6 reasons why Bitcoin can't be compared with the 'Tulip Mania'

Bitcoin critics often use the Dutch Tulip Mania as their main argument. I've read multiple articles in which the similarity between Bitcoin and the Tulipmania is mentioned. In my opinion, this comparison makes absolutely no sense. Here's my six reasons why...

1. The tulip mania lasted only six months.

As you can see in the chart below, the tulipmania lasted from November 1636 to May 1637. The trade in tulips had been going on for years, but the real hype lasted only six months. Bitcoin exists since 2009 and the price has seen many ups and downs. People said it was a bubble when Bitcoin surged to $200 and the same thing happened when Bitcoin skyrocketed to over $1000 in 2013. Was the price surge from $1 to $200 a bubble? Or from $50 to $1000?

Image source: Wikipedia

2. Bitcoin is divisible, a tulip is not.

You can't break a tulip bulb into a million pieces. 0.0001 of a tulip would be worthless. You wouldn't even recognize it as a tulip. 0.0001 Bitcoin on the other hand can actually buy you something.

3. Tulips are not scarce

Bitcoin has a hard limit of 21 million Bitcoins. You can't just grow more Bitcoins like you can grow more tulips.

4. Tulips are not easily portable.

You can't easily carry thousands of tulips around with you or give a tulip to someone hundreds of miles away from you. They can be transported of course, but it takes time and is expensive. Bitcoin can be sent around the world with the speed of sending an email.

5. A tulip is not secured by millions of computers around the world

The Bitcoin blockchain is the most secure blockchain around and is maintained by an increasing number of nodes and miners around the world. Bitcoin has never been hacked since it's inception in 2009 and will never hacked in the future, because in order to hack the Bitcoin network you need more computation power than 51% of the whole Bitcoin network. This makes Bitcoin payments more secure than any other existing centralized payment method.

6. Tulips die!

People declared Bitcoin dead multiple times in the past, but Bitcoin is here to stay. A tulip though, has a certain future. Every tulip, no matter how beautiful, will eventually die... This makes a tulip unsuitable as a "store of value". Unlike Bitcoin, which is like digital gold.

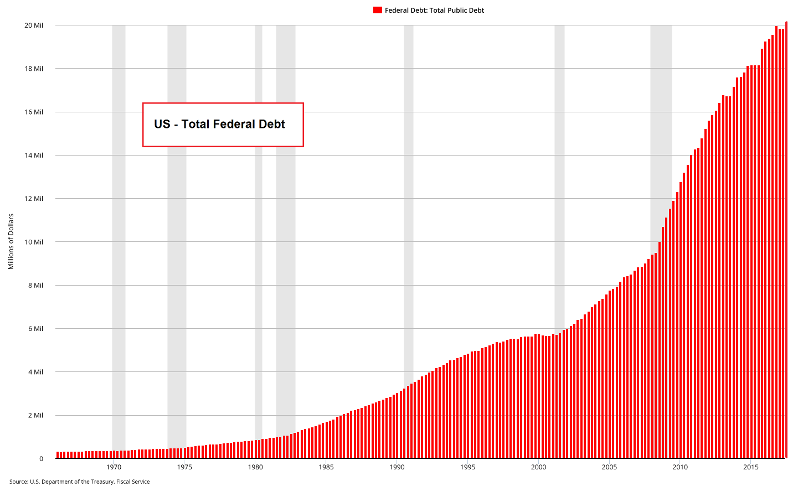

Bitcoin in a bubble? - Chart

But the Bitcoin chart below is clearly a bubble, you might argue...

This price rise of Bitcoin is insane! ...Sure! Look at this chart...

Oh, wait... This is the US debt ;-)

LOVE IT thanks for debunking shitty arguments!!

That’s exactly why I resteemed this article! I love those kind of discussions

Particularly with these kind of things, I'm really getting emotional. I was once invited to Austrian National Bank and hearing this tulip argument out of Mr. president's mouth was like: "Hello hello where is the exit to leave this wrong movie I'm badly stucked in?" Always remember there are these 10 people in the statistics:

This point is incorrect. 'Tulips' were fundamentally scarce, you couldn't just grow more. This is because ordinary bulbs were not the focus of the tulip bubble, it was rare specimens (such as the Viceroy, Semper Augustus and Admirael van der Eijck) that you couldn't simply selectively breed. The phenomenon was caused by a virus but not understood at the time.

