Bitcoin: My College Paper On Satoshi Nakomoto and Bitcoin's Effects

This is my exact essay on Bitcoin, and the possibilities of crypto-currencies and block chain technology.

In the paper, I point out some interesting use cases and explain the potential of the block chain to help increase freedom for all humans.

Start Paper:

Satoshi Nakomoto’s Silent Currency Revolution

Money makes the world go around, as the saying goes. And for nearly all of us, money can have serious incentivizing properties. Money is the easiest way to be rewarded, or compensate others for labor or time. Perhaps many of us take for granted the fact that we have a stable supply of money, and can use it as a store of value. For thousands of years, however, all that humans had for money was just the ability to trade objects like livestock, tools, and shells or sticks. There was no concept of a universally accepted medium of exchange. The advent of money drastically changed the way that commerce was done throughout the world. And since then, precious metals have been the standard for money that all fiat currencies are based on. These fiat money systems use paper to represent a corresponding amount of a precious metal. One big downfall of these systems though, is that as soon as the entity in charge of the money supply decides that printing money is more advantageous than regulating the supply of the money, the system begins to fail. To remedy this problem, Satoshi Nakomoto released a white paper and set of code in 2008 that (although not its original intentions) had implications that would forever change the way that value is transferred from one person to another. Satoshi’s revolution was in a technology called bitcoin. Some may have heard of this technology in the news, but many know little of how it works, what it does, or the possible effects of this revolutionary technology.

What is Bitcoin? Bitcoin is a decentralized peer to peer money system that utilizes Blockchain technology. Bitcoin is classified as a Crypto-Currency, or an online currency that uses cryptography to ensure that it is not counterfeited. This is one of the most important aspects of bitcoin, and it is in part related to the strict limit of the total number of bitcoins that can be created. There will only ever be a maximum of 21,000,000 bitcoins ever “mined”. Mining is the word that we use to refer to the way that bitcoin is introduced into circulation. Miners are rewarded with Bitcoin for hosting and verifying the digital exchange of the tokens on the Blockchain. Anyone can mine Bitcoin, too. All that is required is a simple everyday laptop or computer device.

What makes Bitcoin so important, you ask? Bitcoin is important because it is the first technology in the age of digital money that does not have a central authority that verifies transactions between parties. With Bitcoin, the act of transacting is synonymous with verifying the authenticity of the transaction. In this way, all transactions are strictly peer-to-peer. Take for example that you want to send $1,000 dollars to someone in Japan. With the traditional money system, this process would take several days to weeks to complete, not to mention the transaction goes through an institution or bank that facilitates this transaction, and takes anywhere from 10% to 20% in fees. Contrast this with Bitcoin however, and the transaction takes place in seconds, and has fees <1% of the transactions value. Further, anyone can own a Bitcoin wallet. The software is open source, and you can even store the bitcoin in your wallet in your mobile device. There are no restrictions to who can use or send Bitcoin.

One popular use of Bitcoin is remittance payments. Many families today have one family member work and live in a different country than the rest of their family because that country pays better wages. That family member then sends as much money back home to support the rest of their family. Unfortunately, though, much of the money sent back home gets eaten in fees by banks. However, now they can use Bitcoin to nearly eliminate these fees. The technology that Bitcoin runs on, called the Blockchain, can be used in many other cases than just sending money, too. Any asset or asset ownership document like a deed to property, a license, or certificate can be digitized and then sent or traded on the blockchain. One of the soon to come uses for this will be the digitization of the stock market. Imagine, not having to rely on a stock broker to make stock trades for you, when you can now do it by yourself, and not have to pay $5 per trade.

