Can Crypto Space become another Dotcom Bubble?

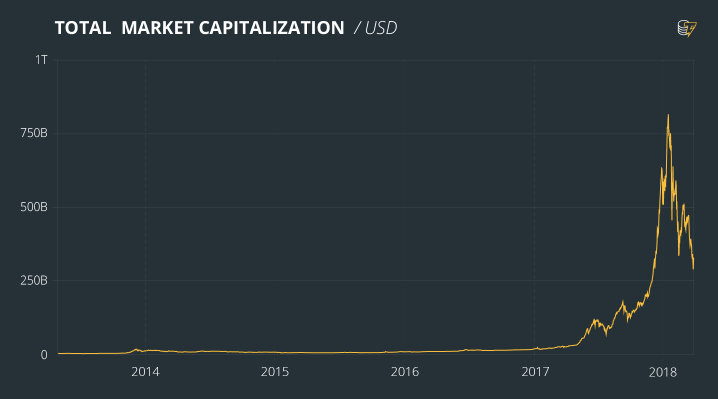

The cryptocurrency craze of the past year has increased the price of encrypted tokens to tens of thousands of times its original value. Bitcoin is not the only sign of reaching its historical high. Even the prices of Etretum, Cardano, Ripple, Stellar, NEO, and other altcoins have been driven by increased demand from investors seeking to take some actions, and have thus reached new heights. In January of this year, the cryptocurrency market reached a peak of nearly 800 billion U.S. dollars in total capital.

The rapid rise of the market has many, especially those from traditional investment, calling this phenomenon a "bubble." As people try to use the past to understand new events, the password space has passed through the "collapse of network communications" in the late 1990s-early 21st century. After the so-called "network bubble", hundreds of companies reached their goals.

So, does the password space move toward a similar path?

Still a frontier

The password space can still be considered as a frontier. As a technology, blockchain has only begun to be widely adopted. There are still some regulations to guarantee the inspection of companies and participants. The market relies heavily on speculation. Most of the items behind cryptographic tokens haven't even shown or provided explicit real-world value.

It seems difficult to determine the basis for promoting the performance of cryptocurrencies. Even without the basic basis for a sudden increase in tokens, support can easily be transferred from one project to another.

It is also difficult to predict how certain events affect the market. For example, considering that the country has banned initial coin-operated products (ICOs), many people expect the blockchain project in China to be difficult to consider. However, this ban seems to be very beneficial to companies like NEO. Since the launch of the platform, it has largely avoided the use of scam projects that have already emerged. Support for the project is increasing, and when Bitcoin depreciates, NEO's social hype and price movement even shows flexibility.

Comprehensible comparison

When the transaction price of an asset is significantly higher than its intrinsic value, an economic bubble is formed. The highly speculative nature of the password market has certainly led to overvaluation of some cryptocurrencies. For example, the market value of paparazzi coins at the time of writing exceeded $323 million. Its peak has even reached more than one billion US dollars - the amazing achievements of this project are just an imitation.

Therefore, through the traditional definition, there are some foundations for what can be called cryptocurrency. Therefore, comparing it to the Internet bubble is natural and fairly fair because it is the bubble that recently involved destructive technology. Both show similarities in the accumulation of events.

The arrival of disruptive technologies. The advent of accessible personal computers, commercial Internet service providers, and better web browser technology has created a consumer market for Internet companies. In the 1990s, the popularity of the Internet was also growing rapidly. As for encryption, Blockchain has existed for a longer time before the cryptocurrency boomed. The use of distributed ledger technology was proposed more than a decade ago. Until recently, more applications were discovered around Bitcoin discussions and the launch of platforms like Ethereum. Traditional institutions legalize technology by starting their own blockchain projects.