I was playing Devil's Advocate as well. ;)

Good article

YES it is

The joke with the last figure was perfect! In a fiat money system, dept can grow infinitely.

Hey, awesome write up. BTC and its associated blockchain tech is here to stay and revolutionise the world as we know it!

hehe ... very good. Although, tulip mania was a very long time ago. you can't say bitcoin isn't a bubble because it will only be called a 'told you so bubble' when it does in fact burst. The price is in a bubble, because it's a price rising on something made from thin air ... yet people think it is valuable, they trade it. Could we see 1 Satoshi replace $1 USD? That's when 1 Bitcoin is $1million ... Is it possible? Nobody can predict, what events could drive people to choose other coins as a store of value. We are not even in the VHS/Betamax wars yet as far as blockchains go!

Lets not try to make 1 Satosi equivalent with 1 USD, since with current value of 1 USD, the least expensive product we can purchase is to the value of 1 USD. I would not like to buy a paperclip to the cost of 1 USD :)

This actually helps defeat the #3 argument, making Tulips more valuable than BitCoin, because it makes them rare and scarce. They are only grown while in season. BitCoins easy access and limited amount actually helps increase demand by those who want to run up the price.

And, while BitCoin can be carried on a piece of paper, there are limits to using it in the real world. You have to deal with someone who knows how to accept BitCoin. Similar to requiring a shipper who can handle shipping flowers over long distances. Not everyone is in that market.

Agree...see also my comment: https://steemit.com/bitcoin/@penguinpablo/6-reasons-why-bitcoin-can-t-be-compared-with-the-tulip-mania#@edje/re-penguinpablo-6-reasons-why-bitcoin-can-t-be-compared-with-the-tulip-mania-20171212t175349312z

lol - yeah, I'd be a helluva lot more worried about that Federal debt bubble! Thanks for the post :) Kate

Although I agree with the fact Bitcoin cannot be compared with the Tulip Mania, some of your argument are not correct. You take the comparison literally, while the comparison is on a more abstract level.

This is a non-argument, lets say we talk in Satosi instead of Bitcoin. 1 Satosi is not divisible, while a Bitcoin is.

Do you have figures from the time Tulip Mania happened? In fact, there are finite Tulips at any given point in time. Value is increased when goods become scares, either less units available, and/or demand increases. In reality: when demand is higher then supply, value goes up in a free market model.

This argument has nothing to do with the comparison critics make: the comparison is about the enormous increase in value and a possible big bubble. And as a matter of fact we have to take the scenario of an enormous implosion of the Bitcoin value into consideration. Not saying it will not get out of an implosion though.

Sorry, again an argument that has nothing to do with the comparision between the Tulip Mania and Bitcoin. BTW, did you know that the majority of the mining power are owned be a handful of companies?

It probably is, but the bubble may not burst. It really depends on the incoming fiat money from the risk takers from Wall Street and the likes. When they pull out their money, wait and see what happens with the Bitcoin price. But, they may not pull their money out of Bitcoin, they may even invest with Bitcoin in some Alts. Owww, I say invest; These are Traders, no Investors since in Cryptospace we hardly have investors other than all those people who invest with their time.

nice to see different point of view from two side. Because some people in my country also comparing Bitcoin with the tulip mania. I have read a bit of that story.

more things to consider when we are into investing to the crypto. 😃

The bulb is still there. So, the bulb can be used to create a similar flower of the same value. If the bulb created a rare tulip, then it would be more valuable than another bulb, storing its value for seasons to come.

The rare tulips were not genetically inheritable because the patterns were caused by a virus which affected each tulip in different ways.

But, the initial bulb, not the ones that grow out of it, wouldn't they still grow that flower again the next season?

Yes, but the flowers weakened severely after the first season. You could grow a second flower but they would be wilted due to rapid genetic deterioration.