What is behind the bitcoat volatility

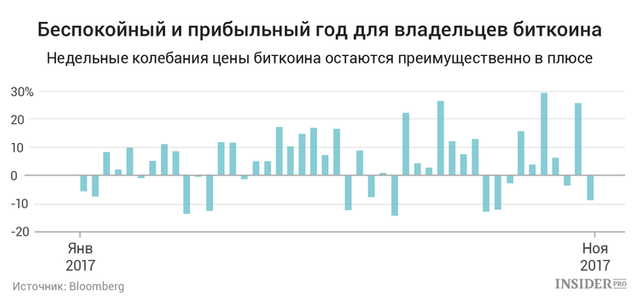

The price of bitcoins has always been volatile, but what happened at the end of last and the beginning of this week - a one-third collapse and subsequent sharp recovery - was unusual even for her. Those who tried to follow the news from the crypto-currency market, in abundance, read specific industry terms: forks, blocks, Bitcoin Cash and Segwit2x were mentioned.

In general, confusion and general confusion is a natural consequence of a situation in which no one person or group of people responsible for solving the technical and commercial problems that have emerged due to the success of the crypto currency. This can be a minor hindrance before groups with different interests and ideology reunite, or a sign that the future of bitcoin is threatened.

Like most other software, the bitcoin network needs periodic updates that will add new features. Difficulties with the processing of transactions bitcoins grew, it was simply not profitable to use the crypto currency for some small transactions. However, unlike other software, updating the bitcoin network requires the consent of users, in particular, miners, whose computers run the software to upgrade to the new version. Over the past few months, the network of bitcoins has already split - or, as they say in the industry, there was a fork in it - twice, and now there are three different versions of the crypto currency: bitcoin (Bitcoin), Bitcoin Cash and Bitcoin Gold.

- What foresights have occurred?

In early August, the bitcoin network was divided into two parts, which led to the appearance of Bitcoin Cash (Bitcoin.Cash). Then the network was changed, allowing faster and cheaper to make transactions. Then in October the network split again and Bitcoin Gold token appeared, different from bitcoin by mining features.

- What is the reason for the sharp jumps in the rate?

When Bitcoin Cash appeared, most members of the bitcoin community viewed this fork as an extra step and assumed that its consequences could be eliminated with a larger network upgrade planned for the fall. It was called SegWit2x and was supposed to double the blocks in which bitcoin transactions are handled, network speed is increased, and transaction costs are reduced. However, the update, which was coordinated with great difficulty and around which heated debates were heated, was canceled at the last moment, as its support has weakened amid concerns about security and disputes between kernel developers and miners. After the cancellation of SegWit2x, the price of bitcoin decreased, while Bitcoin Cash - now the network with the largest block size - took off, briefly pushing the air from the position of the second capitalization of the crypto currency.

- What is the reason for the disagreements?

Many miners and other users feared that the hardcode caused by the SegWit2x update would make the network vulnerable to the so-called playback problem - in this case, the same transaction can be made in both the old and the new version of the chain. Critics said that updating SegWit2x was initially opaque, and this could create a security threat or give its developers an advantage in managing the network.

- What will happen next?

There is a widespread belief that bitcoin-network should work faster. Supporters of SegWit2x argue that the need to speed up the network can be the reason for the adoption of this update. Other community members have moved on to finding completely new solutions, and this can lead to another split in the network.

- Why did this happen?

When the security system of the bitcoin network was conceived, no one expected the volumes of transactions that are going on now. To prevent forgery, the miners verify bitcoin transactions by groups that are called blocks. The blocks are then joined together to form a decentralized public registry, known as a block cache. It is his existence that is one of the key reasons for the demand for crypto currency. Because of fears about cyberattacks, system developers have limited the block size to 1 MB. However, as the popularity of bitcoin increased, the time of transactions and the payment for processing them increased to record levels.

- How serious are the problems?

According to blockchain.info, this year the average time for confirmation of the transaction at some point soared from 20 minutes to 6 hours. The number of deferred transactions soared to a record level, behind them rushed the fees of the miners, as the owners of bitcoins began to offer them more money for speeding up the processing of transactions. In recent weeks, overload (and fees) have dropped significantly, as some users simply avoid transactions. However, the charges are often so high that the use of bitcoin becomes unreasonable for many users.

- What does the ideology of bitcoin have to do with all this?

Created in 2009 by a human or a group of people under the pseudonym of Satoshi Nakamoto, bitcoin initially attracted those who wanted to resist the control of sovereign regulators and central banks. One of the reason for this is that unlike the usual currency, which can be printed as many as you like, the bitcoins can not be produced more than 21 million pieces. By the time the bitcoin capitalization reached $ 75 billion, there was a growing debate about whether it was necessary to integrate bitcoin into the global financial system or, on the contrary, to strengthen its position as a libertarian guiding star. A more practical version of the discussion concerned the question of whether bitcoin would become an asset for savings like gold, or the community should focus on turning it into a payment system and a platform for economic activity. And also - more importantly - whether to develop the underlying technology or divide it in two.

thanks for info