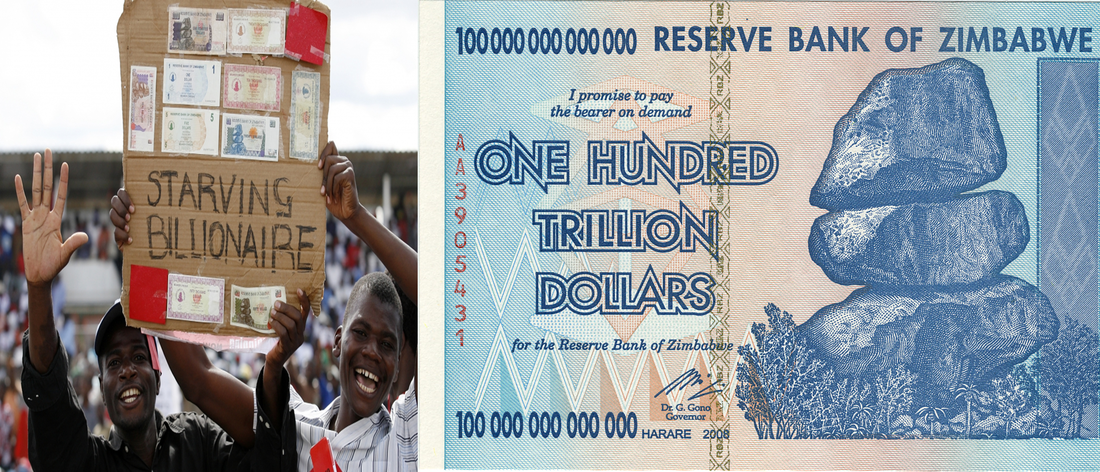

Another advantage to the Bitcoin system is that with its decentralized nature, there is no way to censor or restrict its usage. No one can tell you when you can send money, how much you can send, or who you can or can’t send money to. There are no chargebacks, either, which reduces fraud (Nakomoto, 2). Further, since there is a hard limit on how much bitcoin will ever be created, Bitcoin is inherently deflationary in nature. If you look at the United Sates dollar for contrast, you will see that since its creation in 1913, the Federal Reserve has printed away 98% of its purchasing power, over the span of roughly a hundred years. That means, for every dollar you had in 1913, you effectively now have 2 cents, or that for what you could buy for 2 cents in 1913 will now cost you an entire dollar. This structure of central control is the exact antithesis of Bitcoin, which is why the technology has so much potential. Originally, the purpose of Bitcoin was to make very small transactions (micro-payments) more economically feasible, because of the very low fees of bitcoin. However, the very first purchase using Bitcoin was in 2010, when a man from Florida paid 10,000 Bitcoin for two pizzas (Bort 2014). Two pizzas. The Value of those same bitcoin today would be over $52,000,000 USD.

When Satoshi Nakomoto released the Bitcoin Whitepaper in 2009, there is no way that he could have foresaw the world changing potential that it would usher into the ether. Many think that Bitcoin will have as much importance in the coming years as that of the internet. The use and widespread adoption of Bitcoin, or other crypto currency assets as a universally accepted medium of exchange will forever change the power structure in all countries, returning freedom from financial manipulation by governments and central banks back to its citizenry. Never again will the earth see starving billionaires, like those citizens in post World-War I Germany, or in modern day Zimbabwe.

Works Cited

Bort, Julie. “May 22 Is Bitcoin Pizza Day Thanks To These Two Pizzas Worth $5 Million Today.” Business Insider, Business Insider, 21 May 2014, www.businessinsider.com/may-22-bitcoin-pizza-day-2014-5?IR=T.

Nakomoto, Satoshi. Bitcoin: A Peer-to-Peer Electronic Cash System. www.bitcoin.com, 2008, Web, https://bitcoin.org/bitcoin.pdf.

I really hope that you enjoyed my paper. Please comment below your thoughts and feedback!

Best,

Aaron Kopplin

Steem: @h2ovapor

LinkedIn: https://www.linkedin.com/in/aaronkopplin/

Twitter: https://twitter.com/a_daddy_fresh

Instagram: https://www.instagram.com/a_daddy_fresh/

Great read, good work. Thank you for sharing!

Thank you! What was your favorite part of the paper?