@nolnocluap's Portfolio Update #8: Bullion For Steem, Exchange Restrictions, Lightning Network, Buying Crypto Again

It's been a while...

...since the last of my Portfolio Update series posts. My intention with this series was to collate some of the thoughts that float around in my head when trying to manage my own assets in the hope that they are of use to others or perhaps to spark discussion around some of the conclusions I draw. So, what's been on my mind recently? Let's dive in.

Exchange Restrictions

I'm somewhat ashamed to admit that when it was available, I previously used the PoliPay feature provided by Australia Post to move fiat from a bank account to one of my exchanges, btcmarkets.net. They've since dropped Poli support and perhaps that's not a bad thing in one way as I detest what is essentially indistinguishable from a phishing scheme.

Reference

The convenience of fiat transfers that occur in under a few minutes was too much to resist for me early on. I'd stopped using it for security reasons before it was dropped. What I've noticed this week however is the remaining option, BPay, is very slow to respond when you're looking to move liquid funds into an exchange to snap up some good deals.

If you want to avoid upgrading your exchange account (or more correctly, avoid providing the extra verification required to do so) then you're limited to AUD 2k per deposit and those deposits with BPay take days so for any significant funds, you're only trickling liquidity into the exchange. It puts a brake on any attempts to buy.

To be fair, the upcoming New Payments Platform which I recently wrote about here is looking positive for adoption by Australian exchanges and may act to reduce the restrictions currently inherent in funding exchange accounts. I'm yet to learn what KYC requirements will need to be met with it however.

My grandfather had a saying. "What can't be cured, must be endured". Despite passing away in 2006, he must have had this particular crypto exchange scenario in mind (he was a great thinker). I'm still drawing down fiat at whatever rate the BPay system will allow and am now getting back into the market as a buyer after selling most of my crypto holdings as the selloff commenced.

For those interested, Nugget's News has some great material on what's involved in running a local exchange. From participating in international markets to securing private keys and handling identity information it's a bit of an eye opener when learning about what happens behind the scenes. Some may be surprised at how nascent the whole thing still is. A good starting point for learning more is the Nugget video below.

Becoming A Crypto Buyer Again

Two days ago I'd selected a video to listen to in the car on my drive home from work. It was Jason Burack interviewing the founder of the crypto currency education company, Cryptoversity Chris Coney. After what feels like a long correction in the crypto market space, I'd zoned out to it somewhat. This interview reignited my interest in the tech and the freedom that the tech brings. It reminded me of why we are all so interested in this game and it's a great listen.

In the week just gone, I've been hearing more and more technical analysts talk about entry indicators and, with the small amount of liquid funds that I have on-exchange (reference above section) I started buying in. In recent weeks I've been using LTC almost exclusively for transactions for its speed and cost but this time, I went with a couple of BTC buys.

My intention here is to HODL. I don't have the time or resources to be trading anyway and for me it's about diversifying assets over as many (ideally non-fiat) instruments as possible. I note this morning that EOS is hovering at just over $10, Steem looks attractive again to me, along with a few of the others. I'd drawn down a lot of my crypto holdings as prices fell and to be honest, I've since felt a little naked not holding as much, regardless of prices. There's an interesting psychological observation!

Reference

The bloodbath is both good and bad. If you're liquid, this correction of over 50% is amazing. It's an opportunity to buy in at extreme lows compared to the pre Christmas values. Significant even in the crypto space. There's a big disconnect between the price and technology however as Ivan on Tech explains regarding the Lightning Network in the next section.

Lightning Network

When I first learned of Bitcoin's Lightning Network, I had a negative reaction. It felt centralised, it felt like a turd polishing project. I've since been reevaluating that position, thanks largely to Trace Mayer. How people feel about the Lightning Network is significant as it speaks to Bitcoin's fundamental usability in terms of availability, speed and fees. If these issues are considered to be addressed in some workable manner by the Lightning Network then it'd be reasonable to expect more BTC buying. That means, at least for now, that the rest of the market is likely to follow.

Listen to Trace speaking positively about the Lightning Network and Bitcoin in general in this video released in the last few days.

