ball to predict the future....ultimately, it is your choice to know how to increase the probability of increasing your projection correctly....imo

Upvoted for good question and thinking critically...

Thanks for both the upvote and reply.

Especially since I always read that we should not be (to) critically. But I still think it's best to be myself and part of me likes to ask difficult questions and show data driven things like this.

Hi swisschris! I made a small gift for you. My eyes were painful when i prepared it. But it was worth it :) I hope you will like it !

My post ; https://steemit.com/art/@rewossky/famunger-swisschris-charcoal-portrait

Good work.Appreciated & upvoted

But you need to add more analysts

analyst @salahuddin2004 predicting very well, in his recent updates for bitcoin , he mentioned price will not go below 9k this time which is proved to be true.

interesting and updating post...

Overview of last week and prediction of the next week,that's post is so acquainted for all the steem members...

@upvoted @resteem

Interesting to see all of these expert opinions in one post as always @famunger. I'm starting an ICO overview series soon and I'm looking for some experts about ICOs to work with me to find some good ones, and will do something similar to this.

Valuable post....

Very concise and helpful to anaylize BTC....good effort

@philakone as been hacked

Can be by thieves for putting too much information about his holdings OR because he gives too much TA for free, other analysts that asks thosands for their TA could not having liked it.

Just take care, use strong passwords and antiviruses, they do not want people giving away information to the public for free ...

hi, can you suggest any traders for daily reviews of ETH and LTC? thank you amd good job with these daily updates.