Coinbase Customers To Sue After Bitcoin Cash Soars to $700

Another rendition of bitcoin hit the market on Tuesday and, on its second day of exchanging, it has just tripled in cost and its market top is presently third greatest of all computerized monetary standards.

Known as Bitcoin Cash, the new money arrived through a purported "fork" in which a group of individuals who run the product that controls bitcoin began a breakaway form.

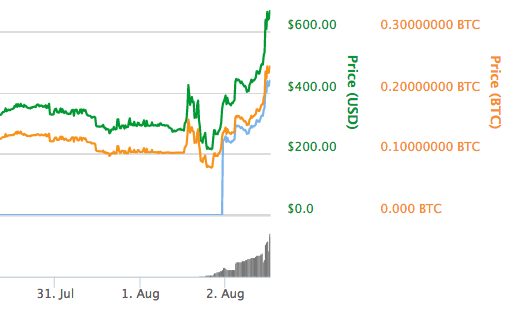

The cost of Bitcoin Cash floated amongst $200 and $300 for a large portion of Tuesday and afterward all of a sudden shot up. As this screenshot from CoinMarketCap appears (look to one side of the chart), Bitcoin Cash has likewise refreshing in connection to bitcoin—one unit of the new money is currently worth around 30% of the first one:

In the mean time, the cost of the first bitcoin has, in spite of the feelings of dread of numerous bitcoin proprietors preceding the split, kept up its esteem. On Wednesday, bitcoin was exchanging around $2,700, which is not a long way from its untouched high of $3000.

With respect to Bitcoin Cash, it can be viewed as another advantage class that accomplished a valuation of $12 billion actually overnight.

It's misty if Bitcoin Cash will be capable keep up its incentive since, as other advanced monetary forms, its genuine utilize is constrained and its esteem gets basically from what financial specialists appoint to it.

What's more, some portion of Bitcoin Cash's surge in esteem might be attached to a liquidity issue emerging from a choice by a few trades to decline to circulate the new money to their clients.

Claims Brewing

The formation of the fork in bitcoin's blockchain—the product record that for all time records all exchanges—by a minority of bitcoin administrators took after a time of astringent infighting in the bitcoin group.

The subtle elements are obscure (they fixate on the size and preparing pace of the "squares" on the blockchain), however the upshot is there are currently two bitcoin blockchains, each with its own cash.

Get Data Sheet, Fortune's innovation bulletin.

Upon the production of the new chain, the breakaway group granted Bitcoin Cash on a one-for-one proportion to each proprietor of bitcoin. So if a man possesses five bitcoins, they are qualified for five units of Bitcoin Cash.

This plan has been entangled, be that as it may, by the choice of the world's greatest bitcoin trade, Coinbase, not to help Bitcoin Cash. For commonsense purposes, this implies the a huge number of individuals who keep up a wallet on Coinbase did not get the new "Money" and, starting at now, there is no chance to get for them to do as such.

Coinbase has plainly expressed the organization is not taking clients' Bitcoin Cash for themselves, but rather its choice to withhold the new money has driven one noticeable lawful researcher to recommend the organization will be sued.

Furthermore, for sure, that now looks liable to come to pass. A lobbyist gathering, which asserts Coinbase's choice is likened to a business withholding new offers from its financial specialists, cautions it will start a class activity suit after August 15 if the organization doesn't discharge the Bitcoin Cash.

Then, a lawyer named Priyanka Ghosh-Murthy disclosed to Fortune he plans to record a protestation—conjuring carelessness, rupture of trustee obligation, and out of line advancement—in Florida before the week's over.

Thanks for reading. Hope you gained something from it!