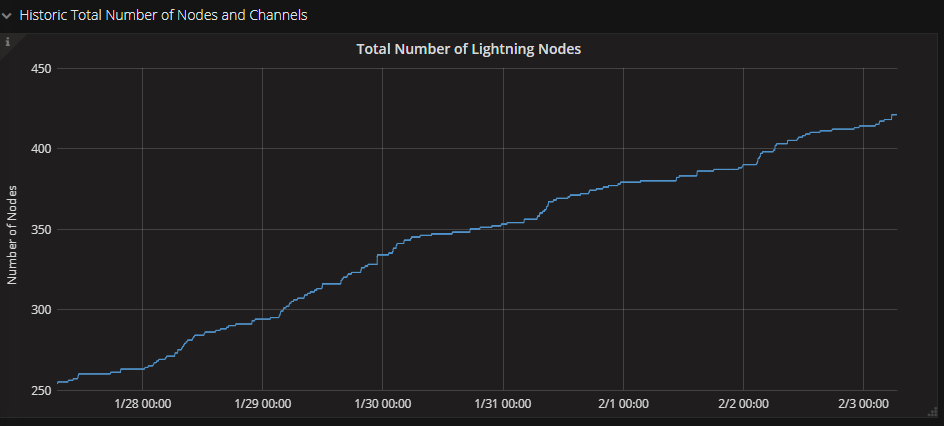

The Lightning Network already has over 400 nodes (421 actually at the point of writing) on the main network. In the above video, Ivan discusses the following points.

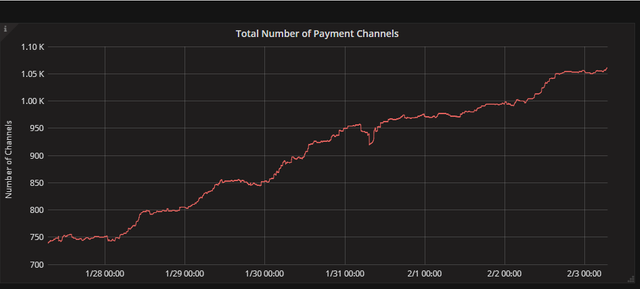

- The growth in Lightning Network is positive.

- Node adoption is increasing.

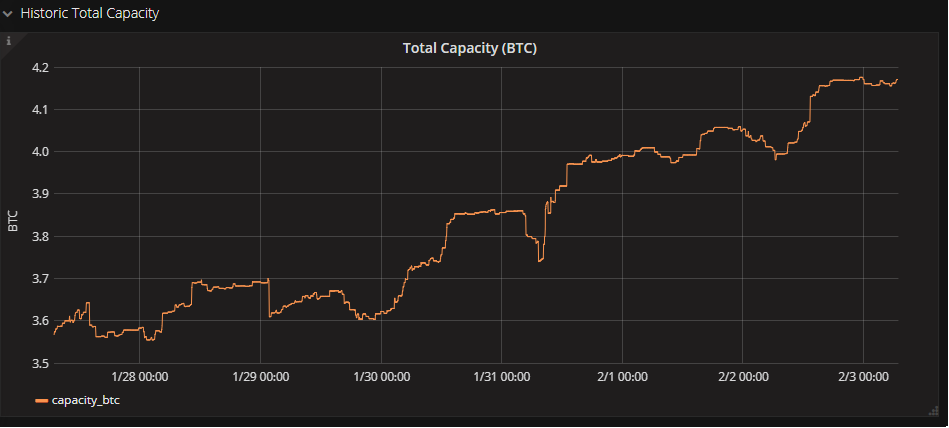

- Total capacity is increasing.

- BTC transaction fees are coming down (in fact Trace Mayer talks about the concept of negative fees on the Lightning Network as a possible way to incentivise usage - a neat concept).

Ivan makes the point that the underlying fundamentals on a technical and unility basis are in disconnect with the price at the moment. That is to say that prices have been aggressively falling while the technology and usability has been improving. To my mind, that's something to look at exploiting by buying in.

I've collated some recent statistics on the Lightning Network from this site (incidentally run by a Swedish gentleman) below to illustrate this growth.