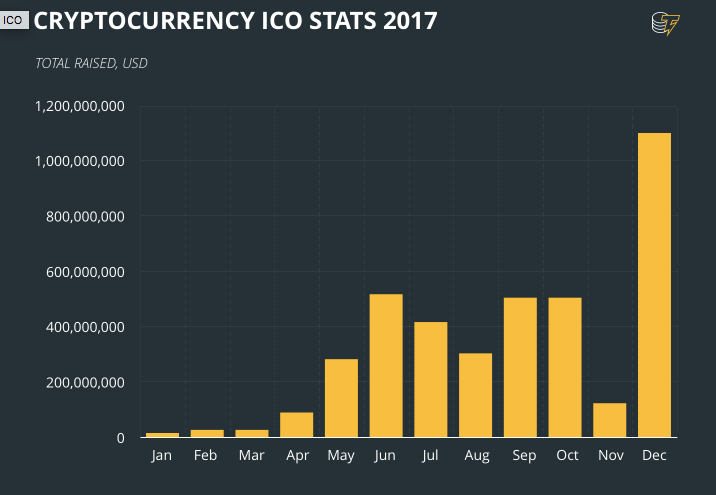

Business explosion. Both of these events highlight the sudden explosion of projects and companies that want to use this technology. Hundreds of companies were established during the dot-com bubble. In 1999, there were 457 initial public offerings (IPOs), most of which were high-tech companies. In March 2000, during the peak of the market, there were a total of 4,715 companies traded on the NASDAQ market. The encryption industry is experiencing similar things to ICO. In 2017, CoinSchedule recorded 210 ICOs, only 43 from 2016. These ICOs raised more than $6 billion in funding. This year, there have been more than 70 token sales.

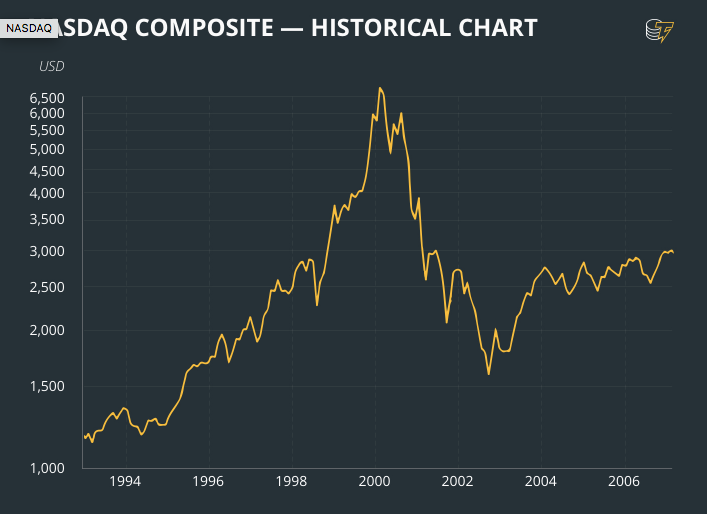

Sharp climb in stock/token prices. Internet company share prices skyrocket while the dotcom industry was developing. Of the IPOs in 1999, 117 companies doubled their share prices just on the first day of trading underscoring the exuberance of the market. Nasdaq peaked in March 2000 hitting an intraday high of 5,132. Crypto tokens display even more gains. It isn’t uncommon in the crypto market to see tokens rise to hundreds of times their ICO prices in just a matter of months.

These patterns make many people believe that the encrypted trajectory is the same. At some point in 2002, the Internet bubble burst. Nasdaq bottomed out in September 2002. It is expected that bad projects will eventually overestimate. The market eventually corrected in a large-scale manner. It is expected that the coin will lose value. Projects and businesses will go bankrupt. Investors will lose bets. what is this

The recent events seem to tease similar things. A large-scale adjustment took place in February, and bitcoin prices fell to the $6,000 mark. Other coins also suffered major blows. The total market value dropped from a peak to about US$265 billion, a decrease of more than 60%. Many people think this is a bubble burst. Analysts even warned that Bitcoin will be below the $1,000 mark. The price of tokens has been very volatile throughout March, and the bottom has not yet been found.

sourced @ cointelegram

We recommended this post here, here and here.

STOP

I am following you. Please follow me back.

Article stolen from cointelegram. Flagged

wheres cheeta at?