Debt is a method of control

There is an impressive amount of debt existing in the world. One of the best websites is the Debt Clock where one can spend hours just looking at all the numbers.

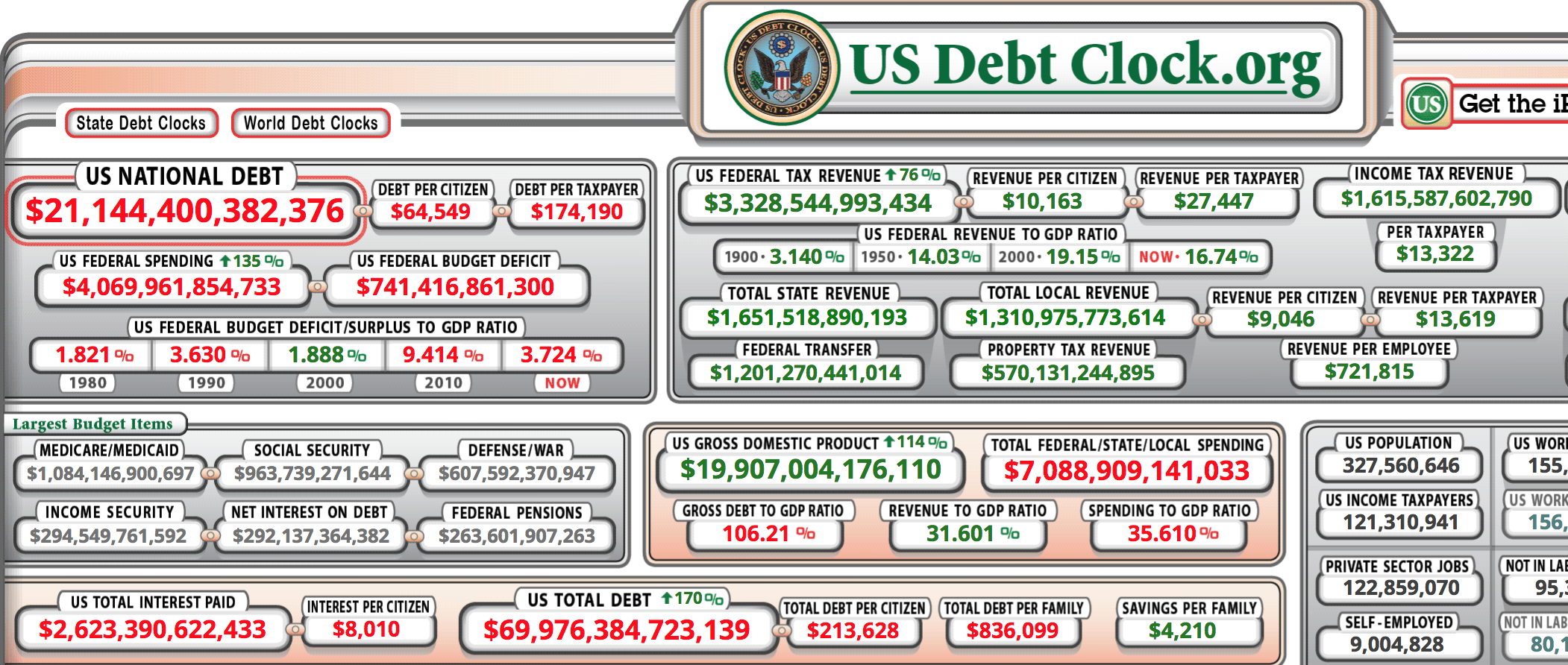

One quickly realises that there is more debt than wealth. This is no surprise as our entire financial system is build on debt. The moment the first dollar is issued there is more debt than money and that difference only grows. Currently the US collects 16.7% of every dollar spend as taxes, but itself spends 35.6%; or more than every third dollar in circulation and more than twice of what they collect.

Opposed to taxes that we painfully feel the debt remains unnoticed for a while. It is typical human behaviour. Lets just push our current problems back a few years. But just as taxes the debt does and will hurt us since nothing in this world is free. Somebody always has to pay the price.

Debt is in fact a tool for control. Lets be optimistic and say that we are the state. Since we own ourselves we can generalise and say that at least to some degree the state owns us because it is us. And here I am saying this in the most positive sense possible.

Now we want to spend some money and we go into debt. So far there is no problem, we got money and we have to pay it back. The problem is that the money the state lends is not spend in our interests (it is not given to us). Large parts are sunk into corruption, warfare and self-preservation of the state. The money flows to few corrupt individuals while the debt is remaining with us.

The state sells itself and gives the profits back to the buyers. These can then buy even more. But since we are the state, these people now partially own us. They claim that we are in their debt and have to work to pay them back. They go even further. They claim that also every new baby born already has a part of that debt and has to work their entire life to sustain this perverted system.

Currently every family has an averaged debt of 836000$! Good luck paying that back, especially considering it is probably faster rising than you can even earn money as an average guy.

This year in the us alone about 292 billion have been paid in interest from tax money. Comparable to the entire crypto market.

But it is not only government debt. Private debt is also an essential part of the system due to fractional reserve lending done by the banks. But it is all coming to an end. When the debt is well distributed the system can be sustained. But we have reached a point where few people have amassed a lot of capital and the rest a big pile of debt. The wealth is centralised, the debt distributed. But at some point it will become evident that even with maximum enslavement the masses can never pay bak their debt. Then the system breaks.

But we actually have a better chance. Bitcoin is a money not based on debt. The first bitcoin was just offered, no strings attached. When we step outside of the financial system and instead use private decentralised currencies we stop the madness. The dollar will become irrelevant and with it all this debt. Who cares if we have a few million$ debt if thats just a few satoshi's?

Bitcoin is not only some internet money, it is a clean financial start for a future world where money is no longer used as a tool to enslave us.

If hyper inflation ever occurs though the debt becomes worthless. Why do you think the Chinese have stopped buying our debt? In a few years it will probably not be worth anything.

Yes hyperinflation is one way to wash out the debt. But the interest rates can be adjusted to protect against inflation. When interest rates dont grow then then state can only print money in such a case. That however will further push into hyperinflation. It is a well known pattern of past inflation crises together with an acceleration in money velocity.

I think that hyperinflation occurs exactly because the trust in the debt is shaken since that debt is the fundamental building block of our currency.

Buying debt is making a bet on the state, buying bitcoin is betting against.

Debt is not just that - U. S. treasuries. Look at any USD - it says: "Federal Reserve Note" and "In God We Trust". A "note" is a debt instrument, a negotiable debt instrument.

So, what most people called the USD "money" is incorrect- every USD is an IOU and you exchange one IOU for another thinking that they are money.

It has already become worthless! In 40 years, a U$D can now only buy $0.05 worth of goods. From 100 cents to 5 cents - would you call that becoming "worthless" I do. It certainly is "worth less".

the thing is when the debt inflates they just use that as an excuse to make even more debt. The number of debts as a function of gdp has increased a lot in the past years.

BTW, freedom = no more debt of any kind. I think we are all on the "freedom train" or the "freedom shift". I am here to look for like minded people and perhaps collaborate and form a "freedom-shift" group to educate people about such matters.

debt is much more than control - it is a master and slave relationship.

Rite !!!!!