Bullion For Steem

I'll finish on this point to spare my dear readers who have made it this far! This one I'm pretty excited about and is related to my recent discussions on the amalgamation of bullion and crypto as a business model.

It's come to my attention that there are now a few voices in the crypto and stacking communities pushing for the direct trade of Steem for bullion. I have learned that there may be more to this than just speculation and we may see this come to fruition this year. This is actually more significant than the general adoption of crypto being accepted for precious metal purchases as it means that earnings on Steemit can be used to pay bullion invoices directly, without the use of crypto exchanges.

Unless you're a miner, using crypto to purchase metal requires the intermediary step of exchanging fiat for crypto on an exchange and, inherently, enduring the restrictions I mentioned at the start of this post. As Steem is earned via the expenditure of labour, earnings are generated within the Steem ecosystem and this would me a lot more freedom in terms of exchanging labour for metal. It's something I see myself exploiting heavily in fact should it come to pass.

What exciting times we live in, wouldn't you agree? Thanks for reading and where ever you are, have a great day!

That's a good summary of a lot of different things.

I think your grandfather knew what he was talking about. If you can't get over it, then learn to deal with it.

It's probably not a bad time to buy Bitcoin as it has seen huge drops. It may go down further, but I don't think it's a bad place to buy in.

I think the effects of the Lightning Network have not even begun to be seen and that as it comes into play even more it will be a boost for the crypto space as a whole.

I think it would be great to have a direct Steem-Bullion exchange! I would be interested in using this if it were available. It would definitely open the merchants up to a whole new class of buyers!

Thanks so much @themanwithnoname. Yeah it's a great phrase and is hard to argue against! Glad to hear you agree with my buying BTC. I think if you were after quick trades you'd be more "careful" but for me just adding to a core position I think it's well suited.

I've yet to hear Lightning Network being talked about frequently, but it seems to be popping up more and more in discussions so I'd agree that we're only just starting to see its impact.

Oh for sure, post -> earn -> buy metal. What a glorious cycle to rinse and repeat!

Would be funny if they changed the projected payout to silver ozt rather than $.

I'm licking my lips already! Would be a nice plug in just to convert it on the page.

This is the best idea I've heard all day - although it's only 10am E.S.T.

Where can we call connect with people interested in exchanging steem:bullion?

Hi @john-robert! One approach would be to contact and campaign local bullion dealers. They would like need to have a penchant for crypto for best results. Other than that are you aware of the #steemsilvergold community on steemit? Lots of like minded folks there.

Good idea. And yes I've been following the steemsilvergold tag for a few weeks now. Want to pursue this for sure.

Fantastic!

Great article. It's true that popular hype was mostly driven by it's insane price action. We're now seeing Bitcoin take a short term beating on price so it may require the Lightning Network or some awesome new use case to revive the hype.

That is a very cool idea for trading Steem for bullion. Like you say it takes energy to create steemworthy content just like it takes energy to mine bullion. They're both commodities in a sense as well. Steem for operating the first truly decentralized social media platform and gold/silver have many thousands of years as a proven commodity.

How can we make this a reality? Some formal bulletin with Steem:Bullion offers?

Hi @john-robert, thanks for the thoughtful reply. It is exciting isn't it. To some extent I feel like there will be a natural evolution in the steem and bullion ecosystems. Currently, there is plenty of talk around the amalgamation of crypto and gold. Andy Hoffman's new endeavour is one example, so is goldmoney and so on. For those businesses such as Ainslie Bullion that capitalise on this nascent tech, times will be prosperous.

It's a buyers market now for sure, I'll probably buy some litecoin and convert it to steem

You see steem as being the strongest offering from here then @viraldrome? I tend to just accumulate from posting but have bought it before.

My thoughts exactly, Strong hands win..!!

https://steemit.com/cryptocurrency/@priyathamreddy/must-see-post-for-all-cryprocurrency-investors-right-now-black-friday-of-cryptocurrency

Just read your post @priyathamreddy. It certainly amped up my enthusiasm. Despite having coins that have fallen I'm happy for the chance to buy more 😎 thanks for the comment!